Let’s have a laugh at this weeks popular memes.

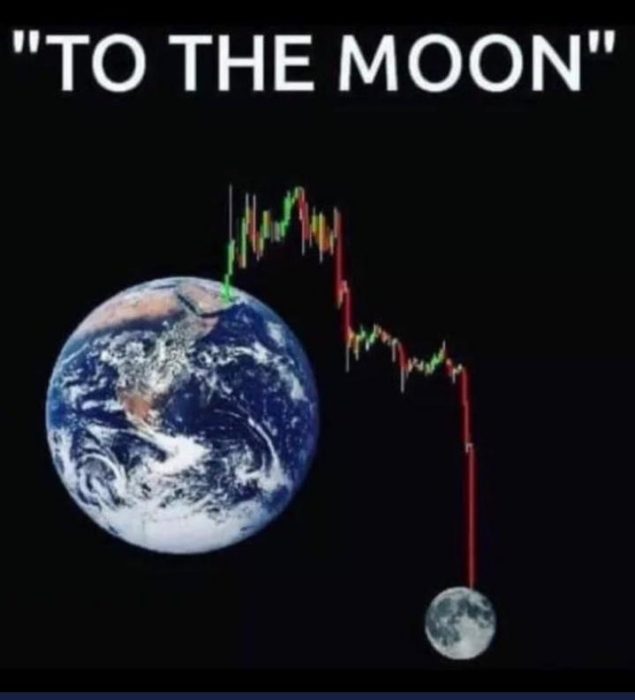

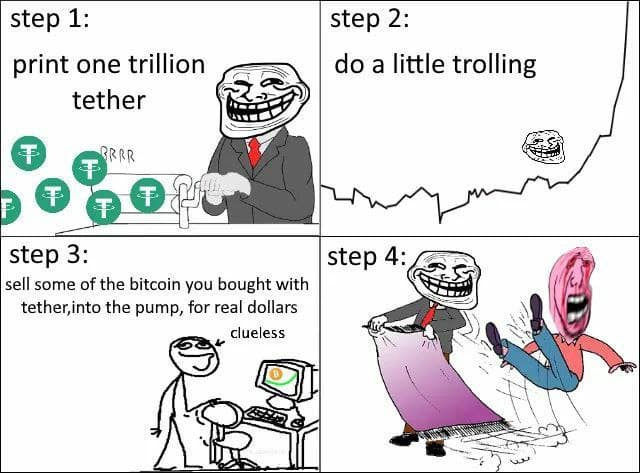

Crypto Bull Run Over?

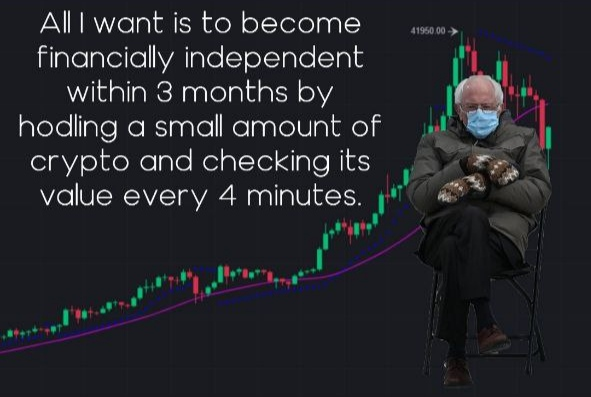

Crypto or Work?

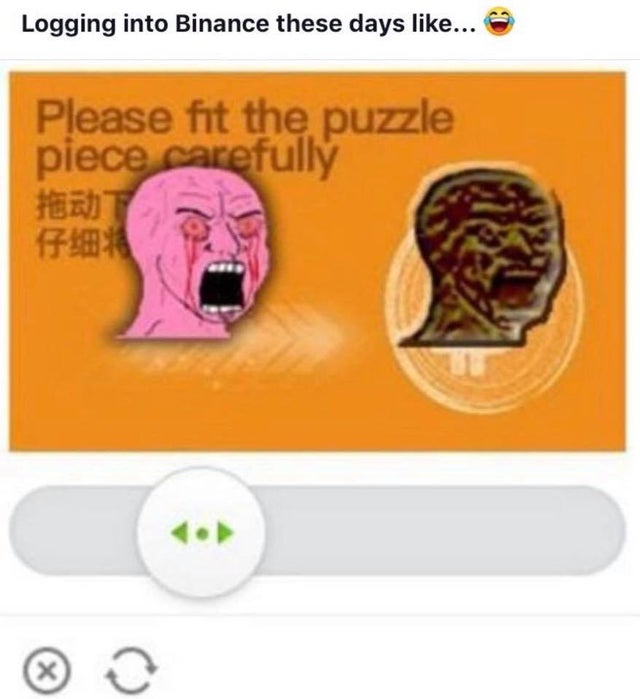

Crypto or Relationship?

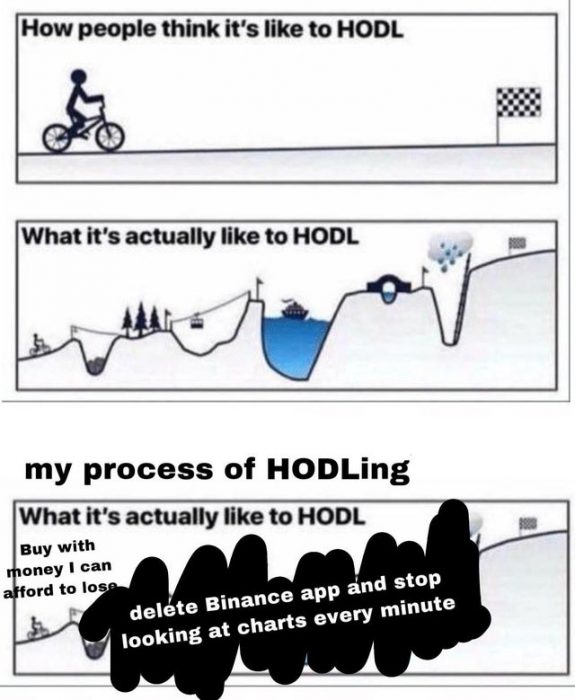

Crypto Education…

Bitcoin Came 8th In The Indy 500

Obligatory DOGE meme!

