Welcome to this weekly series from the TradeRoom. My name is Dave and I’m the founder of The Crypto Den, an Australian-based crypto trading and education community aiming to give you the knowledge to take your trading game to the next level.

Crypto Market Outlook

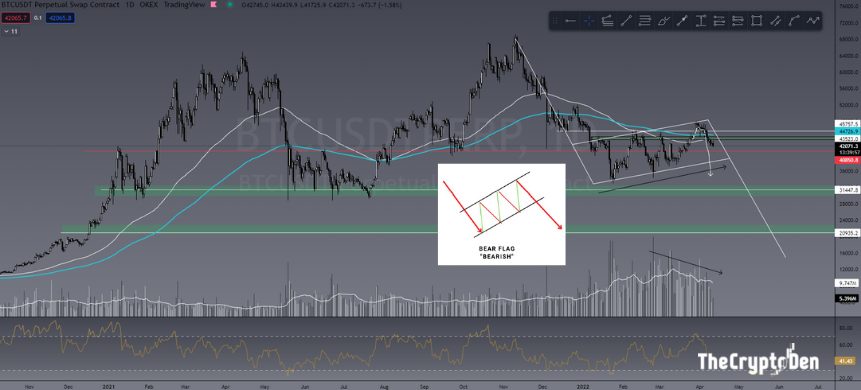

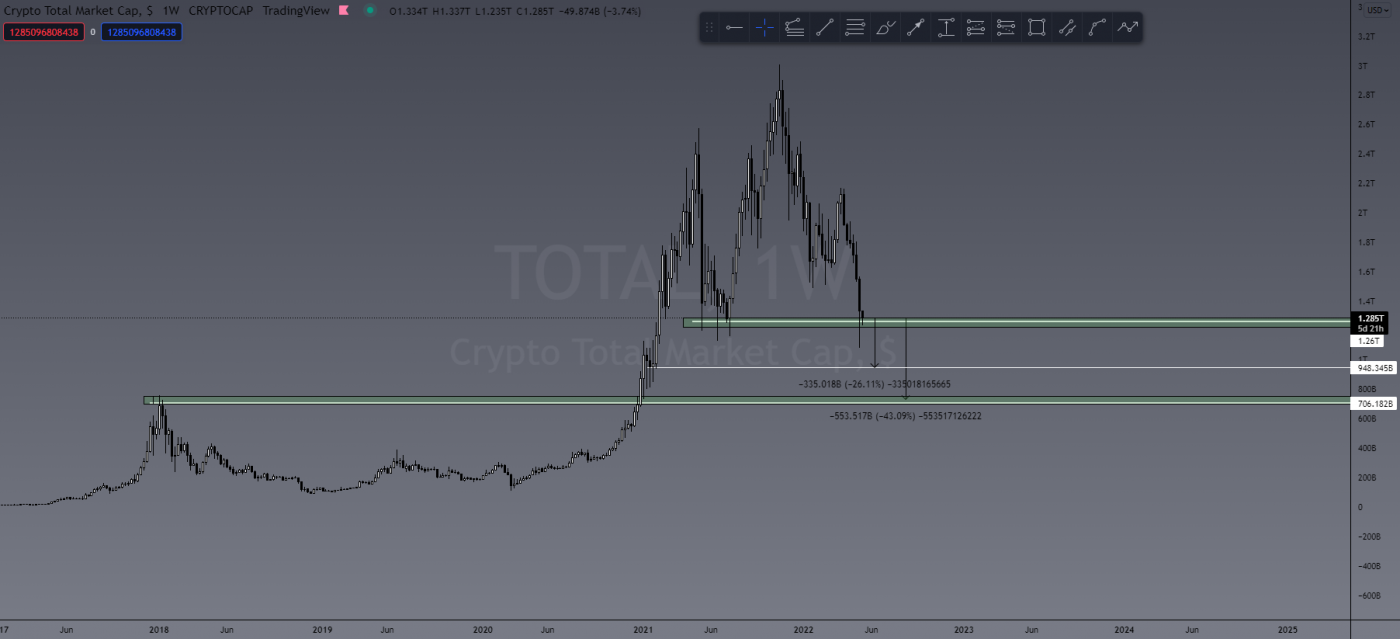

