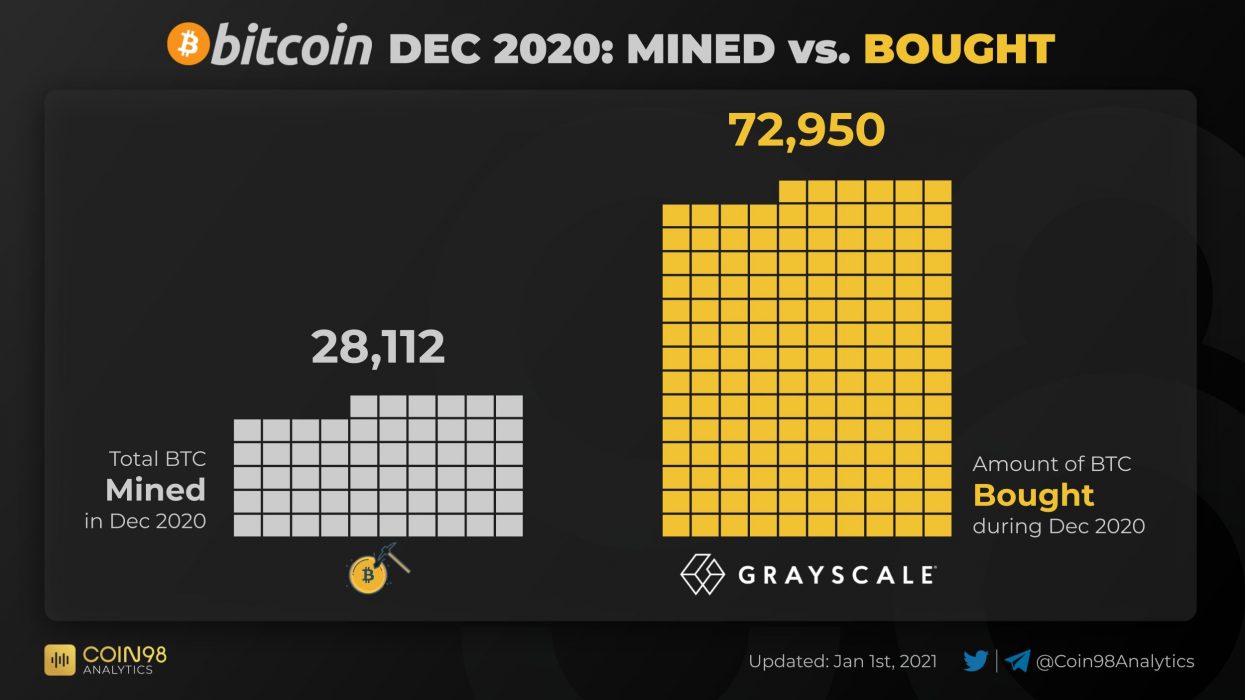

The leading digital assets investment company, Grayscale has resumed its massive Bitcoin (BTC) purchases just a few days after it reopened the Bitcoin Trust product for new investments. Oftentimes, the company buys more than BTC miners could mine in a single day. This somewhat indicates that there is still a growing interest in Bitcoin among institutional investors.