Enjoy your Friday! Tune in next week for more fun.

Crypto News Australia provides you with the most relevant bitcoin, cryptocurrency & blockchain news.

Let’s have a laugh at this weeks popular memes.

Enjoy your Friday! Tune in next week for more fun.

In this article we take a look at important Crypto dates and events happening in this month.

The selected events include Hard Forks, Partnerships, Announcements, Rebranding, Exchange Listings, Releases, Token Swaps, Important Airdrops, Conferences and more.

| Date | Event | Notes |

| 1 June | Swyftx dark mode | Swyftx Dark Mode has been made to increase readability and reduce eye fatigue when viewing your portfolio at night. |

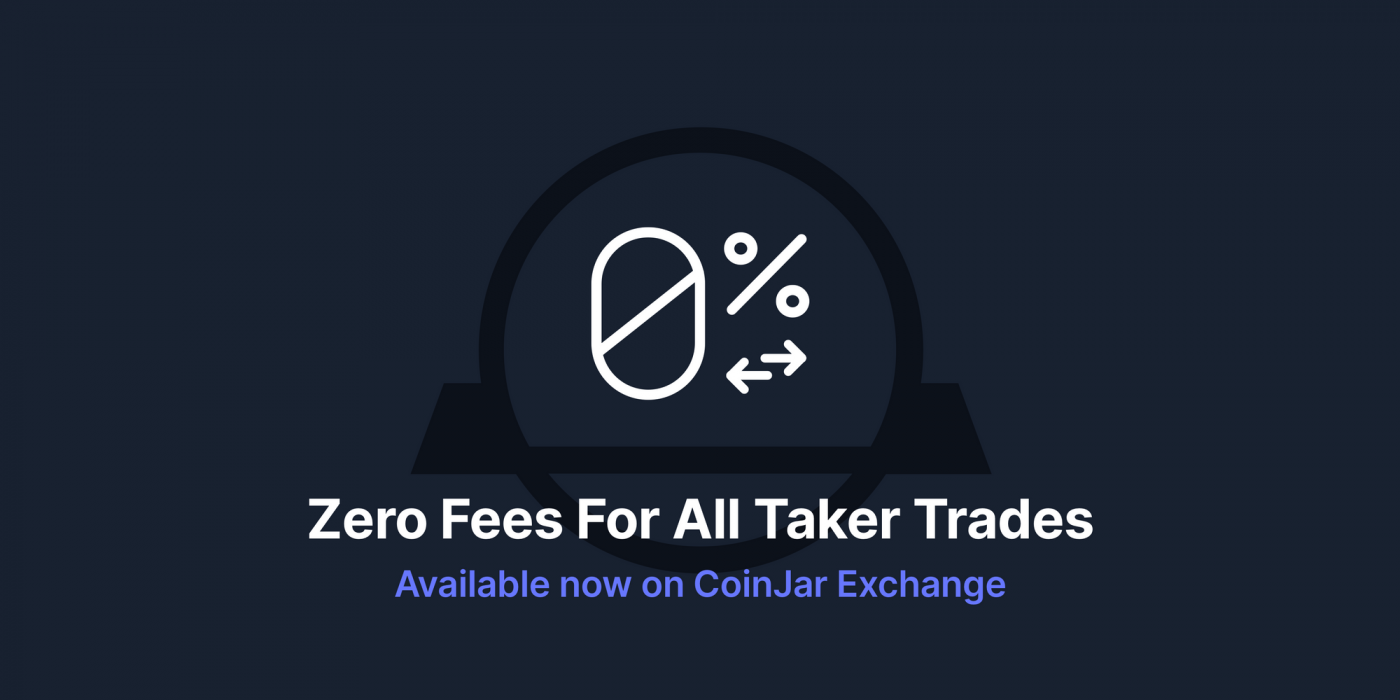

| 2 June | CoinJar Exchange launches 0% fees | CoinJar is pleased to announce that they’re now offering zero-fee on all “taker” trades through their exchange platform. |

| Date | Coin | Event | Notes |

| 3 June | DLSA Protocol (DLSA) | Mainnet on Harmony | DSLA Protocol and the DSLA.Network flagship application are coming to the Harmony network |

| 8 June | ICON (ICX) | Token swap | Automated swapping of your old ERC-20 (“ICO Tokens”) to native Mainnet $ICX will begin on June 8 |

| 10 June | BitTorrent (BTT) | Snapshot | The initial airdrop will commence after the snapshot on June 10, 2021 |

| 14 June | Verox (VRX) | Verox AI App release | No additional info |

| 15 June | Kick Token (Kick) | Token burn | Token burn and staking |

| 21 June | Shiba Inu (Shib) | Stakeprotocol Airdrop | Each holder will be given 1 STK for 1000 shiba, the snapshot will be ghost. Which will be taken between 21-22 June 2021. |

| 26 June | MultiVac (MTV) | Mainnet Launch | MultiVAC Mainnet will launch on June 26th. |

| 30 June | Sylo (SYLO) | Smart Wallet Staking | In wallet Sylo staking,” during Q2 2021. |

| 30 June | Dock (DOCK) | Launch PoS Mainnet | Launch PoS mainnet”, during Q2 2021. |

| 30 June | Horizen Protocol (HZN) | Phoenix Oracle | We plan to launch the initial [Phoenix Oracle] module in production-mode along with the Horizon Genesis Mainnet launch… in mid-June. |

| 30 June | Tenset (10SET) | Mobile App Release | Alpha Mobile App Release and many other features planned around the same time. |

| 30 June | WinkLink (WIN) | Decentralized Prediction Market Dev | WINK will vigorously develop the decentralized prediction market,” during Q2 2021 |

| 30 June | Theta Network (THETA) | Theta Mainnet 3.0 | Theta Mainnet 3.0 is going to be released at June 30 instead of 21 April 2021. |

| 30 June | StormX (STMX) | StormX Debit Card | StormX Debit card will be released during Q2 2021 |

| 30 June | Injective Protocol (INJ) | Mainnet Launch | Intended Mainnet launch in Q2 |

| Date | Event | Location | Notes |

| June 14 – 10 | Defi Summit 2021 | Online | The free virtual conference contains 5 days of exclusive programming featuring live panels, fireside chats, Kickoff & NFT Stage, DeFi Demo Day, and more – in a global blockchain event unlike any other. |

| June 17 | Super Crypto Conference | Online | The destination for thinkers and builders to discuss the latest news, applications and perspectives in the Crypto/Blockchain landscape. |

| June 17 | The Conference NFT | Online | Deep dive into the NFT world. |

| June 24 | Global Defi Summit 2021 | Online | The Global DeFi Summit is 2021’s leading annual gathering of DeFiers in the blockchain and cryptocurrency community. |

