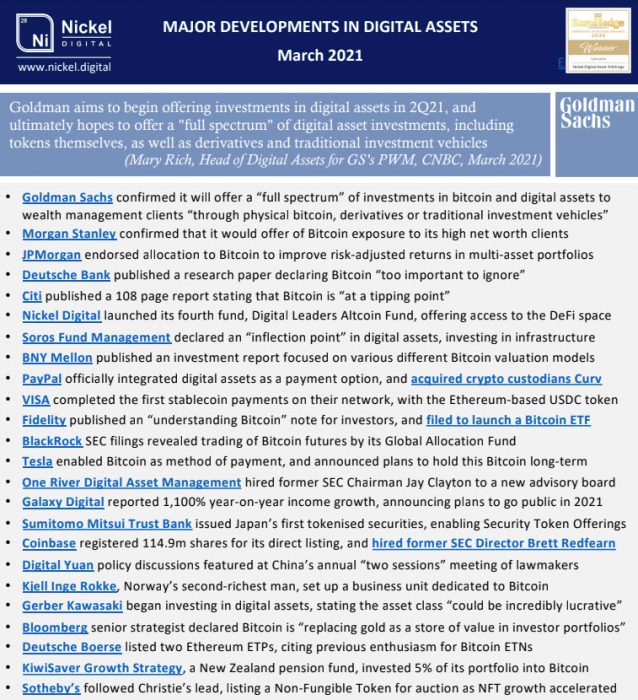

Over the years, people have made a lot of money from crypto – most of whom have done lots of research so they know what they are getting into.

Unfortunately, a lot of promoters, mainly on social media such as Twitter, Facebook and YouTube, feature enthusiastically small cap coins they found profitable and lead plenty astray.

Here is a quick list of six important things to keep in mind while trading crypto (with quotes from real traders via Redditors):

1. Don’t Invest What You Can’t Afford To Lose

Trading crypto is a fundamentally risky endeavour – so only invest what you can afford, as these crypto traders found out.

This crypto trader lost all his crypto while he was sleeping.

I woke up this morning realising that I just lost all of my hard earned money and savings in about 2 hours. Someone got access to my private key (or at least I think so) and everything was gone.

Crypto Trader on Reddit

This crypto trader lost his all his savings by “mistakes”.

Right now I am sick to my stomach, I cannot sleep, and can barely function. After losing money left and right, I finally tipped last night and lost the last bit of a big chunk of my savings that I had ‘invested’ in Cryptos. This story is very hard for me to tell, because I am ashamed. Ashamed of how naive I have been, and how I made mistake, after mistake, after mistake. Saving the dumbest mistake for the last.

Crypto Trader on Reddit

This crypto trader explains the pain of losing money you can’t afford to lose.

For real guys, DON’T put money you can’t afford to lose, it hurts mentally and physically because you get depressed, really thought I was prepared to do that.

Crypto Trader on Reddit

2. The Bear Market Can Strike At Any Time

Over the years, we have seen plenty of bear markets, and they can hit at any time, as these crypto traders found out.

This crypto trader explains how quick the bear market can hit.

Obviously hindsight is 20/20 but I think it’s important to realise that things can seemingly look normal and suddenly you find yourself in a bear market. Some of these were pretty spot on, others not so much.

Crypto Trader on Reddit

This crypto trader explains why “this time is not different”.

Please, please, please be aware that this time is not different. The bear market will return, and it will destroy all of your gains, and at first you’ll tell yourself that it’s just a small correction, and then everyone on Reddit will say it’s just the Chinese new year or something like that, and then you’ll kick yourself for not selling sooner and you promise you’ll sell as soon as there’s another price increase, but it never comes, and you finally give up and accept that you lost a ton of money because you thought this time was different and you thought you could time the market. But it’s not and you can’t.

Crypto Trader on Reddit

3. Partly Cashing Out Can Pay Off

As these crypto traders found out, once you’ve made enough to recoup your initial investment, a partial cash out can pay off, especially in an unpredictable market.

This crypto trader was in relief that he cashed some out before a dip.

I sold a small amount to recover my initial $3000 investment as the price rose; this was a strong psychological barrier for me as now I was purely playing with house money, [so] I literally cannot lose as long as I don’t go chasing losses […] I cashed out $200k yesterday, enough to make an impact in my life while still holding on to a majority of my HODLings. This was literally minutes before yesterday’s dip happened so the sense of relief that came over me was only further reinforced by the dip that soon followed.

Crypto Trader on Reddit

This crypto trader took his family on a holiday with the profits he took.

For the first time … tonight … I took profit!! I didn’t want to do it. I didn’t want to take money away from the investment. I’m thinking long term with what I put in.

