Pseudonymous artist SHL0MS has taken an unusual approach to protesting crypto’s focus on profit by blowing up a US$250,000 Lamborghini Huracan in an undisclosed desert location for a groundbreaking NFT project.

The supercar-related memes are funny, but they also implicitly symbolise the popular association of cryptocurrency to short-sighted profit-seeking and zero-sum behaviour … this project is intended to serve as a reminder of the revolutionary potential of the underlying technology – if we wield it correctly instead of solely for personal gain.

SHLoMS

Lambo Wreck Turns into NFTs

In rotating videos, 999 fragments of the blown-up car have been categorised, documented and filmed, intending to highlight the “striking stochastically-generated abstract forms produced by the wreckage”.

Each video will then be turned into an individual NFT and sold via a unique auction, which has a mechanism designed to limit the outsized power of so-called crypto whales.

By defiling the stereotypical aspiration of the crypto world and positioning the charred wreckage as fine art, SHL0MS is said to have delivered a “smouldering critique of zero-sum, extractive practices in the crypto industry while postulating a way forward that centres around long-termism and a focus on using technology for broader societal value rather than self-enrichment”.

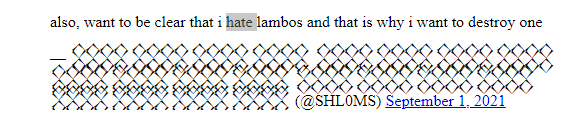

SHL0MS had been plotting the project for some time, and was open about his distaste for Lamborghinis in a since deleted Tweet:

The explosive approach is no doubt novel, and quite clearly in opposition to that of the car manufacturer itself, which last year released its own NFT collection in celebration of its founder.

Potential Sales vs Initial Investment

Like most people, SHL0MS is probably not purely motivated by ideological reasons. You have to imagine that behind the scenes there was a commercial calculation examining whether the NFT sales (and ongoing royalties) plus publicity were likely to exceed the initial investment (ie, a reported total of US$1 million sourcing and blowing up a Lamborghini).

SHL0MS clearly thought that the juice was worth the squeeze. Time will tell whether the hefty upfront investment was worth it, or a costly ideological statement.

Either way, if you’re keen to participate in this unique sale, the auction kicks off February 25 on the official site.