It’s clearly an exciting time for Bitcoin investors as the leading cryptocurrency is making another heavy push once more. A few days past, the cryptocurrency slightly declined from the US$16,000 price level, only to surge back to over US$16,600 yesterday. Today, Bitcoin has reached another milestone, making a new yearly high of US$17,033 according to data provided by Coinmarketcap, a crypto price tracking platform.

Bitcoin is trading at US$17,030 at the time of writing. On this performance, its market capitalization increased to another historical level at over $315 billion. The derivatives market, especially Bitcoin futures, is also booming amid Bitcoin’s bullish moves.

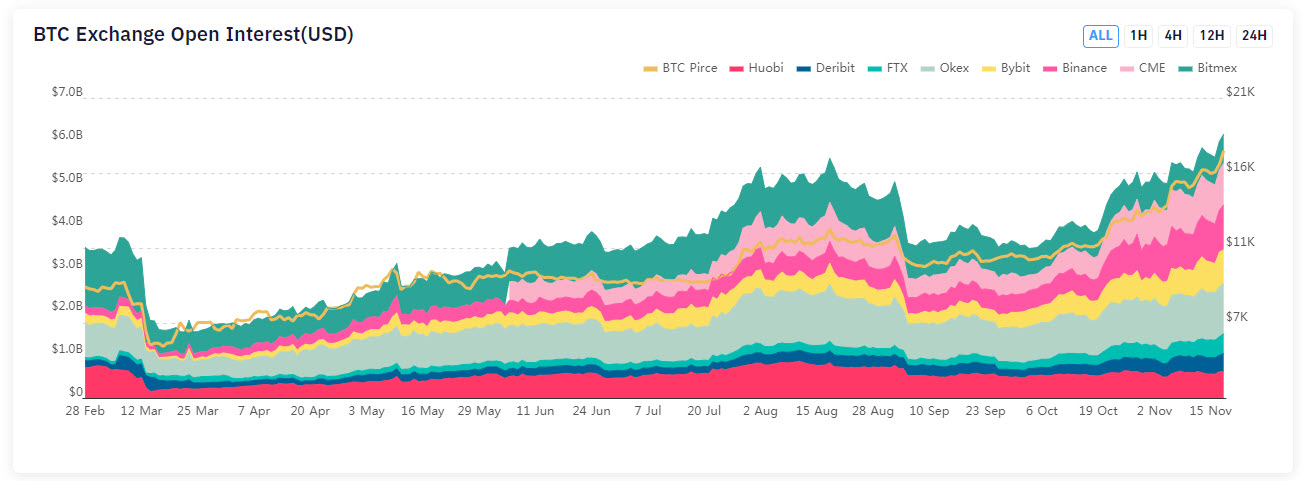

Open Interest in Bitcoin Futures

Data from crypto analytics platform Skew showed that open interest (OI) in Bitcoin futures had surpassed $6 billion in total value combined across derivatives trading platforms. A further glance at Bybt confirmed the all-time high (ATH) of Bitcoin futures OI at $6.52 billion. This is an exponential kind of growth, given that the futures product only had a valuation of $5.4 billion on November 4.

The Malta-based digital currency derivatives exchange, OKEx, continues to lead the BTC futures market at a dominance rate of 17.9 percent. The exchange accounts for $1.17 billion of the total OI in Bitcoin futures. The leading cryptocurrency exchange, Binance, holds nearly one billion USD in the futures market ($999.9 million) as the second-largest trading platform. The Chicago Mercantile Exchange (CME) follows Binance with $963.55 million.

Bitcoin spike in the derivatives market

CME is an institutional-grade derivatives trading platform. Its increasing futures trading suggests the activeness of institutional investors in the derivatives market. Other major trading platforms – Bybit, BitMEX, Huobi, FTX, Deribit, BTSE, Bitfinex, Kraken, and Gate – account for over $3 billion in total open interest in Bitcoin futures combined.

The Bitcoin derivatives market is expected to grow even further, provided the underlying assets continue its bullish momentum. For context, the cryptocurrency is up by more than 137 percent since this year. It remains unknown if and when Bitcoin will break past its $20,000 all-time high.