The US Federal Reserve (Fed) has raised interest rates by 75 basis points, the biggest rate hike since 1994, as part of an ongoing effort to tackle soaring inflation.

Aggressive Rate Hike to Curb Inflation

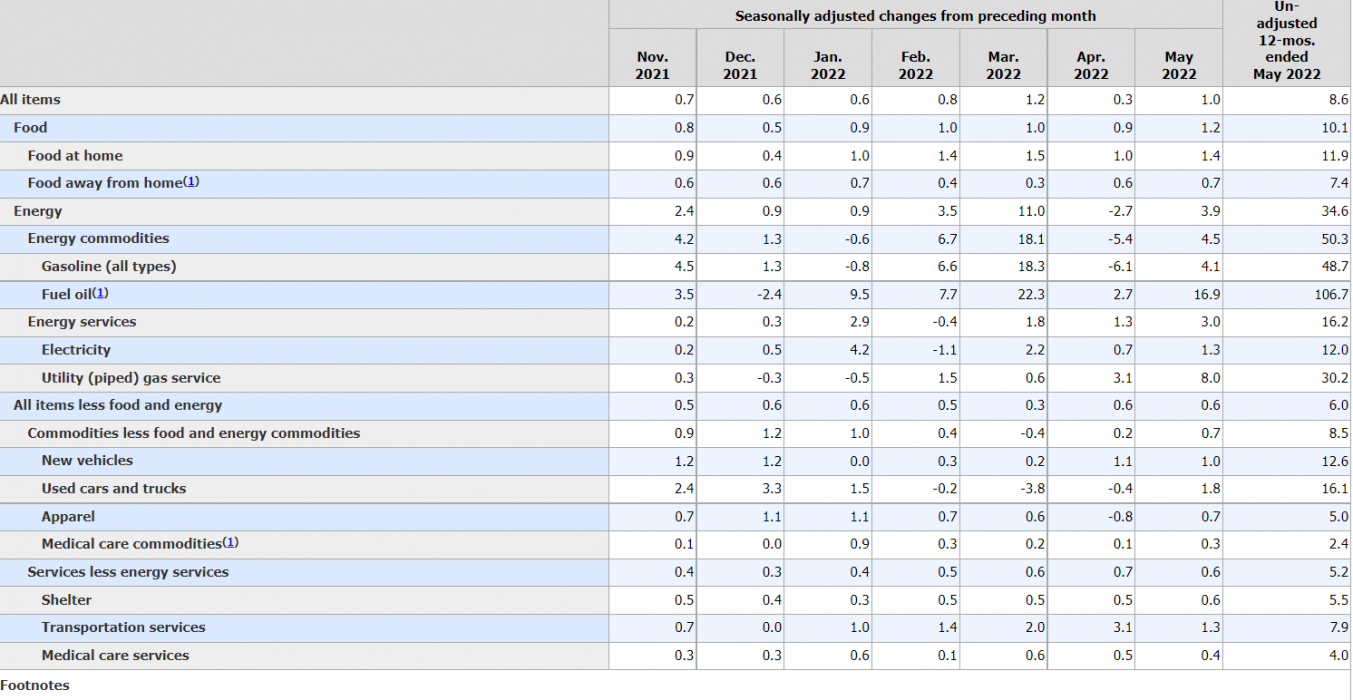

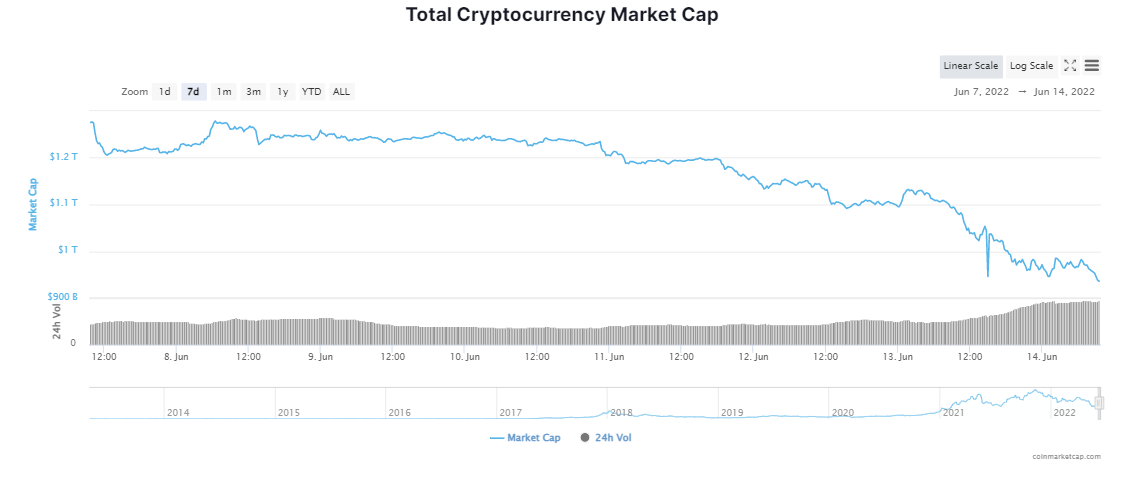

This past week saw crypto markets plummet in the face of US inflation hitting its highest level in 40 years. With a Federal Open Market Committee (FOMC) meeting scheduled for later in the week, commentators speculated that the record 8.6 percent inflation print would likely force the Fed to aggressively raise rates. And it turns out, they were correct.

