Welcome to this weekly series from the TradeRoom. My name is Dave and I’m the founder of The Crypto Den, an Australian-based crypto trading and education community aiming to give you the knowledge to take your trading game to the next level.

Crypto Market Outlook

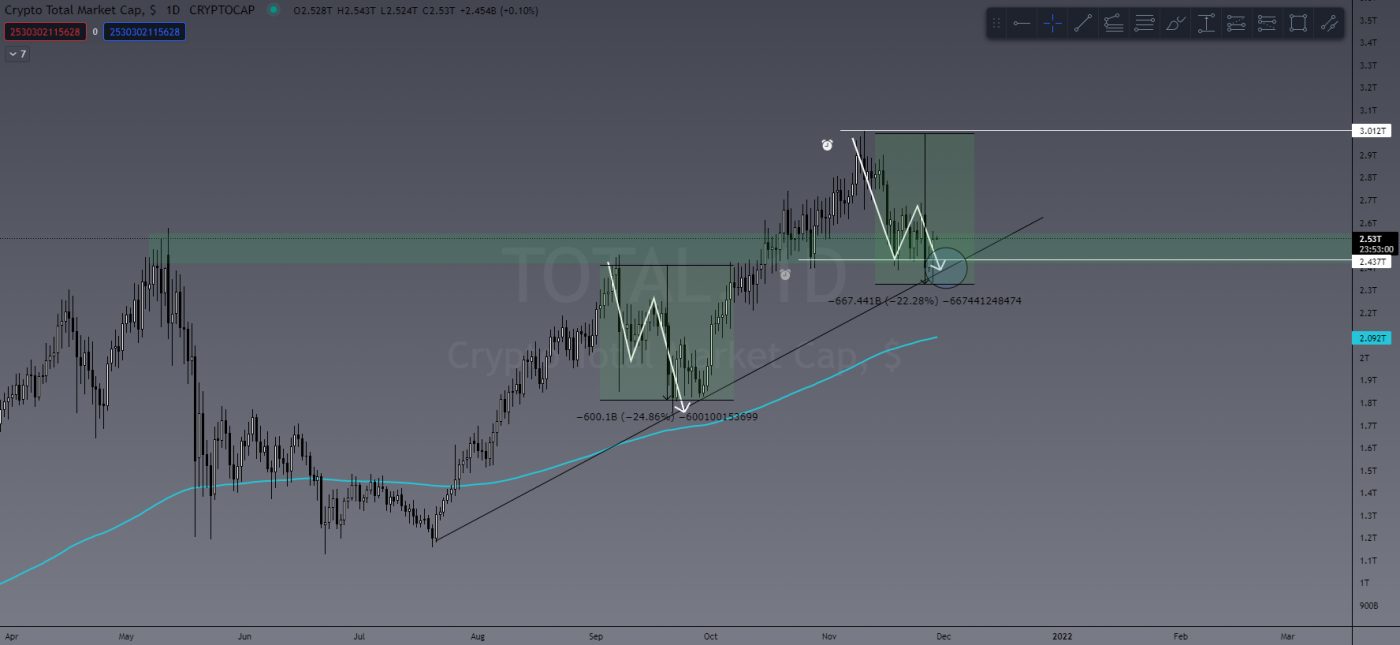

Last week I touched on the US$600 billion drop in TOTAL crypto market cap. I warned that we could see some more selling pressure but there was no reason to stress or start panic selling. You can see below that the TOTAL crypto cap has indeed pulled back further to retest its current uptrend. So far it’s showing a bullish test with a long wick to the downside and a strong bullish engulfing candle on the daily timeframe.

