Cryptocurrency’s are taking the world by storm. They are fast becoming a more trusted form of currency to use, especially in countries experiencing economic turmoil, and with people and organisations who no longer trust the traditional form of the banking system.

There are many ways to obtain and enter into the crypto space, however, one of the safest and more stable means is to invest into crypto mining.

What Is Cryptocurrency Mining?

Cryptocurrency mining is a process in which transactions for various forms of cryptocurrencies are verified and added to the Blockchain digital ledger. Also known as cryptocoin mining, altcoin mining, digital asset mining or Bitcoin mining.

Cryptocurrency mining has increased both as a topic and activity as cryptocurrency usage itself has grown exponentially in the last few years.

Each time a cryptocurrency transaction is made, a cryptocurrency miner (NGS Crypto) is responsible for ensuring the authenticity of information and updating the Blockchain with the transaction.

The mining process itself involves competing with other crypto miners to solve complicated mathematical problems that are associated with a block containing the transaction data.

The first cryptocurrency mining rig to crack the code is rewarded by being able to authorise the transaction, and in return for the service provided, crypto miners earn small amounts of cryptocurrency of their own.

In order to be competitive with other crypto miners a cryptocurrency miner needs a computer with specialised hardware.

NGS Crypto is always utilising the best technologies and up to date procedures in order to ensure our mining farm is always operating at full potential.

We specialise in both Proof of Work (PoW) and Proof of Stake (PoS) when it comes to our mining procedures. It is our core belief that innovation and technology is at the forefront of our digital asset mining operations and ensuring that the most efficient technologies are always used.

Why Mine Through NGS Crypto?

By mining through a trusted, professional mining company, NGS Crypto, this gives you the ability to become a full-time crypto miner without the technical know how.

NGS Crypto is one of Australia’s leading mining companies, with the use of the latest up to date mining technology, they make crypto mining a breeze.

NGS Crypto gives the everyday person, or even an avid crypto enthusiast the opportunity to mine Crypto’s through a fail-safe system, which was tried and tested for years before it was opened up to the investment market.

Benefits of a Mining Investment Through NGS Crypto

- 8% – 15% ROI per annum

- 100% of you initial investment amount returned at the end of your Initial Mining Agreement (IMA)

- Profits are paid out daily in Bitcoin (BTC)

