In a first for the Middle East, a crypto-based exchange-traded fund (EFT) has been listed on the Nasdaq Dubai exchange.

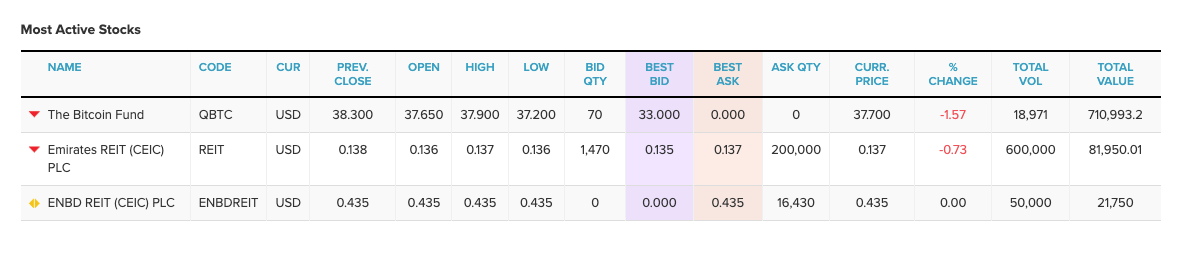

The Bitcoin EFT, trading under the ticker symbol QBTC, was met with strong demand when it debuted on the Nasdaq Dubai on Wednesday, June 23.

‘The Bitcoin Fund’ has roughly US$1.5 billion in assets under management and is dual-listed, having been established by Canadian digital asset management firm 3iQ on the Toronto Stock Exchange (TSX) in 2020.

Expanding to the Middle East will capitalise on investor demand in the region and give people access to trade in their local time zone, according to 3iQ’s chairman and CEO Frederick Pye:

The idea is Bitcoin trades 24 hours a day … so our interest is to bring a regulated product to the Dubai market in their time hours.

Crypto EFTs Continue to Emerge Globally to Meet Demand

Canada was the first country to offer a crypto EFT on a major exchange in 2020 and now has multiple Bitcoin EFTs available on the Toronto Stock Exchange.

Investment management firm Invesco – which holds US$1.5 trillion in assets – applied for two crypto-based EFTs in June 2021, joining a queue of companies waiting on the US Securities and Exchange Commission (SEC) to decide whether to give the EFTs the green light.

Australia’s primary securities exchange the ASX is looking into the creation of a local EFT for cryptos to cater to demand, although the ASX has not specified a timeline for enacting such a mechanism.