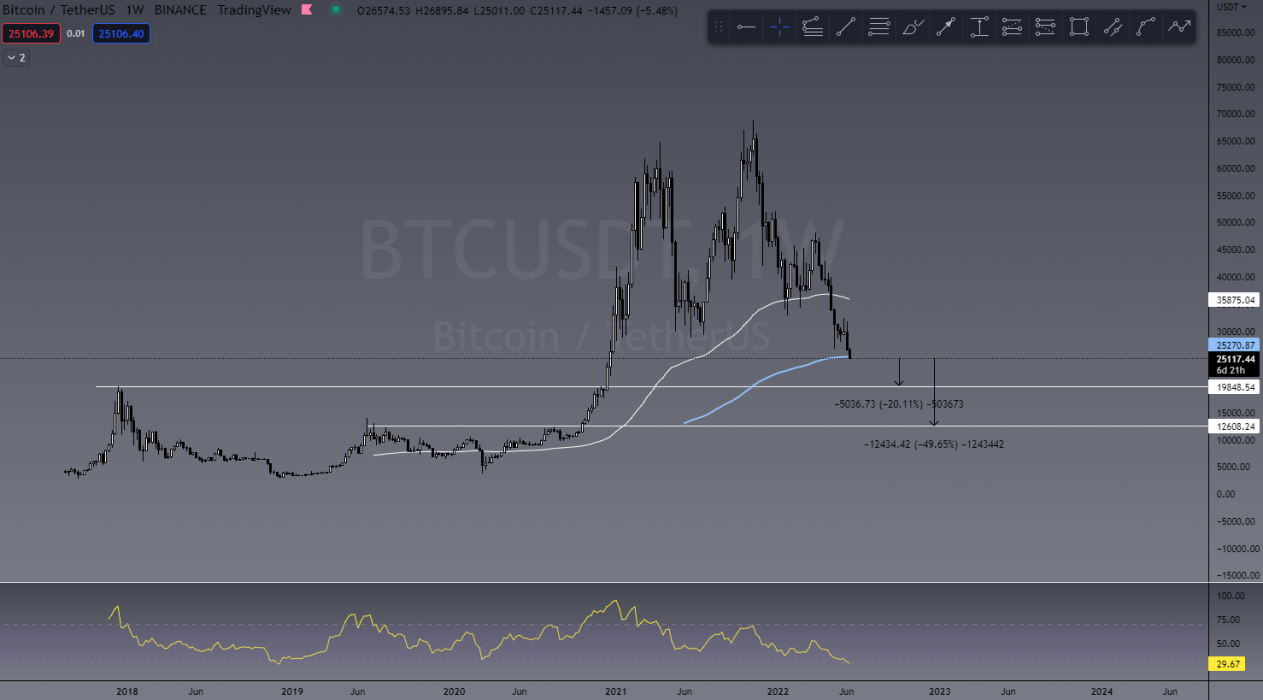

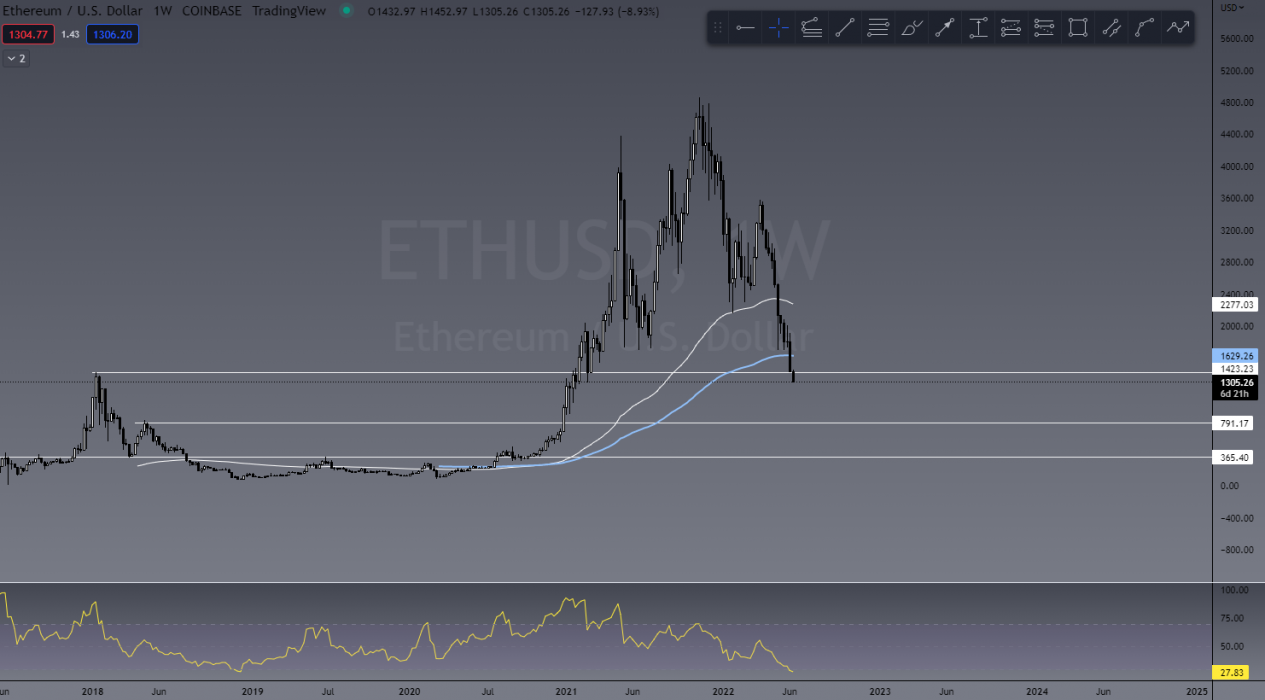

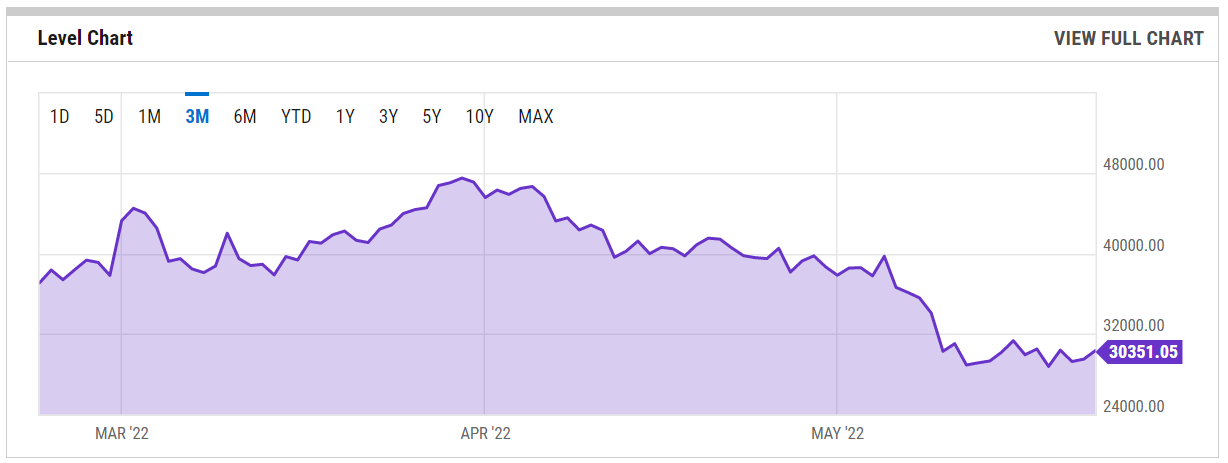

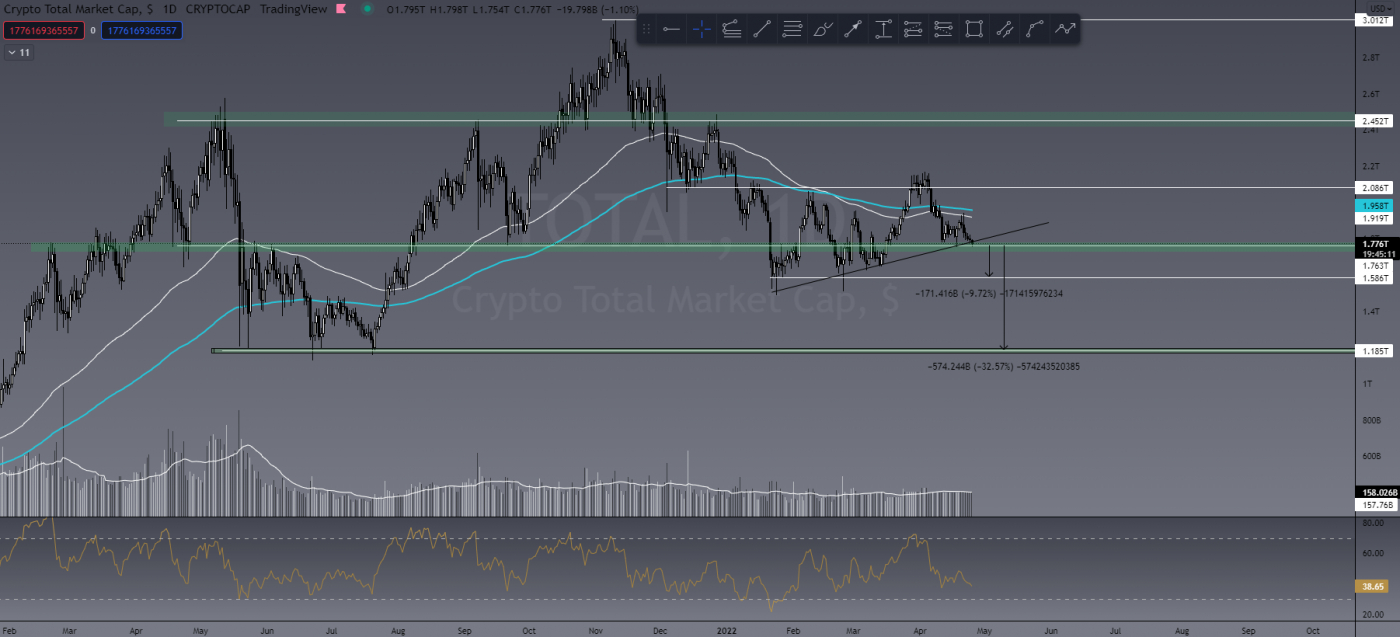

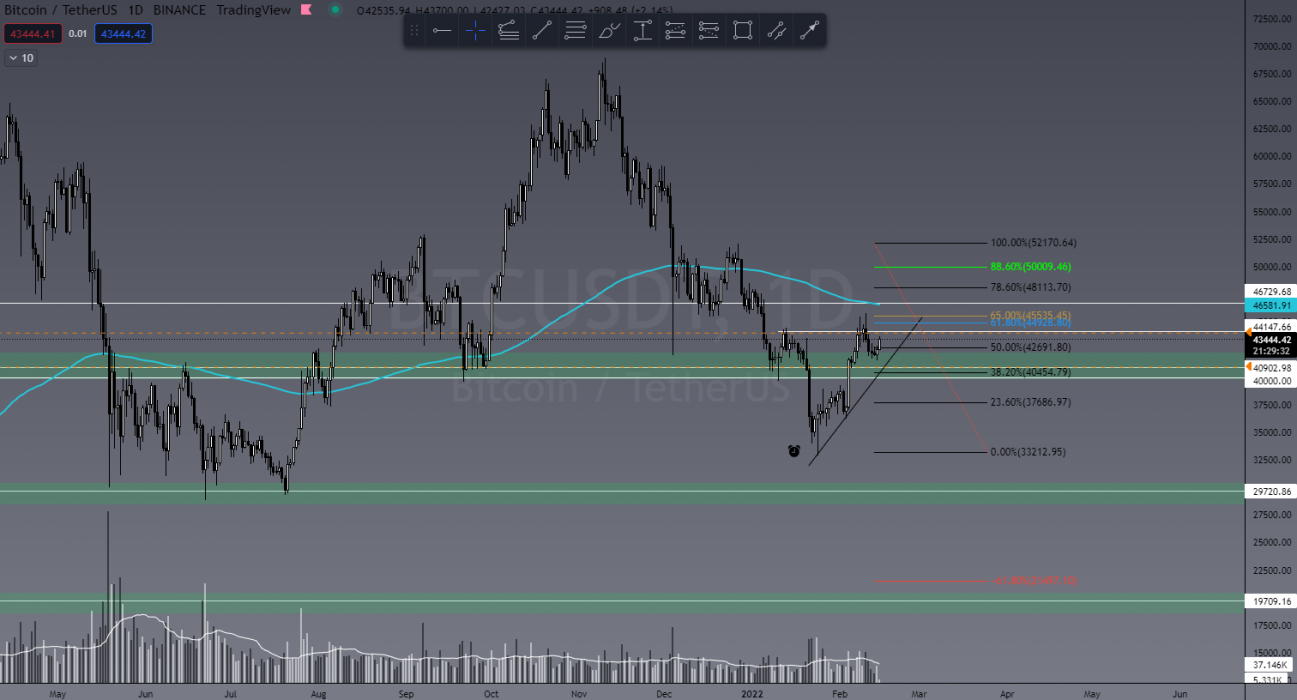

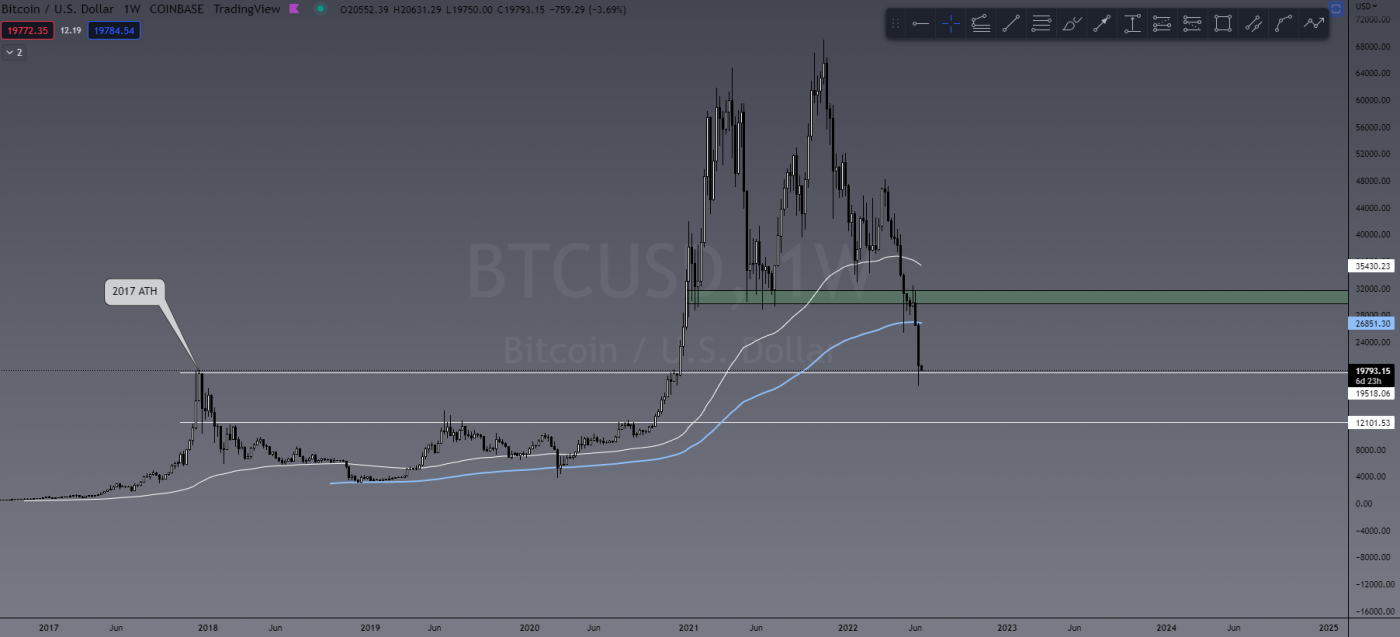

BTC finally retested the all-time high from 2017 and from here it’s very simple: we either confirm a new floor or break through it to US$12,000.

For the US$20,000 level to be confirmed as the bottom, it takes more than just a few candles. We need to see solid market structure with volume behind it. This will take a little time for the market to produce, and could take days or even weeks.

