Welcome to this weekly series from the TradeRoom. My name is Dave and I’m the founder of The Crypto Den, an Australian-based crypto trading and education community aiming to give you the knowledge to take your trading game to the next level.

Crypto Market Outlook

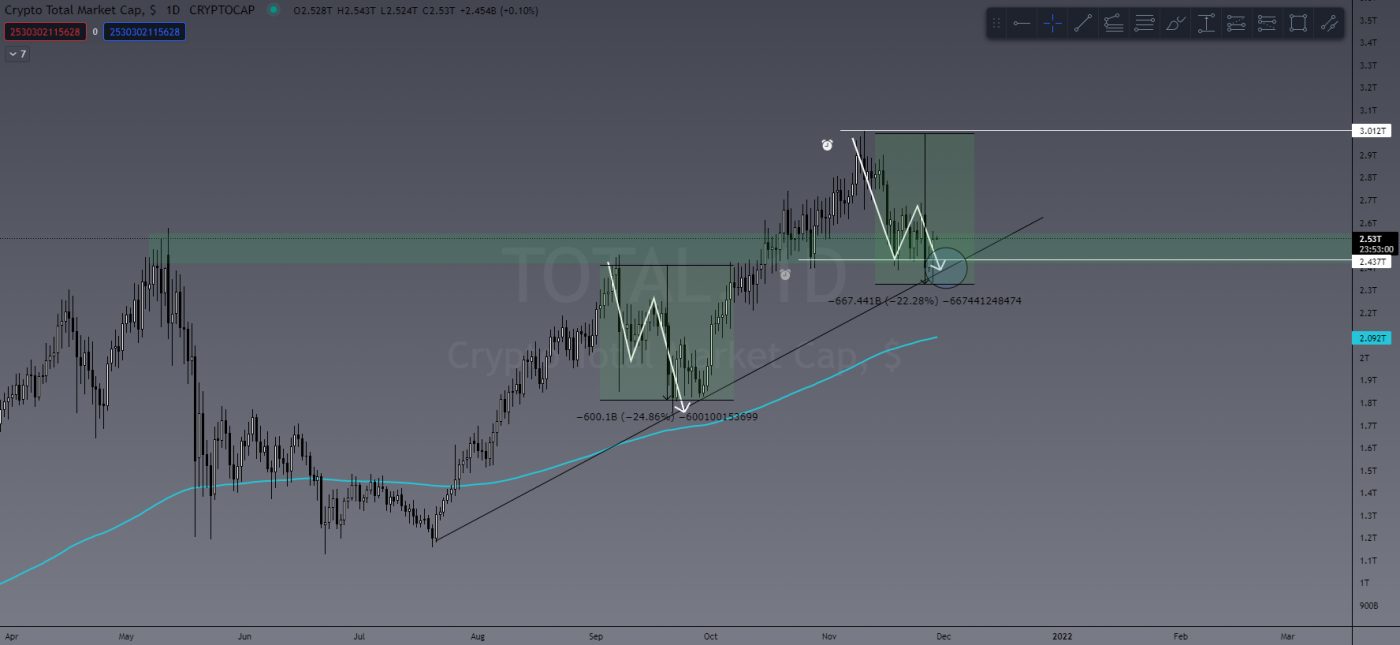

Well, the market lost another US$250 billion this last week and is still not really showing any signs of strength. The TOTAL crypto cap is still trending down in this channel and if we don’t see a recovery soon, I anticipate we could lose another US$500+ billion. I know it’s not what people want to hear/read, but we have tried to give as much warning and caution as possible since November 2021 that the markets could get much worse, and they have with the TOTAL down US$1.3 trillion (43%).

