Zurich-based financial services giant Credit Suisse has released a report entitled “Bretton Woods III” in which its strategist argues that we are witnessing the birth of a new monetary world order.

Pretty wild analysis from @CreditSuisse

— Alex Gladstein 🌋 ⚡ (@gladstein) March 8, 2022

Hard to believe it’s real. But if so, it predicts:

-End of current monetary order

-New dominance of “outside” over “inside” CB money

-Inflation in the West

-High treasury yields and dollar devaluation

-Bitcoin to benefit, if it survives pic.twitter.com/gy0dfA9DJA

New Monetary World Order – Bretton Woods III

The report starts by saying:

We are witnessing the birth of Bretton Woods III – a new world (monetary) order centered around commodity-based currencies in the East that will likely weaken the Eurodollar system and also contribute to inflationary forces in the West.

Zoltan Pozsar, Credit Suisse strategist

“Bretton Woods” refers to the 1944 World War II agreement in which 44 countries consented to a new monetary system in which the US dollar was pegged to gold, and other currencies were pegged to the greenback.

The arrangement completely disintegrated in 1971 when president Richard Nixon took the US off the gold standard. This marked the beginning of the current fiat currency system, what the author terms “Bretton Woods II”, a regime in which the US dollar’s value was largely backed by “inside money” (mostly US treasury bonds).

As G7 nations seized Russia’s foreign exchange reserves following its invasion of Ukraine, Pozsar argues that this marked the beginning of “Bretton Woods III”.

From the Bretton Woods era backed by gold bullion, to Bretton Woods II backed by inside money (Treasuries with un-hedgeable confiscation risks), to Bretton Woods III backed by outside money (gold bullion and other commodities).

Zoltan Pozsar, Credit Suisse strategist

The author notes that the West’s sanctions will result in self-inflicted financial instability, even if it causes pain for Russia. To believe that sanctions won’t lead to price stability risks is to “also believe in unicorns”.

He adds that “this crisis is not like anything we have seen since [Richard] Nixon took the US dollar off gold in 1971”. Pozsar then concludes that the West will therefore necessarily experience continued and increased levels of inflation.

‘Money Will Never Be the Same Again’

Pozsar outlines some possibilities as to what the future may look like and how the Chinese Communist Party may play a role (hint – a big one). He concludes his analysis with an ominous warning, saying:

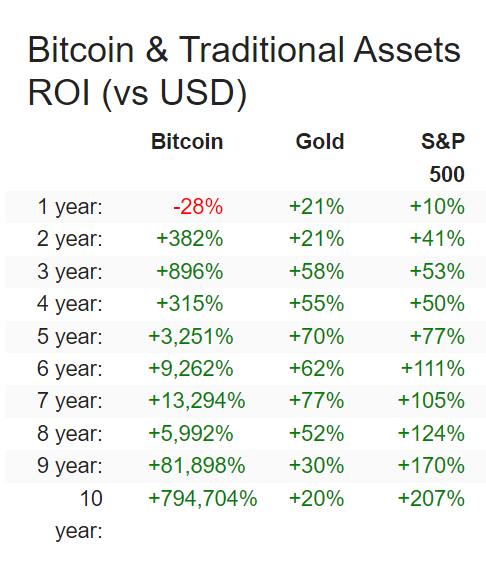

“After this war is over, ‘money’ will never be the same again … and Bitcoin (if it still exists then) will probably benefit from all this.”

