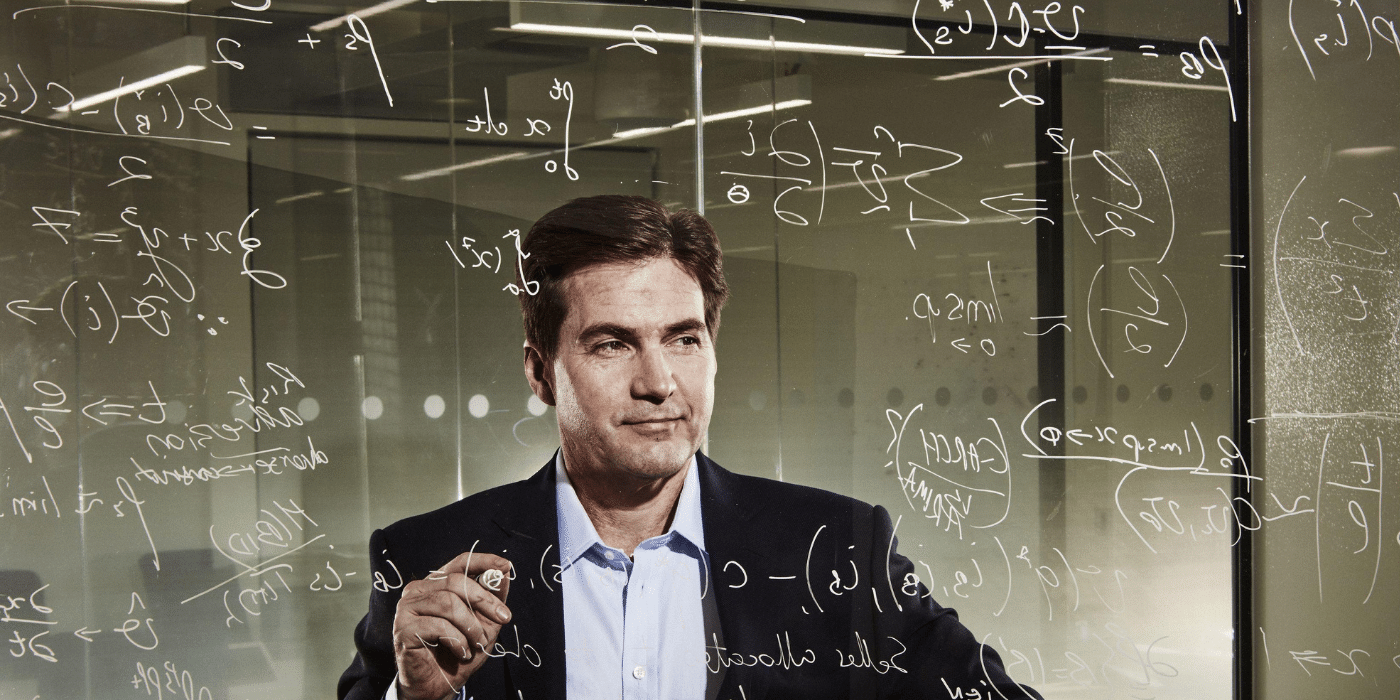

In 2013, 35-year-old British IT engineer James Howells accidentally threw away a hard drive of an old computer containing 7,500 bitcoins.

Eight years later, he still hasn’t given up on his quest to recover his coins, which ended up along with the hard drive in a landfill in his home town of Newport, South Wales.

Howells’ Plan to Find his Fortune

In his mission to find the discarded hard drive with its estimated 7,500 bitcoins (valued presently at A$323.2 million), Howells has devised a 12-month plan to search the city landfill using x-ray scanning devices and AI technology:

We have a system with multiple conveyor-belts, x-ray scanning devices and an AI scanning device that would be trained to recognise items that are a similar size and density to the hard drive.

