Recently we have seen some long awaited institutional activity with big companies adding Bitcoin (BTC) to their portfolios.

Recent notable news:

- PayPal adds support for Bitcoin

- Square, a publicly-traded company, buys $50,000,000 worth of BTC

- Asset management firm, Stone Ridge, buys $115,000,000 worth of BTC

- MicroStrategy converts nearly HALF A BILLION of its USD cash reserve to Bitcoin

- Fidelity Investments recommends Bitcoin should make up 5% of an investment portfolio

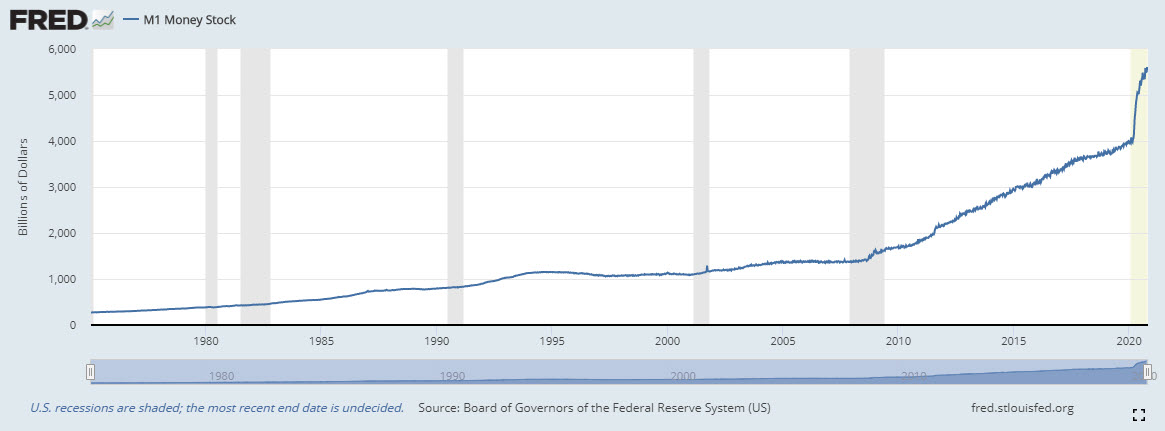

Stimulus Flooding

With the recent stimulus packages, the United States has added around $2.4 trillion to the economy. This has many worrying about the inevitable decrease in the dollar’s purchasing power and the rise in inflation.

To hedge against this rising inflation, many have retreated from the dollar and have taken shelter in assets that historically have held value or have even appreciated in value. Typically, assets that people convert their dollars into to avoid inflation or volatile markets are ones that are scarce or are less volatile in general. These ‘safe-haven’ assets include things like precious metals, stocks in sectors that are generally less volatile, and more recently, Bitcoin.

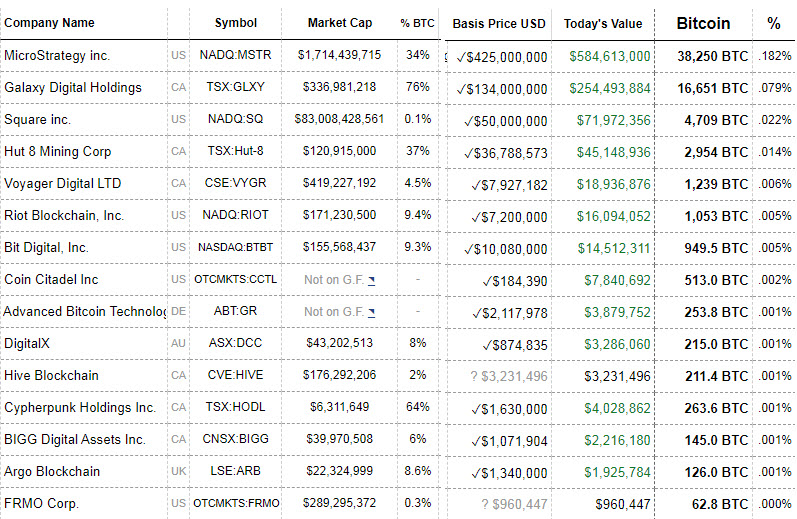

Public Companies Bitcoin Holdings

The table above shows the Publicly Traded Companies Holding Bitcoin, the percentage of their business in BTC and how much they have made in profit since buying. The current total of all these companies is 812,054 BTC ($12 Billion USD) as at 10 November 2020.

Exciting times, looking forward to seeing how this institutional space evolves over the next year or so. Be sure to subscribe to Crypto News to get the news first.