Input Output Global (IOG), the lab behind the Cardano blockchain, released a YouTube update this week informing followers that its Vasil hard fork upgrade has been delayed yet again.

According to the update, more testing is required to ensure “inevitable issues” are ironed out:

All Users Need to be ‘Ready to Progress’

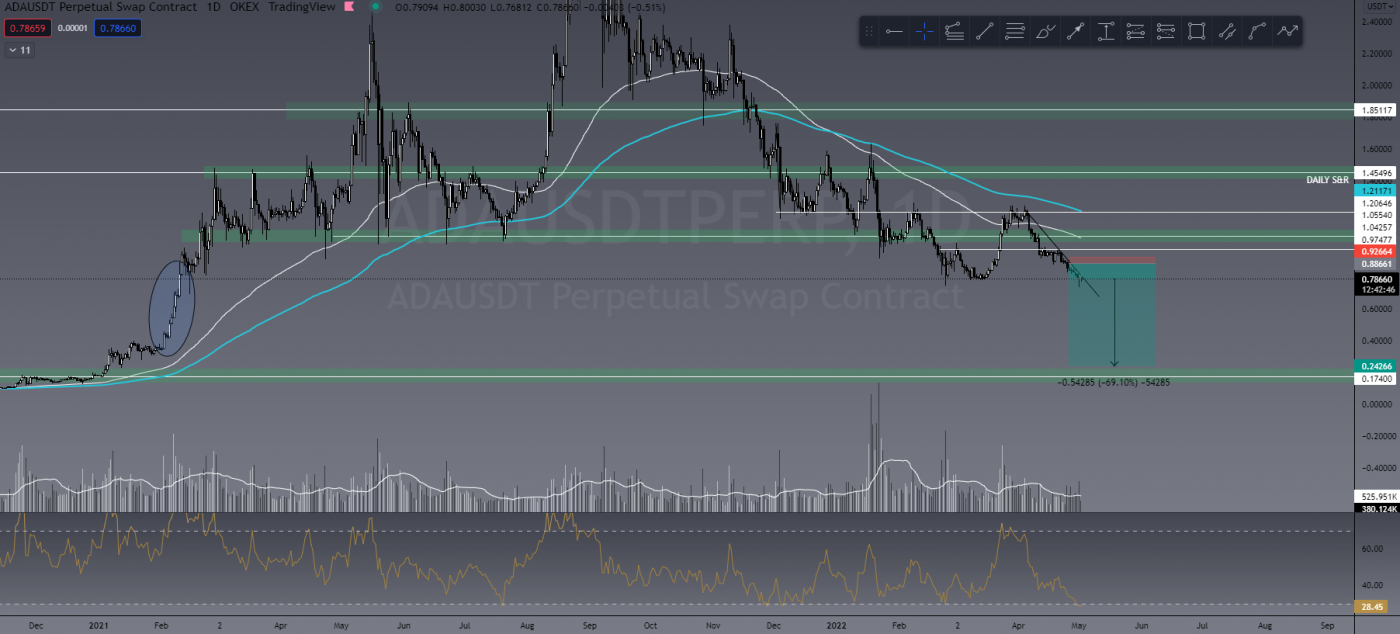

Cardano’s (ADA) long-awaited Vasil hard fork has been delayed by several more weeks, amid some significant price volatility (including a 7.7 percent gain on July 29).

Kevin Hammond, IOG’s technical manager, says the hard fork had to be postponed one more time to ensure that all parties, including exchanges and API developers, were fully ready for the transition to take place.

All users have to be ready to progress through the hard fork to make sure the process is smooth, both for them and end users of the Cardano blockchain.

Kevin Hammond, technical manager, IOG

The upgrade, entitled Vasil, is designed to increase Cardano’s scaling capabilities and is set to be the largest upgrade to the Cardano blockchain since the Alonzo hard fork. Put simply, this hard fork is a backward-incompatible change to the software used to validate and produce new blocks.

The upgrade is expected to be game-changing, offering improved speed and scalability, making it more appropriate for DApps and smart contracts. This is not the first delay Vasil has seen, with the project originally scheduled for release in late June:

The network’s DApp development community has the final decision on the Cardano testnet upgrade, meaning that developers must ensure the testing is void of critical issues before the hard fork can be implemented. A release date is yet to be announced.

Previous Cardano Delay

IOG originally postponed the Vasil upgrade by one month due to alleged bugs “that needed eliminating”, requiring further testing. At the time, Nigel Hemsley, head of delivery and projects at IOG, stated his project was “very close” to completion and a June 20 deployment. However, a minimum of seven non-severe bugs required attention before this could go ahead.