Let’s have a laugh at this week’s topical memes.

Crypto Trader Memes

Virtual Reality

DOGE meme of the week

Tune in next Friday for more meme mayhem!

Crypto News Australia provides you with the most relevant bitcoin, cryptocurrency & blockchain news.

Let’s have a laugh at this week’s topical memes.

Tune in next Friday for more meme mayhem!

Here is some commentary about the process of claiming back your investment into the SALT Lending ICO.

SALT Lending – a crypto lending platform, had a long battle with the SEC regarding an ICO it ran back in 2017 (raising US$47 million by selling SALT tokens) without having permission… And now, three years later, they are finally refunding that money back to the investors.

“all persons and entities that purchased SALT Tokens from the Company before and including December 31, 2019 (the “SALT Token ICO” or “ICO”)”

SALT Lending

Below is our experience of the claims process. There is also a claims process FAQ page which may be helpful.

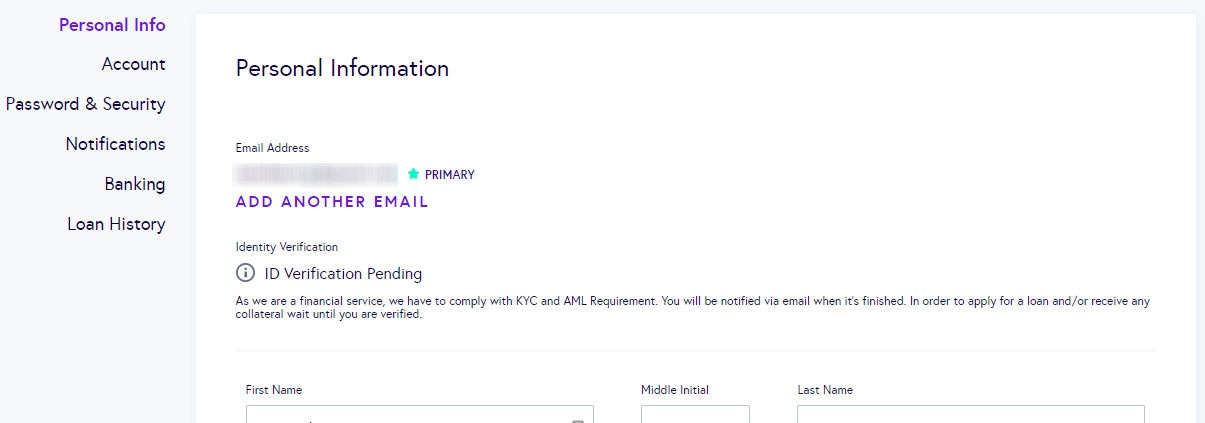

Personal information step

Straight forward.

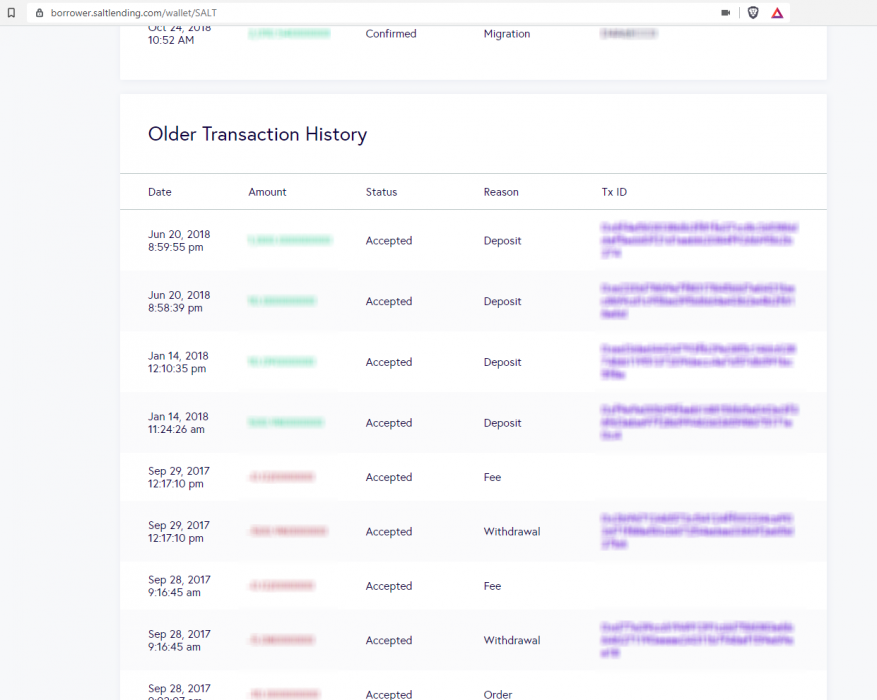

Salt token purchase information step

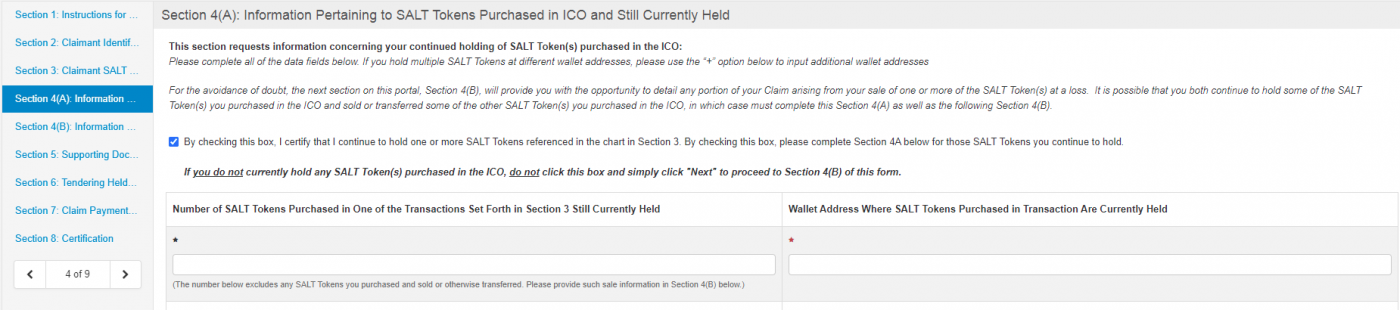

Information pertaining to your purchase(s) of SALT Token(s) can be found by logging onto the SALT website platform at https://borrower.saltlending.com/login

The transaction dates, amounts and addresses are clearly displayed on the site which is useful. If your tokens are not held on the official platform, I feel for you, especially if that information easily accessible. You’ll have to go through your devices and platforms and grab the addresses and TXids. It’s also worth taking screenshots of them too as you’ll need to upload them at a later step.