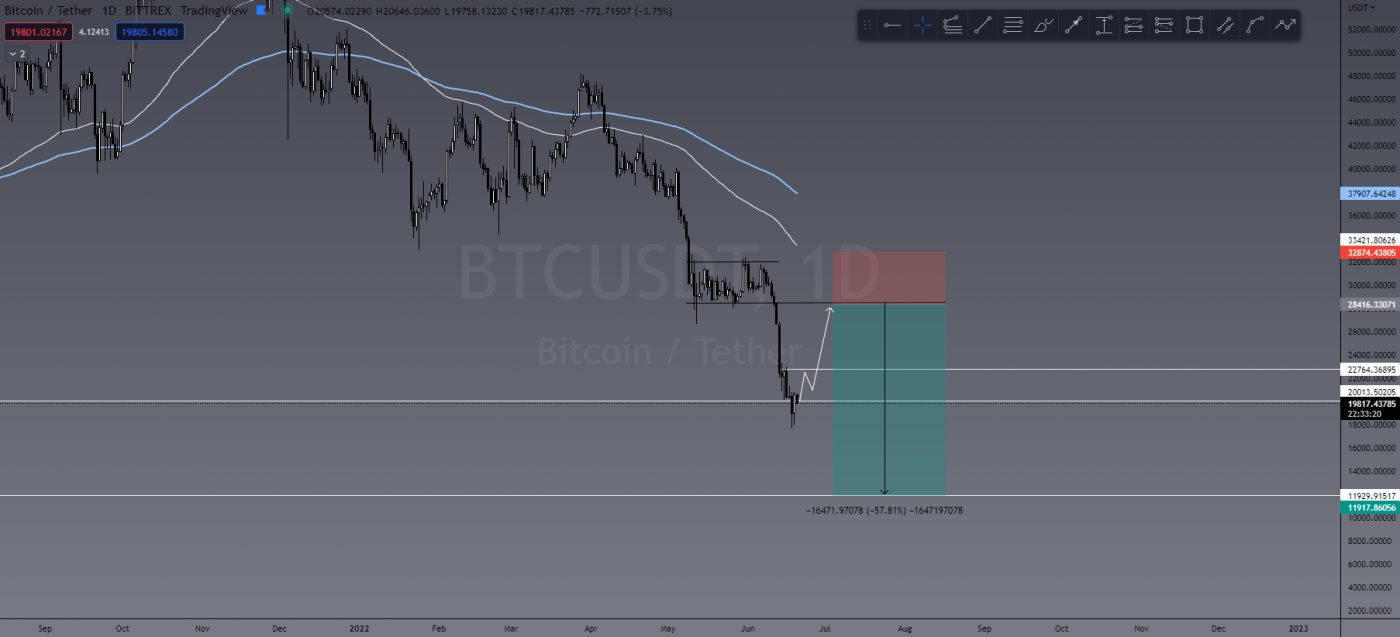

Once again, however, my opinion is we have more red to come (sorry! I know it’s been six months of bearish bias!). That said, we may see a relief rally to around US$28,000 and should that happen I plan to add to my short position and perhaps we visit US$12,000. If we don’t get a pullback in PA, then I’ll continue to ride my open shorts.

I still very much believe the entire bear flag I wrote about on April 11 will play out to the end at minimum. And dare I say we may even go further if the world economic climate doesn’t see a vast change in the coming months. How does buying BTC at US$6,000 sound?

Even if we zoom in on the 1H charts for our day traders, we see a failure to break and hold above 100 EMA confluent with the peak of a 1H rising wedge (bearish candlestick pattern).