CoinJar is pleased to announce that they’re now offering zero-fee taker trades through their CoinJar Exchange platform – becoming one of the first cryptocurrency exchanges in the world to offer zero fees for crypto-fiat trading.

“From the moment CoinJar was founded in 2013, our mission has been clear: to make crypto as simple and accessible as possible,” says CoinJar CEO Asher Tan. “Trading with 0% fees is simply the next step in this journey.”

Drawing on the runaway success of zero-fee trading companies like RobinHood and 212 Trading, CoinJar Exchange offers 0% fees on all taker trades – an order to buy or sell an asset at the current market price – including crypto–fiat pairs like BTC/AUD and ETH/GBP.

Traders who create maker orders – orders to buy or sell below or above the current price – will still only pay fees as low as 0.04%.

“While other fee-free trading platforms make their users pay by offering wide spreads or high deposit or withdrawal fees, CoinJar is still offering the same fair prices, lightning fast execution and free deposits and withdrawals we always have,” says Tan.

Together with the recently launched CoinJar Instant Buy, which allows customers to buy crypto using a credit or debit card with only a 2% fee, Tan says it shows CoinJar’s dedication to improving the crypto experience for the everyday user.

“As believers in the long-term future and importance of cryptocurrency, we think it’s vital to try and remove the barriers to its use and adoption. By offering fee-free trading, we’re hoping to make it easier than ever for people to join the crypto community.”

CoinJar Exchange is an advanced trading platform designed for CoinJar users who want greater control over buying and selling cryptocurrency. This includes the ability to set order prices, as well as a Trading API to manage your accounts, orders and trades.

If you want to learn more about CoinJar Exchange, you can read our dedicated Knowledge Base article, explore the CoinJar Exchange Support articles or take your first steps towards using CoinJar Exchange.

Let’s have a laugh at this weeks memes.

Tune in next Friday for more meme mayhem!

28 May 2021 – We interviewed Coinstash’s co-founder Ting Wang about the company’s plans and his opinions on the crypto market.

Coinstash.com.au is an Australian based cryptocurrency exchange where you can buy and sell Bitcoin and 21 other cryptocurrencies. Following a substantial capital raise of A$2.8 million, the company has big plans for the future – looking to revolutionise the way we use crypto in Australia.

Q: It has been a bit over a month since your capital raise with Birchal. Can you please give us a brief update on how the team has progressed since then? What are the team’s plans to continue to grow the business?

A: We’ve been working on growing the business by engaging legal professionals, mapping out operating models, and hiring new developers – planning to double from 6 people to 12 people.

Australia doesn’t need another crypto trading platform. Coinstash is trying to make crypto easier to spend and revolutionalise personal and business crypto financial services products.

Coinstash Co-Founder Ting Wang

We have plans to introduce new financial products such as spending, earning interest and borrowing against your cryptos. To achieve this, we are working with legal professionals to obtain all the accreditations we require. This space has a high barrier to entry and we’re making sure 100% that we tick all the boxes, so due to regulations it might take some time to get these products out to market.

Q: What’s your current market outlook? In particular, who do you think is benefiting from the sudden fall in price, and what opportunities are there for those interested in entering the space?

A: My perspective is that Bitcoin is still up heaps since the start of the year. The recent FUD is caused by regulatory pressure in countries such as Turkey, India, and of course China. As Binance, OKEx and Huobi traders are mostly from China this has caused a shockwave effect on liquidations, causing the market to dip. China cracking down on mining operations also affected the price – this might be bad for BTC in the short term but should be good in the long run as the network becomes more distributed.

It’s too early to say that the bull market is over, although you need to tread carefully in the current market.

Coinstash Co-Founder Ting Wang

I’m not a financial advisor, but my personal approach is instead of timing the market, invest a recurring amount into major coins, then just hold it, and if it drops, stay calm and don’t panic. In the past, this strategy has well-served many people I know. Coinstash has plans to introduce recurring buys and top coin bundles soon to help you participate.

Q: With tax season around the corner, any tips on what Australians should prepare for?

A: Firstly, you should get a good accountant, one that knows about crypto. Then the simple thing you can do is keep your records, which can save you a lot of headaches down the track. Record the date, transaction amount, buy or sell, the fees, and crypto used. Also, take a note of all the exchanges and wallets you’ve been using. I’ve found this to be helpful if you’re using many different ones. Coinstash offers a free download of all transaction history for the year so you can send it directly to your accountant.

This is a story from a crypto trader who started in 2010, hopefully new traders can learn something from reading it.

Have seen a few people make these and realised just how long I’ve been following crypto by comparison to most, so thought I would share my story and my thoughts in case it helps anyone

So that’s where I am now, just HODLing what I still have. I’ve seen a lot of posts here from people who think they are too late, or who want to sell in a crash to avoid more losses, so I want to encourage everyone to look at the long term charts. This could be another year long crash like 2018, or it could be another quick summer crash where it recovers and takes off like in 2017. Don’t try to predict what it’s going to do, if you believe in it just ride along.

I’ve lost millions in potential profit from panic selling, thinking I was too late to get in, and trying to outsmart the market over the past decade. Don’t be like me.

For years, the gambling world was dominated by the old-school way of staking cash to win. However, in recent times there has been a rise in crypto casinos that is now providing another way to win.