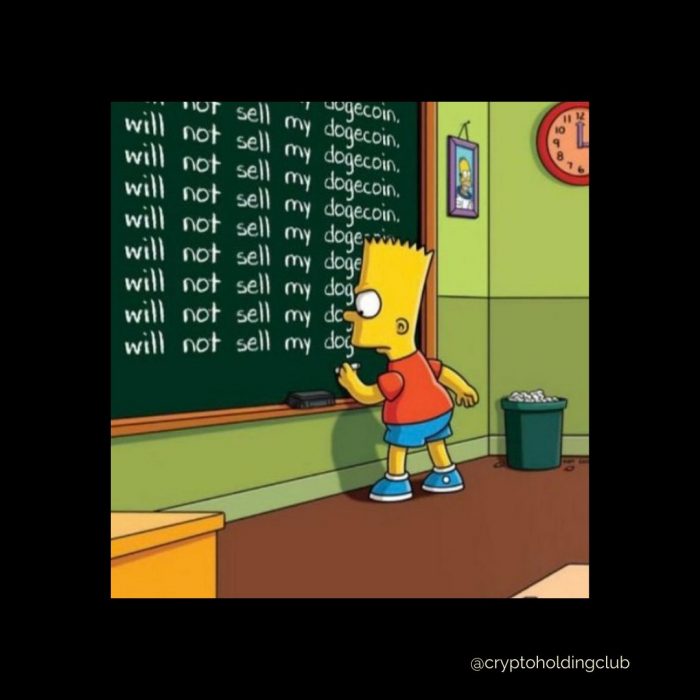

Salt token holding information step

Because of the ID verification error, there is no deposit address to enter into the held input box…. or no option to say they are held on the platform. It’s almost like they are forcing you to verify again on the platform before you can continue with the form. Not cool.

After doing the identify verification which included a biometric face analysis. The system status is “verification pending” which means you cannot proceed with the claim form until this is completed, and it doesn’t say how long it will take. Fail.

But the ID was verified within 5-10 minutes I got an email from them. And was able to enter the deposit address as the holding address of the tokens.

ID documentation step

Even though I just verified myself on the official platform, they still are asking for ID verification documents.

The information regarding the token transfers is very vague. I guess they want a screenshot of the blockchain wallet used? How can you prove ownership of a blockchain wallet unless you show your private keys? The only way you can prove they are the same tokens is by tracking the blockchain transfers – which are already public! Surely they can track this using their systems?

“For claims involving SALT Tokens in a Claimant’s possession, and that were never sold, information sufficient to show that the SALT Tokens currently held are the same SALT Tokens purchased during the ICO.”

As all the tokens i purchased were directly from SALT and they are held there, I just took screenshots of the transaction history on the platform.

Payment information step

It doesn’t ask for payment details, just the method you want to receive.

Then once you submit the form, an email was received within minutes with the full form as a PDF attached.

“Your E-Claim Form has been successfully submitted.

You will be contacted by Prime Clerk LLC, the Company’s Claims Agent at the e-mail address on record with the Company. Please note that this confirmation of submission does not constitute a representation as to the validity of your claim.”

SALT Lending

Now the waiting game… Stay tuned for the outcome.

Binance Masterclass has become the leading crypto training course for both crypto newbies and enthusiasts since its launch in 2020.

Binance Australia is hosting a Tax Masterclass with Robin Singh and Michelle Legge from Koinly to cover everything you need to know about crypto taxes in Australia for EOFY 2021.

The masterclass will cover a step-by-step tutorial on generating statements, calculating your crypto tax, and filing your crypto gains with myTax to avoid penalties.

Guest Speaker: Robin Singh

Robin is the founder and CEO of Koinly, a cryptocurrency tax solution that helps Bitcoin investors generate their capital gains tax reports. He has a background in finance and accounting and worked as a lead engineer at a Fortune 100 company in the UK before founding Koinly.

Guest Speaker: Michelle Legge

Michelle heads up at research and content at Koinly. Before crossing into the crypto space, Michelle looked after content and community at a Sydney fin-tech startup and held a similar role on the Qantas frequent flyer program.

Host: James Prosser

James is the host for the Binance Australia Online MasterClasses. James has been investing and trading cryptocurrency since 2017 and is also a member of the Binance Australia team.

The masterclass has a Q&A session to cover any questions you may have about Crypto Tax in Australia. Every masterclass participant will receive a 20% discount to sign up on Koinly. All you need to do is:

* To be eligible, participants must be a registered Binance Australia user and have completed the set tasks. Binance Australia reserves the right to cancel or amend any activity or activity rules at our sole discretion.