We don’t take many vacations as a family. We cut the month tight with bills and our planned vacation got REAL tight. So I sold some profit, not a lot. Enough to enjoy time with my fam!! I thought I may regret it, but I didn’t!! It was totally worth it.

Crypto Trader on Reddit

This crypto trader did not take profits and was feeling the pain of “losing his gains”.

I lost 250k gains and now at losses. 🙁 I joined crypto around March and I was proud that I bought coins that gave me 70% gains because of HODL. But I was too greedy that I didn’t take profit because I didn’t want to let go of the coins I bought for cheap. Now those coins are back to my entry price and even lower. All my gains gone. I don’t know what to do 🙁 If I sell now, what haunts me is that I could’ve sold with all the gains but instead, I’m now selling with losses. I feel bad about this huhu.

Crypto Trader on Reddit

4. Sometimes HODLing Is The Best Strategy

I think we’ve all seen a coin boom after we just sold it. Sometimes just HODLing a coin can pay off, especially when the market follows cycles, as these crypto traders found out.

This crypto trader feels the pain of not HODLing and what might have been if he did, just, HODL.

I watch another bull run happen without being on board, in Dogecoin, the one I got rid of. My holdings would have been worth over $1 million if I held. I track down my old doge wallet info desperately hoping I’m remembering wrong and that I’m still holding some, but it’s empty. The ETH I traded it for is up nicely, but a small fraction of what the doge would have been worth. Strange how upsetting it is to be up 1000% on an investment when you realise you could be up 10,000%.

Crypto Trader on Reddit

This crypto trader’s plan was to just HODL until the next bull run.

I had been through enough bull cycles by this time to know that if/when the next one would eventually came it would dwarf all others. And by the time that happened, what I had learned was that I needed to have a solid plan in place so I could execute it without making irrational decisions.

Crypto Trader on Reddit

5. Day Trading Is A Dangerous Game

Timing the market is not an easy thing to do and trying to predict the bottoms is like “trying to catch a falling knife”. Day trading cryptocurrencies is not an easy game as these crypto traders found out.

It’s really hard to predict which direction the market is going short term. You might see a quick spike up sell a bit and wait for the correction. Then it comes back down and you buy it back. What goes wrong is when you wait a little too long and it starts going back up again, and your buy order never goes thru bc the price is rising / holding / rising / etc….. You bid a penny below value and it just doesnt dip back until it’s past your sell point anyway, now you lost.

Crypto Trader on Reddit

This crypto trader’s friends all lost trying to day trade.

A friend of mine made 400K with day trading. All my other friends lost an insane amount of money trying to do the same. Unless you have the time to become pro I wouldn’t recommend it.

Crypto Trader on Reddit

This crypto trader was trying to “revenge trade” to recoup his losses.

It got to the point where my bank account had no money left to fund my Bitmex account and that’s where I made my biggest mistake. I decided to “borrow” funds from my BTC and ETH cold storage to try to recuperate everything I’ve lost so far on Bitmex. And as I now know, revenge trading never works. Today marked the end of my crypto career, all my alts were liquidated when BTC broke 9k and pretty much dumped right after.

Crypto Trader on Reddit

6. Keep Your Crypto Safe

If you hold your crypto on exchanges, then they control the wallets’ private keys, so they effectively “own” the crypto. Having your crypto stored in a safe location can pay off in the long run, as these crypto traders found out the hard way.

College roommates convinced me to buy bitcoin back in 2010, i ended up buying 10,000 bitcoins for $60-80 and storing them on my laptop, forg[o]t about it until 2014 when my friend randomly mentions it hitting $1k and a good buying opportunity, i rush home to look for my old broken laptop which had the bitcoins on it in the hard drive to discover my mom threw it out and the bitcoins were gone forever, i become severely depressed and affected by this and til this day cant help but think what if i had those bitcoins.

Crypto Trader on Reddit

This crypto trader lost his crypto he had stored on his phone.

Lost .5 BTC off my phone which is a lot to me :(, I recently switched from blockchain wallet to the bitcoin wallet by andreas schildbach which i backed up, but the file was on my phone. I got a new phone HTC one m8 and was excited, had the people at ATT factory reset my note 2 without even thinking in excitement… And its all gone. I cannot find the private key 🙁

Crypto Trader on Reddit

This crypto trader’s hardware wallet is now swimming with the fishes.

It was a tragic boating accident. I just moved all my bitcoin to a hardware wallet, when it happened to slip my hands and into the ocean. Any further transfers done on that wallet are because of Poseidon.

Crypto Trader on Reddit