This article will explain the differences between traditional casinos and crypto casinos.

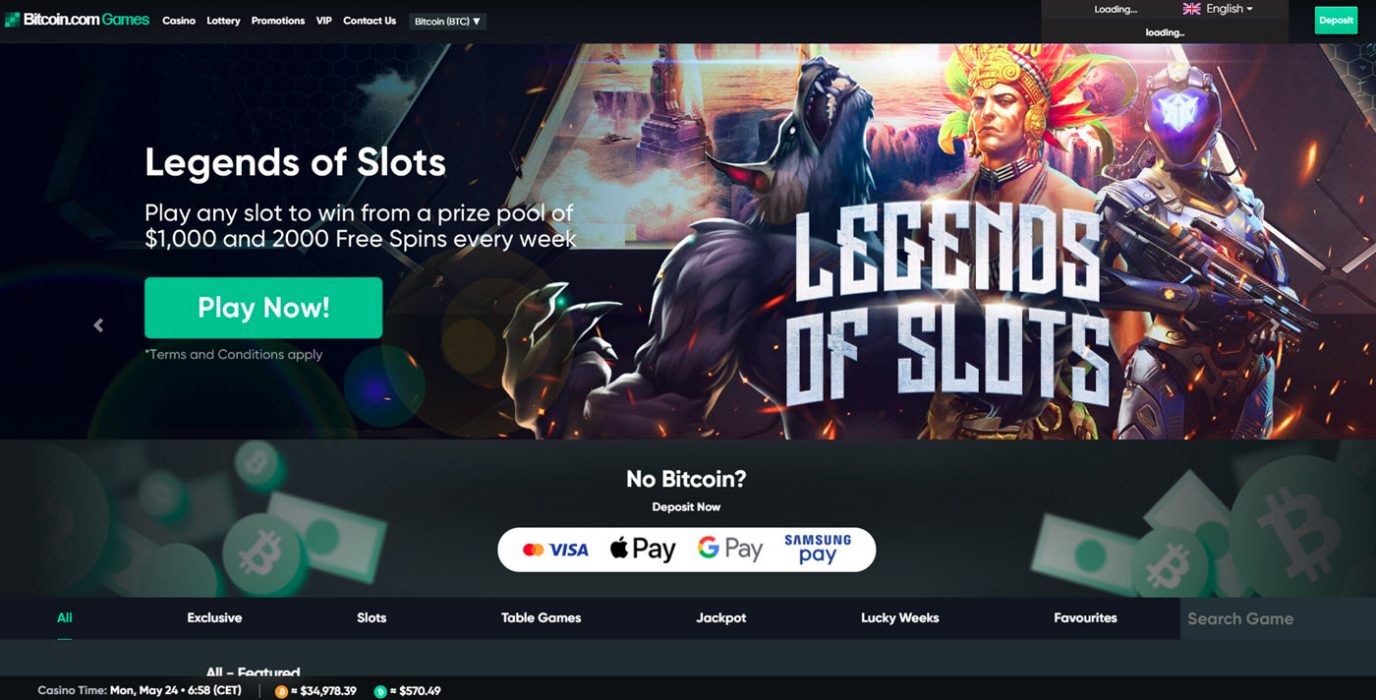

In the simplest terms, a crypto casino is an online casino or betting agency that accepts the use of Bitcoin (and/or other cryptocurrencies) to stake games and also rewards in crypto. An example of an online crypto casino is Bitcoin.com Games. This has some pros and cons over traditional casinos, which we’ll consider below.

Whereas a traditional casino is a building that holds the real-life in-person game setting, where you use the fiat currency to play, stake, and win. Most traditional casinos are located in very luxurious places offering drinks and entertainment.

The functioning of a crypto casino is very familiar to that of a traditional online casino. But unlike a traditional casino, it makes use of software that will conduct and run the game online. Many crypto casinos prefer to use their own built in-house gaming software to run the games, while smaller companies can decide to either rent or purchase versions of gaming software.

The fact that crypto technology is entirely digital means that casinos have to establish trust with their participants. They usually do this by being fully transparent about how their algorithms work including the security methods, randomness methods and blockchain used.

Ever since the rise of Bitcoin, Internet casinos are beginning to favour the use of cryptocurrency. Because of its ability to overcome the incredible hardships of transactions and transaction speeds imposed by fiat currency such as USD/AUD. Other online casinos might have introduced cryptocurrency because they wanted to escape the regulatory reviews accompanied by fiat currency.

While in the traditional casinos, where it usually took 4-7 business days to wire transfers, today, it will only take minutes when dealing with cryptocurrencies like Bitcoin or Ethereum. Using a currency like Bitcoin will allow you to use decentralized finance of cryptocurrency for gambling, giving you the chance to stake your value, play the odds, and cash out your earnings in less than an hour.

The fundamental advantage of the crypto casino operation is that it has attracted a considerable number of new players who actively own and trade cryptocurrencies and they favour the following:

Anonymity is a feature of cryptocurrencies that may be attractive to some punters when it comes to online gambling. The users can freely make transactions without the bank tracking them. Even personal data is not required to play games and make bets. In some rare cases, there are instances where registering to play is not even required, increasing the player’s anonymity further.

In crypto casinos, the financial institution isn’t involved, so the transaction fees are generally low, depending on the blockchain used. It has allowed many players who win not to pay any high commission to make deposits or withdrawals.

As we know, Bitcoin is available all over the world, and where there is a Cryptocurrency, there is a crypto casino available. It allows players from different countries and backgrounds to play at any given time. Of course, this also opens up the possibility of being hacked by people worldwide and has made a lot of people wonder if it is as safe as the traditional casino. However, with the appearance of crypto casinos, the Blockchain has become commonplace among these companies as it is a highly secure method that also grants you your privacy.

There are stark advantages and disadvantages of playing on a crypto casino vs traditional casinos. Let’s take a look at some of them.

You can play on a crypto casino anytime you want. All you need to do is turn on your laptop. If you want, try the blackjack tables, or spin your way to victory you can do so at any time of the day or night. Whereas at a traditional casino they usually have opening and closing hours which restrict your playing times.

