Despite the chaotic geopolitical environment, the Bitcoin market is in a fairly balanced state with low exchange inflows, suggesting seller exhaustion. Could this indicate we’re approaching a turning point in the market?

According to market analysis firm Glassnode, net BTC inflows to exchanges since September 2021 have been virtually flat, indicating fairly modest sell-side supply pressure. Even with the heightened geopolitical uncertainty of the past week, total exchange inflows have remained relatively small at around 1000 BTC per day.

#Bitcoin is in a state of delicate equilibrium, with neither the bulls or bears able to break into a direction.

— _Checkmate 🔑⚡🦬🌋 (@_Checkmatey_) March 7, 2022

Given the state of macro and geopolitical risks, it remains quite remarkable that exchange inflows remain fairly weak.

Deep dive report live: https://t.co/NAarvC1SMA

Investors Flock to BTC Derivatives

Although the net inflow of BTC to exchanges overall has been flat, there has been a movement of BTC from exchanges with less derivative market dominance to those with more, indicating investors may be looking increasingly to hedge risk rather than actually sell their BTC.

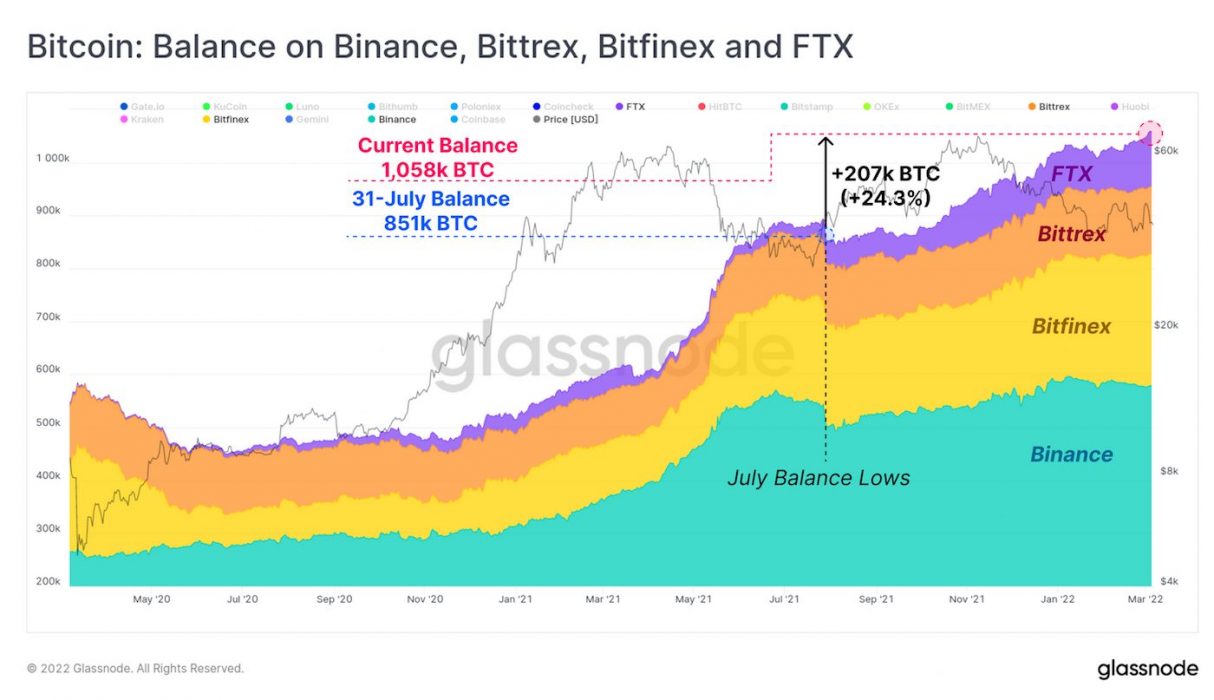

Binance, FTX, Bittrex and Bitfinex have seen significant growth in the amount of BTC they hold: in aggregate, these exchanges have seen an increase of BTC inflows of 24.3 percent since the end of July 2021. In contrast, all other exchanges Glassnode tracks have seen drops.

In addition to the growth of their held BTC, Binance and FTX have seen their dominance in the BTC derivatives markets more than double since December 2020. This growth in derivatives suggests that investors are generally looking to find ways to offset their risk rather than sell.

Other Market Indicators Further Suggest Seller Exhaustion

According to Glassnode, the majority of sell-side pressure for BTC has been coming from short-term HODLers – those who bought in the past 155 days – who are about 15 percent down on their investment on average. Selling pressure from long-term HODLers has been in steady decline since January 2021.

Despite many recent sellers realising losses, the aggregate market losses are not nearly as significant as we’ve seen in previous bear markets – around 0.5 percent of market cap per day compared to around 1.0 percent in previous bear markets.

According to Glassnode, these relatively small aggregate losses may be a further signal of seller exhaustion, that is to say most of those who plan to sell already have. Although they warn a “final and complete capitulation” is still possible based on historical precedent.

Are We Getting a Look at Bitcoin’s Bear Bottom?

Another encouraging indicator that the bottom of the bear market may be close is that approximately 52.5 percent of all transaction volume is currently spent at a loss: historically this figure has been around 55 percent in the final stages of bear markets.

This finding follows a sell-off of BTC in January 2022, where Bitcoin’s relative strength indicator (RSI) dropped to levels not seen since March 2020 during the Covid crash, which some analysts suggested showed that BTC was oversold and primed for a rebound.