Civic was squeezing inside the falling wedge pattern on a 1-day candle chart and it just went up over +54% in a single day. Let’s take a quick look at CVC, price analysis, and possible reasons for the recent breakout.

What is Civic?

Civic’s identity verification and protection tools give both businesses and individuals the power to control and protect their identities through the blockchain.

Civic Quick Stats

| SYMBOL: | CVC |

| Global rank: | 112 |

| Market cap: | $118,682,481 AUD |

| Current price: | $0.1855 AUD |

| All time high price: | $2.25 AUD |

| 1 day: | +54.41% |

| 7 day: | +49.73% |

| 1 year: | +330.15% |

Civic Price Analysis

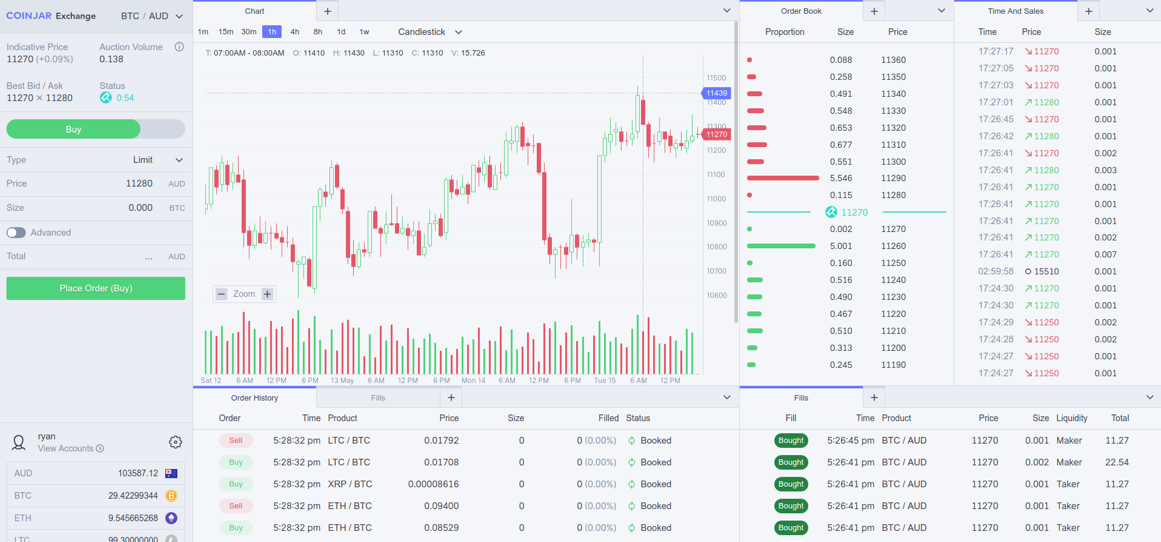

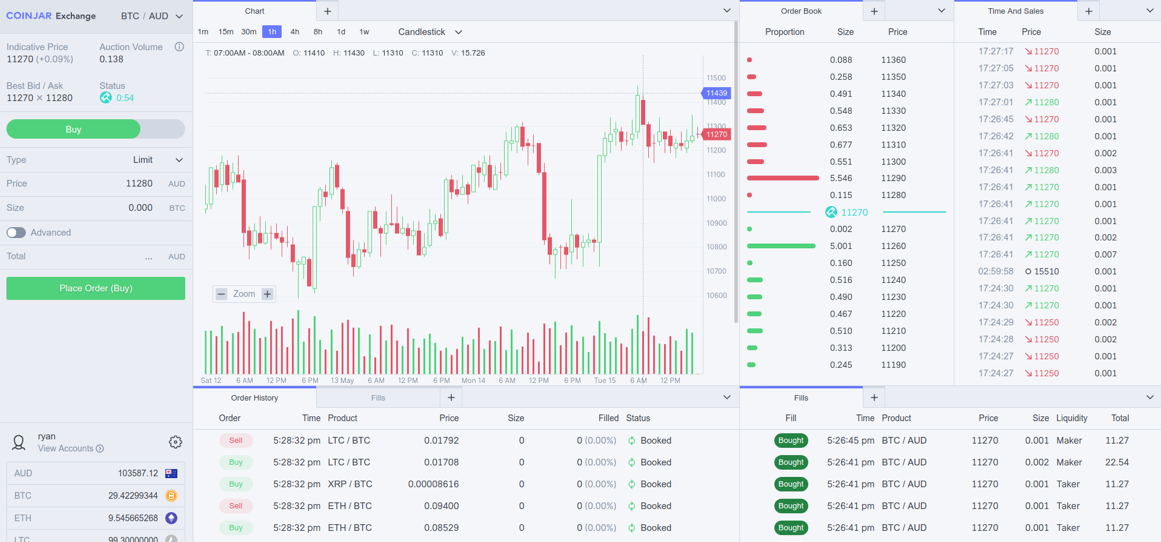

At the time of writing, CVC is ranked 112th cryptocurrency globally and the current price is $0.1855 AUD. This is a +54.41% increase in a single day as shown in the chart below.

After looking at the above 1-day candle chart, we can clearly see that Civic was trading inside the falling wedge pattern on the CVC/BTC pair. The first resistance was on the $0.1456 AUD price level which CVC broke with a strong bullish trend buying volume and is now heading towards the next resistance at $0.2935 AUD & $0.3555 AUD respectively. Seeing that many altcoins are waking up bullish today, CVC is likely to continue to increase.

“The falling wedge pattern is a continuation pattern formed when price bounces between two downward slopings, converging trendlines. It is considered a bullish chart formation but can indicate both reversal and continuation patterns – depending on where it appears in the trend”

What do the Technical indicators say?

