PayPal has announced it will begin allowing US crypto holders to transfer their digital assets to external wallets. The rollout of the update has just begun and is likely to be available to all US users within the next fortnight.

PayPal for BTC and ETH

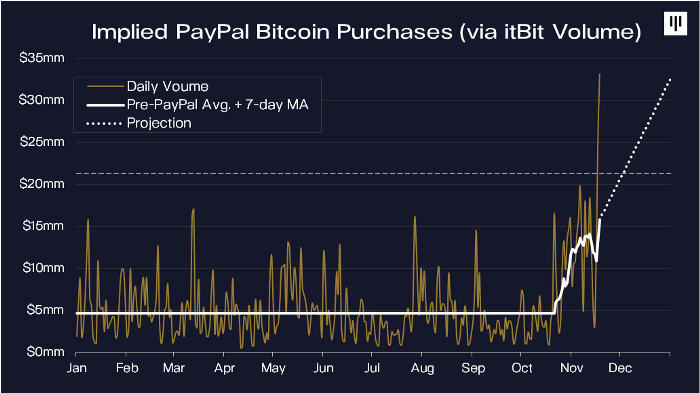

PayPal will offer users the option to transfer bitcoin, ether, litecoin, and bitcoin cash to external wallets in coming weeks. The long sought-after addition will bring PayPal in line with other successful cryptocurrency services in the industry. The feature has been a hot topic since the company’s October 2021 launch of its crypto buy, sell and hold service:

According to Jose Fernandez da Ponte, senior vice president of PayPal’s blockchain, crypto and digital currencies sector, the company believes its “role in the ecosystem is about increasing access”. The move to permit transfers to external wallets has made PayPal the largest blockchain-enabled consumer digital wallet.

Earlier Crypto Business Moves

In March 2021, PayPal upgraded its technology to permit US users to make payments with their cryptocurrency with the same ease as using a debit or credit card. This option became available for millions of global merchants, easily converting ethereum, bitcoin and litecoin to fiat money.

And at the beginning of 2022, a developer found stablecoin development code within the PayPal App. The discovery prompted PayPal to come forward with the admission that it was experimenting with a stablecoin of the same name. A logo image was discovered alongside the code.