Capital gains tax will continue to apply to Aussie’s crypto investments, as confirmed by an explicit mention of digital currencies in the federal budget released on Tuesday October 25.

The budget papers 2022-23 state that legislation will be introduced to clarify that crypto won’t be treated as foreign currency for tax purposes. The incoming legislation will be backdated to income years that include 1 July 2021.

It confirms the continuation of current practices whereby investors must track, calculate and declare any capital gain or loss made on digital assets in their tax returns.

However, the budget specified the rules are different for government-issued digital currencies: “The exclusion does not apply to digital currencies issued by, or under the authority of, a government agency, which continue to be taxed as foreign currency.”

Certainty for Investors, No Impact on Coffers

Although the mention of digital currency taxation is just one small section in a document of more than 200 pages — with no expected impact on government coffers — calling out crypto in the budget signifies the rising relevance of digital assets in financial markets.

It reinforces a statement issued in June, not long after the Albanese Government took power, that said cryptocurrencies held as investments would be excluded from foreign currency tax arrangements — to reduce uncertainty in the wake of a decision by El Salvador to allow Bitcoin as legal tender.

In that earlier statement, Assistant Treasurer Stephen Jones said maintaining a capital gains tax approach to crypto investments, “…gives certainty and clarity at a time of volatility for crypto currencies.”

“The Government will continue to take a pragmatic and timely approach to its role in the rapidly-evolving digital currency landscape.”

Assistant Treasurer Stephen Jones

Understanding Your Crypto Tax Obligations

Most Australians who treat crypto as a personal investment, with the hope of making long-term gains, are considered investors and therefore subject to capital gains tax on the gains or losses they make on their digital assets.

