A German/US joint operation has seen Hydra Market – the world’s largest darknet marketplace – shut down. At the same time, the US Treasury’s Office of Foreign Assets Control (OFAC) has sanctioned wallets and a Russian cryptocurrency exchange known for money laundering.

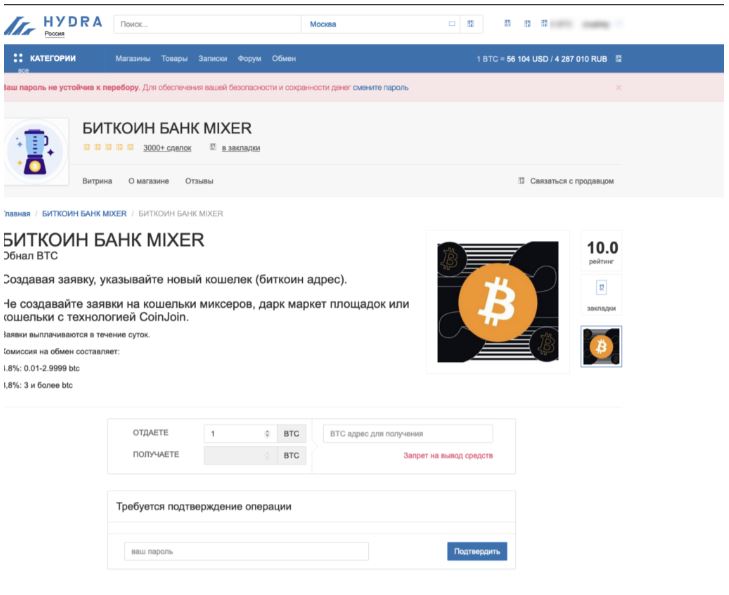

The marketplace offered a variety of services, from allegedly arranging drug transactions to money laundering. OFAC sanctioned more than 100 cryptocurrency addresses related to Hydra, adding them to its Specially Designated Nationals and Blocked Persons (SDN) list.

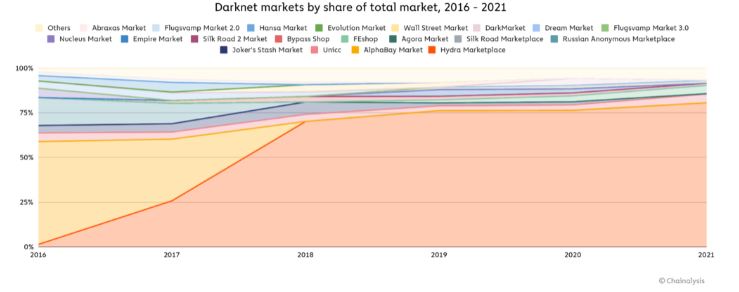

The Russian-based Hydra Market has been the largest darknet market for the past few years, even though it only served Russian-speaking countries. In 2021, Hydra received more than US$1.7 billion worth of cryptocurrency, which accounts for over 75 percent of all darknet market revenue globally.

Money Laundering Staunched by Hydra’s Closure

In fact, since 2020, Hydra received US$645 million worth of cryptocurrency from illicit sources, including other darknet markets, wallets holding stolen funds, ransomware operators, and scammers. Chainalysis believes much of this was due to its widely used money-laundering services.

Russian Crypto Exchange Goes Down With Hydra

Garantex is a sizeable crypto exchange based in Russia and, according to the Chainalysis 2022 Crime Report, is also the largest platform for money laundering in Moscow, having received more than US$10 million from known ransomware strains including NetWalker, Phoenix Cryptolocker, and Conti.

Following the closure of Hydra, OFAC has also sanctioned Garantex, which has been previously investigated for its money-laundering indiscretions.

Illicit Activity a Fraction of Total Transaction Volume

As it stands, illicit activity represents only a small portion of total transaction volume as adoption in the crypto space has soared. The level of criminality on the blockchain has lessened considerably, with illicit transactions accounting for a much smaller segment of the total.

Across all cryptocurrencies tracked by Chainalysis, total transaction volume grew to US$15.8 trillion in 2021, up 567 per cent on 2020’s totals. Given the massive increase in adoption, it’s no surprise that more cybercriminals are using cryptocurrency. But the fact that the increase in illicit transaction volume was nearly an order of magnitude lower than overall adoption shows that illicit activity may be in decline.