James Howells

Howells estimates he would need to sift through 300,000–400,000 tonnes of waste up to 15 metres deep across 200 square metres. He notes it would be a difficult search given the delicacy of the hard drive and therefore he has enlisted assistance from “some of the best data recovery experts in the world to make sure we can get [the bitcoins] off the hard drive”.

While the search would be expensive, Howells says his plan is supported by a hedge fund that is prepared to cover the cost in exchange for a share of the bitcoins.

Despite Howells’ plan, it has not been received favourably by the Newport City Council, even after he offered it £55 million (approximately US$76 million). Council explained that:

The cost of digging up the landfill, storing and treating the waste could run into millions of pounds – without any guarantee of either finding [the hard drive] or it still being in working order … excavation is not possible under our licensing permit and excavation itself would have a huge environmental impact on the surrounding area.

Newport City Council spokesperson

Risks of Self-Custody

Situations such as this provide a timely reminder of some of the risks inherent in holding your own private keys. Self-custody of digital assets such as Bitcoin is a doubled-edged sword.

On the plus side, no one can confiscate them without your permission. You can effectively “be your own bank” and spend it without ever needing the assistance or cooperation of any third party. The downside is that if you lose your private keys, there is no customer helpdesk to call. Once your keys are gone, you’ve lost access to your crypto and recovering them can be next to impossible.

