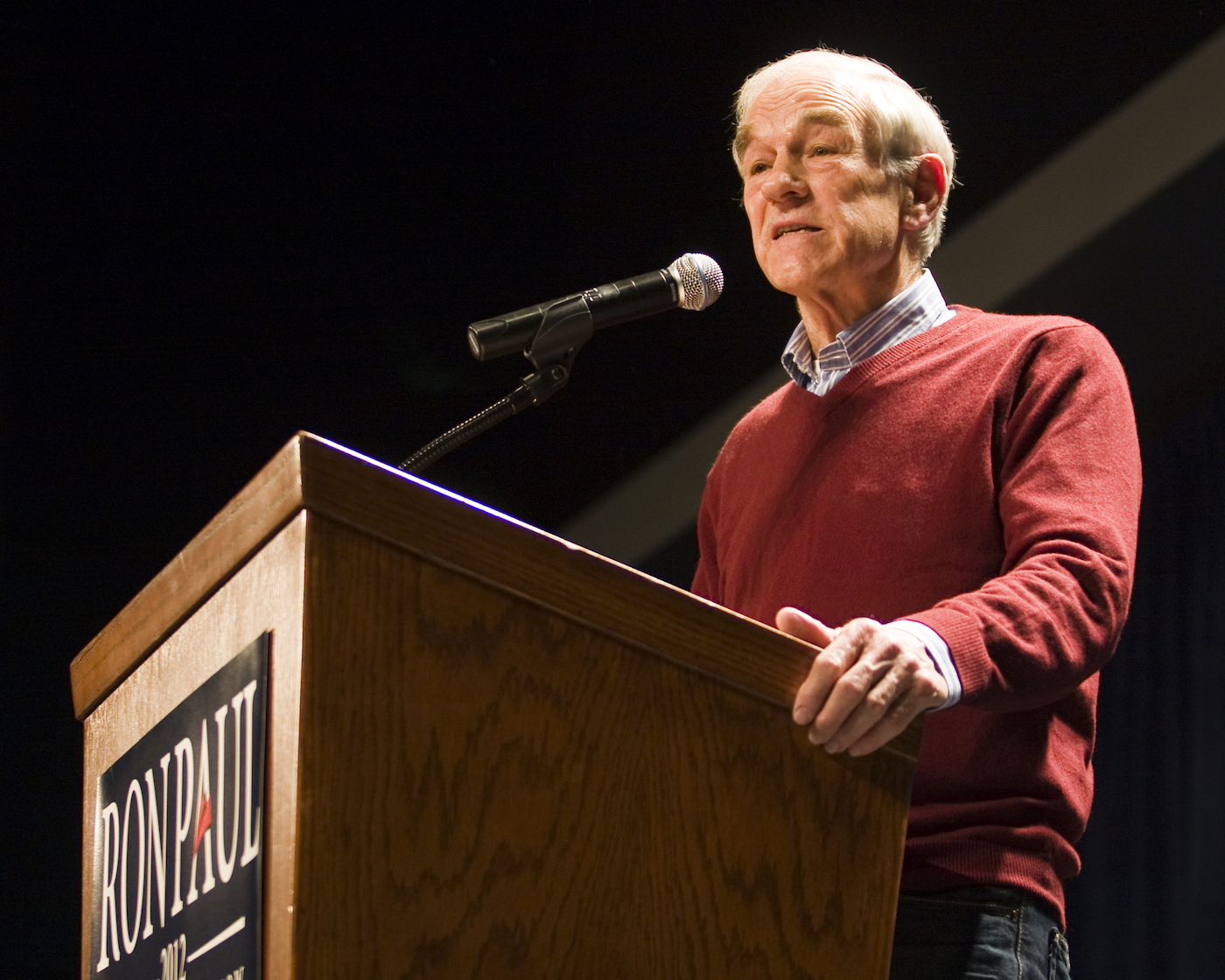

Ron Paul, former US Congressman and Libertarian Party candidate for the 1988 US presidency, has put forward a strong case that Bitcoin should not be regulated.

In an interview last week with Michelle Makori of Kitco News, Paul told how supporters of one of his three presidential nominations designed a coin bearing his image called “the Ron Paul Dollar”.

They got into big trouble. They could not use the word ‘dollar’ as it encroached on the [US] government’s monopoly control of money.

Ron Paul

Referring to popular wisdom that Bitcoin will inevitably replace the US dollar, Paul expects the greenback to survive. “It’ll still be around, though it won’t be worth much,” he said.

Legal tender laws force you to use legal tender, so [the US government] won’t allow you to replace the dollar with cryptocurrency. There will be laws against that, but I want to legalise it.

Ron Paul

Ron Paul Interview

With Bitcoin facing regulatory pressures in countries such as China, investors worry that similar limitations will be placed on cryptocurrency in the US.

“Right now, if you buy and sell gold, it’s subject to tax,” Paul said. “If you make a profit in Bitcoin, you read stories about people getting taxed on it. You can’t tax money … If you bought a dollar a year ago and it went down 10 percent, you can’t take a loss because your dollar lost value.”

Governments will always try to suppress alternative currencies, Paul noted, but he said the free market ultimately should be allowed to decide. “I will argue more the case for legalisation of freedom of choice,” he said. “The people should make the decision, not the government.”