Ethereum is currently powering the future of global decentralised finance (known as “DeFi”) so it’s blockchain must be well equipped to scale and handle an influx of apps and users into the millions. Currently there are limitations with Ether blockchain with speed and high transaction fees, which has led to the emergence of Ethereum layer 2 projects that help resolve the network performance and enable continued expansion of the DeFi ecosystem.

What is Ethereum Layer 2?

A layer 2 project is a company and network of its own that operates on top of the Ethereum blockchain base layer (known as “layer 1”). Layer 2 projects (also known as “sidechains”) connect Decentralised applications (Dapps) to interact with aspects of the layer 1 blockchain to significantly speed up transactions, whilst making use of the base layer’s privacy and decentralised infrastructure.

Why use Layer 2 Projects?

The main Ethereum 1.0 blockchain currently has a low speed of around 7-15 transactions per second (TPS). Layer 2 solutions can achieve much faster speeds of up to 9,000 tps by handling most of the hard processing “off-chain” on their sidechains to increase efficiency.

There are an increasing amount of layer 2 projects and sidechains in circulation, each working to improve user experience for swapping coins and tokens, minting NFTs, reducing transaction GAS fees and increasing the speed of transactions.

We have compiled a list below of what we think are the best 10+ Ethereum layer-2 projects and sidechains worth knowing about.

1. Polygon

Polygon is a protocol and framework that allows projects to connect with Ethereum-compatible networks to enable ‘scalable-solutions’ for a multi-chain ecosystem.

Advertised as being for developers, by developers, Polygon has identified the challenges facing the Ethereum blockchain and presented its own solutions by offering instant and ‘zero-gas’ transactions with a Proof-of-stake (PoS) chain.

Polygon utilises the MATIC token, which helps to secure the network and to pay any transaction fees. Originally the project was called MATIC and was seen as a direct competitor to Ethereum, but in 2021 it rebranded to Polygon and now enhances the Ethereum ecosystem rather than directly competing with it.

There are currently over 3,000 decentralised applications running on the Polygon network which include wallets, oracles, DeFi, DAO, B2B NFT and Gaming projects.

2. Optimism

Optimism is a community focused layer 2 framework that offers projects with lighting speed for a lower cost to transmit data to and from the layer 1 blockchain. Optimism is an optimistic rollup chain, which means a large batch of transactions are ‘rolled’ together and then condensed and processed on layer 1.

The Optimism ecosystem promotes hundreds of apps and integrations including DeFi, NFTs, Bridges and Portfolio trackers. There isn’t a native token for the Optimism project yet. The project current donates all the profits towards scaling the growth and sustainability of public goods.

3. Arbitrum

Arbitrum is a layer 2 project built by Offchain Labs that provides Ethereum apps to scale at low cost whilst also providing software developer’s which simplified feature implementation of smart contracts. Arbitrum claims that you can build an Eth app in as little as five minutes.

Much like Optimism, the Arbitrum also doesn’t have a project token yet. That being said, the ecosystem is growing with hundreds of live applications including NFT marketplaces, Wallets, Bridges and On-Ramps making use of the quick start developer tools.

4. Starkware

Starkware is an Ethereum layer 2 project that provides scaling solutions for applications wanting to keep transaction fees low and fast executing.

The Starkware ecosystem includes a few different sub-projects which help provide permissionless decentralised ZK-Rollups that help facilitate the transactions that accompany AMM, spot trading, NFT minting and crypto trading. Big projects such as Sorare have integrated Starkware into their infrastructure to enable minting of Ethereum-based NFTs.

Starkware doesn’t have a native token yet.

5. Uniswap

Uniswap is one of the leading the decentralised crypto trading protocol projects that supports thousands of DeFi applications including token swapping, staking, voting, liquidity providers and more.

You can use the Uniswap app to swap DeFi tokens directly on-chain through popular DeFi wallet providers on Ethereum, Polygon, Optimism and Arbitrum networks.

The native token for Uniswap is the UNI token, which you can use to save trading fee costs and stake in liquidity mining pools to earn yield. The UNI token also serves for decentralised governance of the project.

6. Loopring

Loopring is a zkRollup Ethereum Layer 2 project that provide low-fees and high speed for trading, swapping and payments using ETH.

Loopring promotes an ‘automated execution system’ that allows users to trade cross-exchange and participate in cross-blockchain liquidity. Defined as ‘blockchain agnostic’, Loopring can integrate with any platform using smart contracts. You can use the Loopring BETA marketplace to create a Layer 2 wallet and trade DeFi tokens with ETH and USDT trading pairs.

The LRC token is native to Loopring and aids in these transactions.

7. OMG Network

OMG Network (also known as “OMG Foundation”) provides Ethereum with a Layer 2 Optimistic Rollup solution that reduces gas fees and improves transaction throughput for smart contracts.

A new project launched by OMG is called Boba, which is extending Ethereum Virtual Machine (EVM) smart contract capabilities specifically for DeFi and NFTs projects running integrations on external servers such as AWS to help execute sophisticated algorithms that are not possible to run on-chain.

8. ZKSpace

ZKSpace is a fairly new ZK-Rollup Ethereum Layer 2 protocol that offers near instant transactions without waiting for block confirmations.

The ZK project offers a layer 2 NFT protocol which provides NFT projects with cheaper NFT issuance, minting, airdrops and sales. 2022 should be an interesting year for ZKSpace, with lots of exciting developments scheduled, including ZKSea – an NFT Layer-2 marketplace.

