A number of cryptocurrency exchanges, including Bitcoin.com, LocalBitcoins and Crypto.com, have reportedly opted to stop serving Russia-based customers following a raft of new sanctions enacted by the European Union against Russia on October 6th.

This news follows an earlier move by the blockchain-focussed developer Dapper Labs’ to ban Russian citizens from accessing its services. With numerous major exchanges set to follow suit, Russian residents’ access to crypto markets seems severely restricted.

New Sanctions Further Restrict Russian Access to Crypto

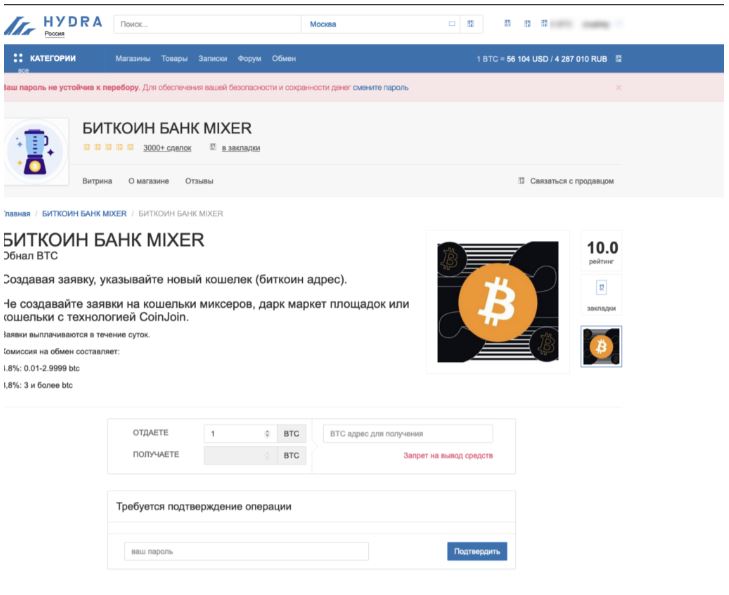

Previous sanctions had limited the value of crypto transfers between EU nations and Russia to €10,000, or approximately US$9,700. These new sanctions go much further, essentially banning the provision of crypto-asset wallet services to any person residing in Russia:

“Decision (CFSP) 2022/1909 removes the threshold for the existing prohibition on the provision of crypto-asset wallet, account or custody services to Russian persons and residents, thereby banning the provision of such services regardless of the total value of such crypto-assets…It shall be prohibited to provide crypto-asset wallet, account or custody services to Russian nationals or natural persons residing in Russia, or legal persons, entities or bodies established in Russia.”

Offical Journal of the European Union, Volume 65

It’s unclear if this ban includes non-custodial wallets, such as those offered by Bitcoin.com and Crypto.com, or if it’s limited to custodial wallets held on exchanges and used by customers for trading.

Exchanges Set to Block Russian Customers Starting This Month

According to reports in the Russian media, Bitcoin.com gave Russia-based customers until October 27th to remove their assets from the exchange. After the deadline, Bitcoin.com will block customers from accessing their accounts.

Peer-to-peer crypto exchange, LocalBitcoins, blocked access to its services by Russian residents on October 7th, the day after the new sanctions were announced.

Many other exchanges will follow, with most major exchanges, including Binance and Coinbase, reportedly working towards complying with the new sanctions as quickly as possible. Having said that, it’s not currently known exactly when Russian access to most exchanges will end, as it could take some time to safely and effectively implement the restrictions.

Could Any Exchanges Defy The Sanctions?

It’s unclear whether any crypto exchanges intend to defy the new restrictions and continue offering services to Russian residents.

Bitfinex has previously expressed opposition to EU sanctions against Russians. In March of this year, Bitfinex CTO Paulo Ardoino, expressed concern about cutting services to Russia, saying Bitfinex was prepared to safeguard customers’ access to their accounts unless ordered to do otherwise by regulatory agencies.