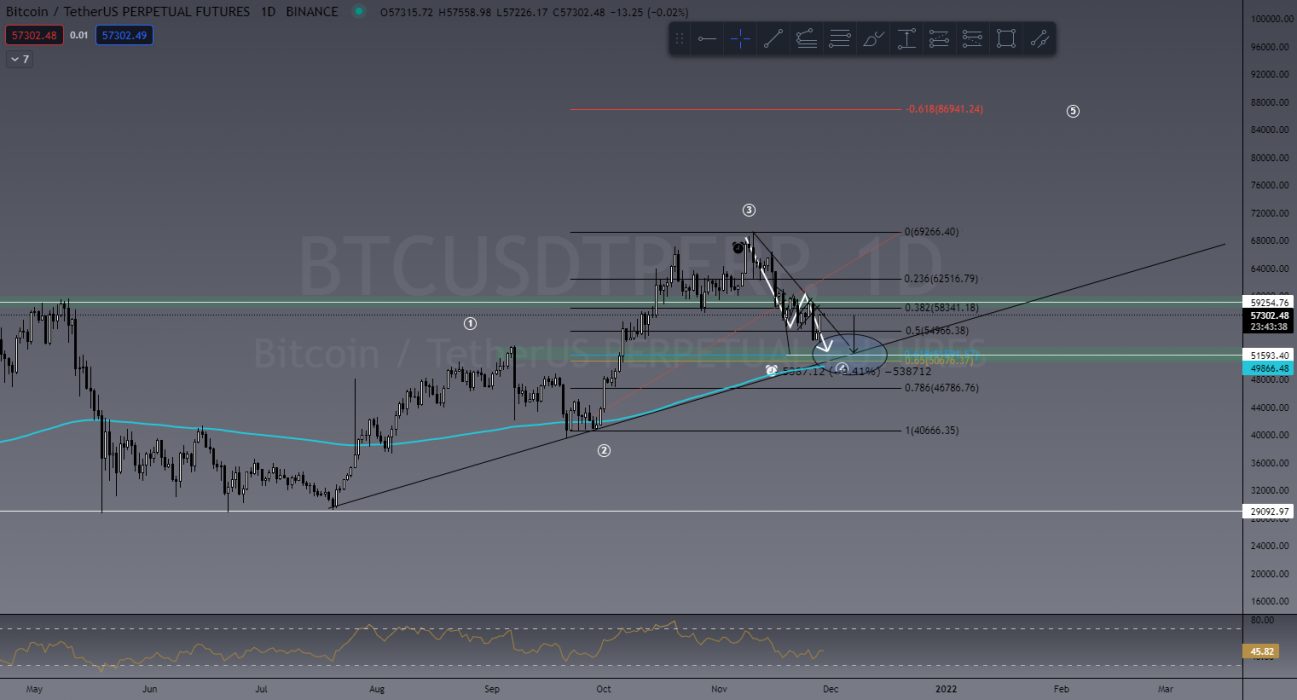

With the projection of the TOTAL heading down in value, I suggested BTC would follow this formation and see further bearish price action. My target being US$51,000, we haven’t hit that price YET. So far BTC is showing some signs of strength and the bottom of this local downtrend MIGHT be in, so it would serve you well to expect a bounce here and plan your trades accordingly.

That said, we’re not out of the woods yet. While BTC is trending below that local downtrend line and forming lower lows/lower highs (bearish market structure), we could see it hit that suggested area of support at US$51,500.

What’s interesting about the US$51,500 level is the perfect storm forming. There are so many key identifiers converging in that one area. We have:

- the 61.8% Fibonacci retrace level;

- daily 200 Exponential Moving Average(EMA);

- daily level of support;

- daily uptrend;

- daily Higher Low (excellent market structure);

- all of which plays well into the Elliott Wave Theory of market cycles.

It’s almost the perfect trade setup and something we discussed in last Thursday’s market scan in the TradeRoom. You can catch a sneak peek on our YouTube channel.