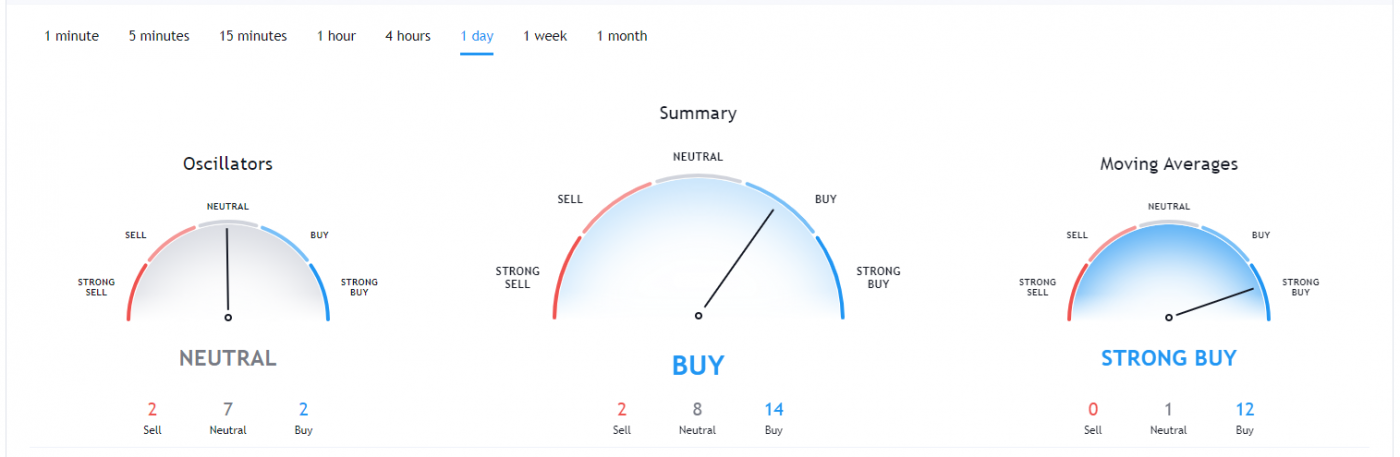

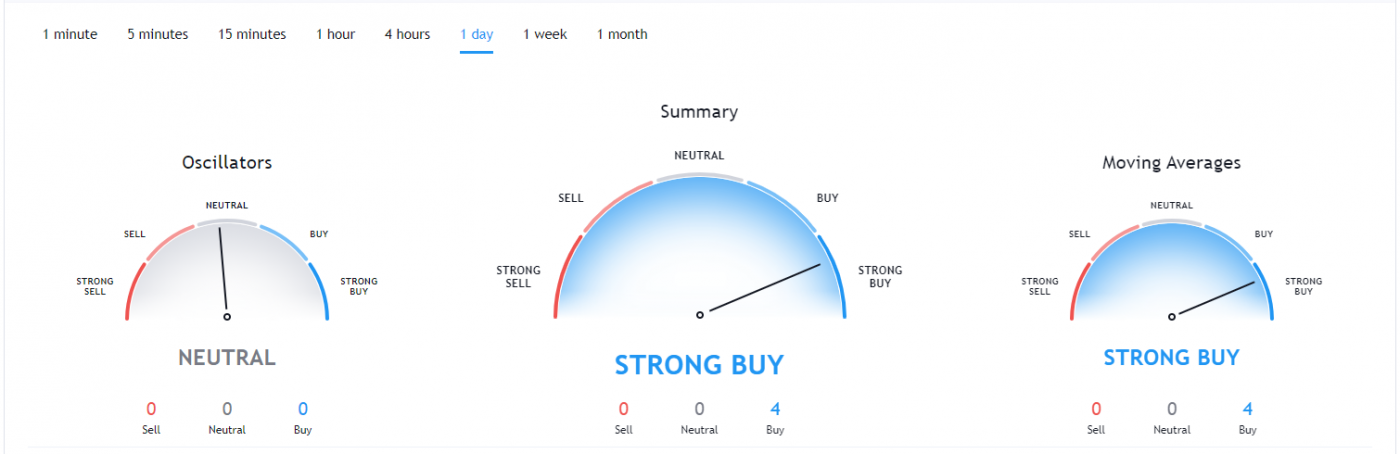

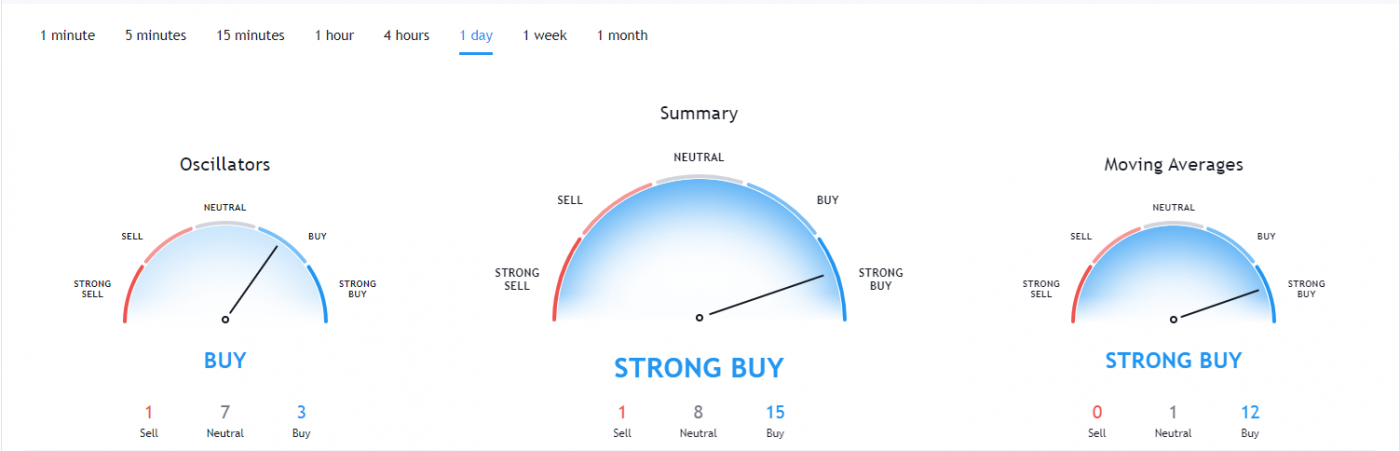