Traditional casino games such as Blackjack, Baccarat, Poker etc are known for their slow action. Even the best of the dealers can only deal cards and shuffle them at a particular pace. And when a new player sits down at the table it can chew up time allocating their chips.

The crypto casino offers a different experience in this respect; the digital dealers will deal cards and shuffle them instantly; therefore, you can enjoy more time playing your games than you would in a traditional casino.

Most traditional casinos will have a strict dress code. Crypto casinos can be played in the conform of your home – so you can wear (or not wear) anything you want to. Birthday suit anyone?

Crypto casinos will offer you a lot more game variety than a traditional casino as new games are easily added into unlimited gaming space. Traditional casinos are limited to only so much floor space in the building.

Traditional casinos usually have large overheads with building rent, paying dealers and staff and utilities such as electricity. Online crypto casinos do not have most of these large overheads so they can offer more rewards to the players in return.

In this recent times, the rise of cryptocurrency and the digital age has made the crypto casino a fast-growing industry. Companies like Bitcoin.com Games, an online casino that allows you to play over 100 games with Bitcoin from anywhere in the world. Popular games include Pokies and Roulette.

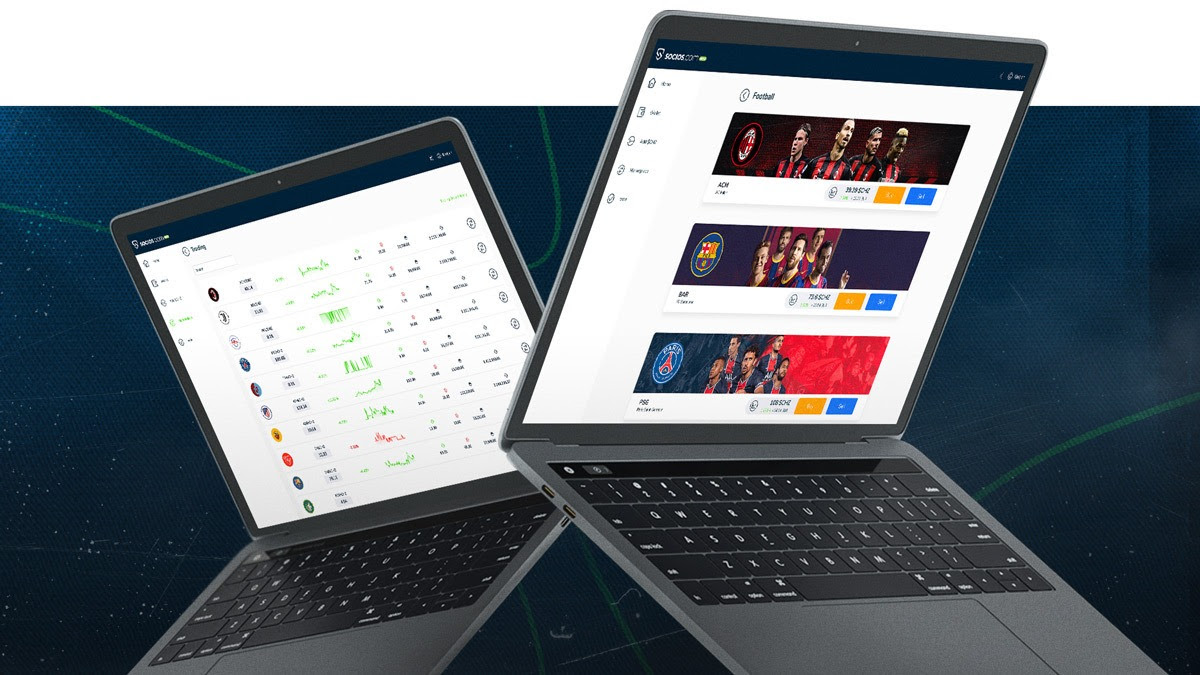

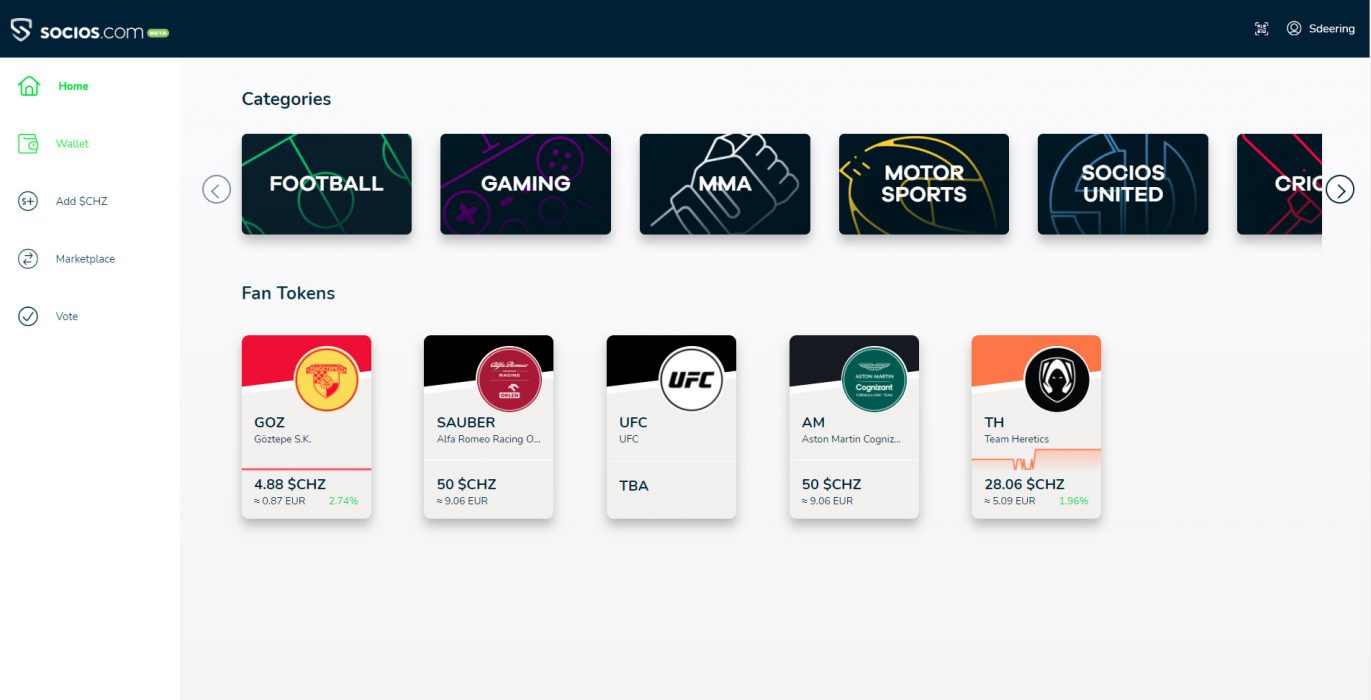

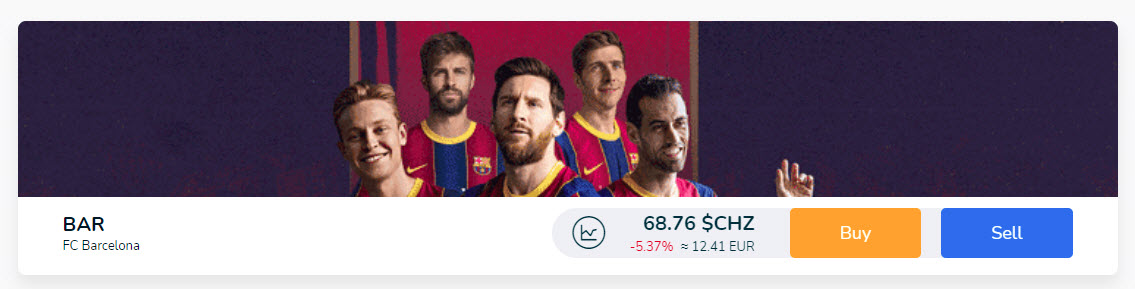

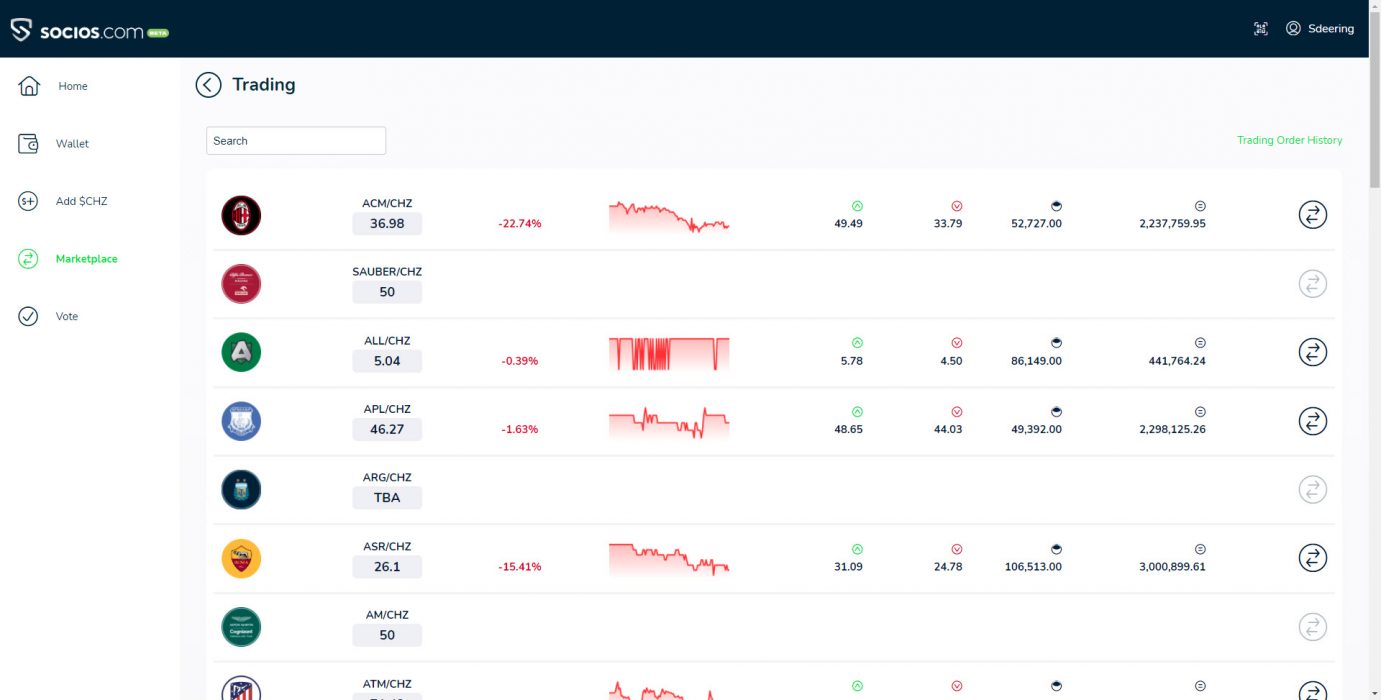

The beta version of the Socios.com web app is now live where now you can use the main features including buying and selling fan tokens.

