In yet another unexpected twist in the ongoing European cryptocurrency regulation saga, the EU Parliament has officially removed all language banning proof-of-work (POW) cryptocurrencies from the newly passed Markets in Crypto Assets (MiCA) directive.

EU Goes Back and Forth on POW

The crypto industry was initially concerned about a draft of the MiCA bill that included provisions banning POW cryptocurrencies such as Bitcoin. It then reversed course following a strong backlash, claiming it “wasn’t their intention to create a de facto Bitcoin ban”. But then things changed, again.

In a classic last-minute insertion of dangerous far-reaching language, reminiscent of last year’s US$1.2 trillion infrastructure bill, provisions banning POW cryptocurrencies were once again inserted into draft bill.

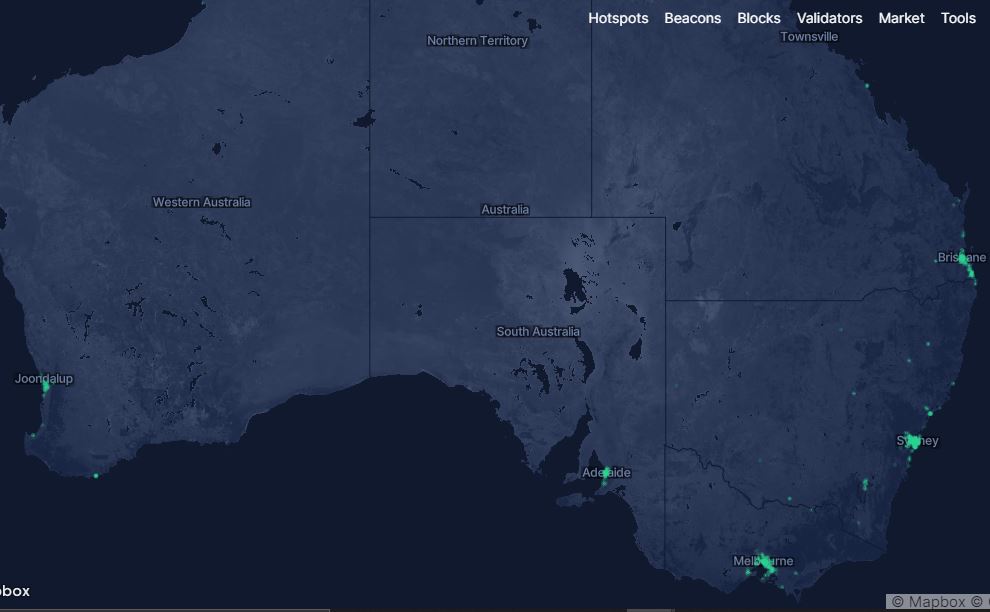

Even though research shows that Bitcoin mining emissions are at “inconsequential levels”, policymakers nonetheless felt it necessary to highlight so-called “unsustainable” crypto mining practices, a clear attempt if ever there was one at appeasing ESG stakeholders.

Crypto lawyer Jake Chervinsky had his doubts about the true intentions of lawmakers and didn’t mince his words:

Nathaniel Whittemore, host of The Breakdown podcast, suggested in his latest episode that environmental concerns are likely more about Bitcoin using energy at all:

My point is that fundamentally, the key thing that any environmental consideration of Bitcoin or proof-of-work is going to rest on, is not whether other things consume more energy, it’s whether the energy that Bitcoin does consume in the first place, is worth it.

Nathaniel Whittemore, host of The Breakdown podcast

POW Provisions Rejected … For Now

After the surprise inclusion of the POW provisions, the European Parliament’s Committee on Economic and Monetary Affairs (ECON) rejected versions of the legislative package that contained a “de facto” ban on POW cryptocurrency mining by a count of 32 to 23 – with six individuals abstaining.

While commentators breathed a sigh of relief, Patrick Hansen of Unstoppable DeFi was quick to pour cold water on the notion that the battle was over:

Any chances left for the POW-ban? The groups that lost the vote have one last option. They could veto a fast-track procedure of MiCA through the trilogues and bring the discussion to the plenary of the Parliament. They need 1/10 of the votes of the EP to do so, which they have. That would bring the discussion around POW into the high-level policy arena. As we can’t predict how that would play out, it should be prevented. Even if it doesn’t change the vote on POW, it would unnecessarily delay the regulation for at least a couple of months. And even outside of this MiCA regulation, the discussion around POW-regulation is far from over. It will come back in the context of the sustainability taxonomy or in the upcoming data centre regulation.

Patrick Hansen, head of strategy & business development, Unstoppable DeFi

Hansen concluded by saying there is still “loads of work left in the month and years ahead, but today is a big political success for crypto in the EU”.

Bitcoin holders, miners and other POW cryptocurrencies might have won the battle, but clearly the war is far from over.