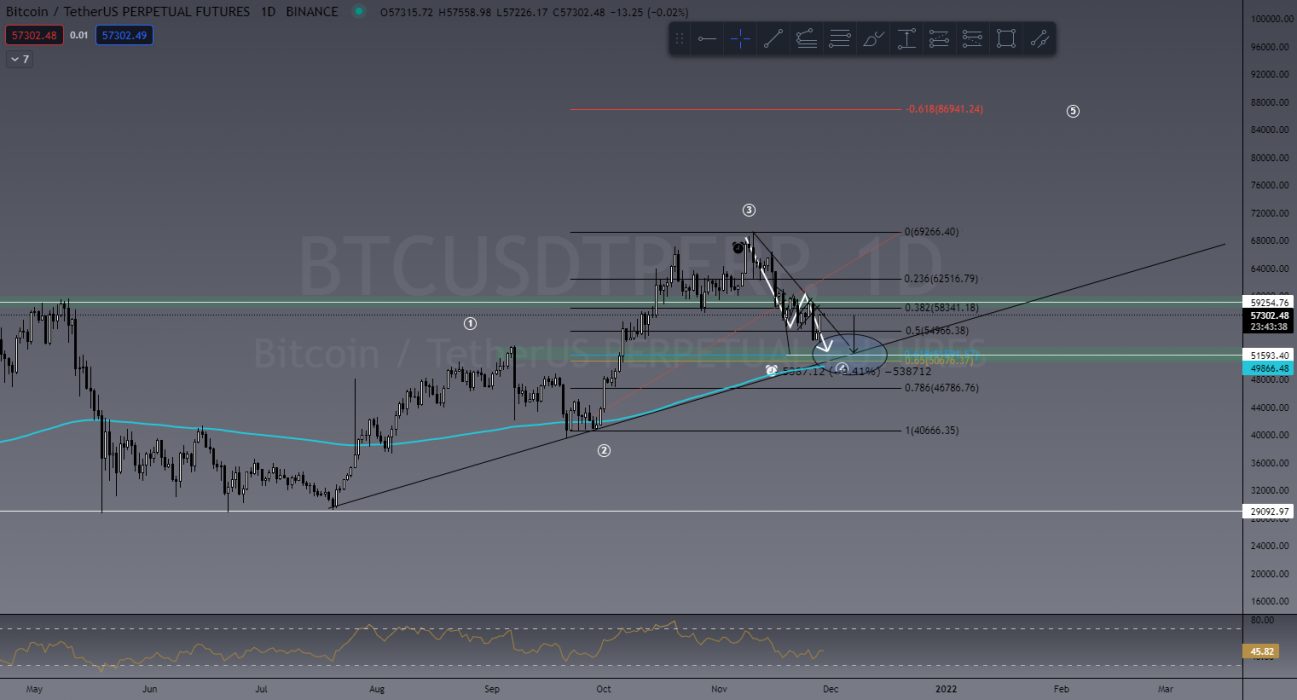

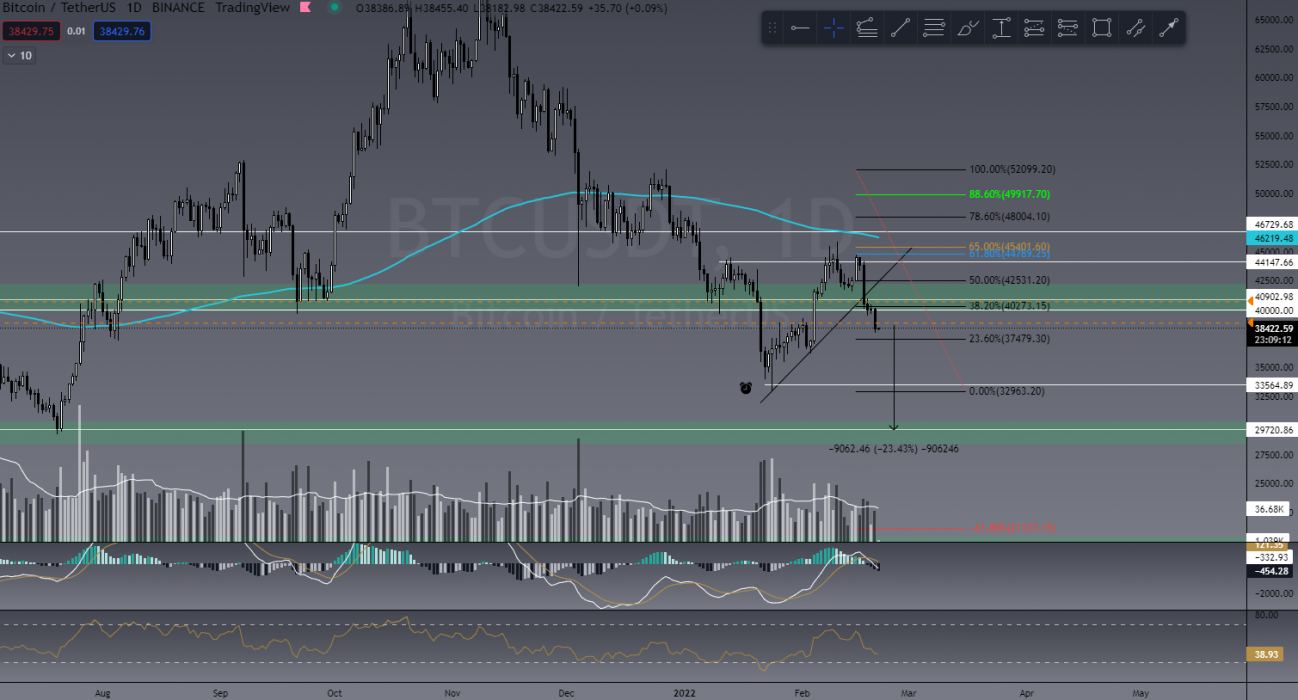

BTC has broken the local uptrend I showed in last week’s article after hitting the retrace golden pocket on the fibs. To me this is the first confirmation that the recent uptick was nothing but a relief rally, as we have been saying for a couple of weeks now. The second confirmation I’m looking for is a new lower low (LL) on the daily timeframe. An anticipated 13%-23% drop is likely at this stage, taking us back to US$29,000.

Last Week’s Performance

In last Thursday night’s live market scan in Our TradeRoom we had an absolute banger! We found six amazing entries into short trades as a community effort to help each other WIN! I’ll show three here today:

KNC/USDT

We looked at KNC/USDT peaking out at a daily level of resistance which is generally a very strong level to break. With its solid risk-to-reward ratio, we jumped into this one there and then. For me at the time of writing, it’s currently on 160% profit on a 10x trade.

