Everything is being dematerialised and it’s no surprise that money is quickly moving in that direction too. Central banks around the world have recognised that digital currencies are here to stay and in response they are forming their own stablecoins, CBDCs.

What are CBDCs?

A CBDC (central bank digital currency) is simply a digital form of a fiat currency issued and regulated by a central bank and/or government authority. They can be classified as either retail or wholesale.

- Retail CBDCs

- Issued for all people and companies (or, put differently, the general public)

- Wholesale CBDCs

- Only used by permitted institutions such as banks

- Used as a form of settlement for interbank transfers

Despite improvements in efficiency, a recent European survey showed that privacy remains the #1 concern when it comes to CBDCs. CBDCs would allow governments to automatically tax every transaction, to allocate funds away from specific individuals and, most importantly, provide visibility into every transaction and counterparty.

Are Stablecoins Different to CBDCs?

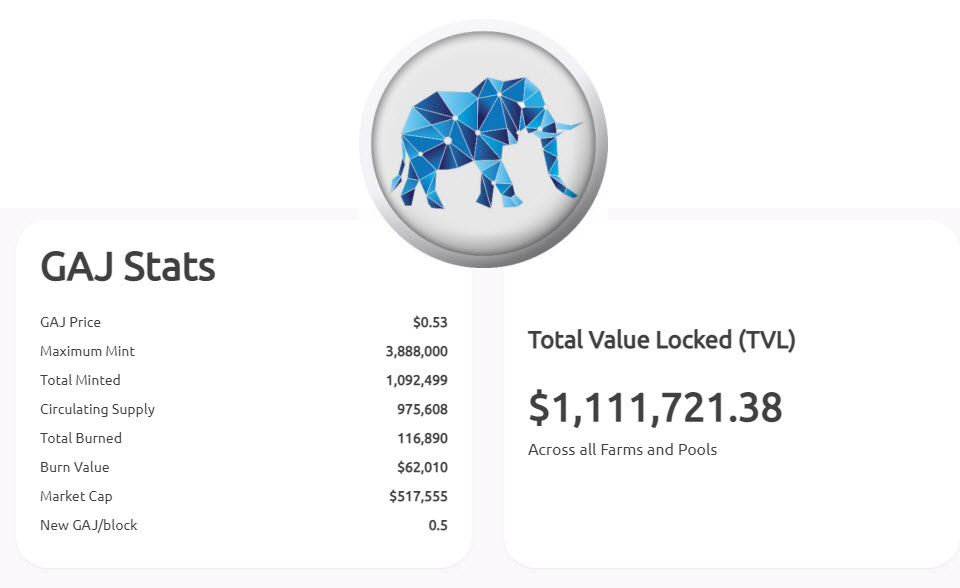

Stablecoins are a type of cryptocurrency whose value is tied to an outside asset, such as the US dollar or gold. Unlike CBDCs, issued by public authorities, stablecoins are issued by private companies. Therein lies the primary difference between the two.

Usually the entity behind the stablecoin will set up a regularly audited reserve asset base backing the stablecoin. Fiat is the most common collateral for stablecoins (as is the case with Tether and USDC), but others are pegged to precious metals or other cryptocurrencies.

What’s the Current Regulatory State of Stablecoins and CBDCs?

Over the past few years, stablecoins have continued to enjoy increased levels of acceptance among regulators. Most notably in January, the US Office of the Comptroller of the Currency (OCC) announced to the 1,100 banks and federal savings associations that they can issue payments with stablecoins to their clients. The UK Treasury also took steps towards regulation, recognising the important role stablecoins may play in settling and clearing large transactions in capital markets.

Some argue that CBDC projects have been initiated largely in response to the growth in the use of stablecoins, but not all governments agree. At present, there are 77 CBDC projects in either research, pilot or close to production stages.

Some, such as the Bank of Japan, are in the early research/experimentation phase, while others such as the “Sand Dollar” by the Central Bank of the Bahamas is already in full production. The People’s Bank of China’s “DCEP” appears to be in late test stages with the general public and as recently as May 2021, the US Federal Reserve in collaboration with MIT announced it was pursuing its own digital dollar currency project – dubbed Project Hamilton.

The Race is On

At this stage, it remains unclear how stablecoins and CBDCs will coexist in a future fully digitised economy. In some respects, it looks to be a race between corporates and governments.

In the short term, it is unlikely that growth in the use of stablecoins between merchants, corporates and retail will subside. It also seems reasonable to expect more robust regulatory frameworks and increased competition and development of CBDCs over the coming year.

Despite a lack of clarity, one thing is certain: the race is on as to which digital currency will be the first to be recognised as legal tender.