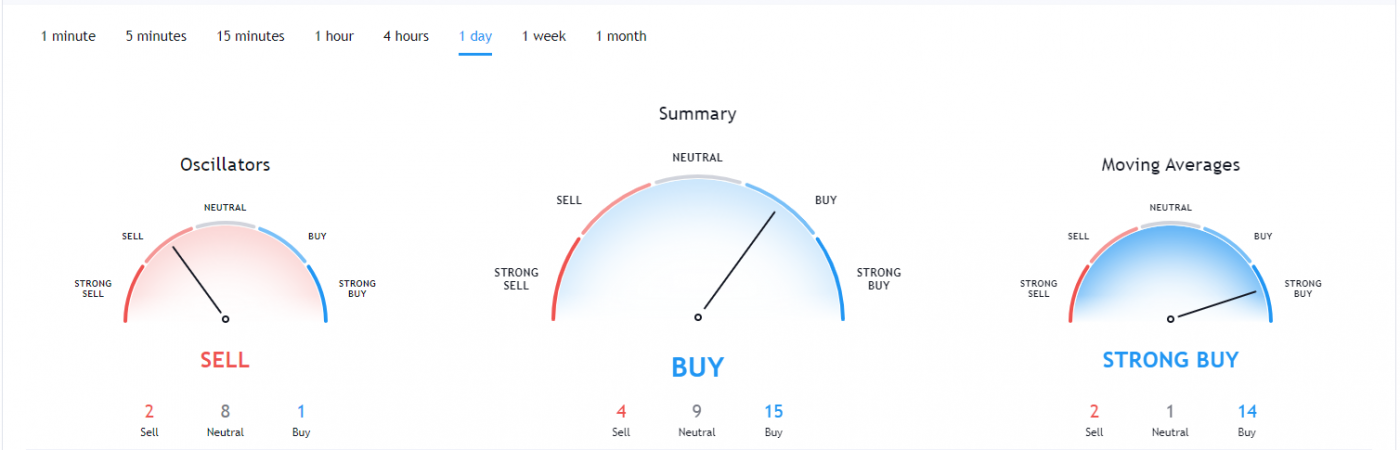

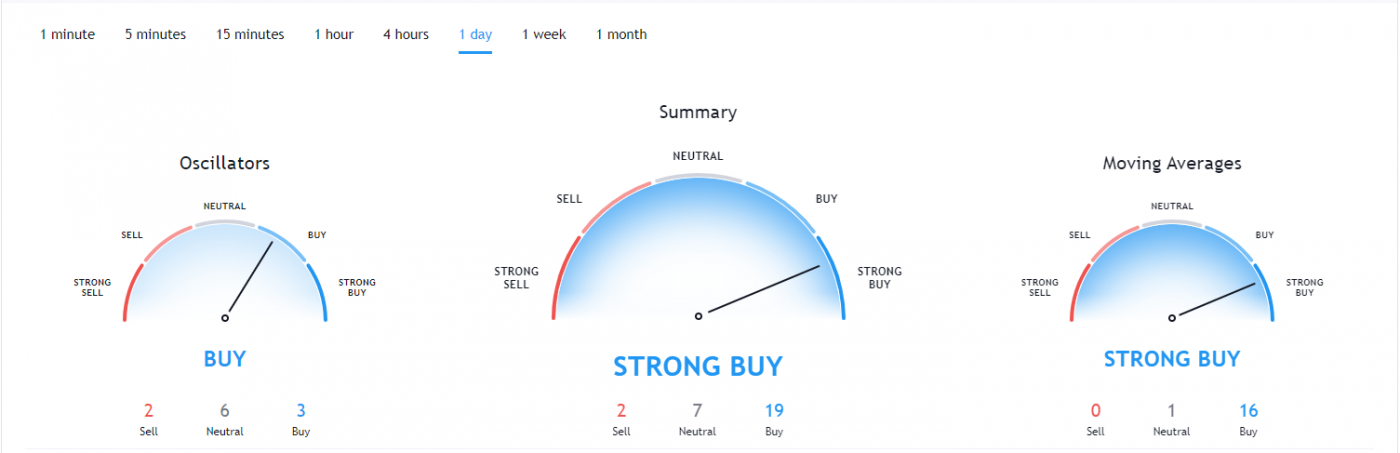

The Civic TradingView indicators (on the 1 day) mainly indicate CVC as a strong buy, except the Oscillators which indicate CVC as a buy.

So Why did Civic Breakout?