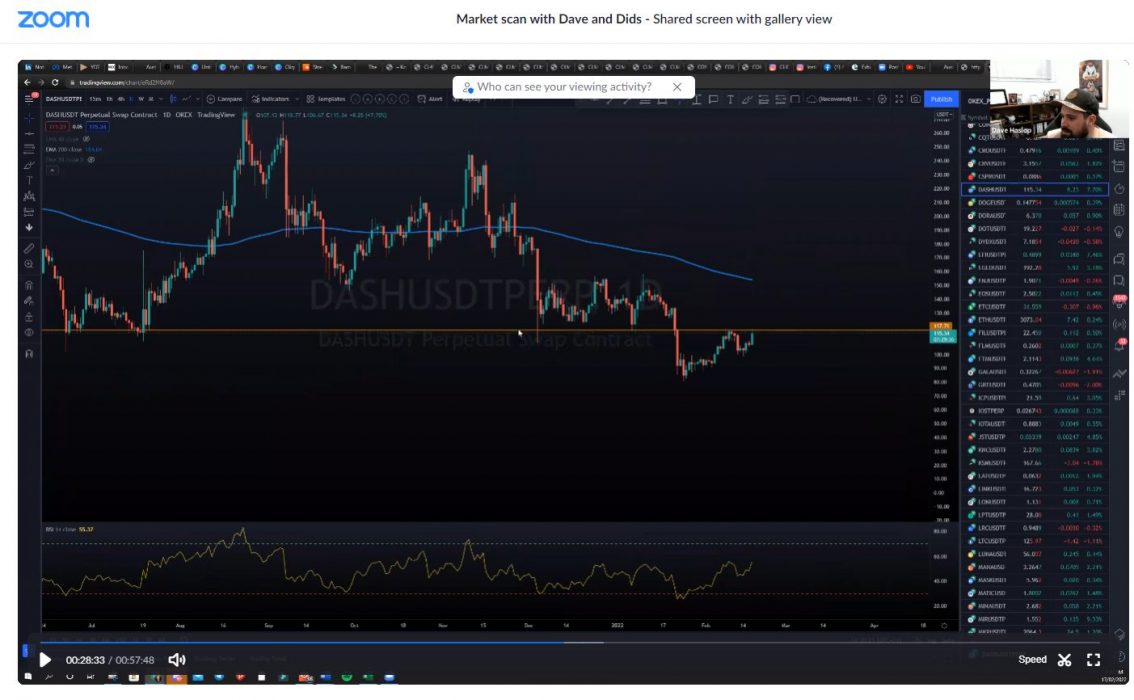

DASH/USDT

DASH showed us a textbook little double top at daily resistance. We entered this short and within minutes were already in profit. Doesn’t really get simpler than this. Currently sitting at 150% on 10x.