Last Week’s Performance

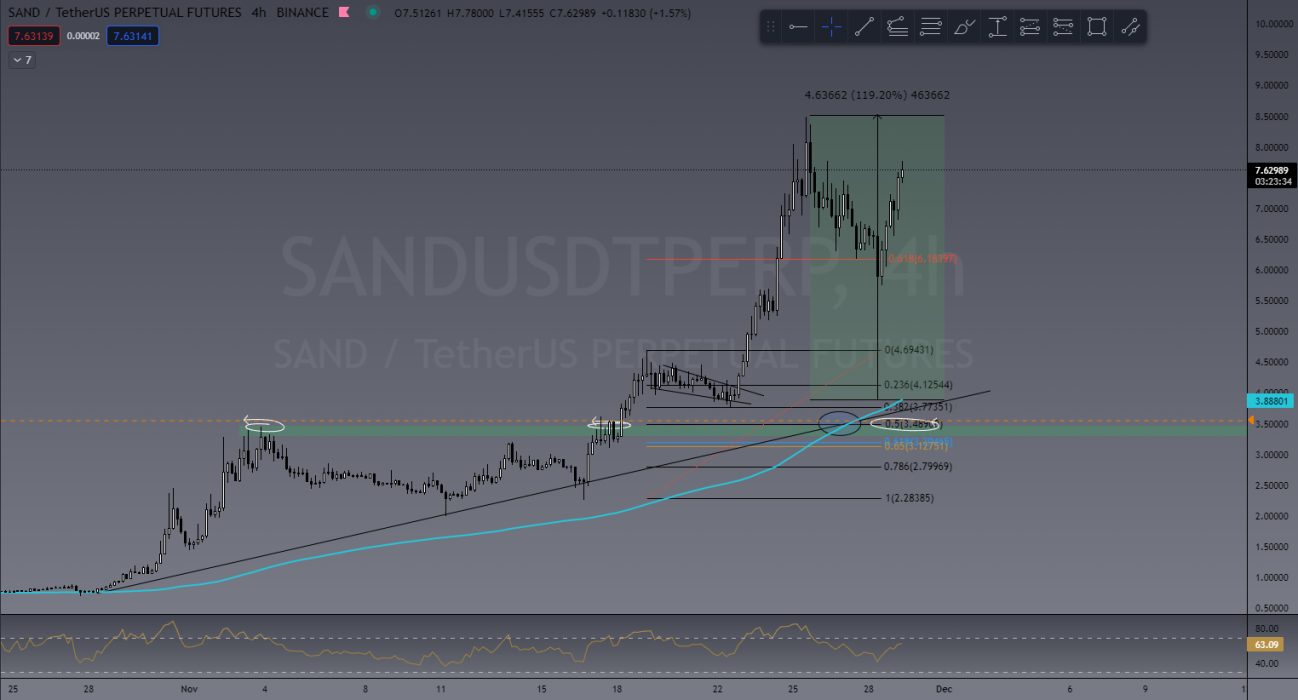

SAND/USDT

Last week in the TradeRoom, we were watching a lot of these Metaverse coins and SAND did not disappoint. I showed a bullflag forming on the 4H chart and was personally hoping to see a test of previous support and uptrend, but SAND didn’t want to wait. Breakout from the bullflag boasted a 120% push to the upside!

LRC/USDT

Like SAND, LRC didn’t want to wait for another test on support. Breaking out of a falling wedge identified by one of our team leaders, Pete, last week LRC sported a 60% bullish push and currently seems to be forming a new bullish market structure.

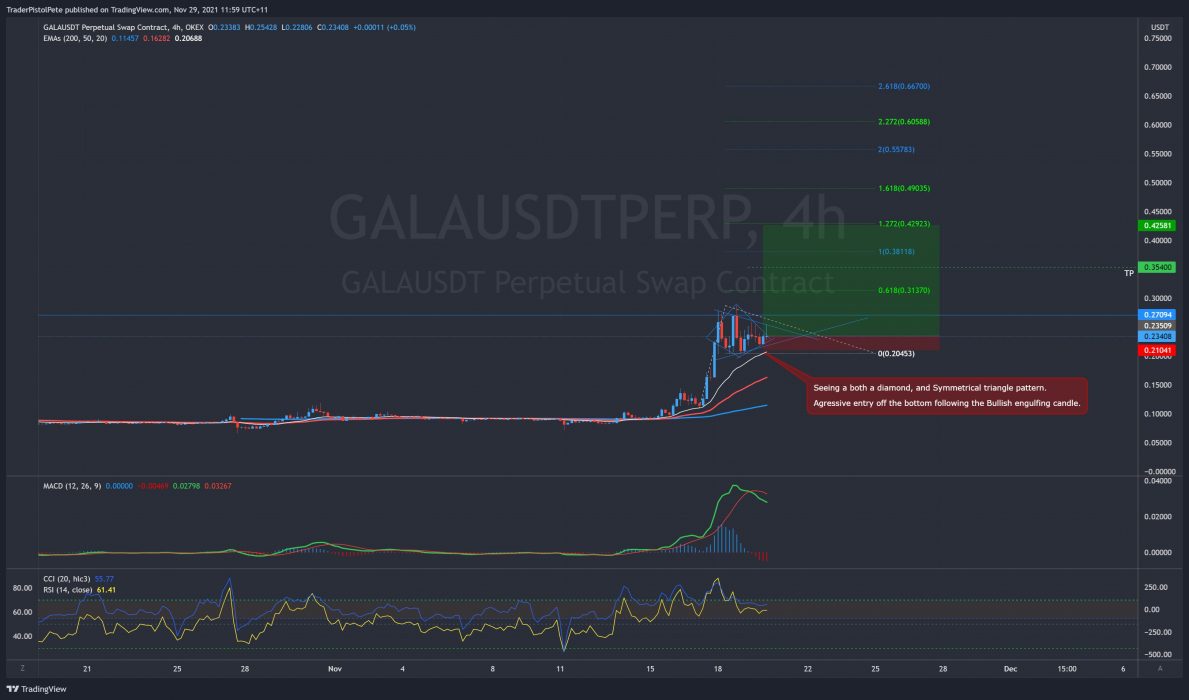

GALA/USDT

Trade of the week has to go to TCD team leader Pete for his massive GALA trade! With 10x leverage (considered a safe leverage for experienced traders), Pete’s profit is currently over 2000% while a spot trade would give a massive 262% from entry. Pete is a pattern trader and often enters trades based off certain chart patterns. In this case, he has seen a symmetrical triangle bullish continuation pattern.

This Week’s Trades

ADA/USDT

ADA has been trending down since the start of September and is really starting to come into some key levels here. This trade might play out this week or even over the next two weeks, but it’s certainly worth mentioning.

