Nexo is trading in active uptrend here like many other altcoins are. The Cryptocurrency Nexo just went up +24.5% in a single day and surges over +30.6% in a week.

What is Nexo?

Nexo wants to Build The World’s First Instant Crypto Overdrafts. Powered by Credissimo – A Leading FinTech Group serving millions of people across Europe for over 10 years.

Nexo Quick Stats

| SYMBOL: | NEXO |

| Global rank: | 75 |

| Market cap: | $242,936,162 AUD |

| Current price: | $0.4325 AUD |

| All time high price: | $0.7304 AUD |

| 1 day: | +24.5% |

| 7 day: | +30.6% |

| 1 year: | +325.74% |

Nexo Price Analysis

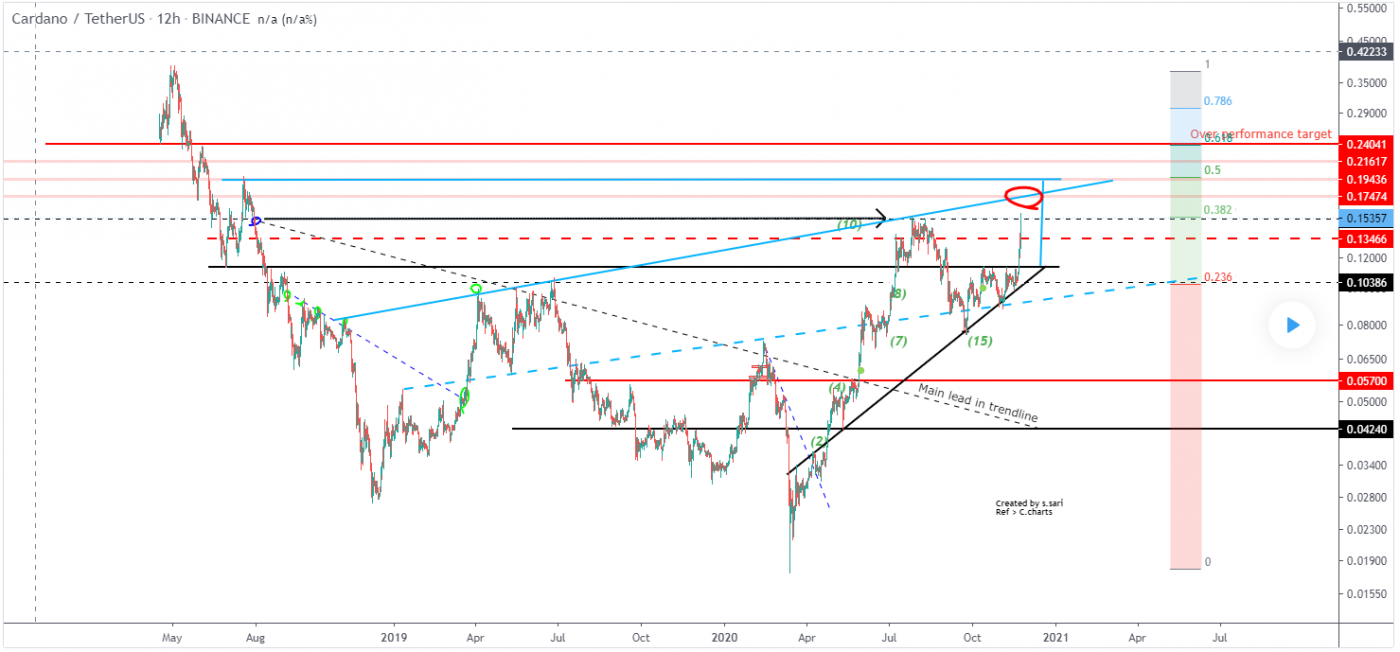

At the time of writing, Nexo is ranked 75th cryptocurrency globally and the current price is $0.4325 AUD. This is a +30% increase since 23 November 2020 (7 days ago) as shown in the chart below.

Price already increased a little bit after the Nexonomics announcement last week and then Nexo did an awesome breakout from this bearish rectangle by breaking all previous resistances & is now currently trading at $0.4325 AUD price levels.

“The bearish rectangle is a continuation pattern that occurs when a price pauses during a strong downtrend and temporarily bounces between two parallel levels before the trend continues.”