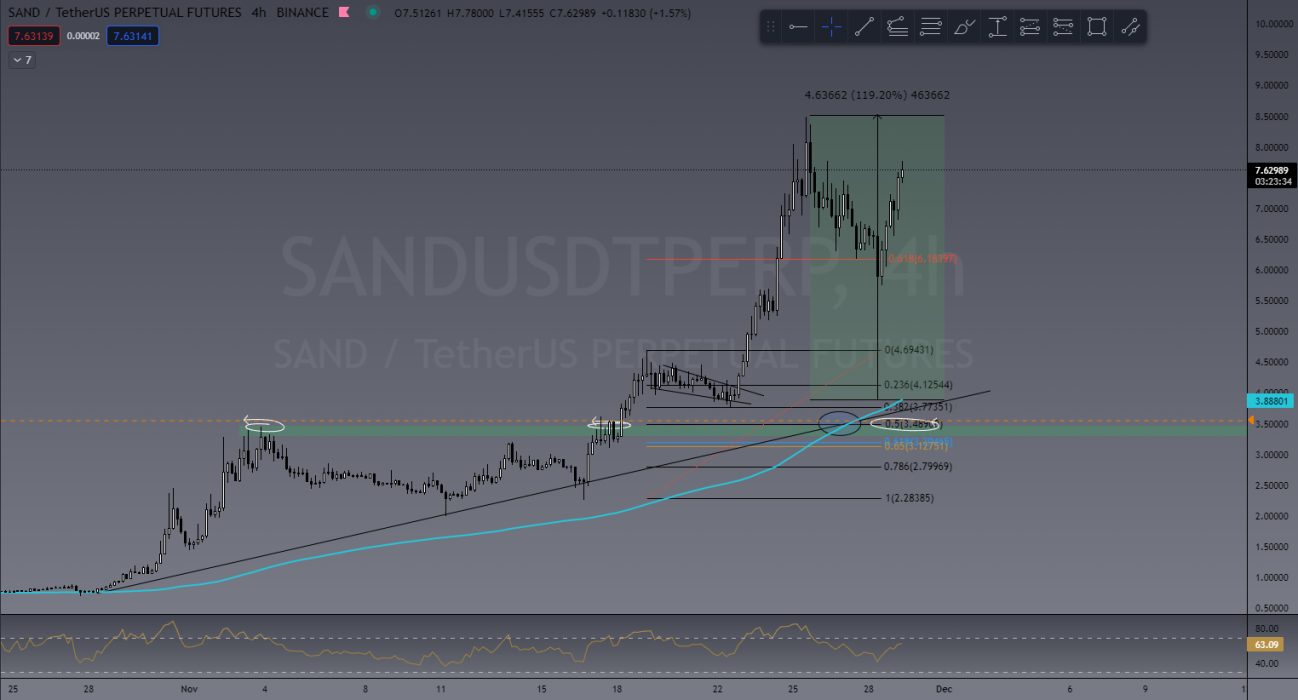

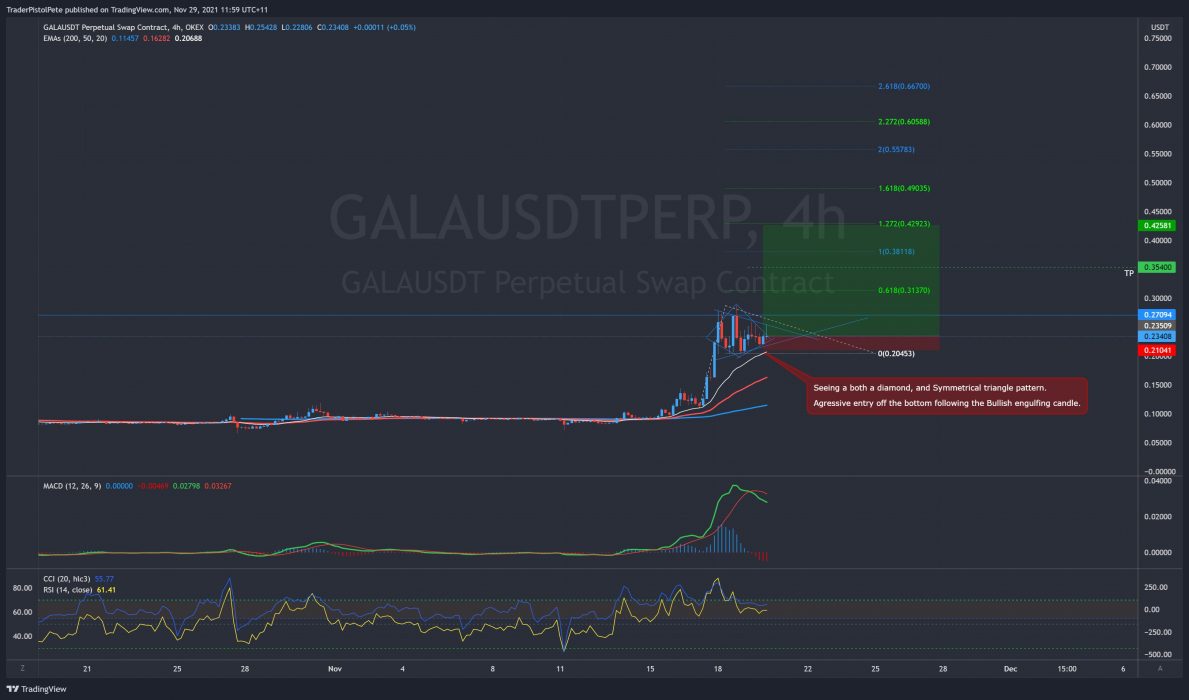

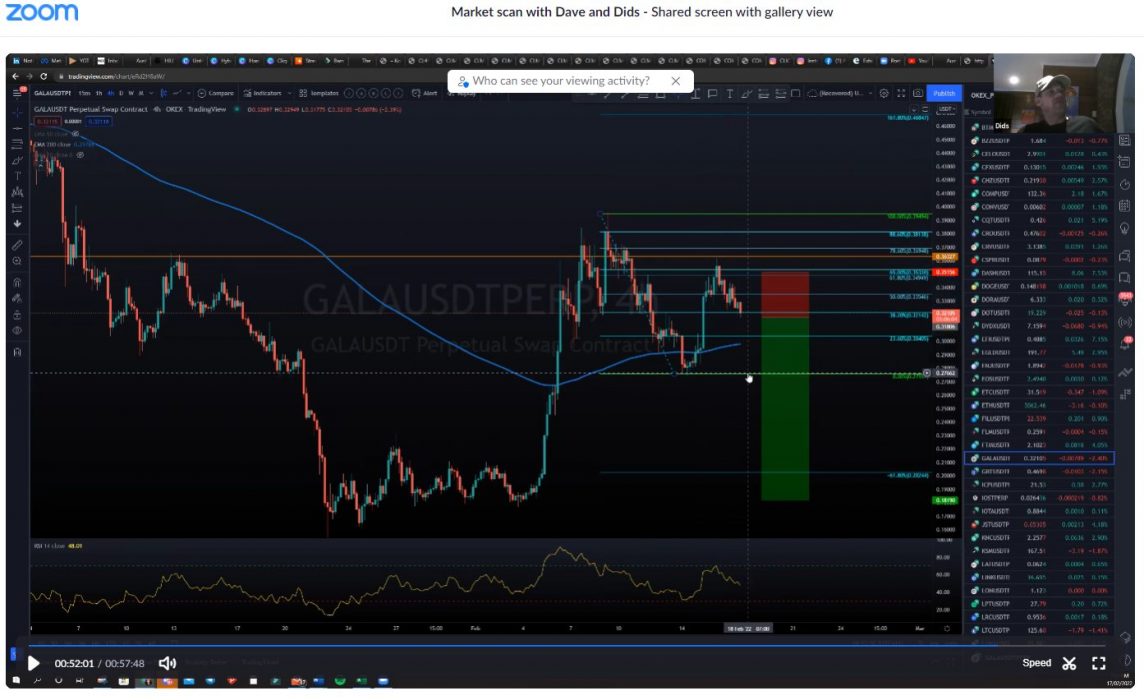

GALA/USDT

Again we see a beauty of a support/resistance flip here with a lower high (LH) capping out at the golden pocket fib level. Credit to “Typeguy” for finding this one! He’s pretty much a trade-finding machine! Currently 220% on 10x.

This Week’s Trades

ADA/USDT

I’m finally in! For those of you who have been following along, I have been waiting for this trade since November 2021 and first shared this here in an early December article. At the risk of repeating myself enough to annoy readers, this still looks primed for me! A potential 80% drop can be seen here on ADA, and if BTC continues to drop there’s absolutely no reason for people to think this can’t happen. I know A LOT of holders of this coin get quite upset when you post a bearish chart, but it’s important not to get emotionally attached to a coin when investing your hard-earned money.

TORN/USDT

Another one found in Thursday’s market scan is TORN. With a potential 50% drop, it’s one we’re keeping an eye on and some have entered already.

NOTE:

I just wanted to mention that in a lot of social media posts I see on Facebook, Twitter and even YouTube, there are A LOT of people sharing bullish charts and have been for months. It’s for this reason we continue to caution people when we’re seeing a bearish outlook despite