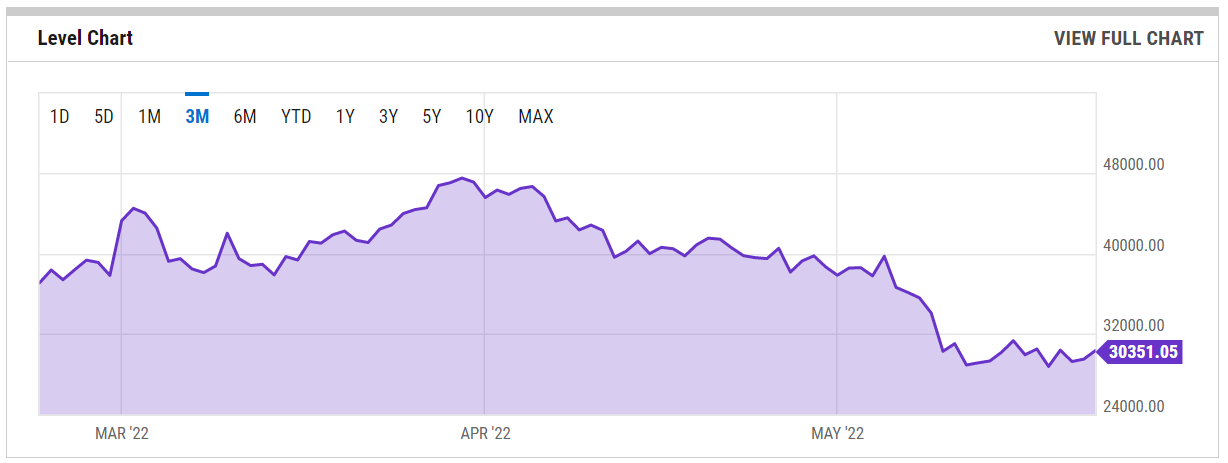

To the disappointment of investors, Bitcoin has logged its eighth red candle, setting a record for the currency. According to data graphed by YCharts, Bitcoin has now been on a downward trend since March 30:

However, investors are starting to hold out some hope for the beginning of a rebound:

‘If in Doubt, Zoom Out’

With Bitcoin breaking records for its eighth consecutive week in the red, things are seeming dire for investors thanks to an absence of volatility. The price point has managed to hold just above the US$30k mark, with investors showing bearish sentiments. Regardless, the adage remains, if in doubt – zoom out.

The fall of Terra and its LUNA token induced mass sell-offs last week, with Bitcoin dropping almost as low as US$24k. However, Bitcoin’s correlation with the stock market is decreasing in comparison to previous months, a shift that many investors are perceiving positively with increasingly hopeful chatter circulating on social media regarding Bitcoin’s outlook for the weeks to come.

2022: Bad for Bitcoin

Only a week ago, Bitcoin had reportedly slipped below US$29k, its (at the time) lowest level since 2020. As that drop was perceived to be the result of the latest US Consumer Price Index figures, investors were left unsure as to which way the coin might go next.

Not only has the price of Bitcoin itself had a rough start to 2022, but Bitcoin mining stocks have mirrored this sharp decrease in value. Where Bitcoin had been recording losses around the 30 percent mark, mining stocks had doubled this figure in some cases.