Decentralised finance (DeFi) is increasingly bridging the gap between the crypto and traditional finance (TradFi) worlds, most recently signalled by Compound Treasury, who has just made history by becoming the first institutional DeFi offering to receive a credit rating from international rating agency Standard and Poor (S&P):

Ratings Agencies?

In TradFi lending, one of the key requirements for debt issuance in public markets is a credit rating from one of the ‘big three’ rating agencies: S&P, Moody’s, or Fitch.

Credit ratings offer prospective investors useful insights as to the relative risk of specific corporate or government debt. A rating of “D” denotes debt that is most risky or speculative, whereas “AAA”, on the other end of the spectrum, is seen to be “safe”.

Compound Gets ‘Junk’ Status

Compound Treasury is a product converting US dollar deposits into stablecoins, typically USDC, which it uses for its lending product offering investors a 4 percent guaranteed return. It has now become the first in DeFi to receive a rating, in this case a B- grade from S&P.

A B- grade is technically “junk”, as it is known within public markets, putting it on a par with the sovereign debt of El Salvador, Nigeria and South Africa.

S&P said Compound received a rating below investment grade due to “weaknesses” including operational and convertibility risks between fiat and stablecoins.

In outlining potential risks, the rating agency cited regulation, Compound’s “low capital base” and “hurdles to generate a 4 percent return”. Despite this, S&P suggest that the “outlook is stable” on the back of limited loan losses and rapid expansion of its balance sheet.

Compound’s general manager, Reid Cuming, viewed the rating as a signal of growing maturity in the sector, saying:

Today, Compound Treasury received a B – credit rating from S&P Global Ratings. This makes Compound Treasury the first institutional decentralised finance (DeFi) offering to be rated by a major credit rating agency, and signals tremendous progress in the crypto industry’s maturity, as traditional institutions begin to judge the risks of digital asset-powered financial offerings.

Reid Cuming, general manager, Compound Treasury

DeFi Draws Increasing Interest From TradFi

Reid further suggested that “Compound Treasury is predictable, liquid, compliant, transparent, and now rated”, which “helps our institutional clients more easily understand the opportunity and risks of crypto-powered cash management”.

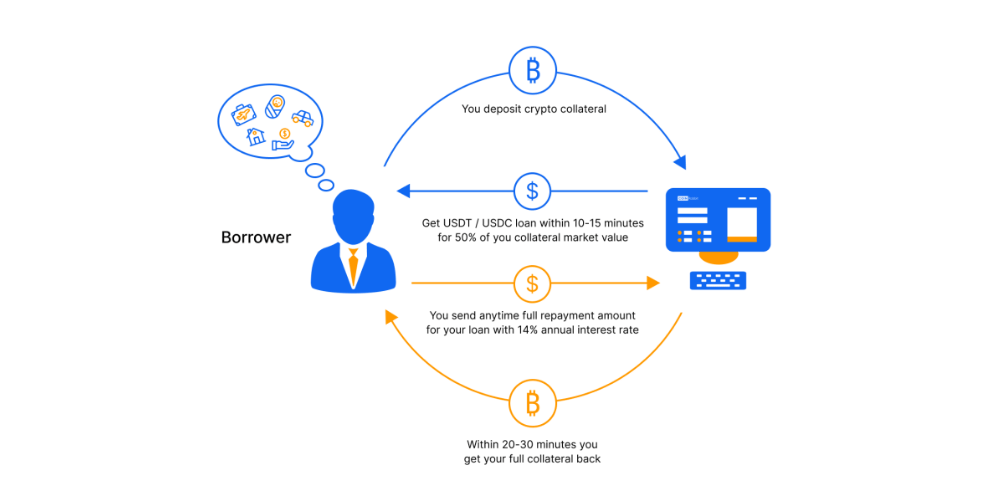

Despite slowing down in 2022, it’s clear that DeFi has garnered the attention of TradFi companies as they seek to innovate and offer products in response to growing consumer demand. To illustrate, one company in the US recently concluded the first DeFi-based mortgage loan, which perhaps is one of the reasons banking giants such as ING are exploring the space.

It should go without saying, but investors would be well advised to DYOR (do your own research) as week after week we continue to see DeFi hacks, most recently to the tune of US$80 million.