the amount of negativity we receive. It’s incredibly important to not blindly follow ANYONE (myself included). I’ve seen too many people lose money as a result, so I encourage you to at the very least learn the basics before entering the markets. No matter where you decide to learn, please do it!

Learn to Trade

We are giving away 3 months FREE TradeRoom (valued at $300) to those who join our Trading Fundamentals course starting February 28!

The Crypto Den is holding its first of only two trading courses for 2022 on February 28! That’s right, we will only be running two programs in 2022! What makes us different? Our lessons are LIVE and come with a community where you submit your homework and receive feedback to ensure you understand what we teach!

Duration: 6 week course

Date/Time: Live trading course twice a week – Mon & Wed at 7pm AEST

Frequency: We now run our LIVE course only twice per year

Location: Zoom Webinar

From: February 28 to April 13

The Crypto Den’s Trading Fundamentals trading course is a LIVE interactive course designed to teach you how to trade the crypto markets from absolute beginner level!

Our six-week program teaches you how to set up your trade accounts using reputable exchanges and brokers, how to read the charts using technical analysis, and to protect your capital using effective risk management strategies.

We have taught thousands of students in the past five years how to trade these volatile and highly profitable markets. See our REAL reviews from REAL students.

Using ZOOM twice a week, all of our lessons are LIVE and recorded so you can access them over and over again in our structured course through our website and smartphone app. Lessons come with homework and online quizzes, as well as an amazing online and private community of students.

So what are you waiting for? Join now to start learning!

Already Know How to Trade?

Invite to Join our TradeRoom

If you’d like to become a better trader, you’re invited to join our TradeRoom where we share daily charts and market analysis. In our community we strongly encourage and teach correct risk management strategies to keep our members safe in this new volatile crypto market.

Join our “Apprentice” plan now for your 7-day trial.

The Crypto Den was created in 2017 to help the rapidly growing crypto community learn and understand the fundamentals of digital currencies and how to trade them.

Since then we have taught thousands of members the basics of technical analysis and trading strategies to further progress and perfect their trading abilities.

In the TradeRoom you will be included in a supportive environment which encourages personal growth, education and community support.

It’s a place to share your trading ideas and follow other experienced traders’ feeds to help keep your finger on the pulse of such a volatile market!