Ricardo B. Salinas is among the swarm of cyber hornets as one of the top high-profile advocates for Bitcoin, with laser eyes and #Bitcoin in his Twitter profile. Putting his money where his mouth is, he has invested 10% of his personal wealth into Bitcoin.

Worth an estimated US$15.2 billion, Salinas is the third-richest man in Mexico and among the top 200 richest people in the world. As founder and chairman of Grupo Salinas, a group of companies with interests in telecommunications, media, financial services and retail stores, he says the best thing to put your money into is Bitcoin.

Last November, Salinas tweeted a video showing piles of paper money thrown into a bank’s bin because it is so worthless, due to hyperinflation affecting most countries south of the US border.

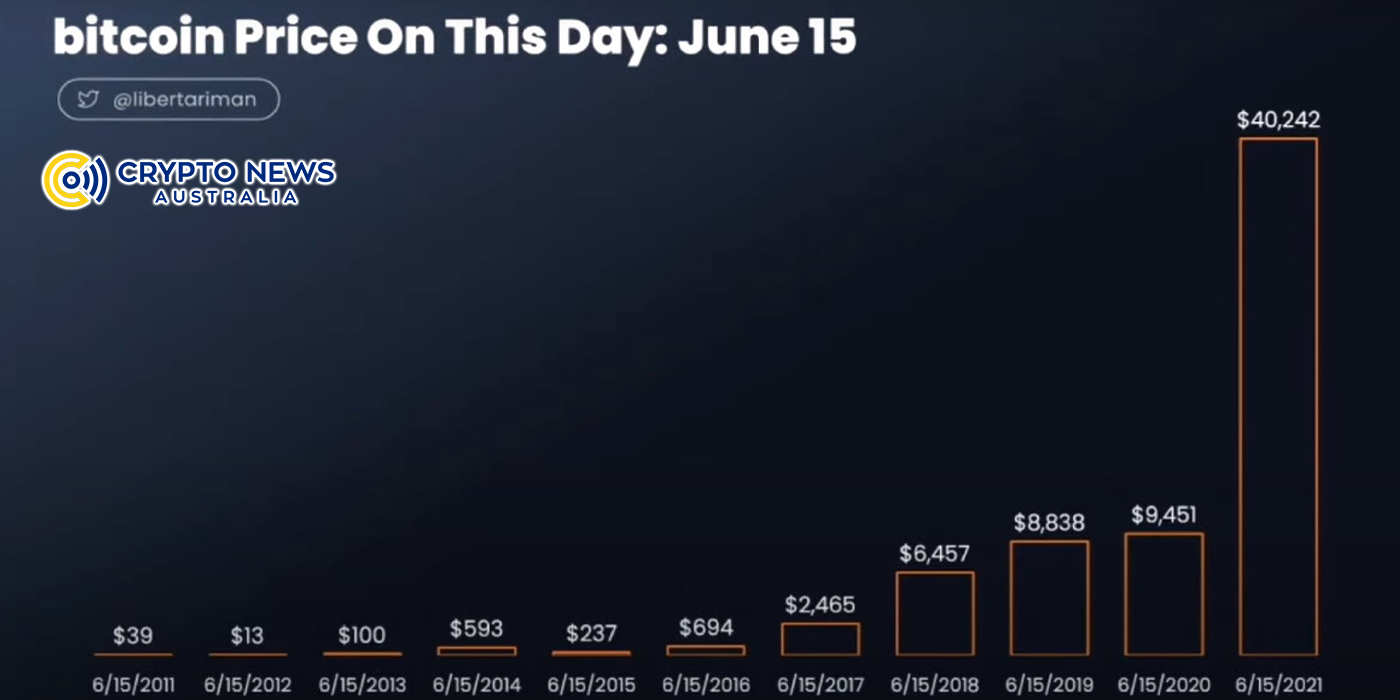

Mexican Peso Blows Out 1000% in 40 Years

Talking about inflation, Salinas stated that when he first started working in 1981, a US dollar was worth 20 pesos. Now, 40 years later, a dollar equates to 20,000 pesos. Bitcoin’s finite supply makes it a very attractive asset to invest in because it is deflationary.