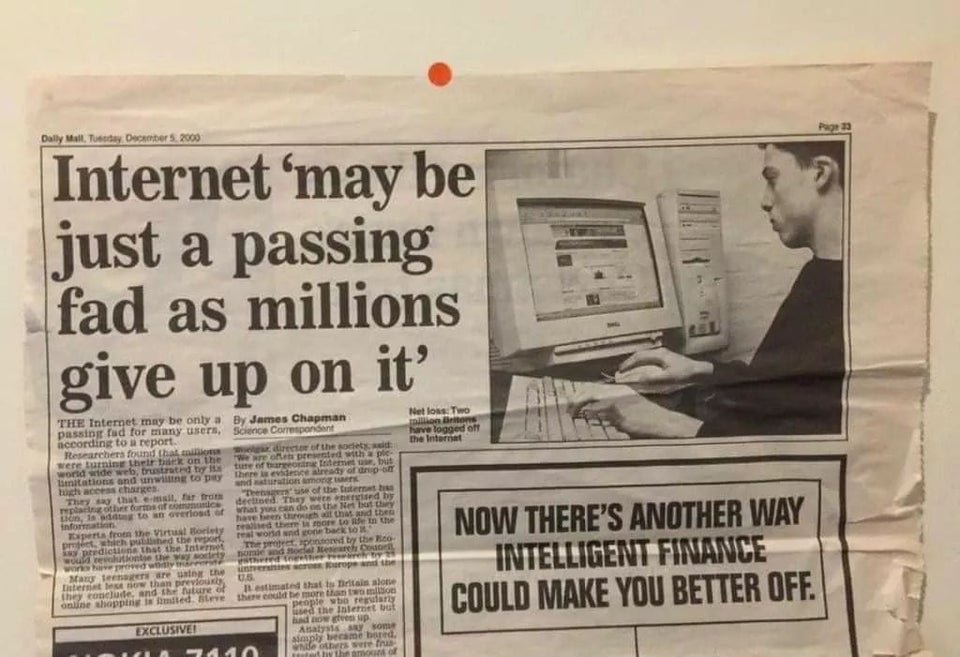

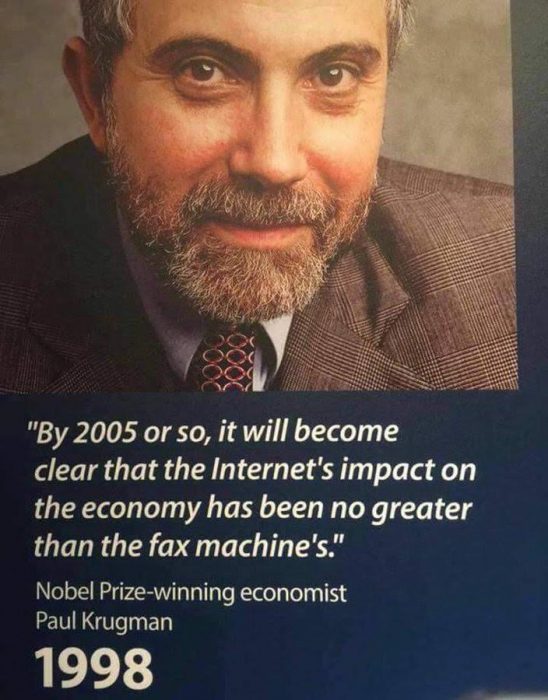

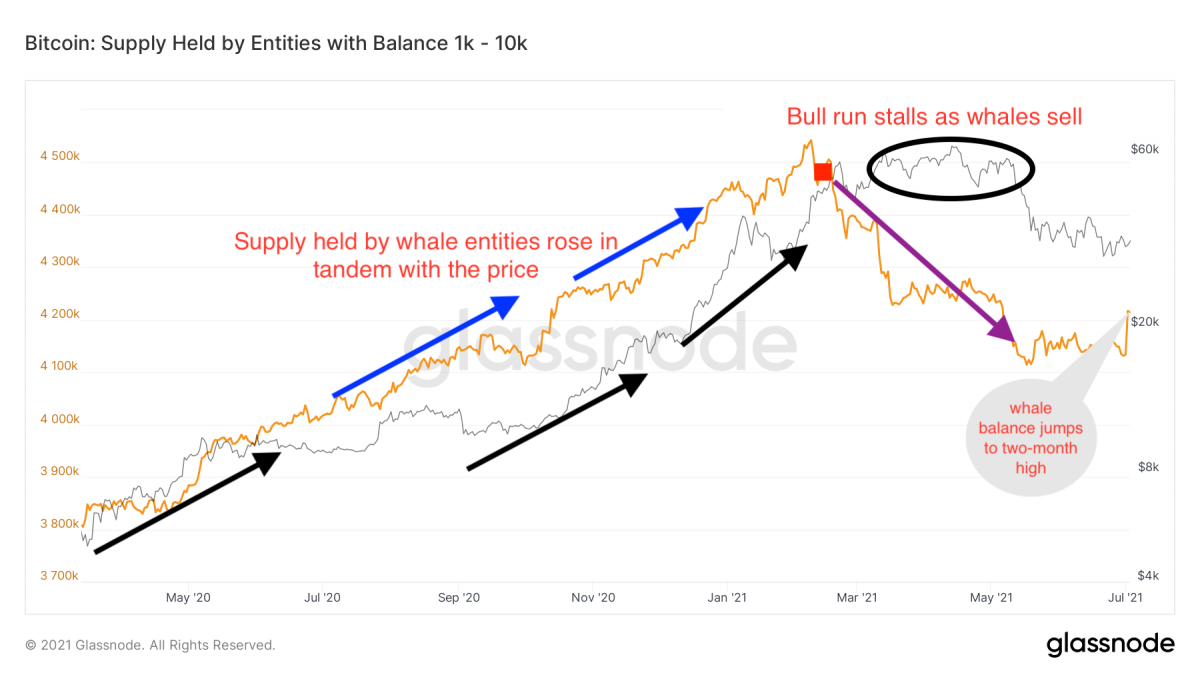

There are only ever going to be 21 million bitcoins and up to 20 percent of supply has been lost forever. In many cases, those who have lost their private keys are early adopters who acquired their coins before much of the user-friendly interfaces and products existed (Ripple’s CTO is one such example).

These risks intrinsic to self-custody remain one of the most compelling reasons some investors prefer investing in crypto funds or exchange traded projects (ETPs). That way, the risk is transferred to a trusted third party.

On the face of it, it would appear Howells may have reached the end of the road. However, given the prize at stake, it wouldn’t be entirely surprising to see the matter proceed to court. And you probably wouldn’t blame him.