This Week’s Trades

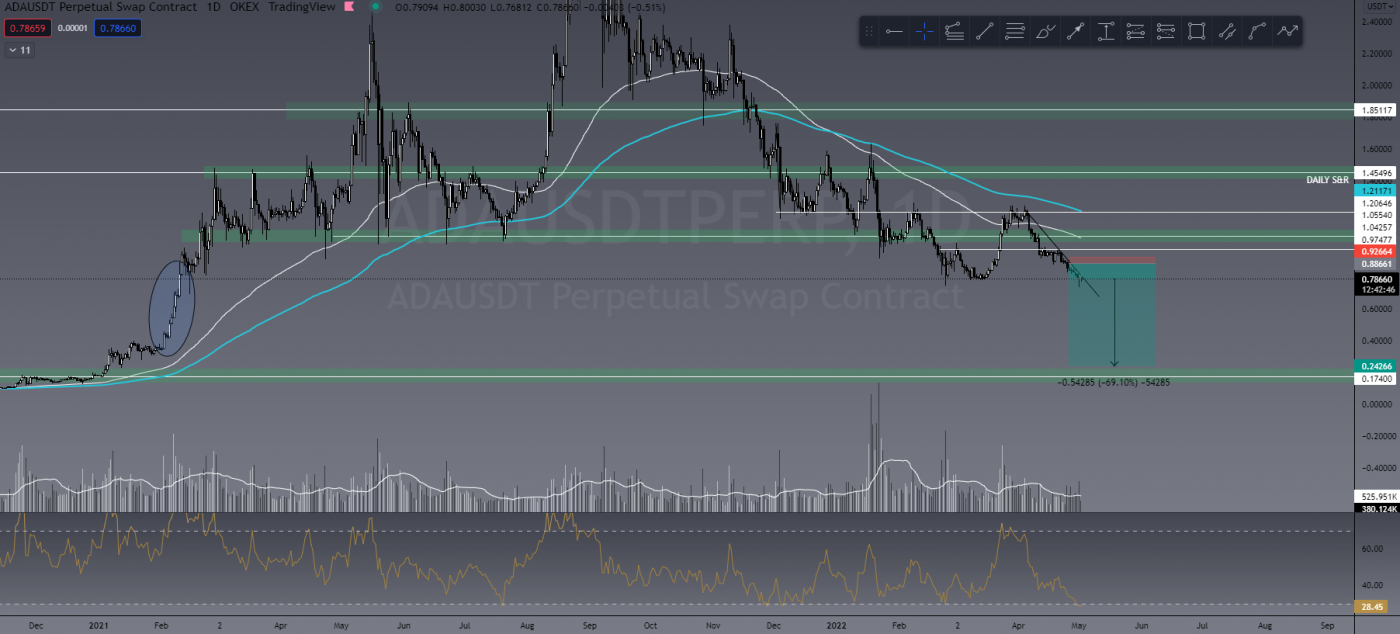

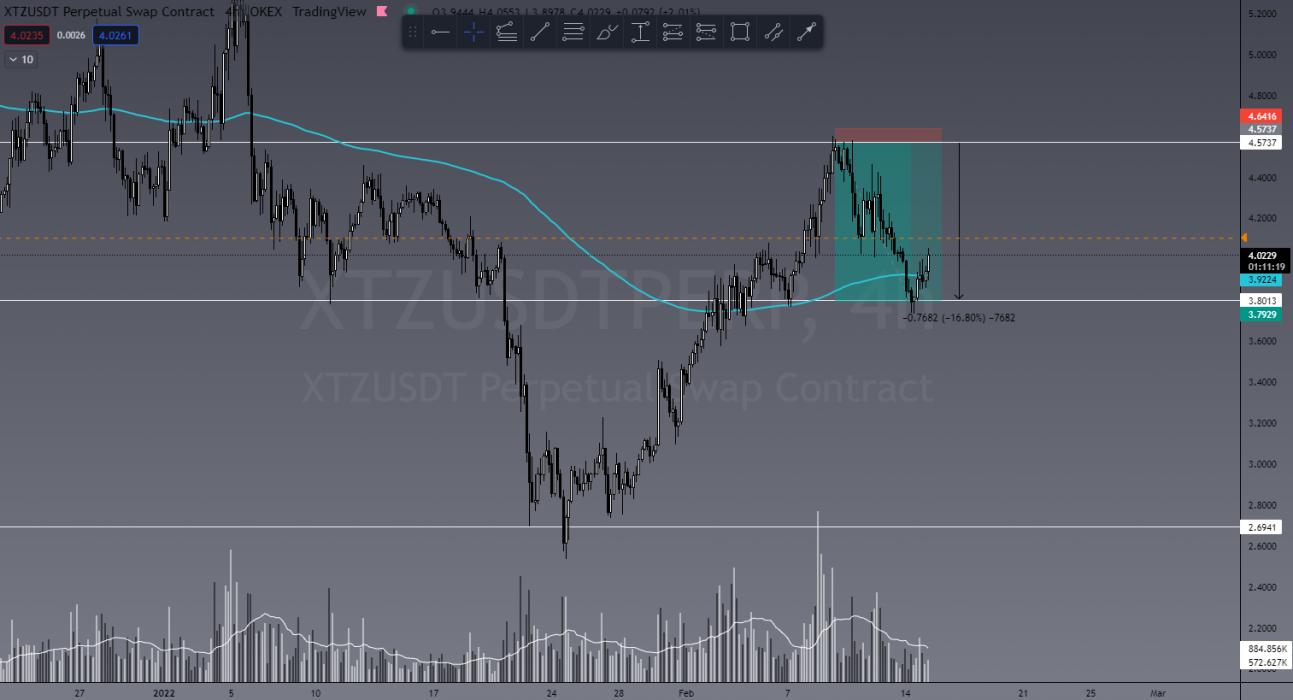

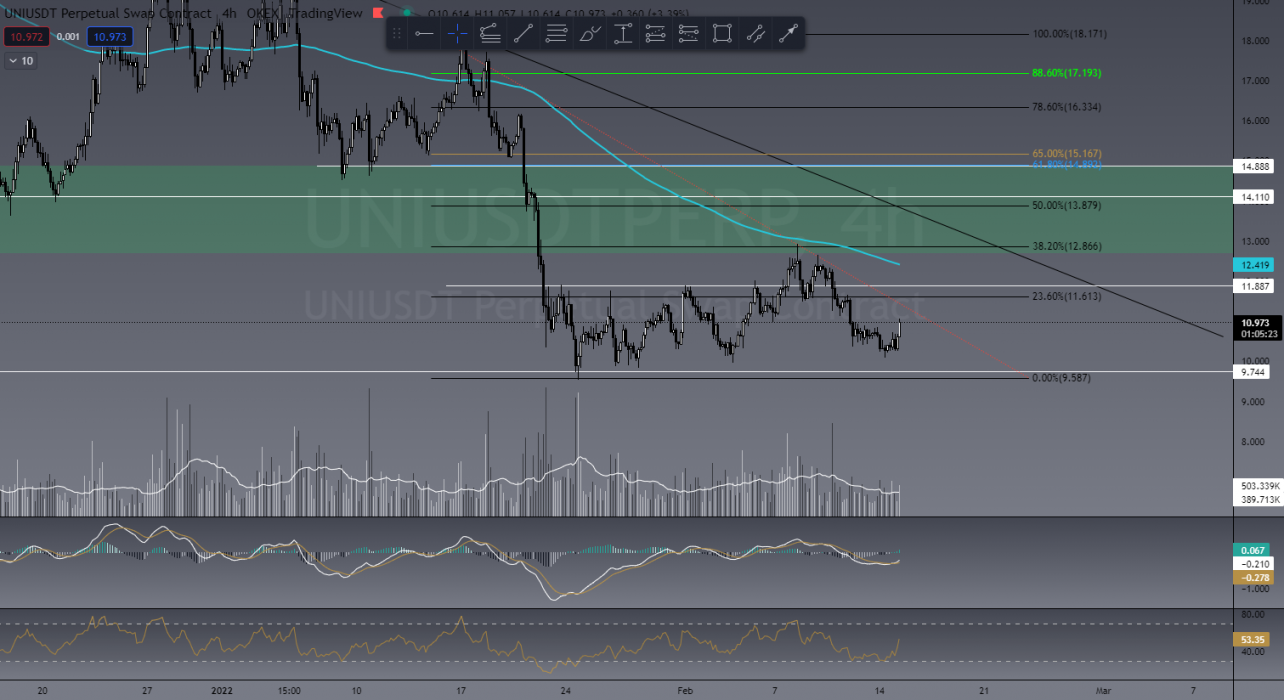

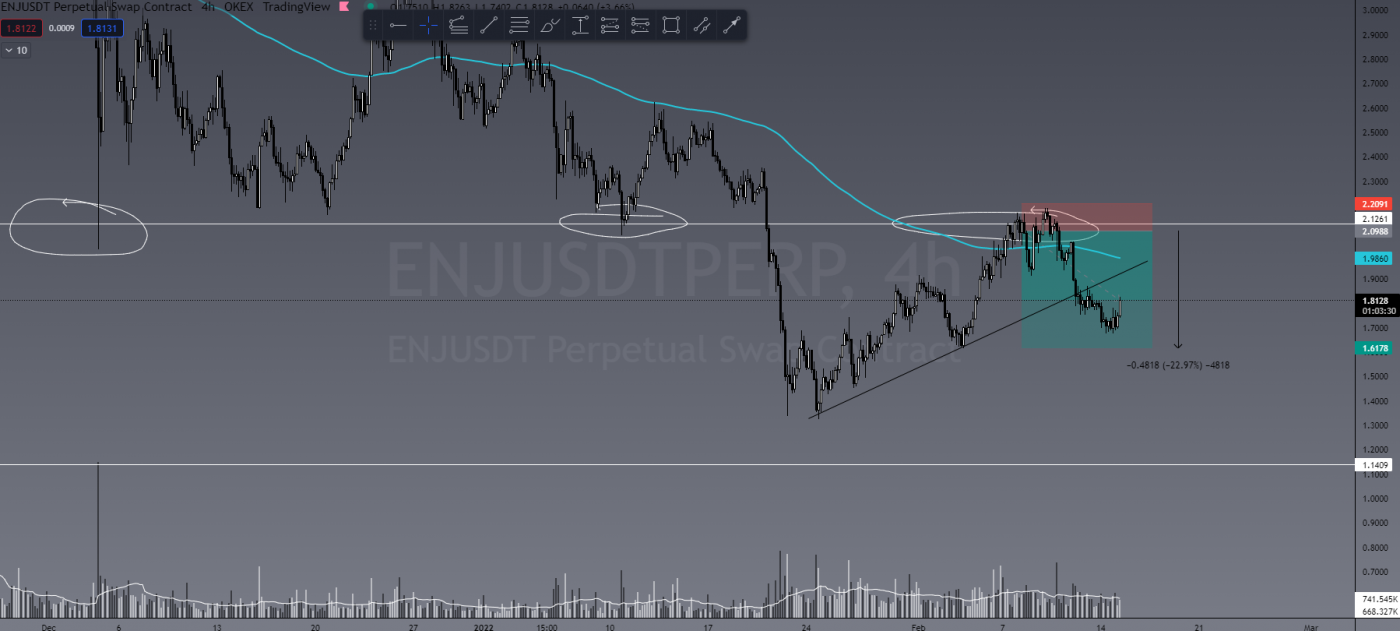

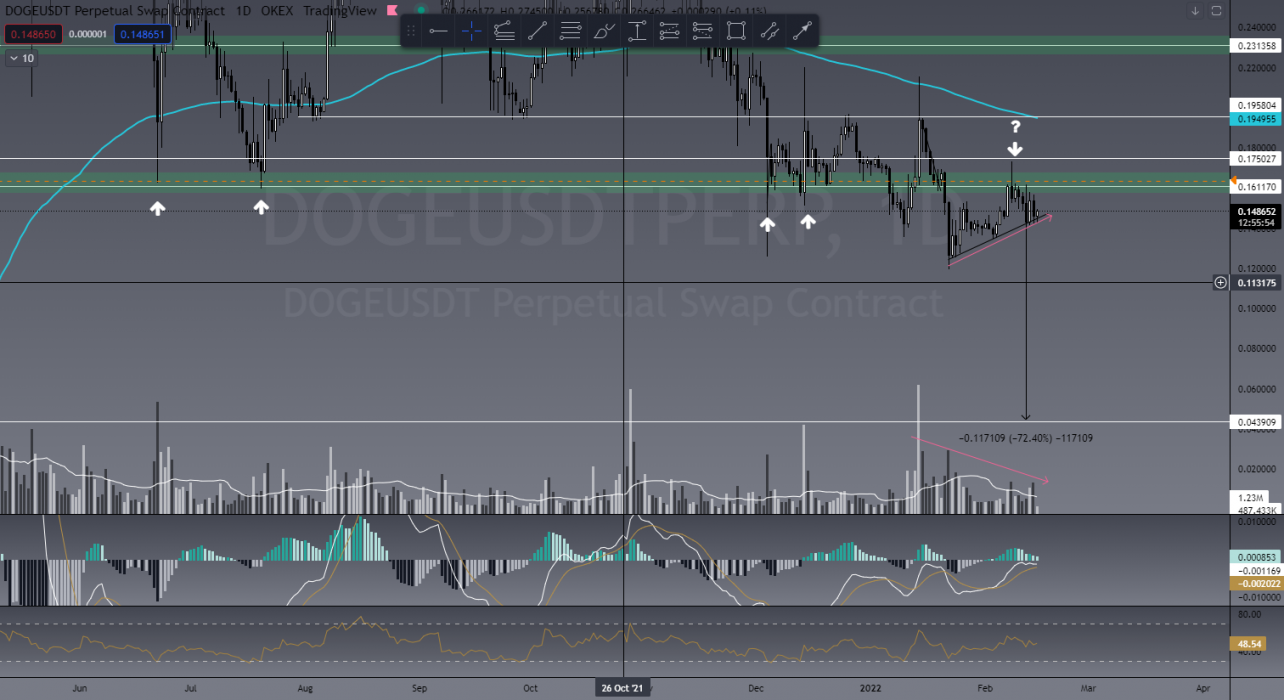

Because I still have a bearish outlook on the market, entering long trades or buy orders on ALT coins is high-risk and short-lived. So instead, what I’m looking for is ALTs that have seen a significant pump and in turn yield higher percentage gains if the market dumps again. Remember, you can still make serious ROI in a downtrending market.

Setups similar to the below chart of SNX is what I’m looking for – a clear retest and rejection from a new level of resistance (previously support). There are a few ALT setups like this already in play.

To enter before BTC decides if it’ll dead-cat bounce has higher risk and far more aggressive entries. Best practice would be to “wait and see”. If BTC pulls back – find entries. If BTC doesn’t – do nothing.