- Free training and education upon becoming a member

- Access to a financial discovery call with an approved Financial Advisor

- NEW Mortgage Holiday 8% – 15% fixed income options

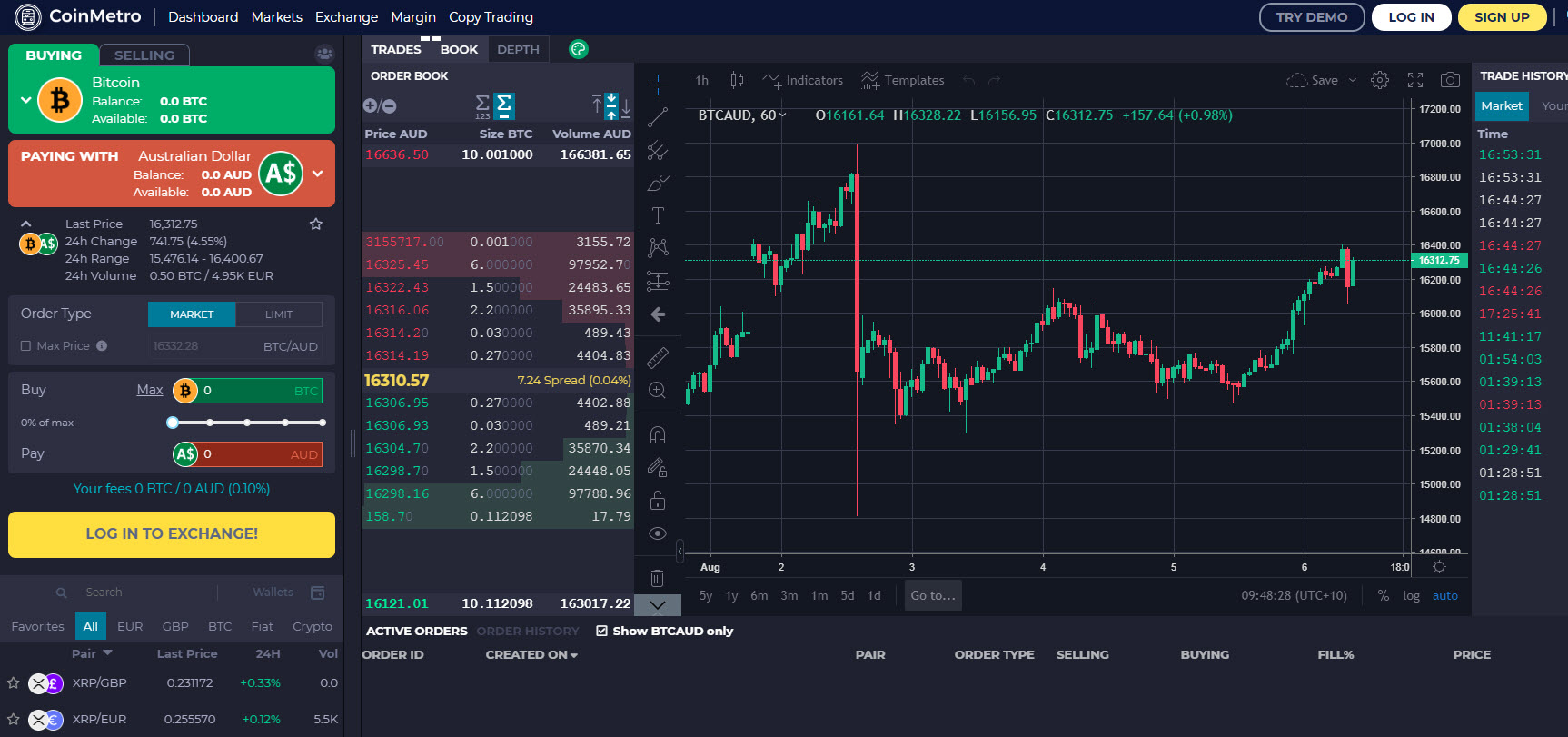

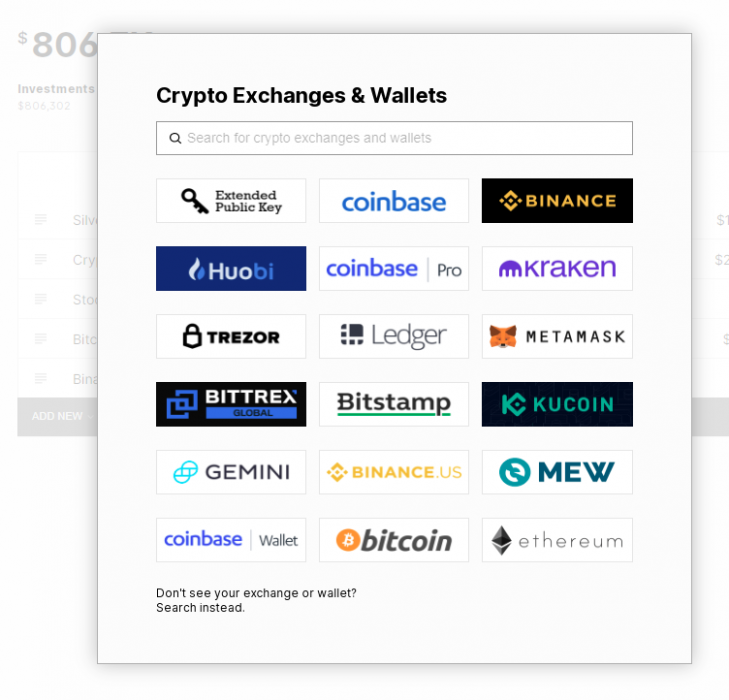

- Personal NGS Crypto Dashboard

- 100% Australian owned