The People’s Bank of China (PBoC) has issued a whitepaper outlining the progress of China’s CBDC, formally called e-CNY. The document, released on July 16, reveals the e-CNY uses smart contracts programmability as part of one of its seven major features.

E-CNY obtains programmability from deploying smart contracts that don’t impair its monetary functions. Under the premise of security and compliance, this feature enables self-executing payments according to the predefined conditions or terms agreed between two sides, so as to facilitate business model innovations.

PBoC whitepaper

Implications of “Programmable Money”

This is the first time that the PBoC has clarified the use of smart contracts. But two researchers of the PBoC’s digital currency research lab have stated contrary opinions on the programmability layer of the e-CNY.

Mu Changchun, head of the research lab, and Fan Yifei, vice governor of the central bank, said the digital yuan could support smart contracts to boost its performance as a currency, but beyond a currency, smart contracts could “undermine the renminbi by adding extra social or administrative functions”.

The Chinese View of Smart Contracts

The PBoC believes in “state-led innovation” and that the issuance of a digital currency such as the e-CNY belongs to the state. The currency is a centralised, two-tier system that uses distributed technology.

The right to issue e-CNY belongs to the state. The PBoC lies at the centre of the e-CNY operational system. It issues e-CNY to authorised operators which are commercial banks, and manages e-CNY through its whole life cycle. Meanwhile, it is the authorised operators and other commercial institutions that exchange and circulate e-CNY to the public.

PBoC whitepaper

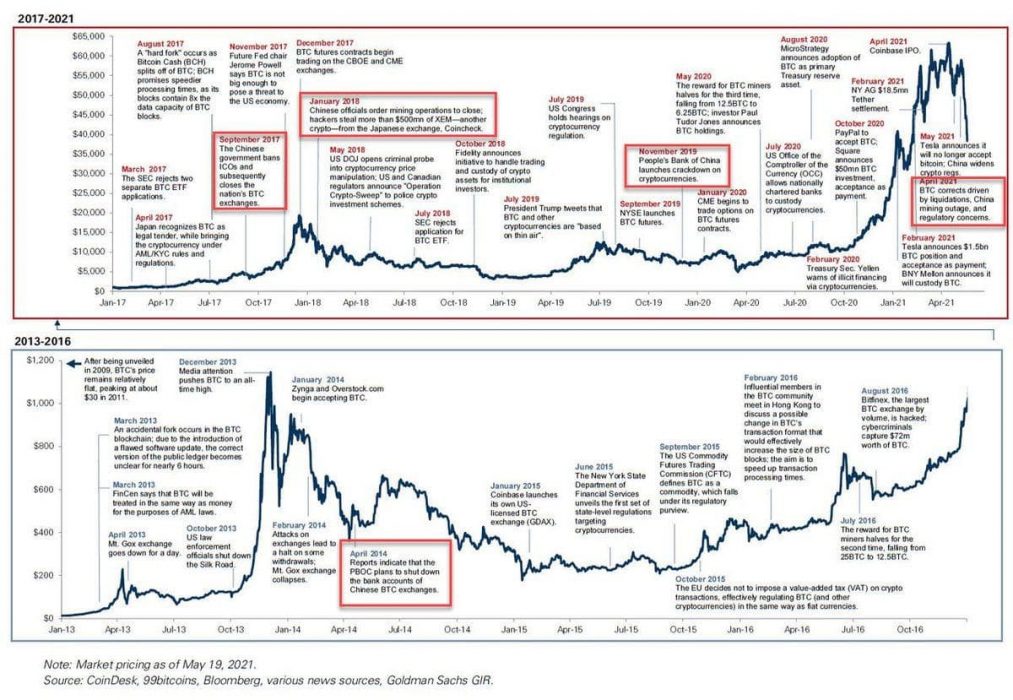

Moreover, the report didn’t fail to criticise cryptocurrencies and the rise of altcoins, saying the intrinsic volatility of crypto represents a huge risk to the stability of society and financial security.

Cryptocurrencies such as bitcoin are claimed to be decentralised and entirely anonymous. However, given their lack of intrinsic value, acute price fluctuations, low trading efficiencies and huge energy consumption, they can hardly serve as currencies used in daily economic activities. In addition, cryptocurrencies are mostly speculative instruments, and therefore pose potential risks to financial security and social stability.

PBoC whitepaper

CBDC Research, Development and Trials

In 2017, the same year the crypto market began one of its rallies, the PBoC created a task force to study and research the use cases and properties of a CBDC, while also seeking advice from several international organisations.

Since then, the Chinese government has carried out several domestic trials. In June, authorities in Xiong’an, a region southwest of Beijing, announced that salaries of residents would be paid in digital yuan.

The e-CNY has been put to the test in multiple Chinese locations through 20 million retail e-CNY wallets. As of June 30, the number of transactions exceeded 70 million, totalling 34.5 billion yuan (US$5.3 billion).

Meanwhile, as Crypto News Australia reported earlier this month, the Reserve Bank of Australia has also been conducting research on implementing a CBDC.