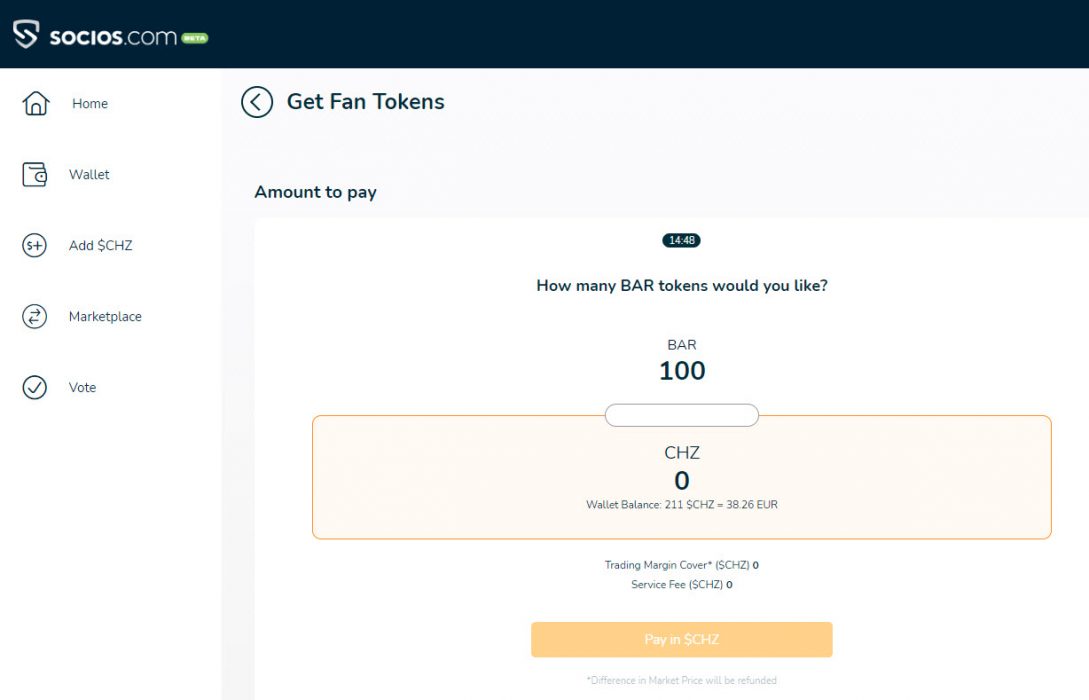

You can buy and sell tokens directly using the platform.

The fan tokens can be swapped with CHZ tokens directly.

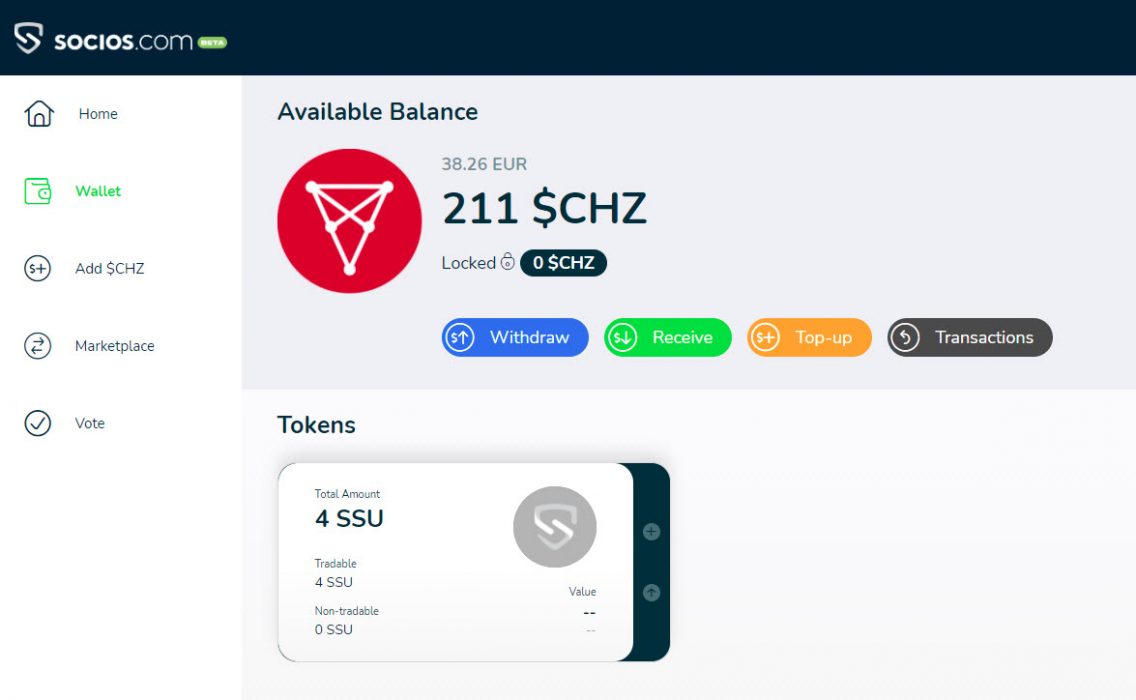

You can manage your CHZ from the Wallets tab.

You can trade the tokens between different sports and teams.