You can see in the chart below that ADA has currently found some bullish price action at the US$1.45 level of support. We could see a decent 30% push here, which would be great, and MAYBE even a breakout of the downtrend. However, I’m looking a little further ahead. If ADA rejected off the downtrend and pushed further below, the next, and likely last, level of support before revisiting US$0.30 is at the US$1 level.

This is a major level of both tested and psychological zone of support, and I’d expect to see some big money flow happen around here because failing to rally at US$1 would absolutely nuke ADA’s price action.

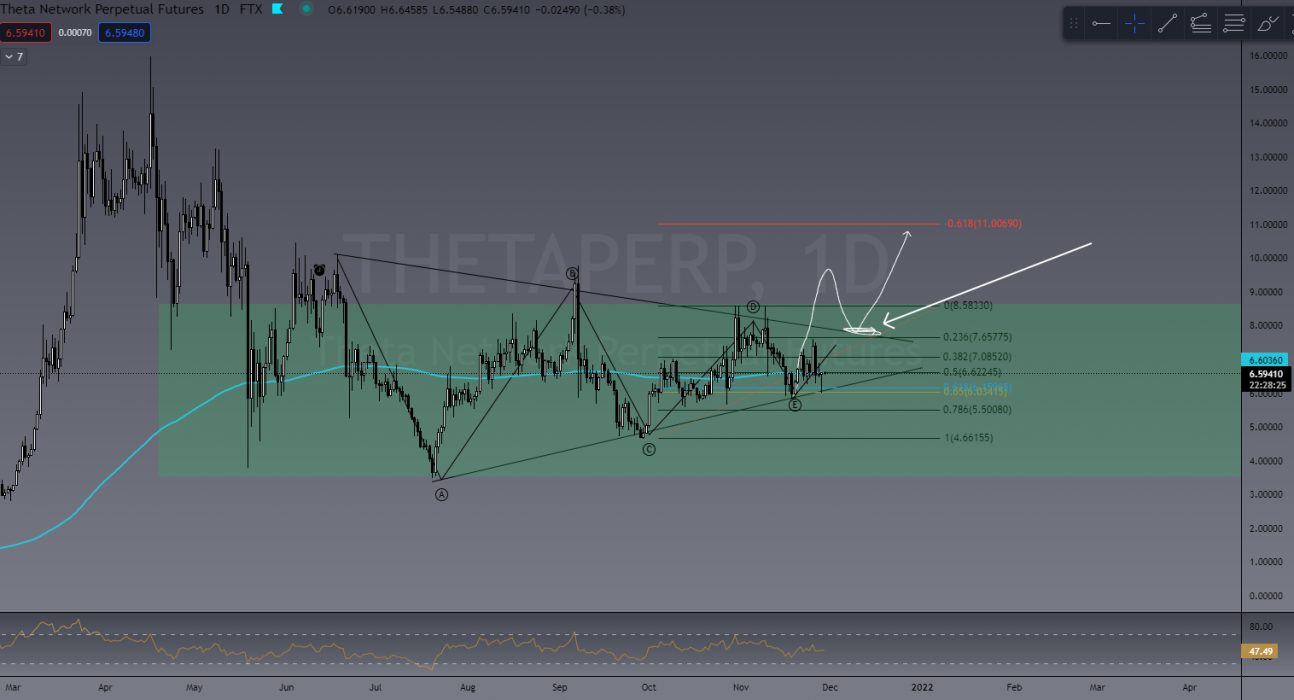

THETA/USDT

Another coin to keep an eye on is THETA. This is such a good coin to trade and will require a bit of patience to find the right entry.

After a period of consolidation, I’m looking to enter LONG/BUY at the RETEST of a breakout. This will of course highly depend on what BTC does this week, and it may stay in a consolidation zone a little longer. Nevertheless, it’s one to add to your watchlist.

OMG/USDT

OMG could be coming into a key area of daily support, and is likely a rally point if BTC can behave a little. If OMG can push from US$7 and reclaim its previous high of US$17, we’ll see 150% growth. Another one to add to the watchlist.

Invite to Join our TradeRoom

If you’d like to become a better trader, you’re invited to join our TradeRoom where we share daily charts and market analysis. In our community we strongly encourage and teach correct risk management strategies to keep our members safe in this new volatile crypto market.

Join our “Apprentice” plan now for your 7-day trial.

The Crypto Den was created in 2017 to help the rapidly growing crypto community learn and understand the fundamentals of digital currencies and how to trade them.

Since then we have taught thousands of members the basics of technical analysis and trading strategies to further progress and perfect their trading abilities.

In the TradeRoom you will be included in a supportive environment which encourages personal growth, education and community support.

It’s a place to share your trading ideas and follow other experienced traders’ feeds to help keep your finger on the pulse of such a volatile market!