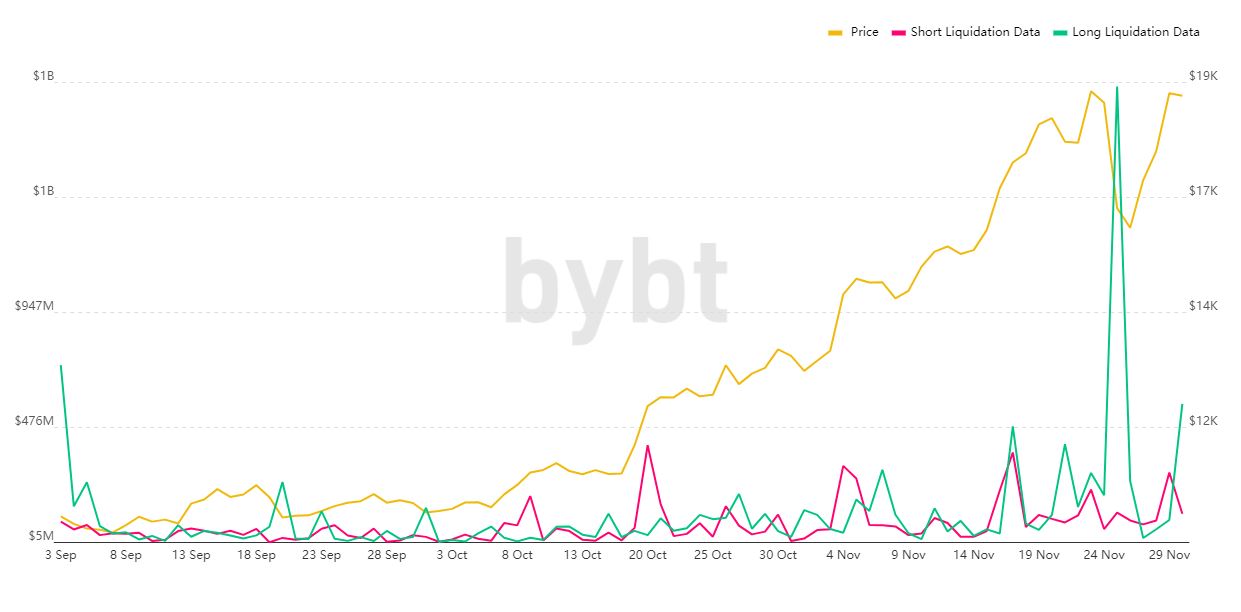

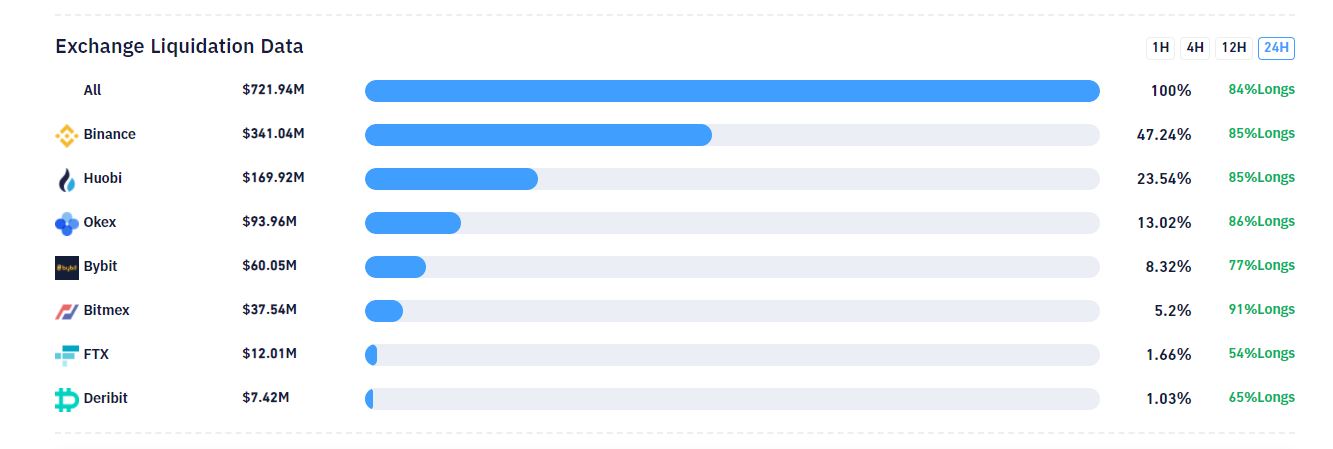

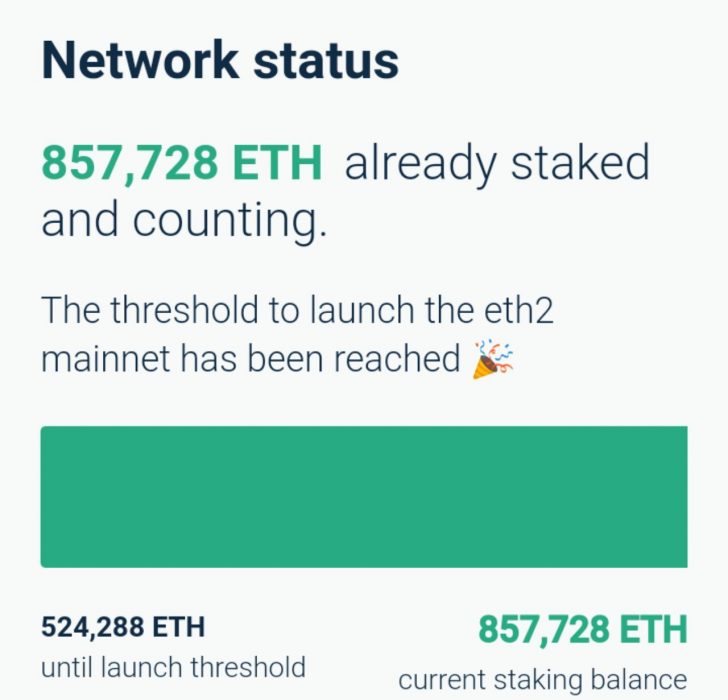

The recent rise in Bitcoin over 100% since the halving in May and then the suggested start of the Altcoin season could have contributed to the recent breakout. Another reason could be the whales, secretly stacking up CVC to their portfolio for this Altcoin rally. It could also be contributed to some of the recent news for the public demo of Launch Accelerator.

Recent Civic News & Events:

- 07 January 2020 – Digital Money Forum

- 20 June 2020 – Civic v2.0 Launch

- 08 October 2020 – Civic – Crypto for Congress

- 15 October 2020 – Public Demo of Launch Accelerator

- 25 November 2020 – Civic – Crypto Banter Live Session

Where to Buy or Trade Civic?

Civic has the highest liquidity on Binance Exchange so that would help for trading CVC/USDT or CVC/BTC pairs. However, if you’re just looking at buying some quick and hodling then Swyftx Exchange is a popular choice in Australia.