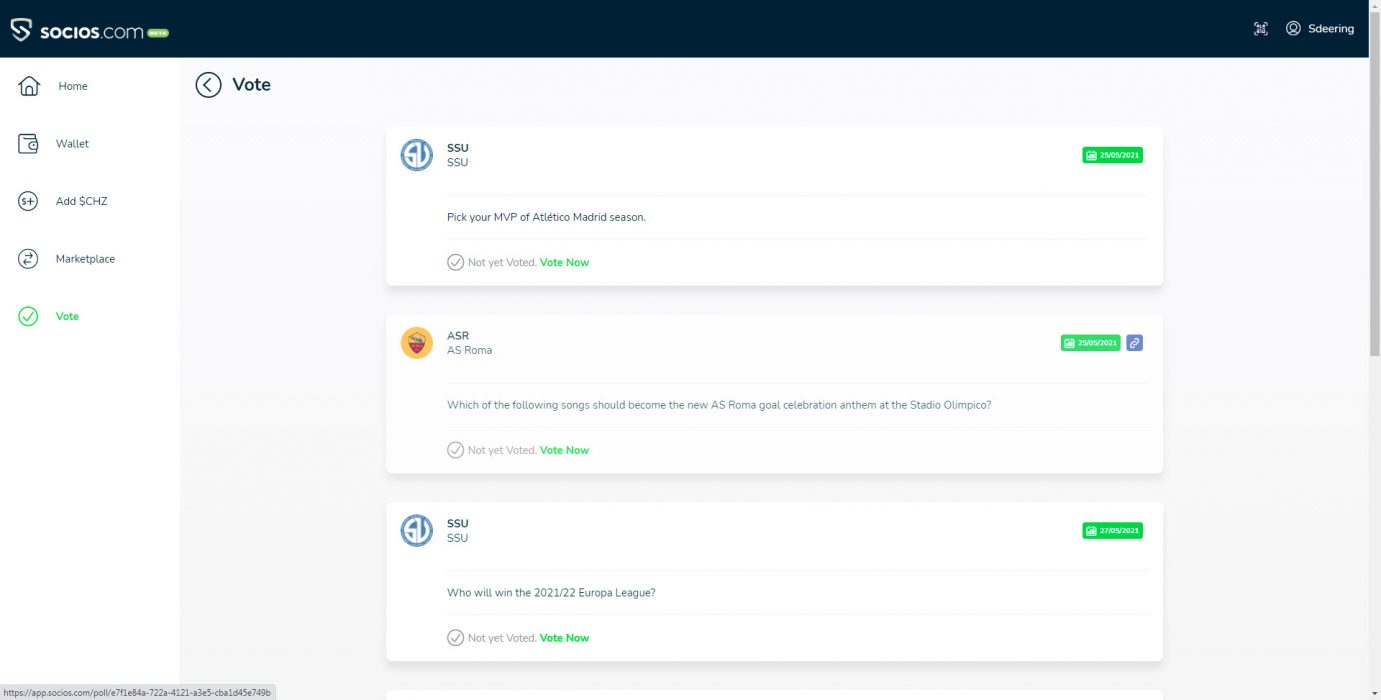

Have your say by voting on your favourite sports teams activities.

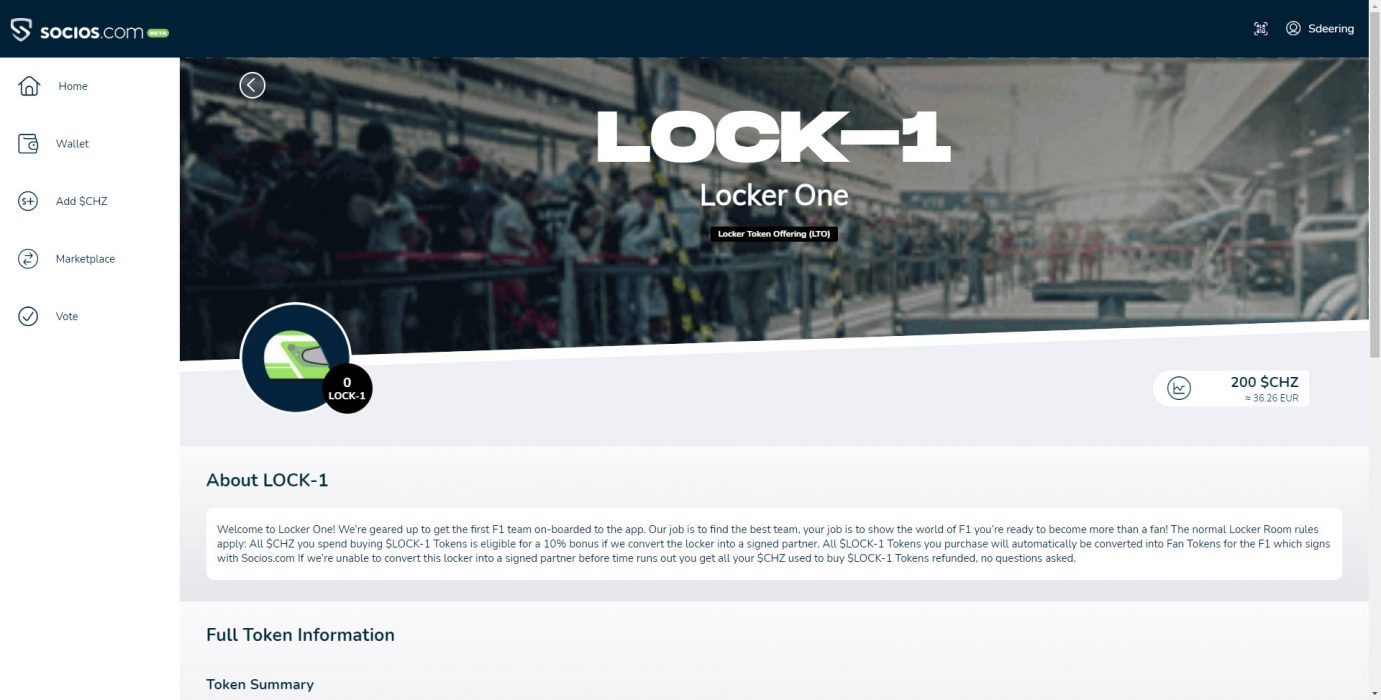

Participate directly in the pre-sale token offerings (lockers).

Read more about the platform in our Chiliz Token review.

CoinJar, Australia’s longest-running cryptocurrency exchange, has partnered with global payments leader Checkout.com to launch fast, low-fee credit card purchases for its users in Australia and the UK.

“This is a huge moment for CoinJar and its users, as well as for Australian and UK crypto in general. Buying crypto used to be something you had to plan days in advance. Now you can literally do it in seconds.”.

CoinJar CEO Asher Tan

CoinJar Instant Buy lets you instantly purchase crypto tokens using your Mastercard or Visa.* And with only a 2% fee, promotes Instant Buys as one of the cheapest rates for credit/debit card crypto purchases worldwide.^

When you’re buying crypto using the CoinJar app, all you need to do is:

Instant Buy works with any UK or Australian-issued Visa or Mastercard, but the card may need to match the name and billing address as your CoinJar account. Apple Pay and Google Pay functionality will be added in the near future. If you are experiencing issues please contact CoinJar support.

You can use Instant Buy to purchase any of the 24 cryptocurrencies supported on the CoinJar platform, with the exception of CoinJar Bundles and Recurring Buys – which are to be added soon.

*CoinJar requires Identity Verification to be completed prior to any crypto purchase. In a small number of cases, we might have to request additional identity verification information, in adherence with national law.

^As of 26th of April 2021. This excludes any additional fees that you may be charged by your bank or credit card provider.

Let’s have a laugh at this weeks memes.

Tune in next Friday for more meme mayhem!