Since the past month, Bitcoin (BTC) has seen posting an exponential increase in price, and especially on December 27, the network’s hashrate began spiking. A growing hashrate means more mining machines are going online on the BTC network. Probably, miners became active amid the growing price of Bitcoin and have presently turned to take profits from their BTC holding, as the cryptocurrency seems to be due for a larger correction.

Bitcoin Hashrate at ATH

Looking at the Bitcoin blockchain explorer, Blockchain.com, the hashing power on the BTC network has been growing since the past weeks. Currently, the hashrate is sitting at a new record level of 150.776 million terahashes per second or TH/s. As recently as January 8, Crypto News Australia reported the previous all-time high at 148.727 million TH/s, which happened when the Bitcoin’s price was pushing for the US$40,000.

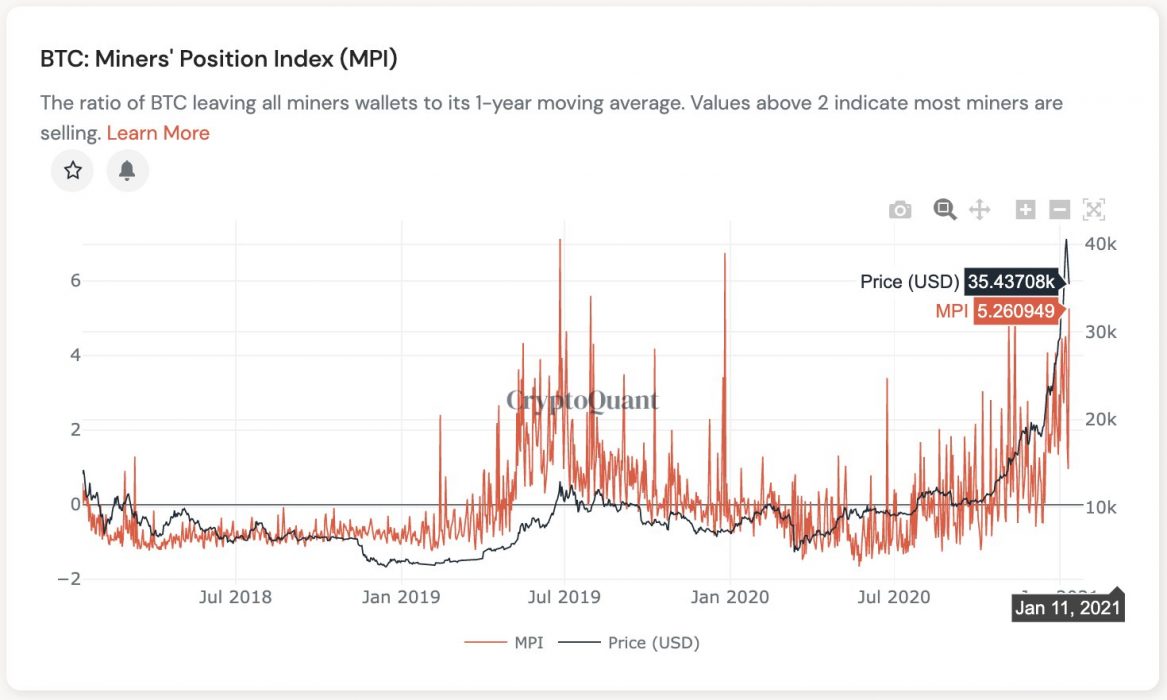

Judging by this, one might say that the current trend in the Bitcoin hashrate is somewhat influenced by the growth of the crypto. However, on-chain metrics suggest that some miners have turned to take profits, than hodling the cryptocurrency for the long term. This was probably caused by Bitcoin’s correction from January 10, as Miner Position Index (MPI) was seen spiking notably at the same time.

Miners are Selling

A recent chart shared by Ki-Young Ju, the founder of CryptoQuant, showed that the ratio of Bitcoin leaving miners’ wallets to exchanges in the 1-year moving average has been growing steadily. As of January 12, the MPI reached 5.26 points, which is more than double the standard (2 points), which shows miners are beginning to sell their coins. Massive inflows from miners to exchanges can disrupt Bitcoin’s volatility, and Ki-Young thinks, “we might have second dumping.”

However, more BTC buys from institutions can alter the effect of these deposits from miners, as was seen in December.