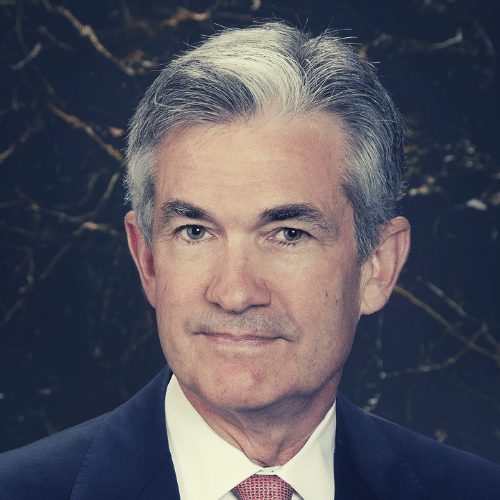

At a meeting of the FOMC, members took the decision to raise rates by 0.75 percent to 1.75 percent, with Fed chair Jerome Powell commenting:

Clearly, today’s 75 basis point increase is an unusually large one, and I do not expect moves of this size to be common.

Jerome Powell, Fed chair

Powell added, though, that he expects the July meeting to see an increase of 50 or 75 basis points too, though any decisions would be made “meeting by meeting”. Continuing, he said: “We [Fed] want to see progress. Inflation can’t go down until it flattens out. If we don’t see progress, that could cause us to react. Soon enough, we will be seeing some progress.”