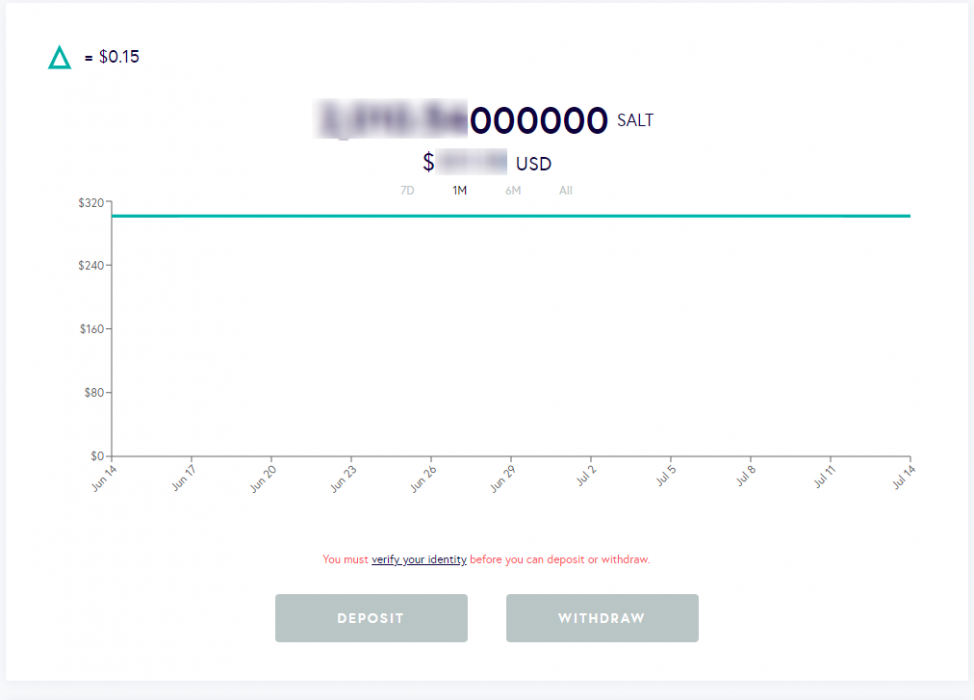

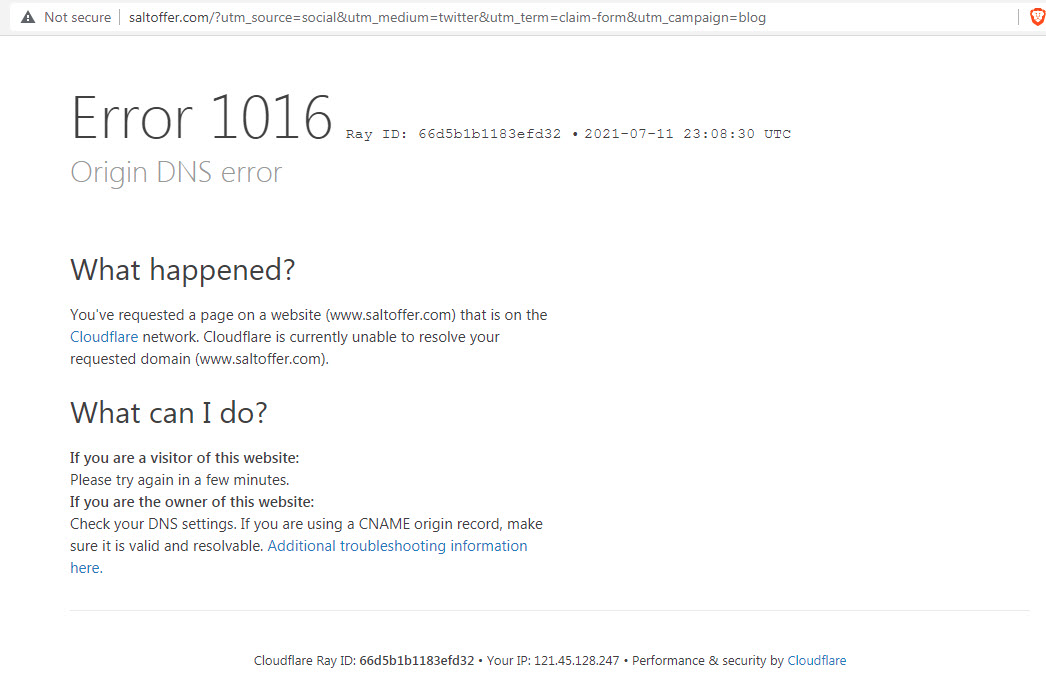

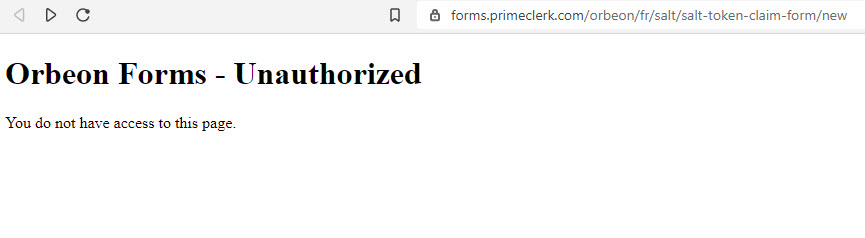

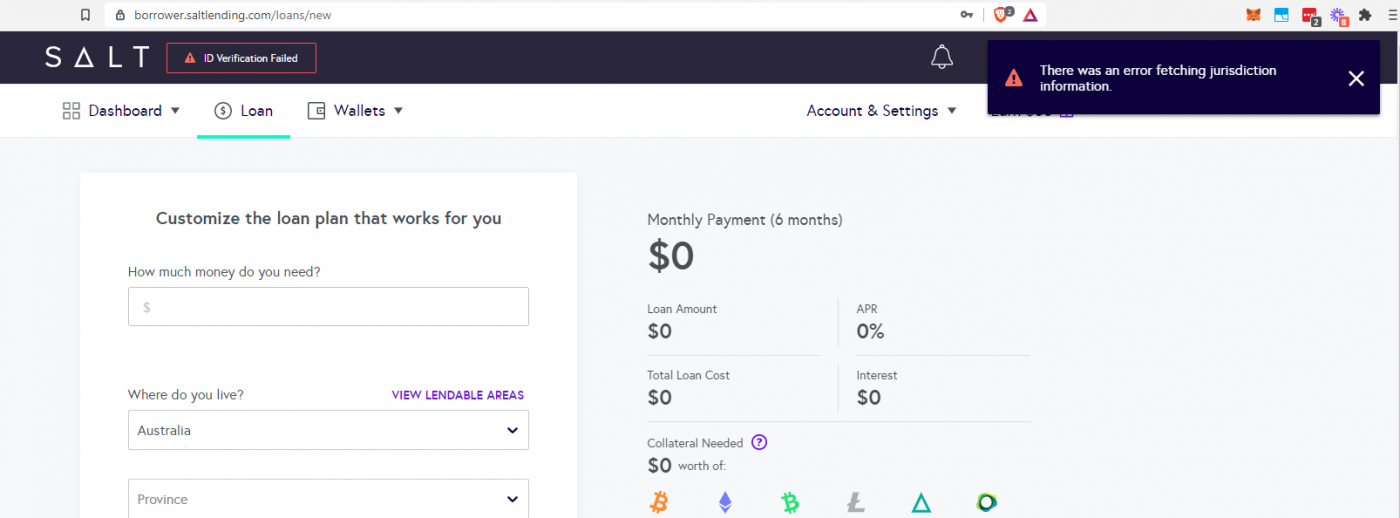

Crypto loans provider SALT Lending has finally launched its ICO claim forms so users can apply for their investment refunds. However, when you go to view the forms, they error out (as shown below).