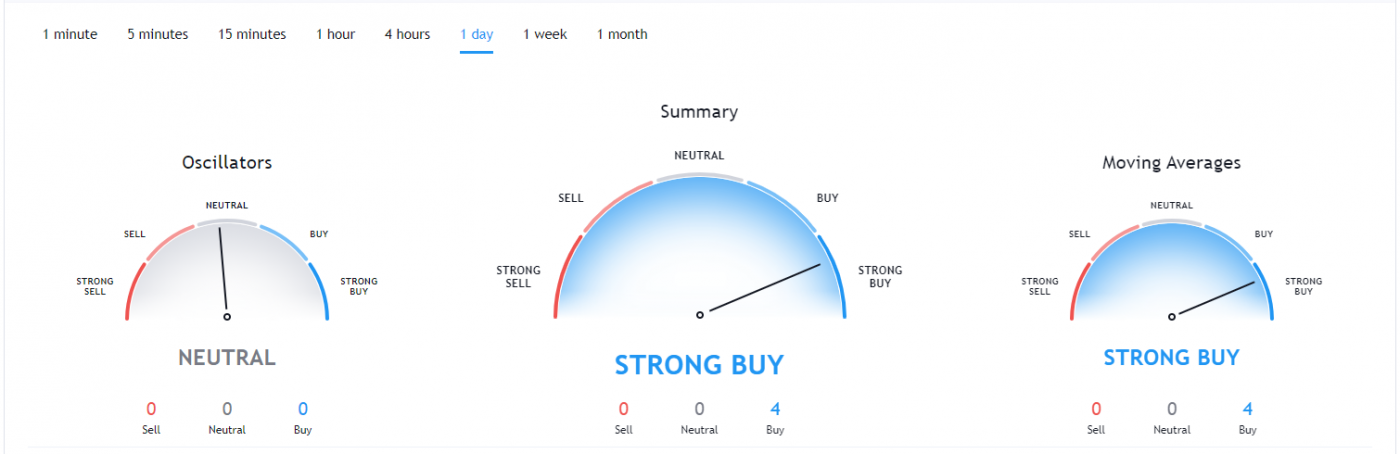

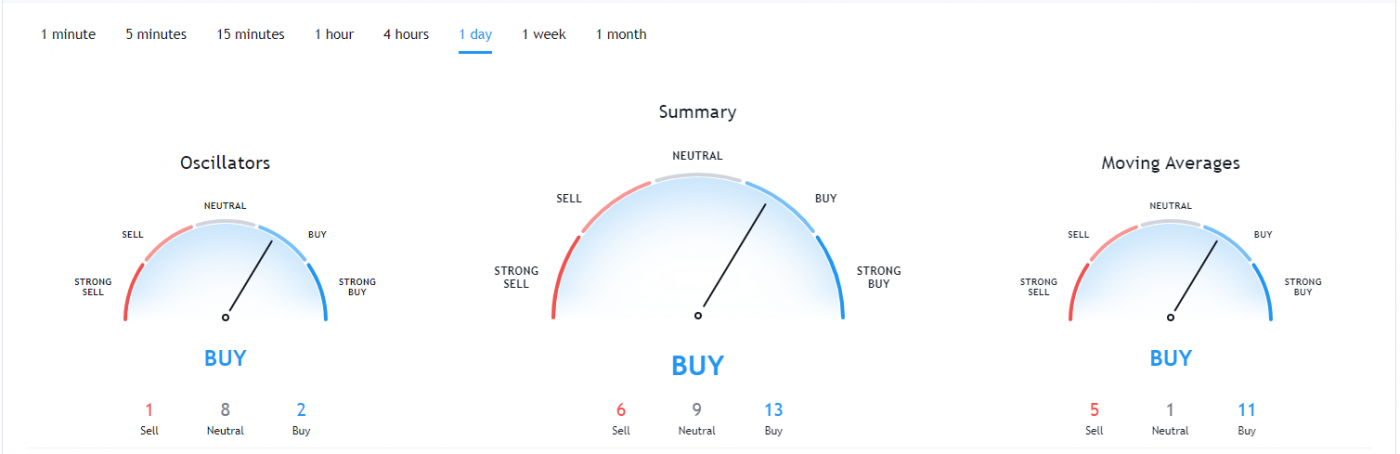

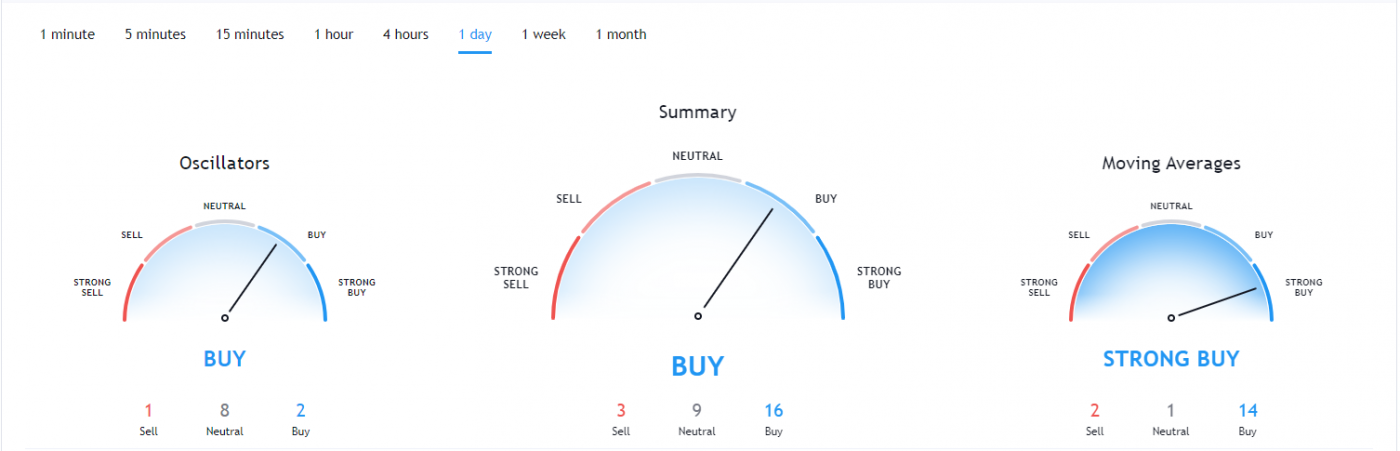

What do the technical indicators say?