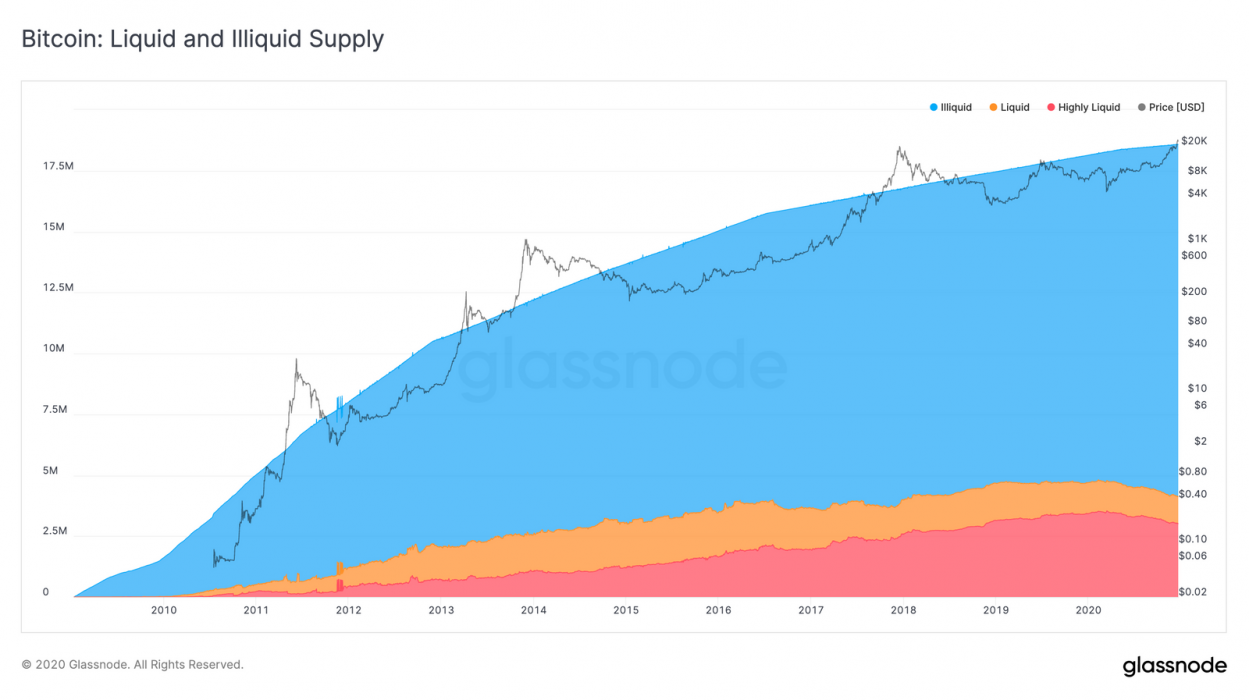

Massive purchases like this create scarcity for the leading cryptocurrency, which should be a good sign in the long term.

