Following a July 26 filing with the Securities and Exchange Commission (SEC), Wall Street investment bank Goldman Sachs has taken its tentative first steps into the world of DeFi with the announcement of a DeFi exchange traded fund (ETF).

On closer inspection, however, it isn’t quite as it seems.

Goldman Sachs ‘DeFi ETF’

As per the filing:

The Goldman Sachs Innovate DeFi and Blockchain Equity ETF (the ‘Fund’) seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the Solactive Decentralized Finance and Blockchain Index (the ‘Index’).

Goldman Sachs SEC filing

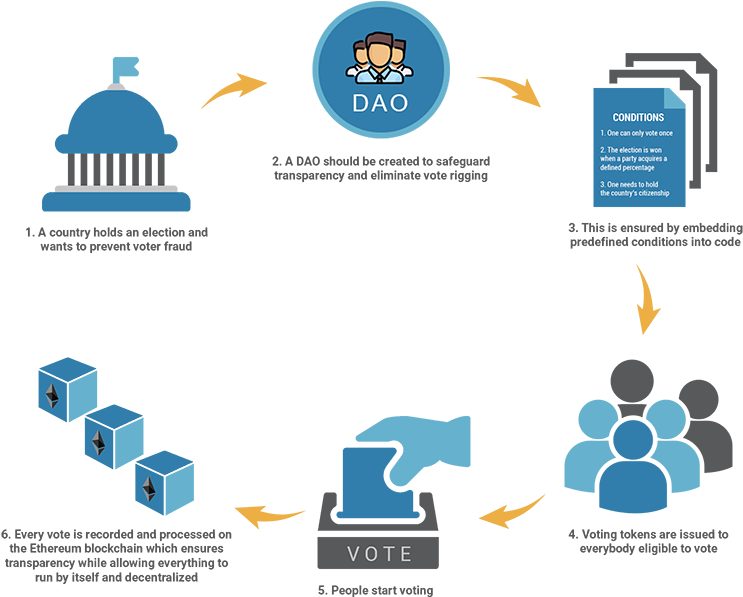

Goldman Sachs considered “DeFi” to mean the “Digitalisation of Finance”, defined as “the digital transformation of traditional financial services, including the support and delivery of payments, transaction services, lending and insurance”.

In terms of the types of investments with the ETF, the filing noted:

The eligible universe of stocks is comprised of common equity securities, including depositary receipts, of companies located across developed and emerging markets worldwide, listed and traded on major exchanges in certain developed markets, including: Australia, Canada, France, Germany, Hong Kong, Japan, South Korea, Switzerland, the Netherlands, the United Kingdom and the United States.

Goldman Sachs SEC filing

According to the filing, the ETF will be tied to the performance of companies that are working on blockchain technology and the digitisation of finance.

The ‘DeFi ETF’ Is Anything But DeFi

While some were quick to praise the move, some sharp-eyed critics highlighted a glaring issue:

On a closer inspection of the index that the ETF would be tracking, it revealed only legacy companies with zero exposure to crypto-native businesses – hardly a ‘DeFi ETF’ as advertised.

Buzzwords Over Substance

Earlier this year, Goldman appeared to be making moves in the right direction. In May it recognised crypto as an investment asset, followed by the introduction of a crypto trading desk despite investors’ uncertainty. Following this latest move, however, the megabank’s reputation will undoubtedly suffer within crypto circles.

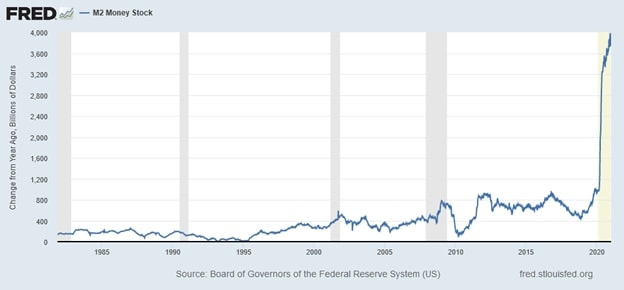

What drives such inaccurate labelling of financial products, and is it deliberate? Could it be the blockchain equivalent of environmental greenwashing? Given the track record of investment banks, it seems likely that the appearance of “keeping [up] with the times” (ie, blockchain) is more important than actually doing so.

Experienced members of the crypto community have long been suspicious of Wall Street’s moves into the industry, and perhaps they have a point.