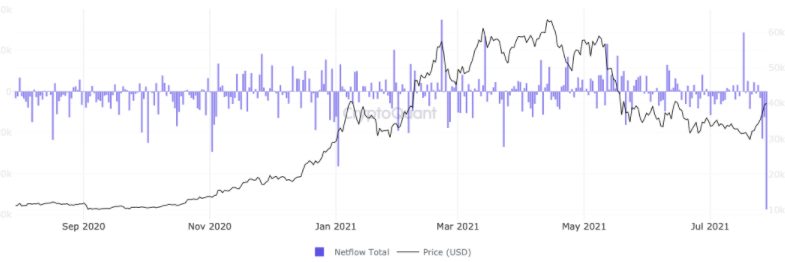

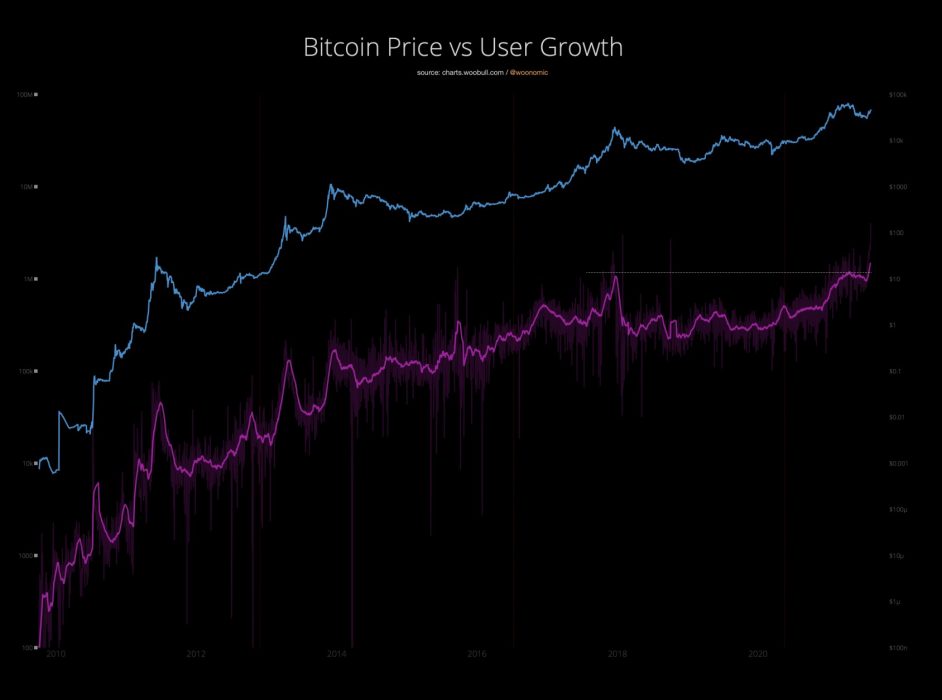

On the back of positive sentiment and growing evidence that bitcoin may have turned a corner, user growth data is painting an even more bullish picture.

User Growth Equivalent to Adding Mauritius in a Month

According to on-chain specialist Willy Woo, the chart above illustrates that the number of users (purple line) is growing at its fastest rate ever.

In fact, over the past 30 days, 1.2 million users have been added to the network. This, according to Woo, doesn’t include off-chain users on exchanges which typically see up to three times that number.

Bitcoin – Still So Early

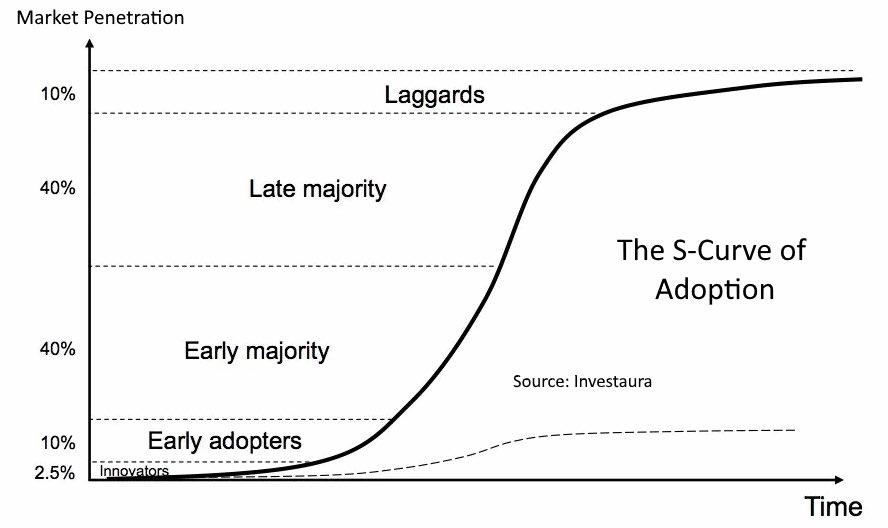

The S-curve of technology adoption is a useful way of considering where we are in the adoption of Bitcoin. It has five main phases:

- Innovators – adoption is slow as only a small group make a bet on a new technology before it is proven or widely accepted.

- Early Adopters – they accelerate the technology’s growth and evangelise its value and are often seen as representing the tipping point towards broader adoption.

- Early Majority – this is where the slope is steepest, and hence the rate of adoption is at its fastest.

- Late Majority – adoption continues growing at a solid pace as more are convinced to participate, and the technology appears almost everywhere.

- Laggards – these are holdouts, those who are last to accept/adopt a technology.

Bitcoin Archive is one of many commentators to suggest we have likely shifted into the Early Majority phase of the technology adoption S-curve, the phase at which growth is fastest.

Along similar lines, Willy Woo tweeted earlier this year that in terms of Bitcoin adoption, we are more or less where the internet was in 1997.

Price and Fundamentals Don’t Always Align

While most investors are often focused solely on bitcoin’s price, it is worth taking heed of Mark Yusko’s advice:

Price is a liar.

Chief investment officer and managing director, Morgan Creek Capital Management

Yusko often advises new investors to focus on Bitcoin’s fundamentals over price. This includes metrics such as user growth, hash rate and growth in the number of nodes. These cumulatively tend to provide a better overall picture of the health of the network.

The foundation appears set for bitcoin to push beyond US$50,000 in the near term, though if one were to take Yusko’s advice on board, it really shouldn’t make all that much difference to the average investor.