Grayscale Stacks +10K Bitcoin

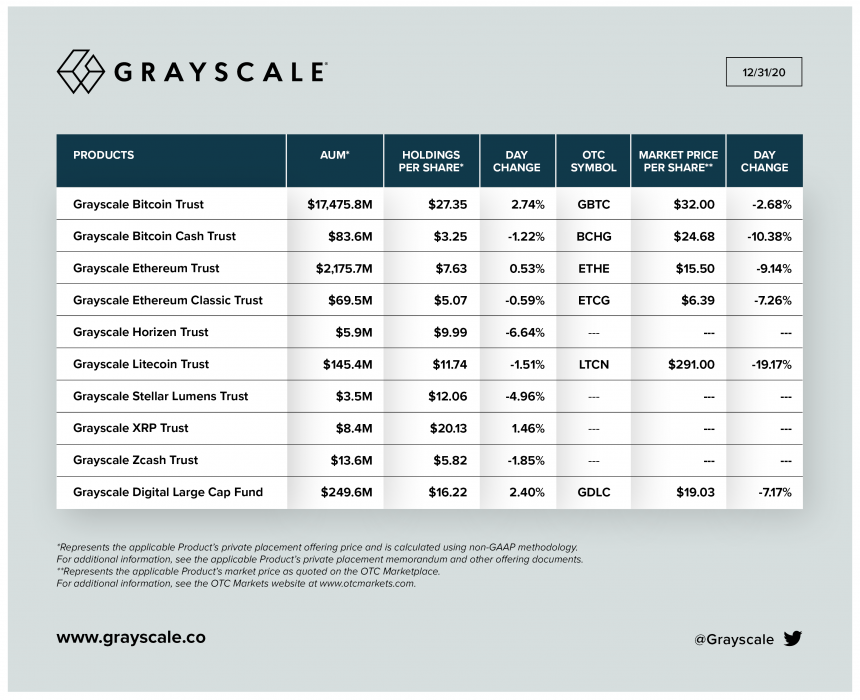

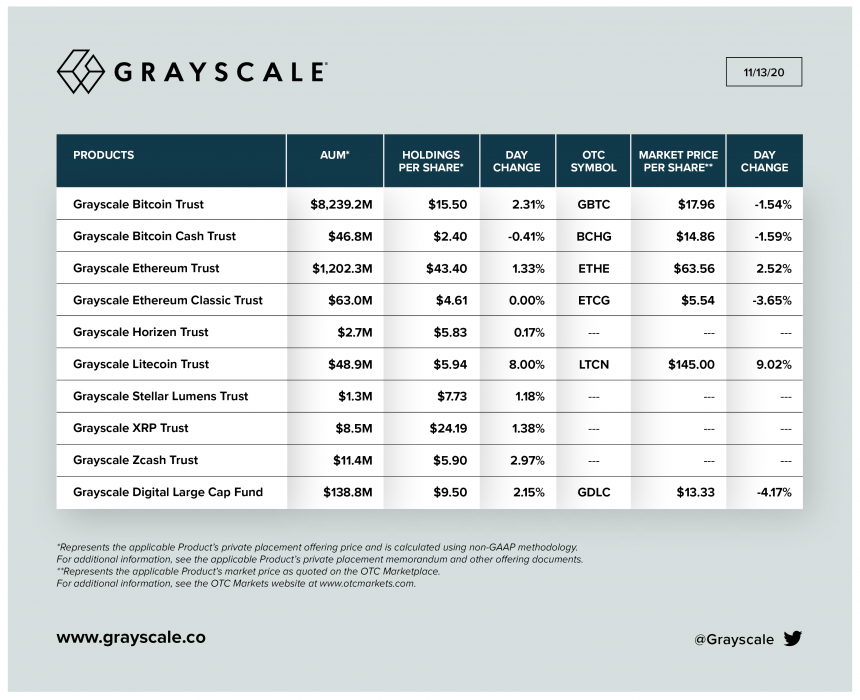

Since December 21, the digital asset investment company stopped accepting new investment to its Bitcoin Trust, and five other large-cap funds like the Ethereum Trust, Ethereum Classic, Litecoin, etc. This is no longer an unusual move from the company, as it’s now understood to be a periodic tradition, where Grayscale reportedly closes the crypto products to “private placement” rounds.

Despite suspending new investments in the crypto products, especially the Bitcoin Trust fund, the company bought more Bitcoin a few days after the announcement.

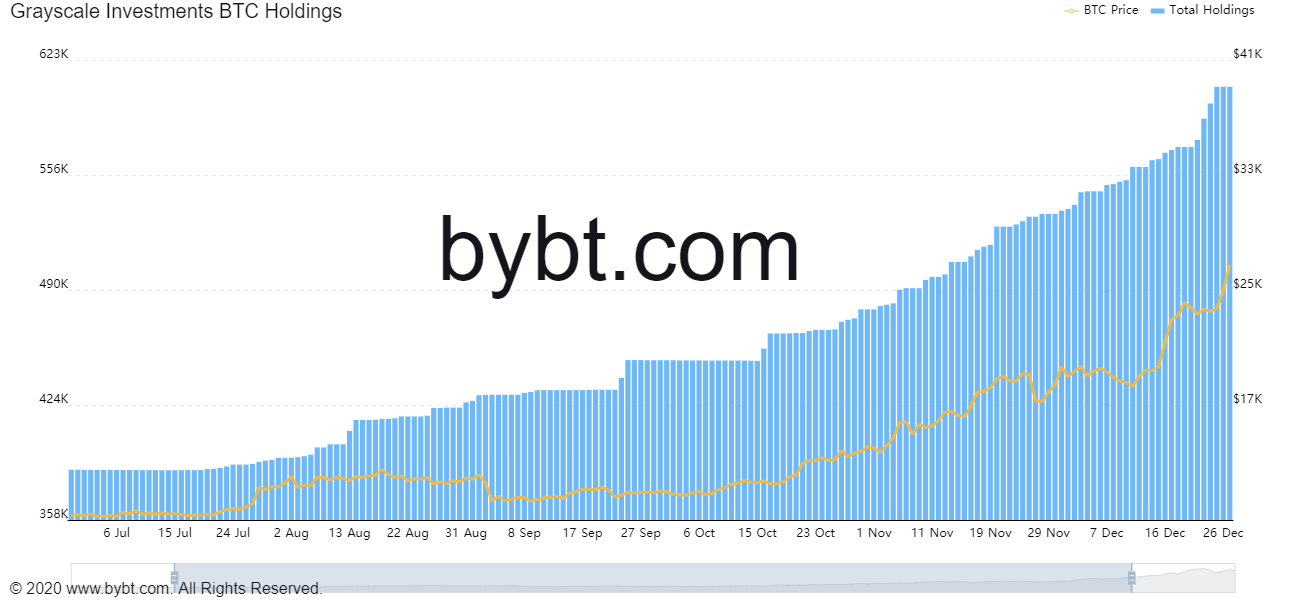

A day after the Bitcoin Trust was resumed for new investments on January 13, the company bought over 2,000 Bitcoin, which is worth more than US$74 million, following the current price of the cryptocurrency at US$37,215. Presently, Grayscale’s Bitcoin holding is sitting at 618.56K, according to the information on ByBt. This means that the company added 8,000 Bitcoin in two days after the first purchase of the week. Thus, Grayscale stacked over 10,000 BTC within three days.

Following the current BTC holding, the Grayscale Bitcoin Trust fund has a valuation of US$23 billion.

Why it Matters

At first, these massive BTC purchases from Grayscale shows there is a steadily growing interest by institutions to hold Bitcoin. As the demand continues to grow on the platform, we are likely to see bigger buys by Grayscale, which creates scarcity for Bitcoin in the crypto market. Basically, the price of an asset is expected to increase when demand is greater than the asset’s supply rate.