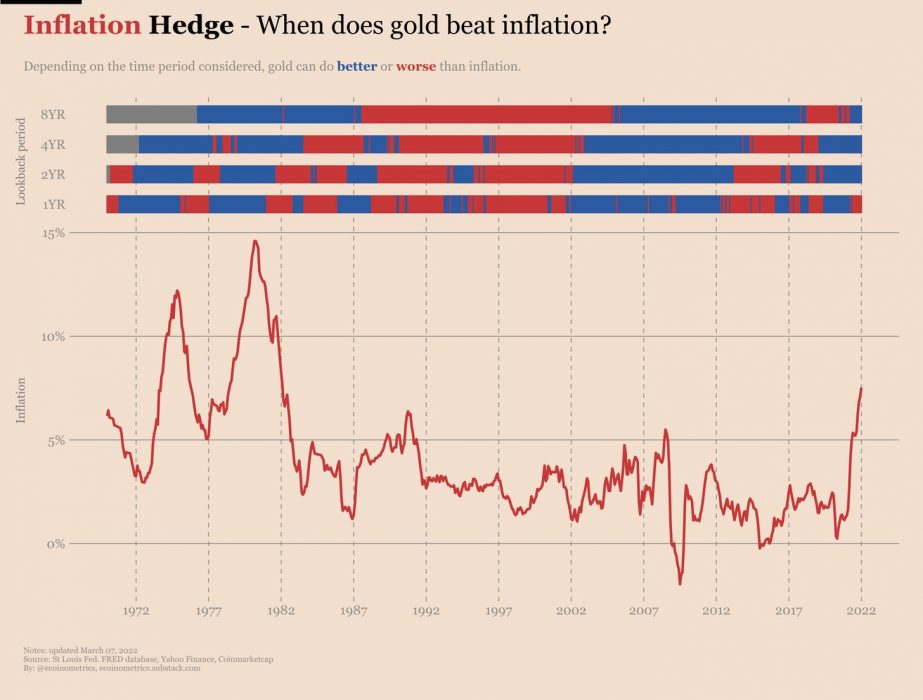

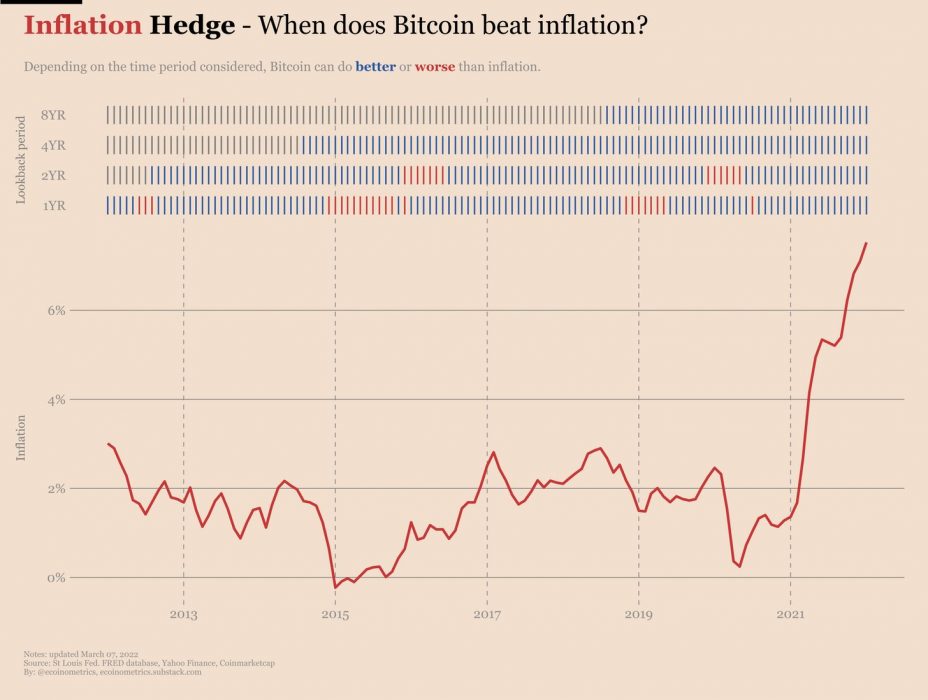

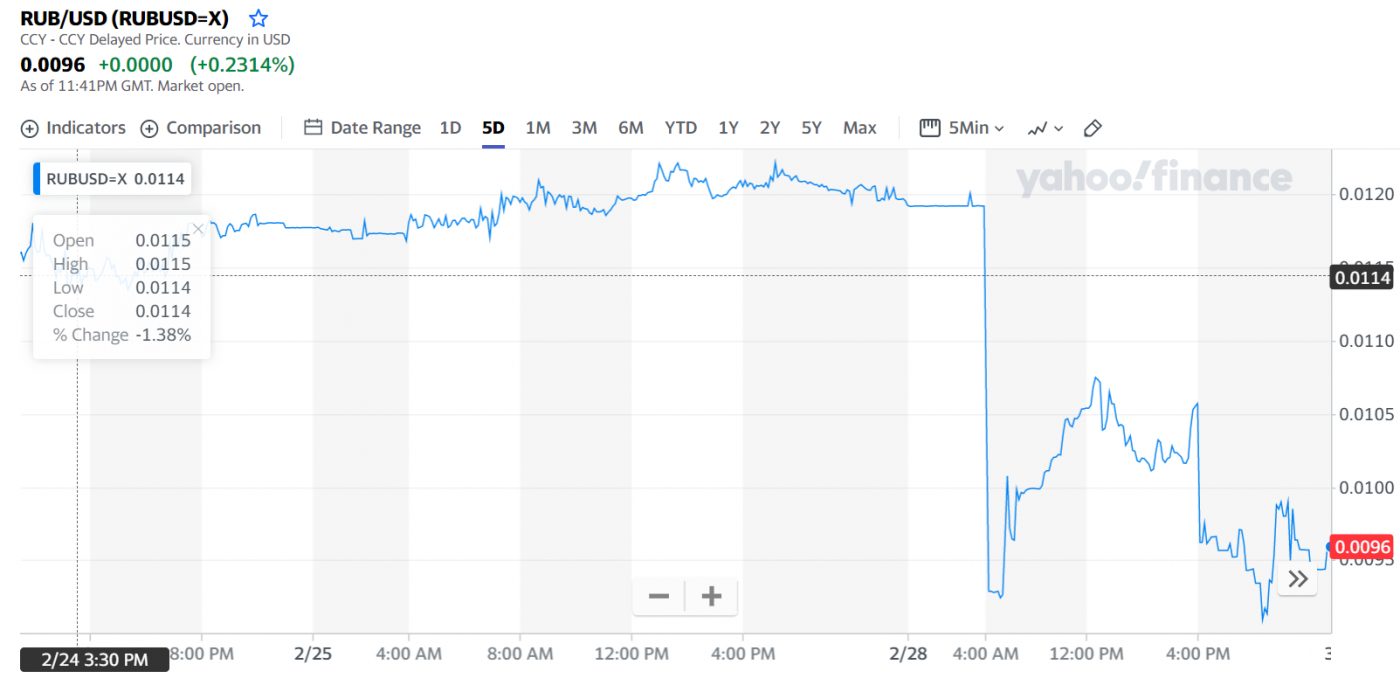

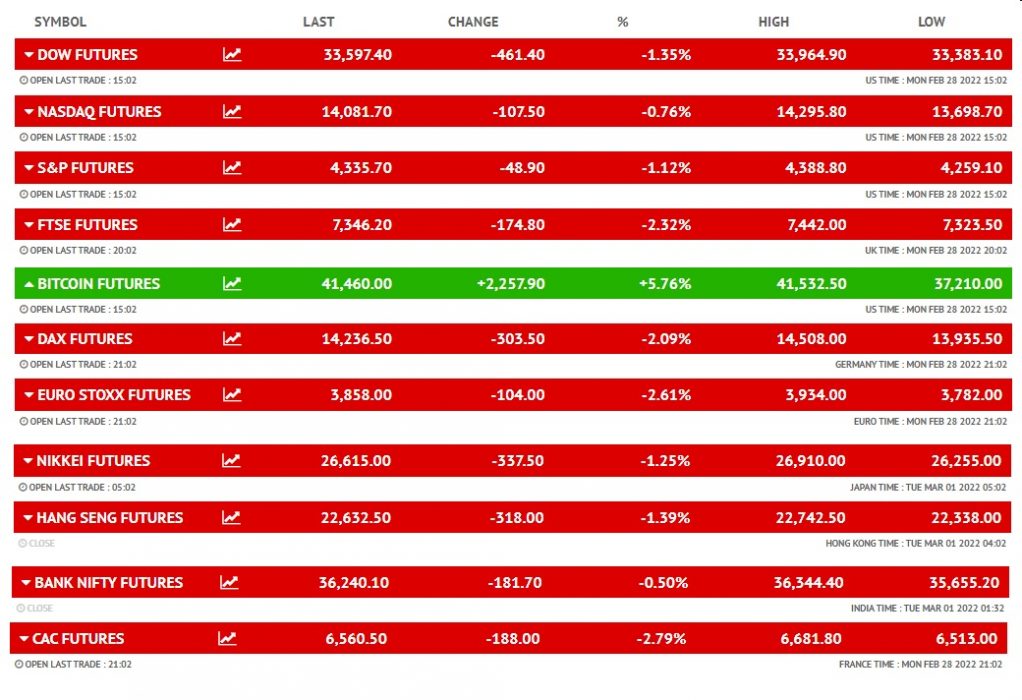

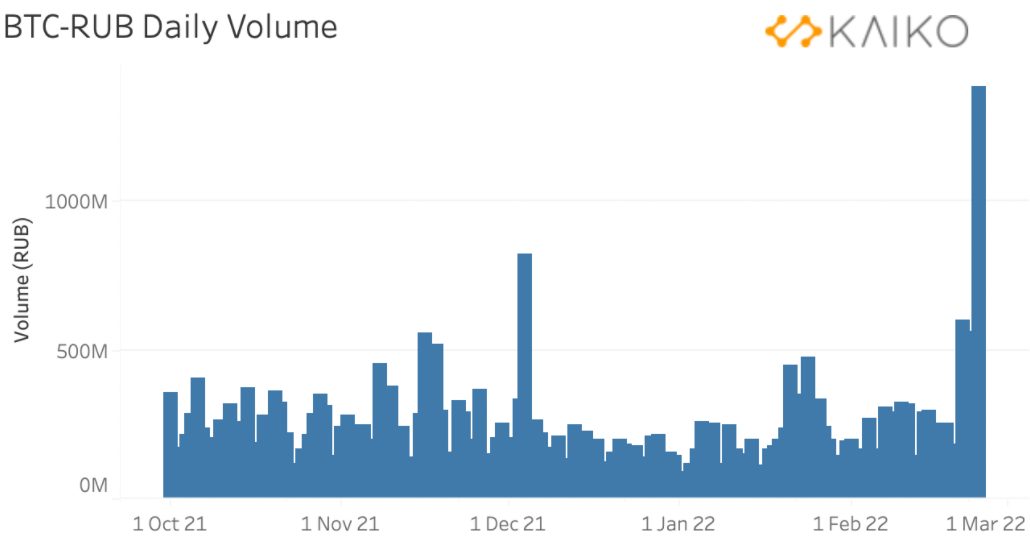

Over extended periods of time, Bitcoin has tended to act as a good hedge against inflation despite being correlated with equities. However, recently it surprised commentators by breaking this correlation and soaring 15 percent overnight in response to the Russian/Ukrainian conflict.

We’re living through an extraordinarily volatile and uncertain period of history, and no doubt the monetary system will look very different in the years to come. Is Bitcoin going to play a role? Quite possibly.

It’s surreal to see global finance companies starting to see what’s coming when there was nothing but dismissal or agression towards ideas like this only a few (admittedly long) years ago.

— Evan Prim (@EvanPrim) March 8, 2022

Simultaneously exciting and terrifying.