Update July 14: It seems the UTM query string in the link was breaking the form and it is now working here.

The short backstory is that SALT had a long battle with the SEC about an ICO it ran in 2017 (raising US$47 million) without having a successful registration from the SEC.

On July 12, 2021, SALT announced on its Twitter and blog post that the claim forms were available:

On clicking the link to view the forms, saltoffer.com, users were shown error pages.

And the error from the saltoffer.com website shows “unauthorised access”.

Users who are trying to use the claim form must be frustrated; hopefully SALT will address this and fix the forms soon. We’ll keep you updated.

As detailed on the claims process FAQ page:

All persons and entities that obtained Salt Tokens from the company on or before December 31, 2019 are entitled to make a claim pursuant to the claims process. A valid claim, among other things, would require the claimant to return the Salt Tokens obtained directly from the company, or substantiate that these were sold on an exchange at a loss, including their value at the time of sale.

SALT Lending FAQ

The interest rate SALT uses is quite interesting too:

We expect to calculate interest by using the yield of the 1-year U.S. Treasury note, which for June 15, 2021 was 0.08%.

SALT Lending FAQ

It’s also stated that you have three to six months to submit your claim, and you’ll be paid in US dollars to your designated bank account.

Upon logging into the SALT Lending platform, I saw two errors. One showing an error fetching jurisdiction information, and one showing my ID verification failed.

The ID error surely cannot be correct, as I verified with them at least twice before, and all that information now seems to be completely missing.

Let’s have a laugh at this week’s topical memes.

Tune in next Friday for more meme mayhem!

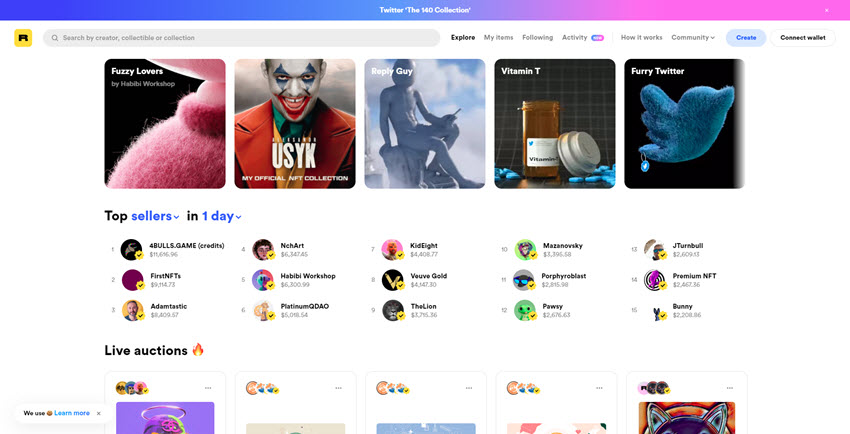

Non-Fungible Tokens (NFTs) are digital tokens that verify ownership of digital collectibles via the blockchain.

You might be wondering: What is the best site to buy NFTs? or What is the best NFT to buy? Well, you should check out the greatest collections of NFTs on the platforms we have reviewed.

Below is a list of what we think are the Best 10 Websites to Buy NFTs.

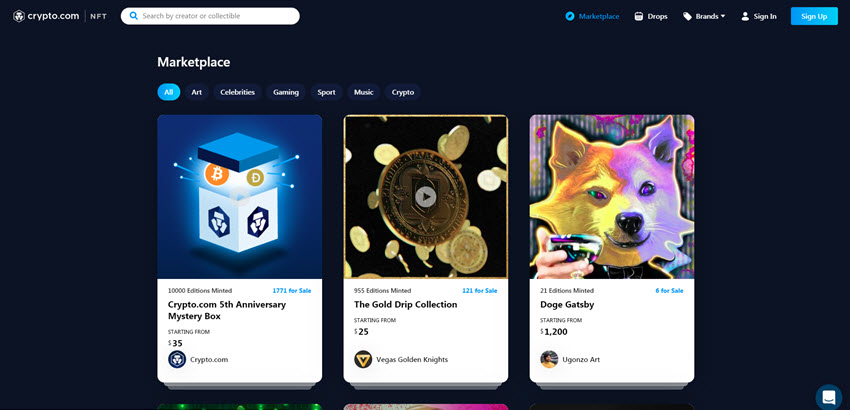

Crypto.com NFT is an off-chain platform that allows buyers and sellers to easily trade with collectibles (NFTs) without having previous experience.

Also read: How to Buy, Sell and Transfer NFTs on Crypto.com

You can find a curated collection of items that are suitable to be converted into NFTs. Crypto.com works with some of the most popular and well-regarded creators and brands to bring you highly sought after collectibles.

All transactions relating to sales items on Crypto.com NFT will be recorded on the Crypto.org Chain. We are exploring compatibility with other blockchains, such as Ethereum.

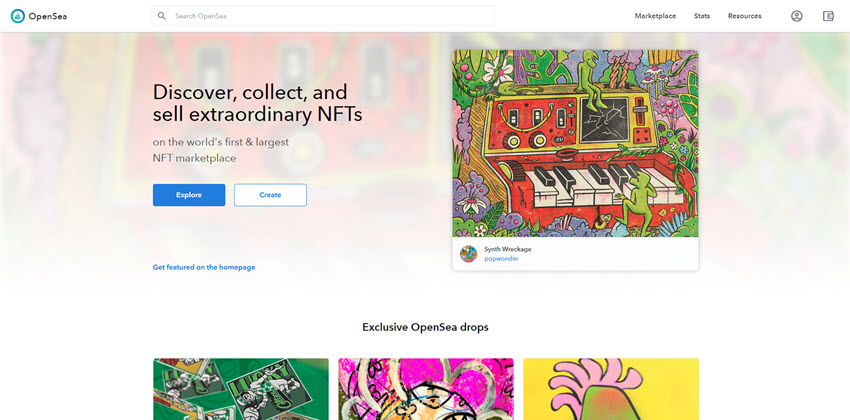

OpenSea – Discover, collect and sell extraordinary NFTs on the world’s first and largest NFT marketplace.