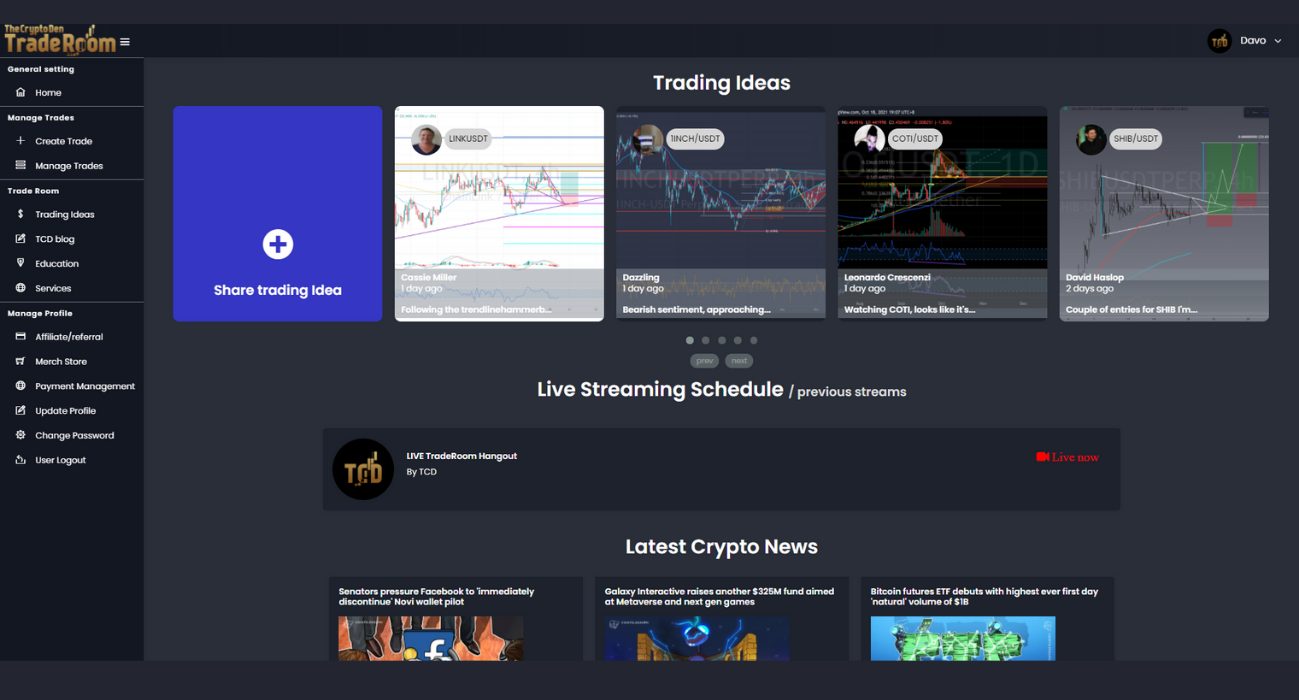

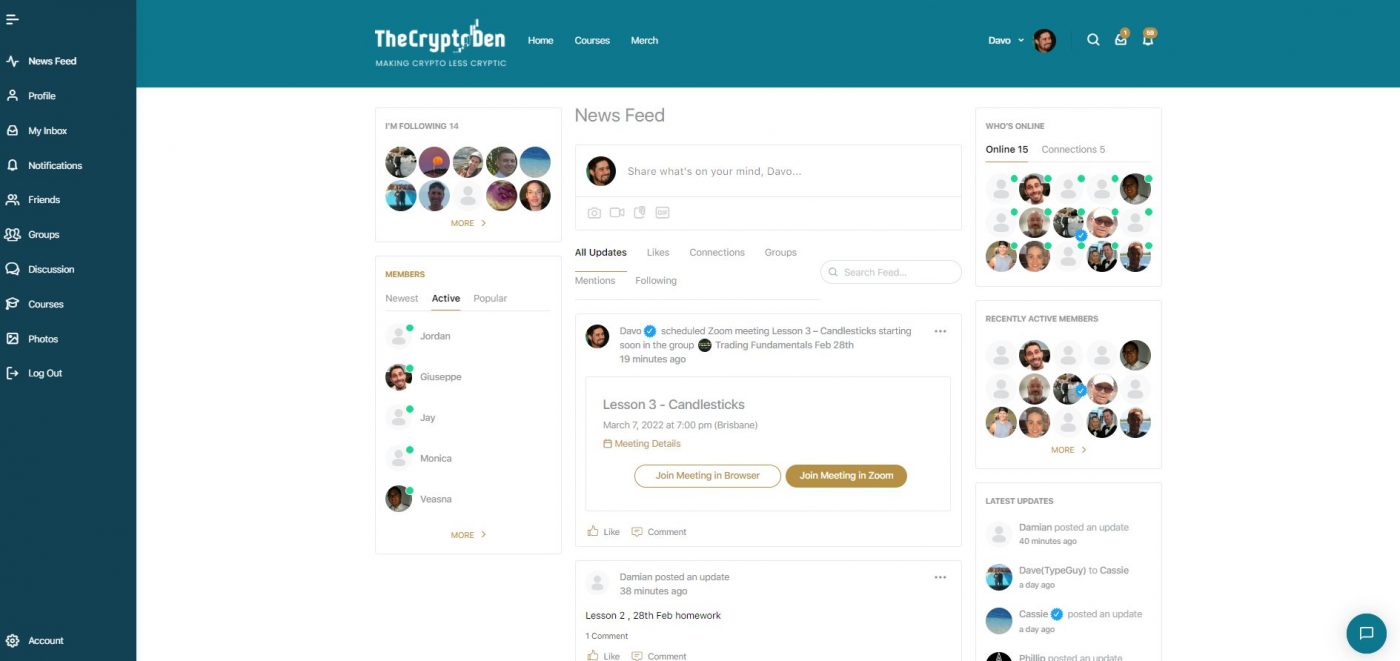

Introducing TCD’s New Social Platform

The Crypto Den now has a FREE purpose-built social platform to share investment ideas, trade chat, connect with like-minded people, share info and more, without the censorship of Facebook. The platform is designed for those more focused on the investment/profitable side of the crypto world.

The Crypto Den was created in 2017 to help the rapidly growing crypto community learn and understand the fundamentals of digital currencies and how to trade them.

Since then we have taught thousands of members the basics of technical analysis and trading strategies to further progress and perfect their trading abilities.

In the TradeRoom, you will be included in a supportive environment which encourages personal growth, education and community support.

It’s a place to share your trading ideas and follow other experienced traders’ feeds to help keep your finger on the pulse of such a volatile market!