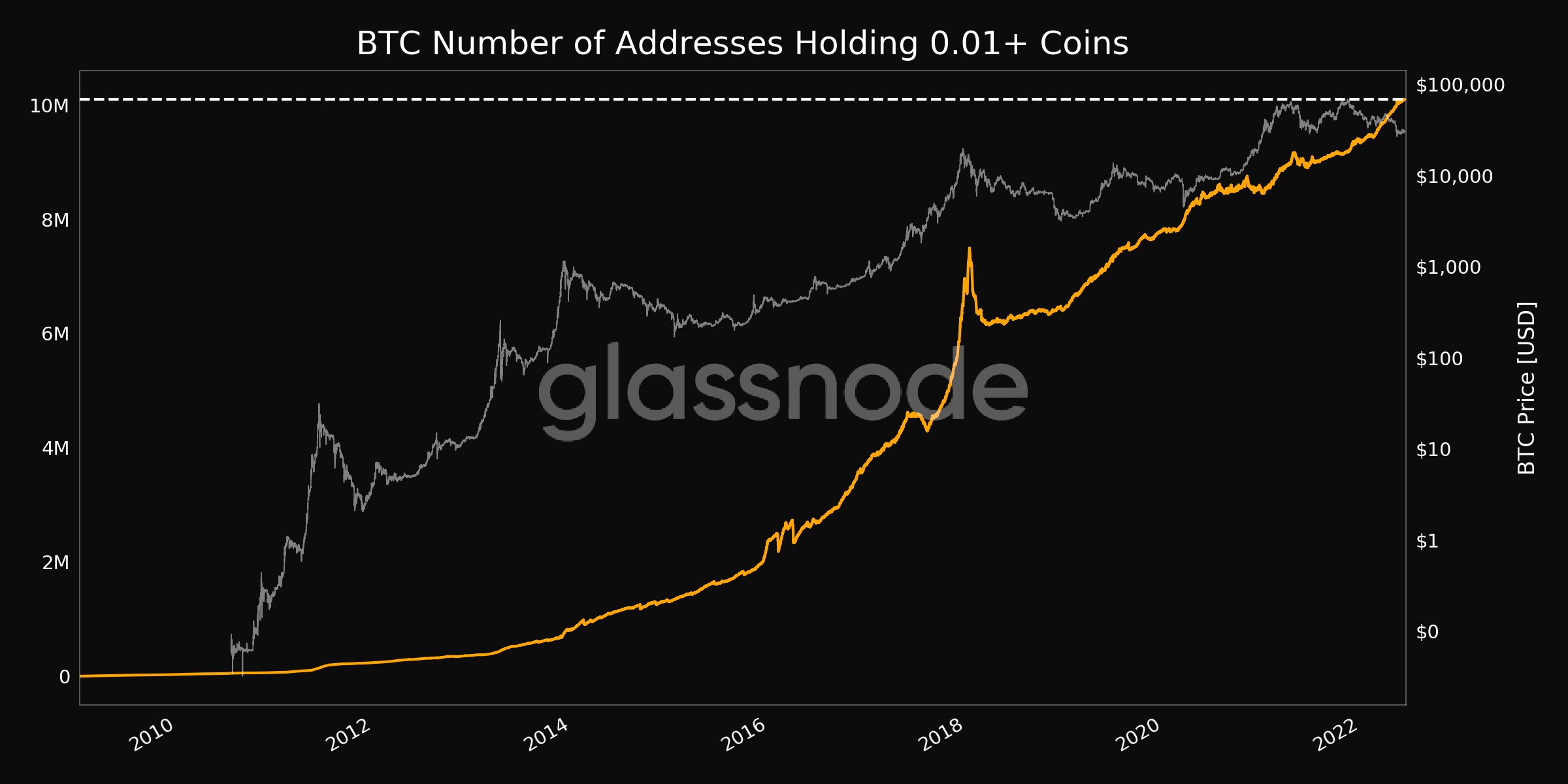

While there were references to soaring energy costs amid the Ukraine/Russia conflict and lockdown-induced supply chain woes out of China, no mention was made of the impact of a 50 percent increase in broad money supply since 2020.

Going forward, FOMC members indicated a much stronger path of rate increases to help the Fed arrest inflation and achieve a 2 percent target which, according to its statement, it is “strongly committed” to.

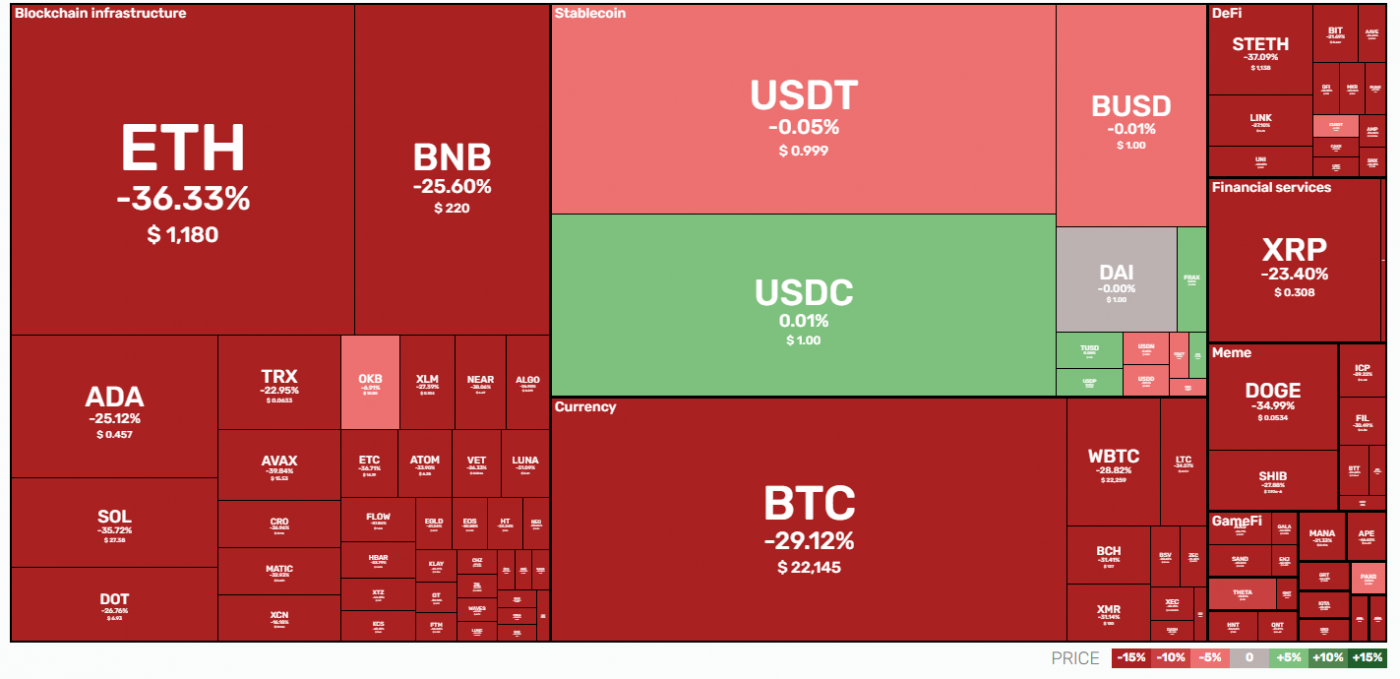

Crypto Market Rallies Briefly in Response

Crypto markets arguably had a sense of impending doom going into June 15’s FOMC meeting, expecting the worst. Surprisingly however, it appears as if the bad news were already priced in as the digital asset market rose more than 10 percent on news of the Fed’s increased rate:

Ethereum rose from US$1,075 to US$1,240, compared to bitcoin which saw an increase of over 10 percent from a low of close to US$20,000 up over US$22,500.

The gains have, however, been trimmed back a touch, and bitcoin is currently exchanging hands at US$22,100.

For all the talk of “uncorrelated assets” and a “supercycle”, 2022 has shown that the digital asset market is intrinsically tied to the broader macro environment. Conditions remain uncertain for now and, therefore, continued volatility ought to be anticipated.