Choose between auctions, fixed-price listings and declining-price listings. You choose how you want to sell your NFTs, and we help you sell them!

Benefits include: OpenSea fees are 2.5 percent of sales, fixed-price listings, ERC721 NFTs and ERC1155, support for ETH, DAI, USDC, MEM, WHALE, REVV, SAND, MANA and wBTC, Gas-free transactions, and NFT bundles.

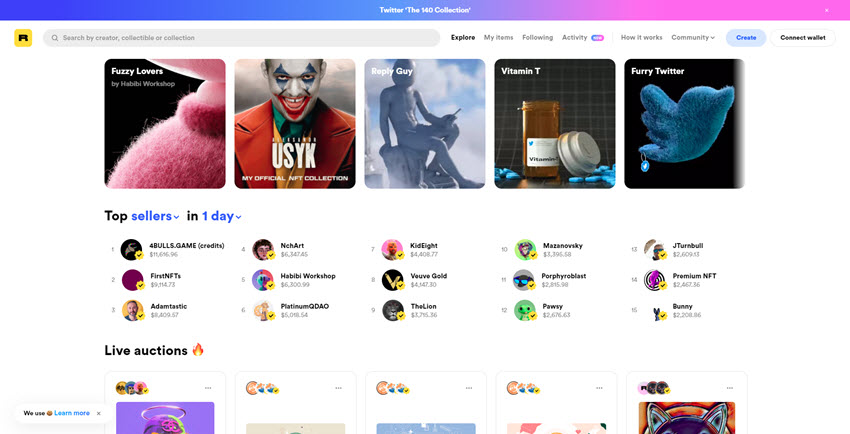

The ultimate goal of Rarible is to evolve into a fully Decentralised Autonomous Organisation (DAO), where all governance and decision rights belong to the platform users.

You can view the collectibles you have created on rarible.com on OpenSea and manage them there as well. Additionally, it is possible to list your collectibles on OpenSea not only in $ETH but also in $RARI.

Benefits include: Whenever you create a collectible you can set a certain percentage as royalty for secondary sales, Verified badges are granted to creators and collectors who show enough proof of authenticity, and 10 percent of the total RARI supply is distributed among NFT holders.

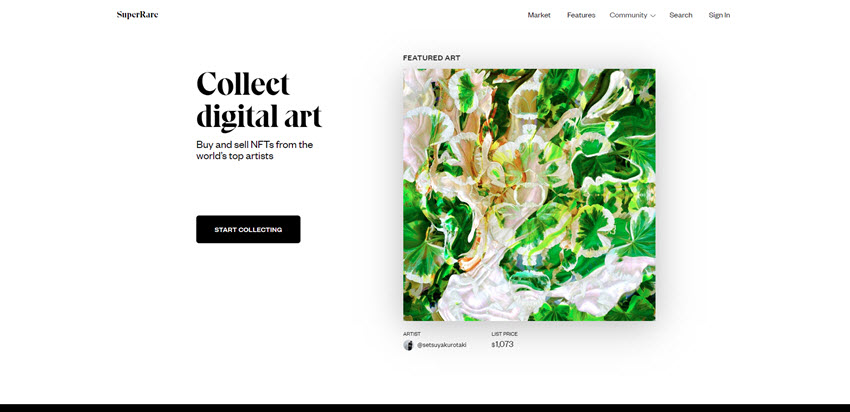

Collect digital art and buy and sell NFTs from the world’s top artists on SuperRare, where you can browse and build your collection of the world’s most cutting-edge digital art.

Benefits include: artists receive continuous royalties for all secondary sales on their artworks – forever; all transactions happen on-chain, creating a tamper-proof record of each artwork’s history

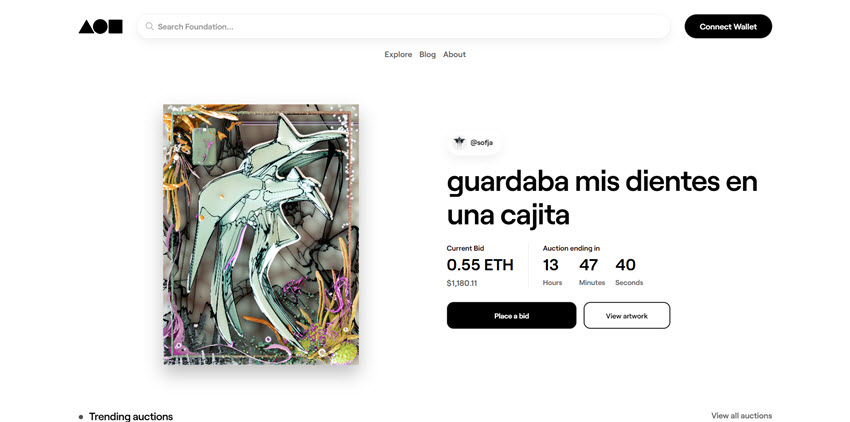

Launching in February 2021, Foundation is a platform that aims to build a new creative economy – a world where creators can use the Ethereum blockchain to value their online expression in entirely new ways, and build stronger connections with their supporters.

Foundation bridges crypto and culture to foster a network of mutual support between artists, creators and collectors. We’re forging a community-driven path, providing culturally pioneering curation, and sharing our tools with the rapidly evolving group of developers who are excited to define this future with us. We want anyone and everyone who cares about the future of digital expression to be a part of it. Let’s explore these new possibilities collectively.