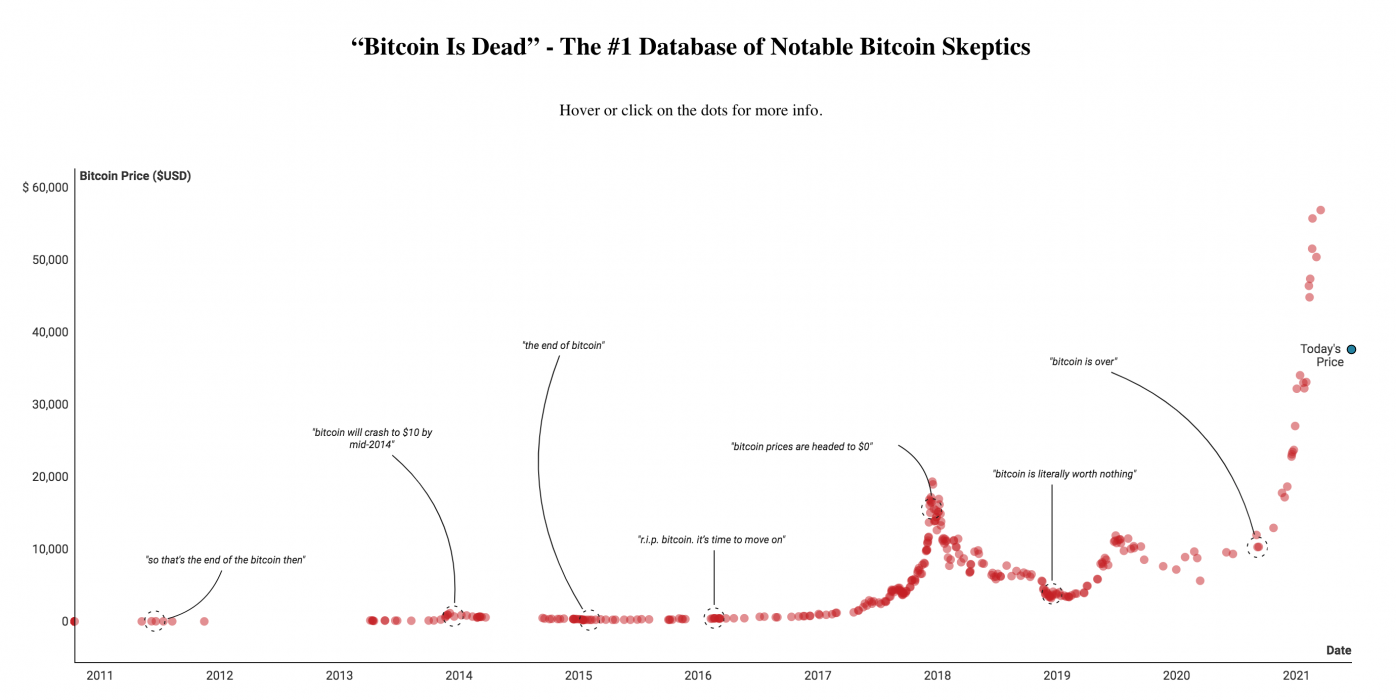

Along with other billionaires such as the Winklevoss twins and Michael Saylor, Salinas is pushing the Gold 2.0 crusade. He believes that every investor should have a part of their portfolio in Bitcoin, likening its value to a modern form of gold.

Bitcoin a ‘Store of Value’ for Billionaire Investors

Billionaires looking for ways to protect their wealth against growing inflation are favouring Bitcoin as a store of value because they understand the many advantages it offers. Even well-respected old-school American institutional investors such as Warren Buffett can’t ignore Bitcoin any longer. Hedge fund manager Marc Lasry, for another, says he regrets not buying more Bitcoin.

Australian billionaire Alex Waislitz, touted as “Australia’s Warren Buffett”, has made tremendous profits of over 400% by investing in cryptocurrency companies.