The native token ZKS is used to save fees on the DeFi token swap L2 Wallet and also used to pay for minting NFTs on the L2 marketplace.

9. Skale

Skale is an elastic blockchain network that focuses on high-performance, offering up to 1000x faster transaction speeds for your Ethereum Dapps.

Crypto projects have the option to rent a sidechain through Skale to increase transaction throughput making use of the Ethereum 2.0 validator nodes with the use of Sharding technology.

Projects can execute solidity smart contracts on Skale powered blockchains to enhances DeFi, games, NFTs and content streaming services.

SKL token is the native token of the Skale network, which aids in ecosystem cleaning, network development and upkeep, and reward validator nodes – the community keeping the network secure.

10. Gnosis Chain

Gnosis Chain (formerly known as xDai) is a prediction market platform on the Ethereum network. Gnosis chain is providing its users with the chance to build their own prediction platform through the creation of a specific infrastructure layer.

Gnosis Chain also hosts free tournaments on the outcomes of their prediction platforms, and doing well with these can earn you GNO – the native token for the Gnosis Chain.

11. Bonus: Raiden Network

Raiden Network is an open source project that aims to help scale Ethereum payments by providing off-chain transfer of ERC20 tokens.

While this network is currently work in progress, Raiden is looking to avoid the ‘blockchain consensus bottleneck’ to facilitate ETH micropayments, similar to that of BTC lightning network.

Currently, the project’s native token is RDN.

Conclusions

Ethereum layer 2 projects will have a big say in the short adoption of Ethereum-based projects and also in the long-term success of Ethereum as a global settlement platform.

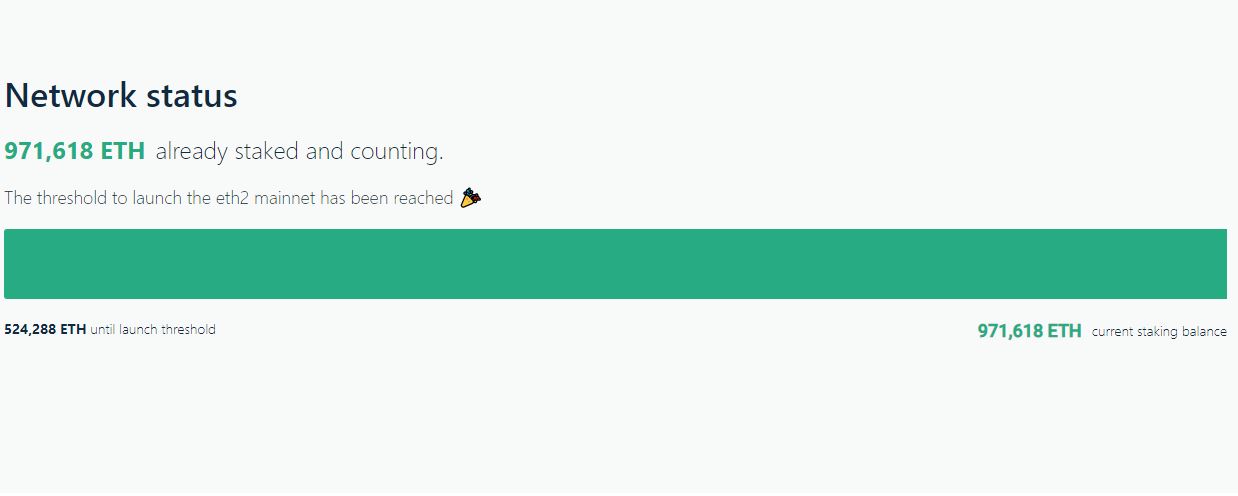

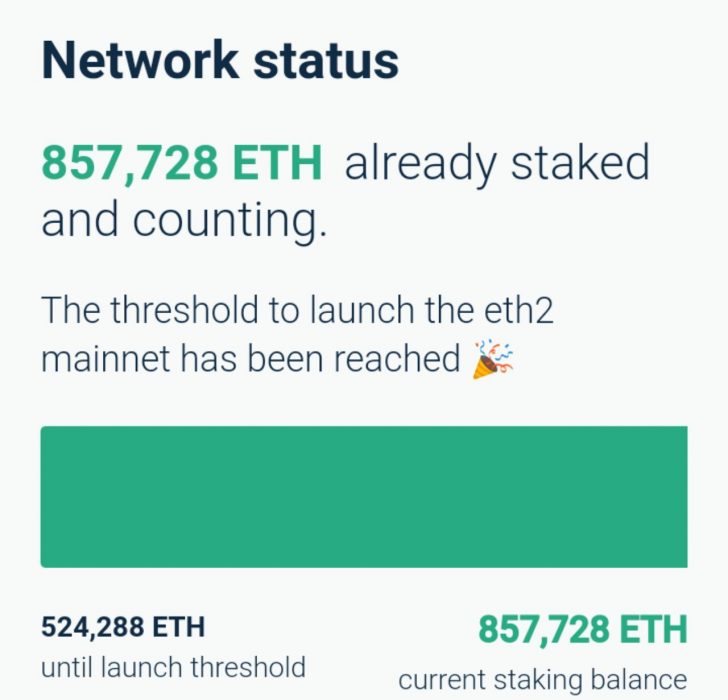

2022 brings the long anticipated Ethereum 2.0 upgrade which many believe will not make Layer 2 networks obsolete, but actually enhance them and increase adoption into the Ethereum ecosystem. Upgrades such as sharding will become available to Layer 2 projects enabling them to improve their services to Dapps and Layer 3 apps.