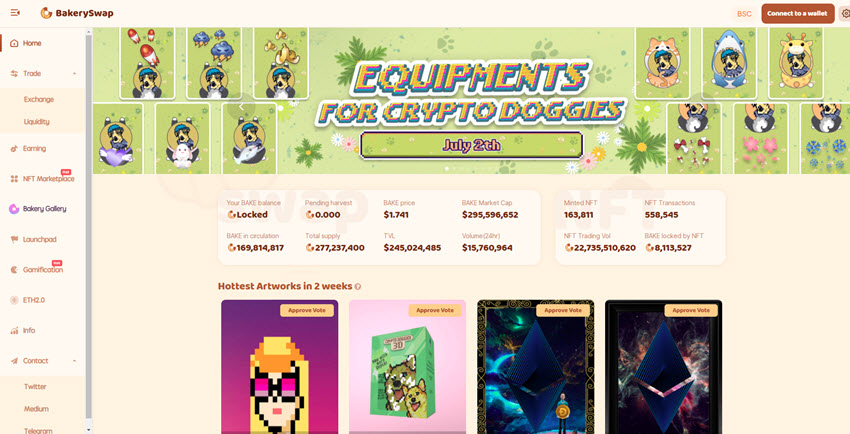

Launched in September 2020, BakerySwap, the first DeFi exchange platform that provides both AMM and NFT Marketplace on Binance Smart Chain, remains the top platform championing global NFT awareness and adoption by rendering services to artists ranging from providing a marketplace where digital artists can showcase their great artworks to a weekly interview session that serves as a platform to promote legendary and upcoming artists.

It also has a gallery called BakeryGallery, which is the platform leader on Binance Smart Chain for top-quality artists and celeb drops. It also has launched events such as the 3D artist’s event and Environmental day charity event.

Benefits include an exchange, staking, liquidity provider, launchpad, gamification, ETH 2.0 support, and a large community.

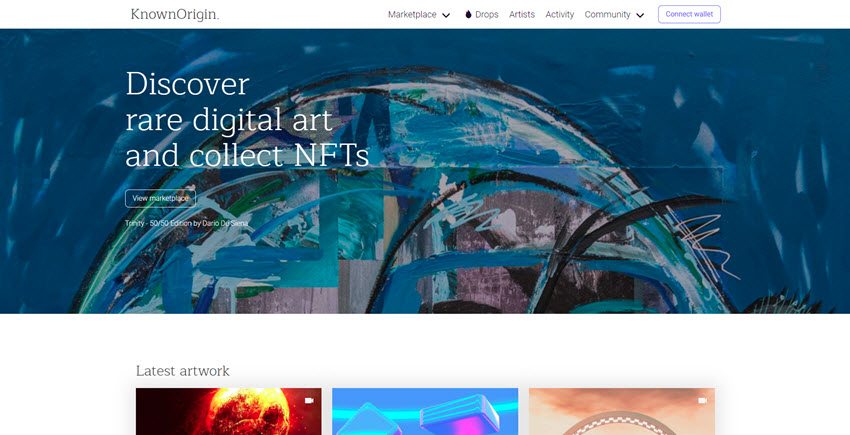

KnownOrigin NFT Marketplace is where you can showcase and sell your digital artworks. You can digitally sign your artwork by creating a tokenised certificate. You can also buy from some of the world’s most respected artists, illustrators and designers.

The Origin team consists of artists and collectors for platform updates, announcements and more, where you can collaborate with them on their discord channel.

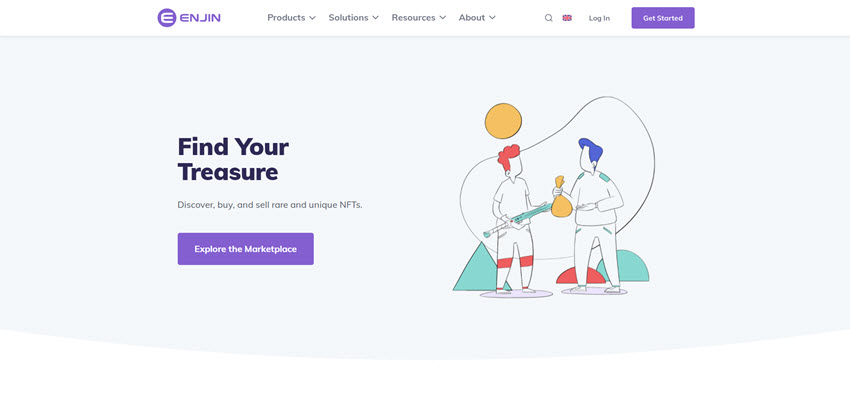

Enjin Coin launched in 2017 and today powers more than two billion non-fungible tokens (NFTs). Enjin Coin has real-life value, meaning that all NFTs created with it have real-life value, too. Use the Enjin Wallet to easily list and purchase gaming items and collectibles.

Your entire gaming inventory can be in your phone, featuring a sword you can use in multiple games, which you can easily sell to anyone, anytime.

The Enjin team is a fully distributed team spread across five continents and a dozen countries – unified by a mission to build futuristic, world-class products.

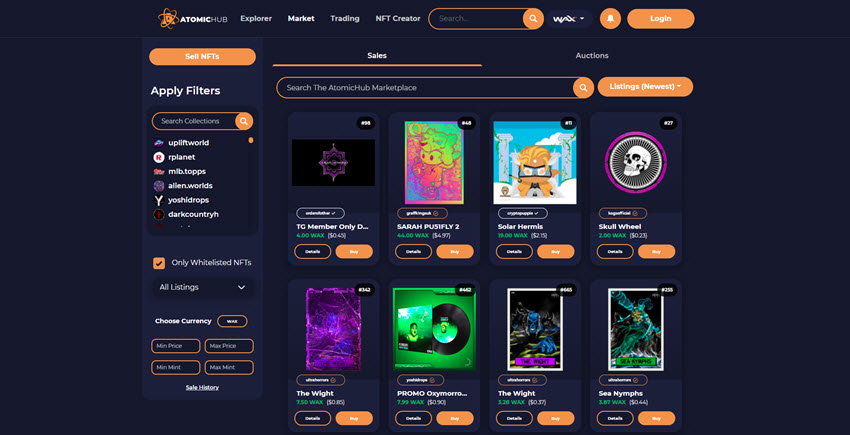

AtomicMarket is a shared liquidity NFT market smart contract used by multiple websites to provide users with the best possible experience. Shared liquidity means that everything listed on one market also shows on all other markets.

