A live broadcast was scheduled for 12 May for the discussion of H.B. No. 4474 to take place. This bill aims to get cryptocurrency recognised under commercial law, to enable superior blockchain innovation and virtual currency regulation in Texas.

Clearing Up Regulatory Uncertainty

The bill is intended to clarify a few key definitions and concepts of virtual currency:

- The definition of “virtual currency”

- Control of a virtual currency

- Rights of purchaser that obtains control of a virtual currency

Representative Tan Parker first introduced the bill in March, and the bill will now go to the Texan Senate to see if there are any proposed amendments, thereafter a final vote. Should the crypto legislation pass the senate, Texas Governor Greg Abbott can sign the bill into law.

The self-proclaimed crypto supporter seems to also stand behind Bitcoin mining initiatives in Texas.

The importance of clarifying cryptocurrency laws and adding to legislation is paramount if a country wishes to house new and upcomming blockchain initiatives. With this move, Texas would be inviting companies to open up shop by reducing regulatory uncertainty.

Texas is already home to crypto mining firms BlockCap and Riot Blockchain. Both companies are also planning to expand their mining ventures in the state with the purchase of new facilities and equipment in the future. Texas is moving toward becoming a crypto-friendly state like Wyoming.

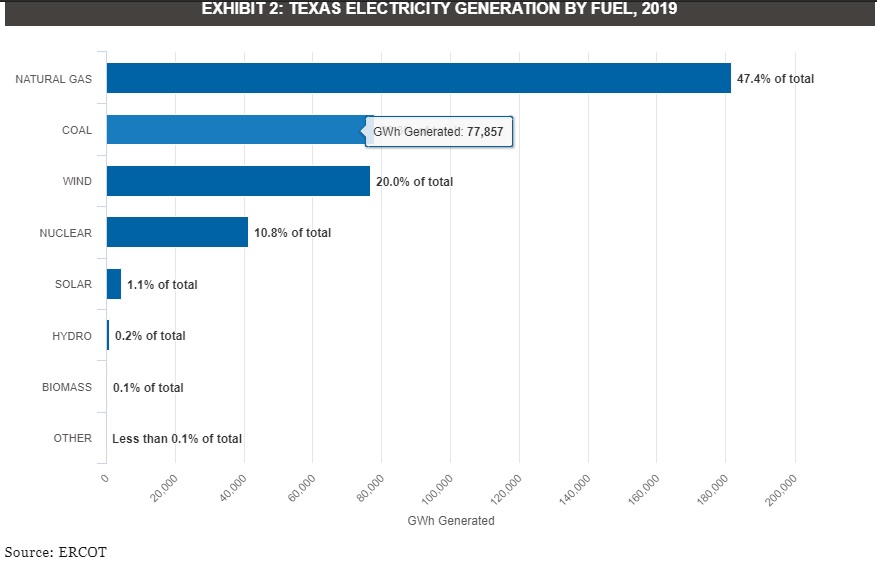

Texan Power Problems

Texas needs to sort out more than just its regulatory framework to become a crypto friendly state. If they want to increase the amount of Bitcoin mining initiatives they will also need to sort out issues with the power grid. Harsh winters in Texas usually have major repercussions for those on the grid.