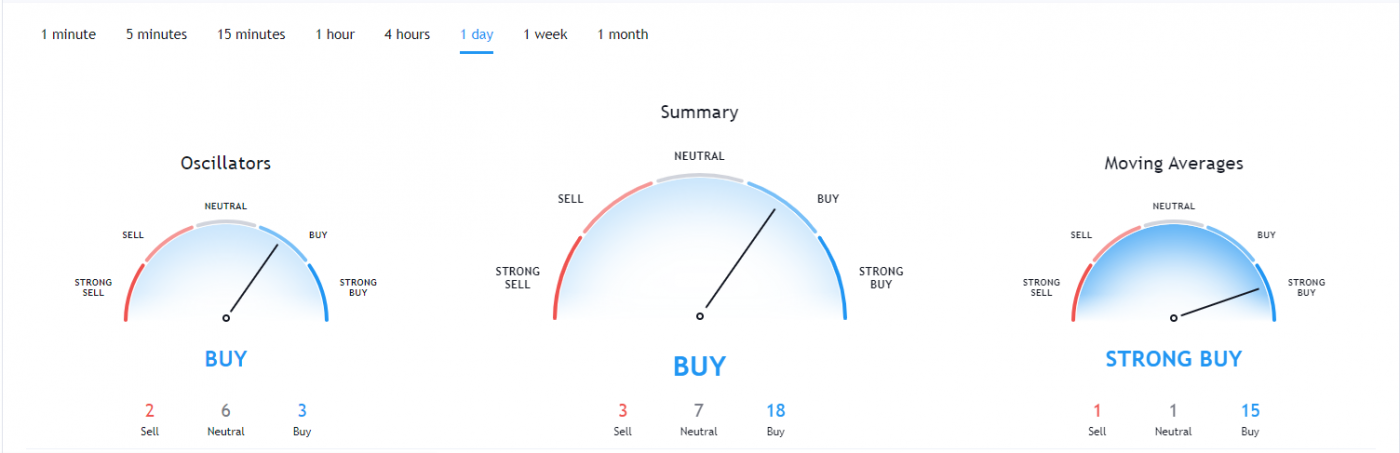

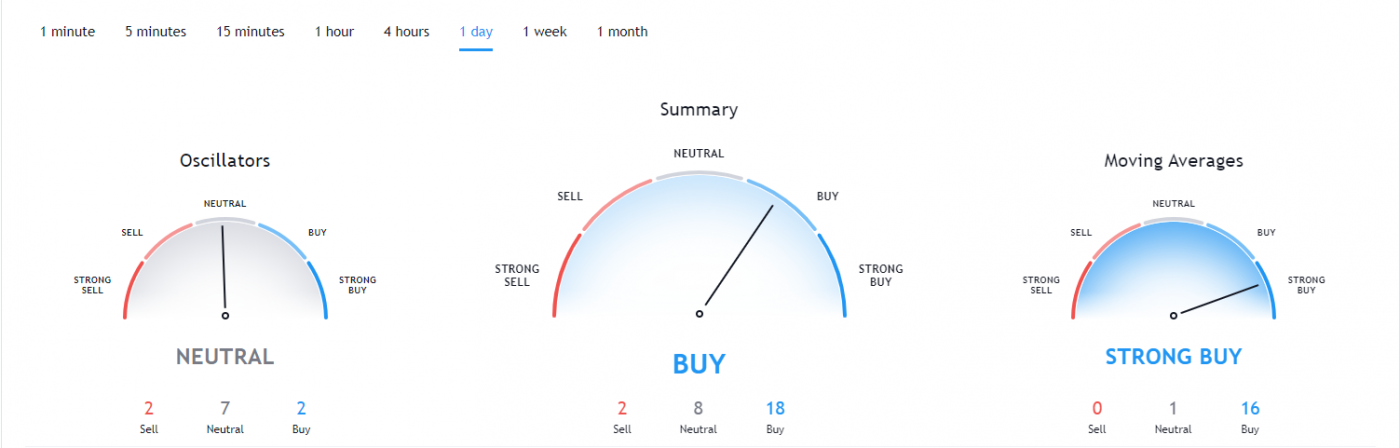

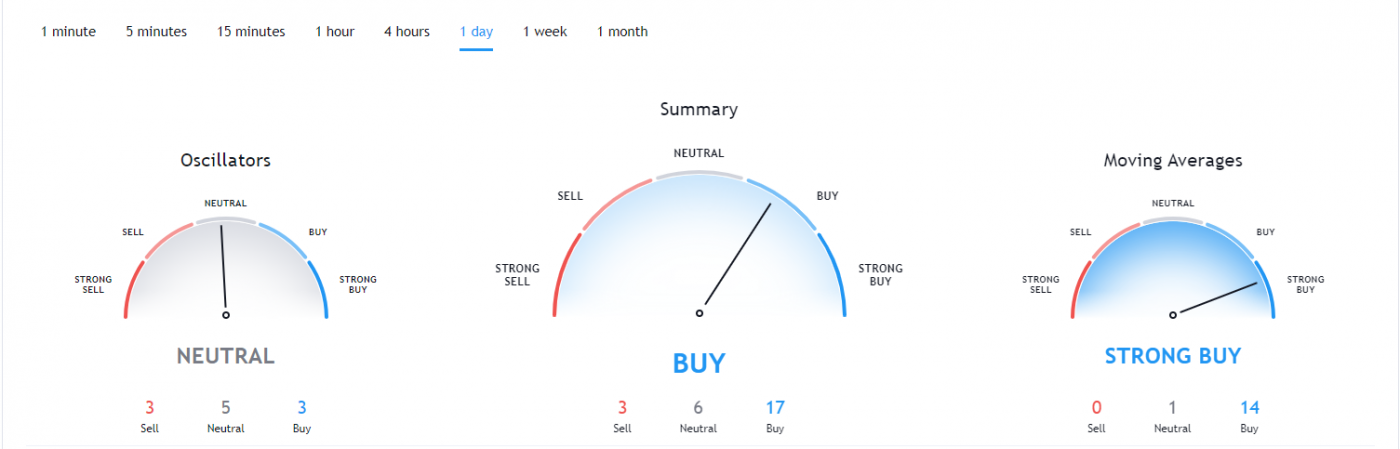

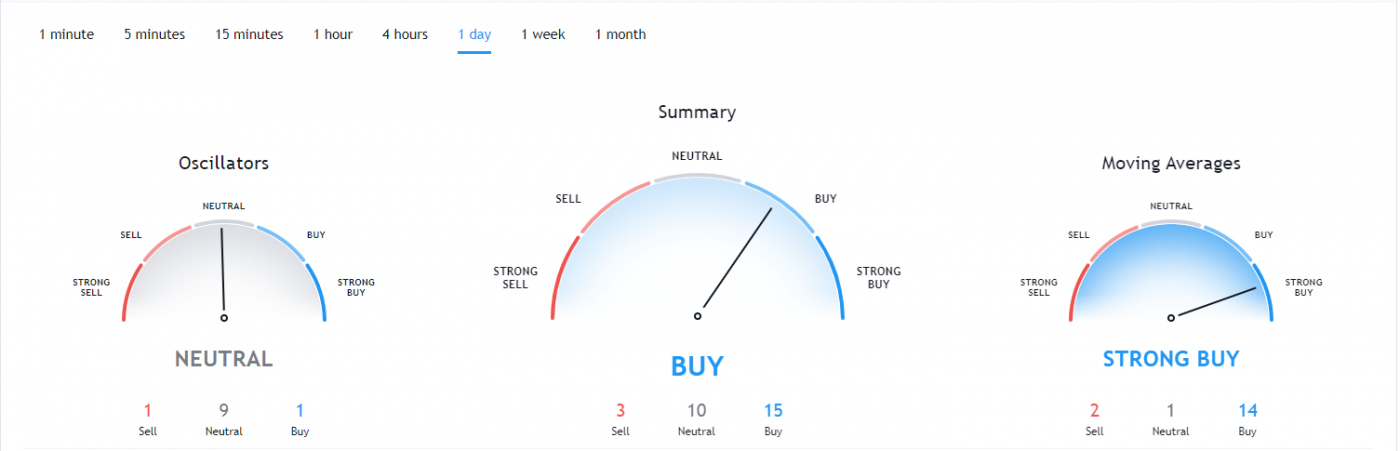

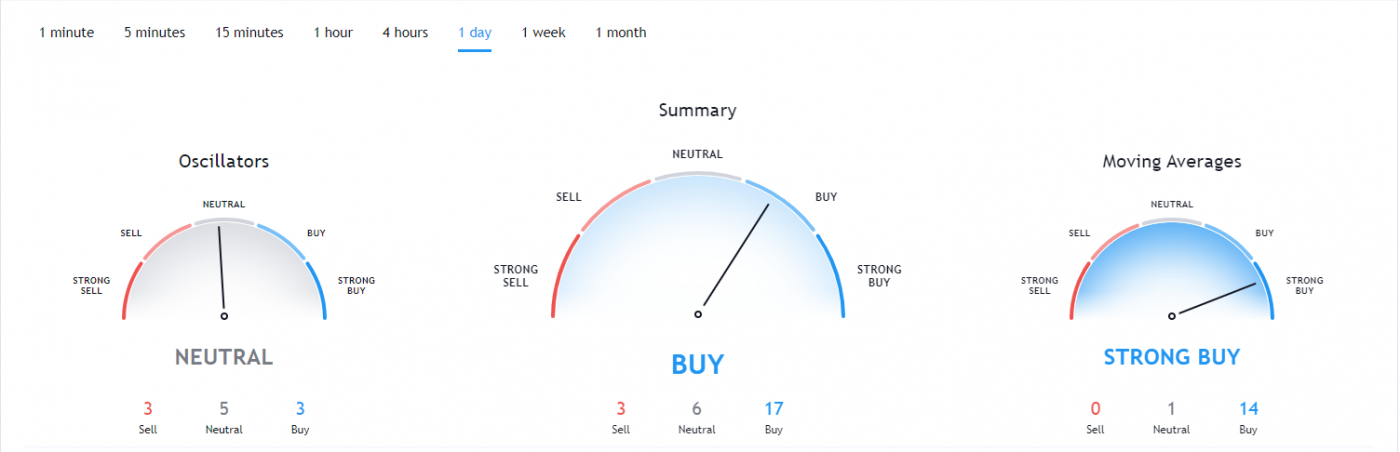

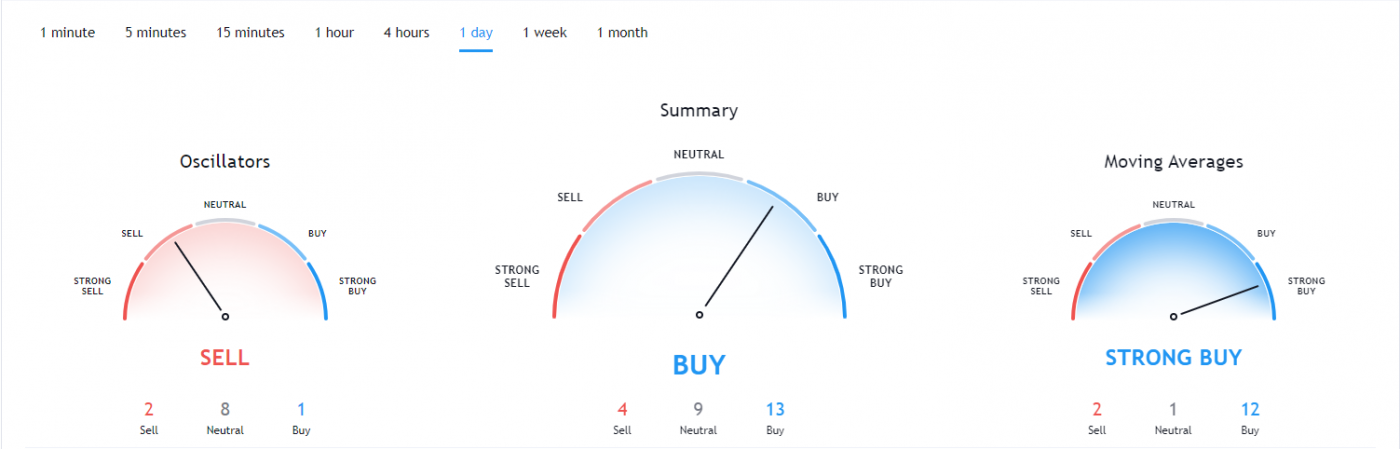

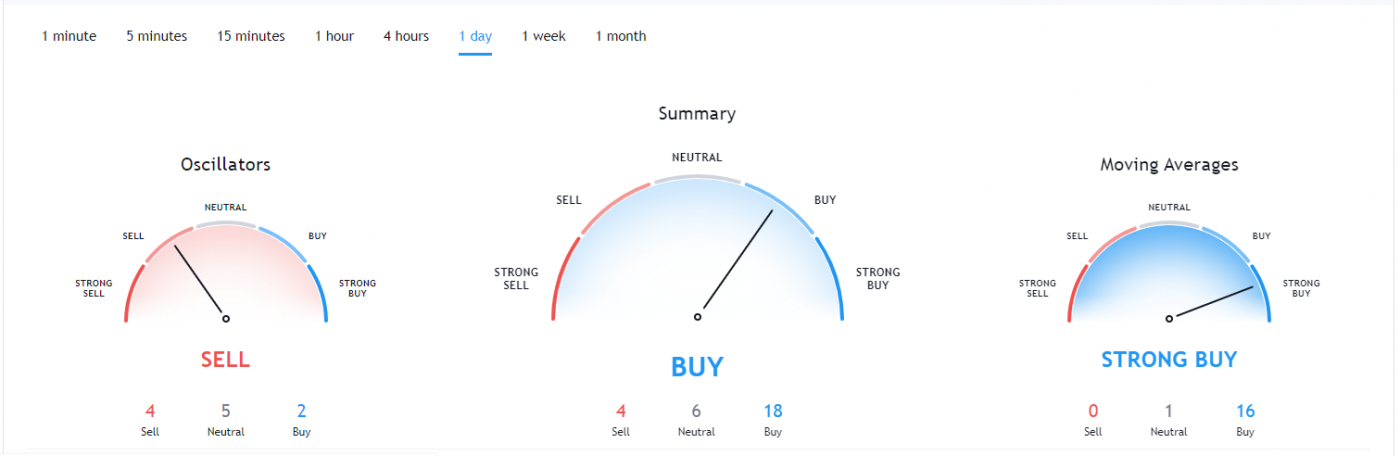

The NEXO TradingView indicators (on the 1 day) mainly indicate Nexo as a buy, except the Oscillators which indicate Nexo as a sell.

So Why did NEXO Breakout?

The recent rise in Bitcoin over 100% since the halving in May and then the suggested start of the Altcoin season could have contributed to the recent breakout. Another reason could be the whales, secretly stacking up NEXO to their portfolio for the upcoming Altcoins rally. It could also be contributed to some of the recent news where they also announced an improved version of the Earn feature.

Recent Nexo News & Events:

- 05 August 2020 – Staking Deadline

- 15 August 2020 – Dividend Distribution

- 05 August 2020 – AMA

Where to Buy or Trade Nexo?

Nexo has the highest liquidity on Binance Exchange so that would help for trading Nexo/USDT or Nexo/BTC pairs. However, if you’re just looking at buying some quick and hodling then Swyftx Exchange is a popular choice in Australia.