AtomicAssets is a standard for NFTs on the eosio blockchain technology. Anyone can utilise the AtomicAsset standard to tokenise and create digital assets and buy, sell and auction assets utilising the AtomicMarket marketplace.

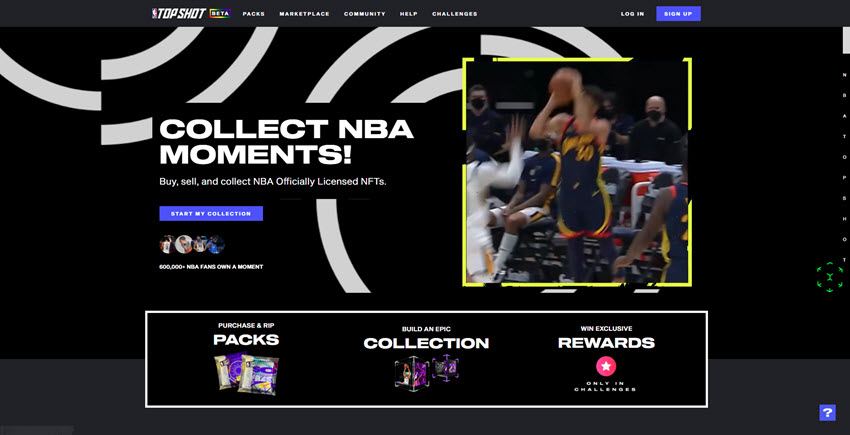

Buy, sell and collect NBA Officially Licensed NFTs on the marketplace that includes packs, collections, moments and rewards for basketball fans.

Only a scarce number of Top Shot Moments are released, so building the best collection requires a scout’s eye and a superstar’s dedication. Become a top collector by snagging in-demand packs when they drop and refine your roster by finding diamond-in-the-rough Moments on the marketplace.

CoinJar has added more cryptocurrencies to their platforms allowing their users to buy, sell and trade more of the most popular coins.

Announced on 23 June, you’ll be able to buy and sell all of these coins on CoinJar, joining the 24 cryptocurrencies that our customers can already trade, store and send.

These tokens won’t initially be available for purchase through CoinJar Bundles or on CoinJar Exchange, but will be added in the near future.

Update your CoinJar app to get access to the full available range.

Balancer (BAL) is an automated market maker (AMM) built on the Ethereum blockchain, similar to Uniswap and Curve. Users earn the BAL token by creating and maintaining liquidity pools. BAL tokens are governance tokens, meaning that they give holders the right to take part in decisions regarding the network. As these decisions often involve rewards and fees being generated by the Balancer protocol, there’s a financial incentive to hold and participate.

Enjin (ENJ) has been one of the pioneers of non-fungible tokens (NFTs). NFTs are one-of-a-kind markers that allow the holder to prove absolute ownership of a digital asset. Through a process known as minting, Enjin makes it easy to create NFTs on the Ethereum blockchain. ENJ is the currency that powers this process, allowing holders to both mint and “melt” NFTs.

The Graph (GRT) describes itself as “a protocol for organizing blockchain data and making it easily accessible”, a designation that has also led to it being called the Google of blockchain. Put simply, The Graph creates an open marketplace where information from different blockchains can be sold to developers who may require it to power their own smart contracts. The Graph Token (GRT) is the currency that powers this marketplace, offering incentives for those that index, curate and sell the data.

Polygon/Matic (MATIC) is a fast, cross-blockchain dApp development platform built on Ethereum. Like the ETH token, MATIC is the fuel that powers the Polygon network, facilitating the payment and settlement of transactions. Polygon uses a Proof-of-Stake consensus mechanism, which means that holders of the token can “stake” their tokens and receive more MATIC in return.

Tether (USDT) is the original stablecoin. Pegged in value to the US dollar, Tether allowed people to buy and sell cryptocurrency at a time when it was difficult for exchanges to find reliable banking and fiat currency partners. Cut to 2021 and the stablecoin market is booming, with more than US$100 billion in circulation. But Tether remains the biggest player by far, accounting for more than 60% of the market and essentially functioning as the crypto world’s reserve currency.

Wrapped BTC (WBTC) is an invention of the DeFi movement. Pegged to the same value as Bitcoin itself, WBTC is a way of representing Bitcoin ownership on the Ethereum network (i.e. you lock Bitcoin in a smart contract and receive an equivalent amount of WBTC in return). Having WBTC means you can use the Bitcoin you own on DeFi apps, for instance to purchase tokens on Uniswap or as liquidity pool collateral on a platform like Compound or Balancer.

If you want to get started, check out our guide on How to Setup a Bitcoin Account with CoinJar.

Let’s have a laugh at this week’s topical memes.

Tune in next Friday for more meme mayhem!

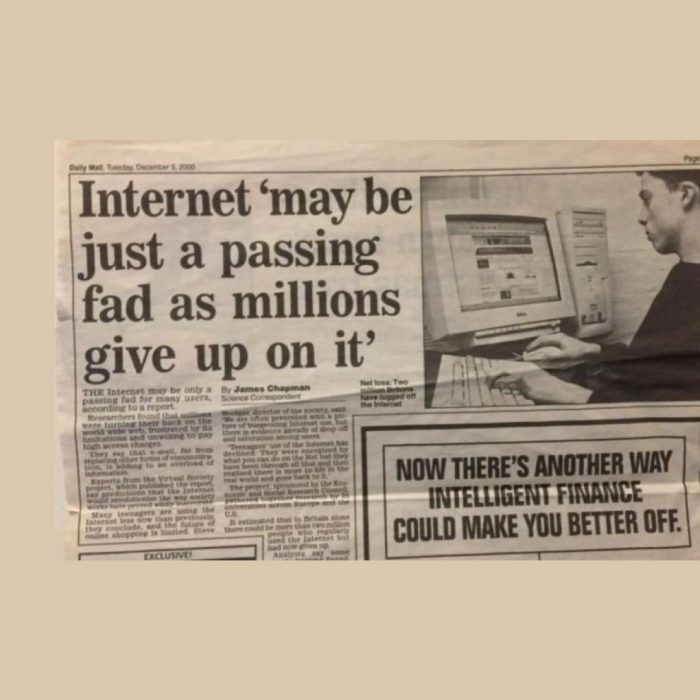

In the early days of crypto trading in Australia, it seemed like a lot of investors were treating cryptocurrency more like a property investment – you saved up, made a single bulk purchase and then held on to that investment while you waited for it to increase in value. But over time, savvy crypto traders in Australia started to realise the potential of actively trading in cryptocurrency. This approach is closer to a stock market investment, where you actively buy and sell shares to increase the value of your portfolio. And while this approach can be far more profitable, it does take more time, more effort, and it can be quite stressful.

