The floodgates have opened on Bitcoin Exchange Traded Fund (ETF) applications, with 34 currently pending approval and more joining the queue by the day.

Advocates for a Bitcoin ETF argue that the complexities of exchanges, crypto wallets and private keys still present a barrier to entry into the crypto space for newcomers. A Bitcoin ETF would enable these investors to gain exposure to Bitcoin without actually having to hold their own cryptocurrency.

A Long and Winding Road

The road toward a Bitcoin ETF has been long and tortuous. Since the Winklevoss twins first filed for a Bitcoin ETF-like trust in 2013, the US Securities Exchange Commission (SEC) has cited concerns over the lack of transparency of trading information, possible market manipulation, and the notion that Bitcoin is fundamentally different from other assets it regularly deals with. It is also worried about a lack of liquidity in the markets, Bitcoin’s inherent volatility, and fears over associated fraud.

Part of the case against a futures-based Bitcoin ETF is the 1 percent annual fund management fee, which detractors warn tends to quietly accumulate, and the added complexity of trading futures, whether they be soy, crude oil, or cryptos.

Could ETFs Push BTC to 100k?

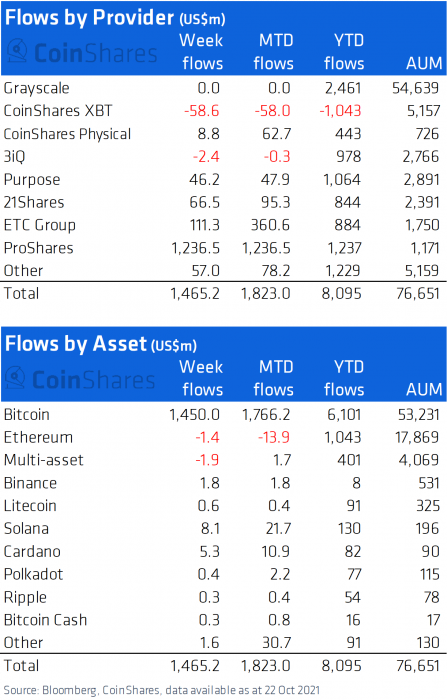

More than US$1.5 billion has flowed into digital asset investment products since last month’s inception of the first Bitcoin ETF by ProShares. About 99 percent of those inflows were generated by bitcoin, while an all-time high (ATH) price spike further raised its dominance in the market.

A month ago, derivative markets gave bitcoin a 3.2 percent chance of reaching the US$100,000 mark before year’s end. In the first week of October alone, BTC surged over 34 percent, leaving the US$55,000 mark in its wake. With just over six weeks to go, there’s every chance that figure will double.

At the time of writing, bitcoin’s price had hit a new ATH of US$68,680 – up 5.03 percent in the previous 24 hours – so it’s well on the way.