Fortunately, there is now a third option for crypto traders in Australia: recurring investments. The recurring investments method allows a crypto trader to make routine purchases in incremental amounts, which gradually increases and diversifies the traders’ portfolio. But where did the concept of recurring buys come from? Is it based on a reliable process? And what are the benefits of recurring buys for Bitcoin traders in Australia?

Recurring buys started as a method for increasing investments in more traditional assets such as shares in the stock market. Stockbrokers found that clients could gradually build up an impressive investment portfolio by making small but regular investments, which over time deliver a result known as compounding returns[1]. Compounding returns produce a snowball effect – they start off minimal but continue to grow exponentially.

Recurring cryptocurrency investments follow the same principle. Bitcoin traders in Australia select an amount to be invested and a frequency for how often they want to make an investment purchase. Their crypto broker will then automatically make recurring purchases on the crypto traders’ behalf. This strategy is based on a process called Dollar Cost Averaging (DCA), which means you opt to buy a set amount at regular intervals. DCA helps to protect investors from price fluctuations in cryptocurrency value because you’re not investing all your money at a particular point in time. For example, you may set up a $15 recurring buy to take place every week. In the first week, the price may be steady, in the second week, it has gone up, and in the third week, it has dropped. But because you’re only investing small amounts, the price fluctuations are less important than if you had chosen to invest $10,000 during the second week when prices were high.

When you set up a recurring buy through a crypto trading platform, it becomes as routine and manageable as paying a bill via direct debit. But instead of incrementally paying down debt, you’re incrementally building up wealth.

Many cryptocurrency traders now consider recurring crypto buys to be a solid long-term goal with measurable benefits. This is because recurring cryptocurrency investments help to:

If you want to set up a recurring buy for cryptocurrency, then it’s important to choose a trusted crypto platform with industry experience. Coinstash is a registered Australian crypto trading platform with SSO encryption and no hidden fees. Our user-friendly platform and dedicated customer service team make it easy for crypto traders (whether experienced or novice) to set up recurring buys. With a Coinstash recurring buy, you choose the amount and you choose the frequency – we’ll take care of the rest for you.

[1] https://www.investopedia.com/articles/investing/100615/investing-100-month-stocks-30-years.asp

As more and more different cryptocurrencies continue to emerge, the volatile nature of these new coins and tokens resembles many similarities to penny stocks.

Just like Jordan Belfort in the film The Wolf of Wall Street capitalized on the high risk, high reward traits that are associated with penny stocks, Bitcoin and other smaller cryptos represent similar lucrative opportunities for investors and traders.

With companies like Tesla, Paypal and Square joining the crypto world, let’s take a look at some smaller Bitcoin penny stocks currently on the blockchain.

Lets take a look at our Top 10 “Bitcoin Penny Stocks”.

Known as the leading torrent software site, BitTorrent launched their BitTorrent Token on the blockchain in 2019 and it has risen by a huge 37.5% in the last 24 hours.

Price: $0.006835 AUD (March 2021)

Launched in December 2019, Dent is an open source project under the umbrella of Linux Foundation that enables users to buy and sell mobile bandwidth. The Ethereum-based cryptocurrency has been a big hit with investors recently and has gone up by 4.56% in the last 24 hours.

Price: $0.02 AUD (March 2021)

Revain is an unbiased review platform built on blockchain technology that aims to prevent fake reviews and unfair feedback from causing problems to businesses. The token based currency is down 0.31% in the last 24 hours.

Price: $0.02 AUD (March 2021)

Born in 2017, the Pundi X project is an open source payment ecosystem that aims to ease crypto payments via Ethereum-based point-of-sale terminals. ‘Pundians’ have seen rapid growth over the last couple of years and the price of NPXS has gone up 2.2% in the past 24 hours.

Price: $0.01 AUD (March 2021)

Holochain is a distributed computing network, rather than a decentralised one, that claims to have infinite scalability and therefore the potential to perform faster than blockchain technology. The ERC -20-based token is certainly HOT at the moment after rising 29.96% in the past 24 hours.

Price: $0.02 AUD (March 2021)

Sia was founded by developers David Vorick and Luke Champine back in 2013 when the then computer science students decided to develop a decentralized cloud storage platform similar to Dropbox. Currently down 2.75% in the past 24 hours.

Price: $0.03 AUD (March 2021)

Nervos Network is a layered crypto-economy made up of a collection of protocols that solve the biggest challenges facing the blockchain. The price of CKB has soared in the last 24 hours, rising by 27.54%.

Price: $0.05 AUD (March 2021)

You may recognise the Dogecoin logo from the famous internet meme that went viral in 2013. Despite being introduced as a joke currency in December that year, the coin was a big hit and reached a market capitalisation of US$60 million within weeks. Dogecoin has gone down 0.7% in the past 24 hours.

Price: $0.07 AUD (March 2021)

IOST is a decentralised blockchain network that aims to build an online structure that meets the security and scalability needs of a decentralised economy. Launched in January 2018, IOST rose by 2.55% in the last 24 hours.

Price: $0.07 AUD (March 2021)

TRON’s mission is to build a free, global, digital content entertainment system with distributed storage technology. The Ethereum-based coin was founded in 2017 and has gone up by 4.06% in the last 24 hours.

Price: $0.09 AUD (March 2021)

Like all cryptocurrencies, these Bitcoin penny stocks are extremely volatile, and susceptible to immense market fluctuation at the drop of a hat, or a tweet for that matter. But the above coins and tokens are some of the cryptocurrencies that are currently offering the most potential in the fast-paced world of digital assets.