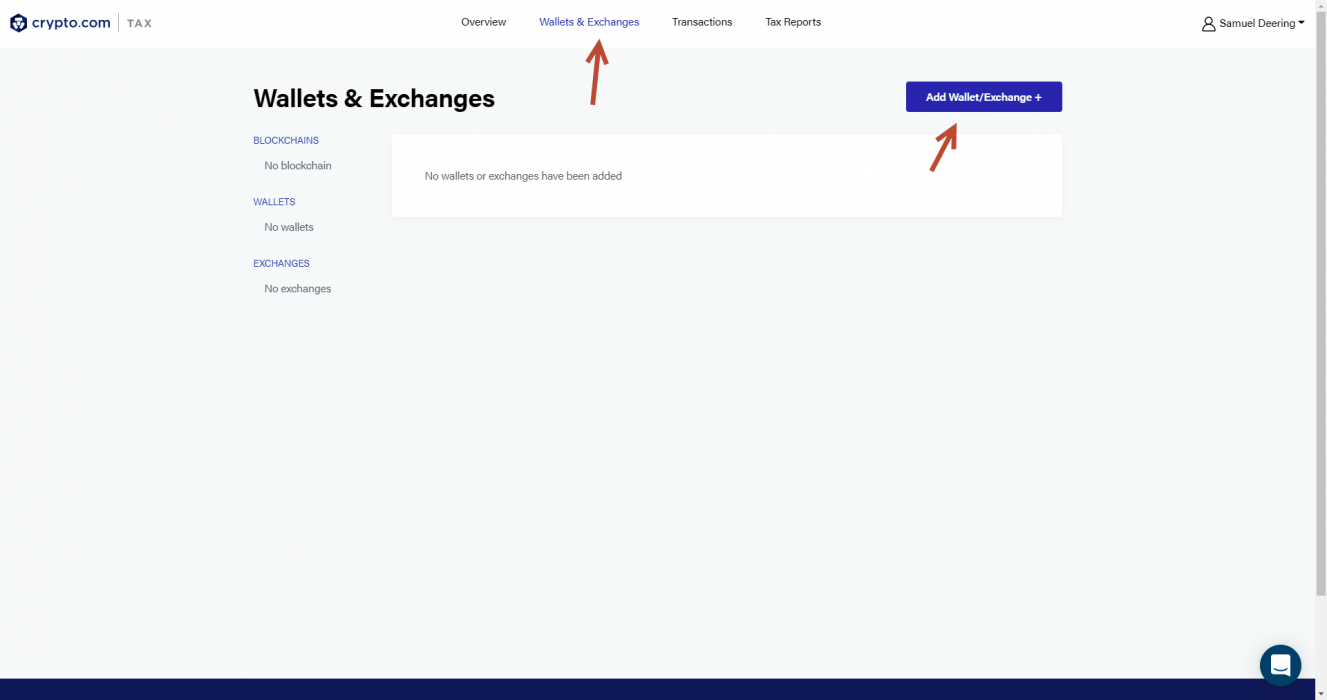

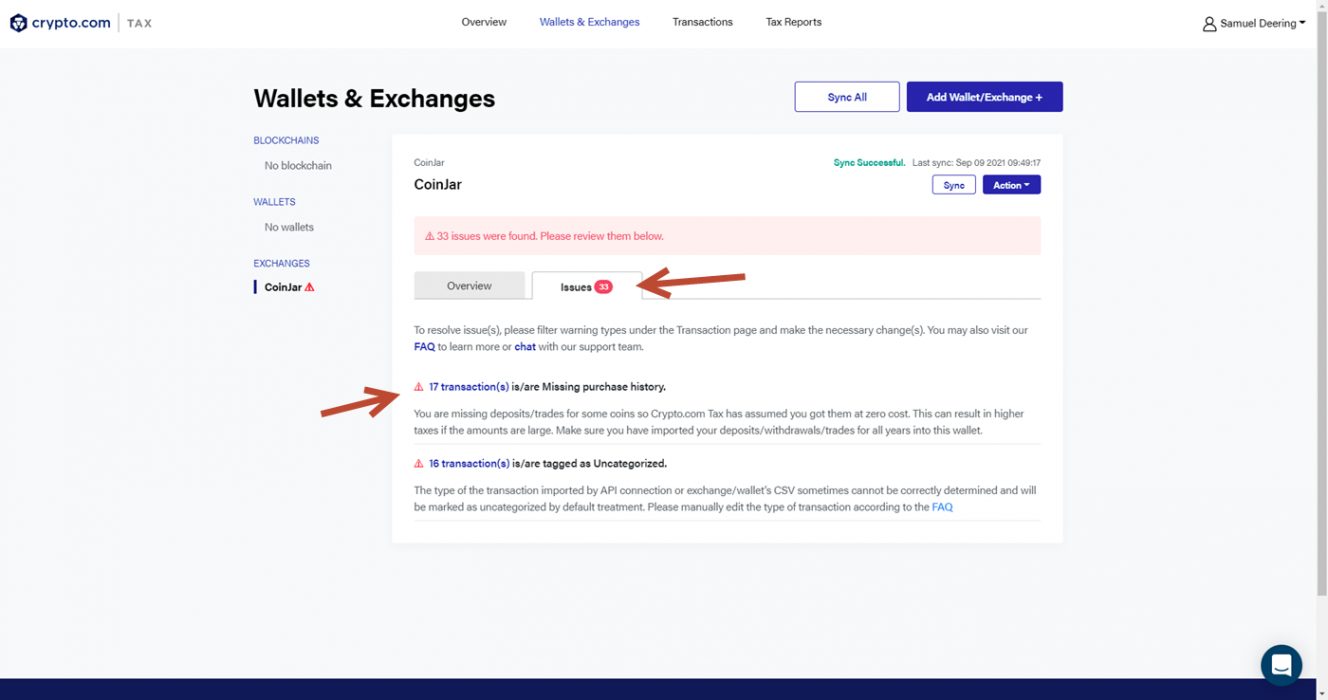

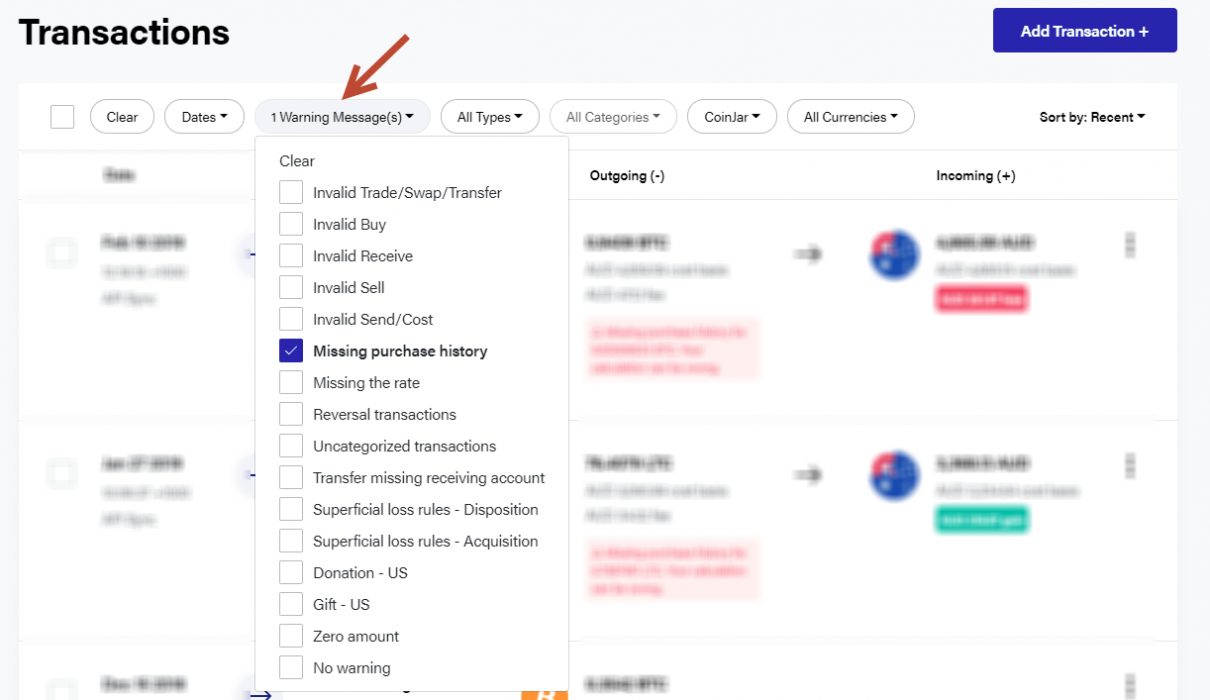

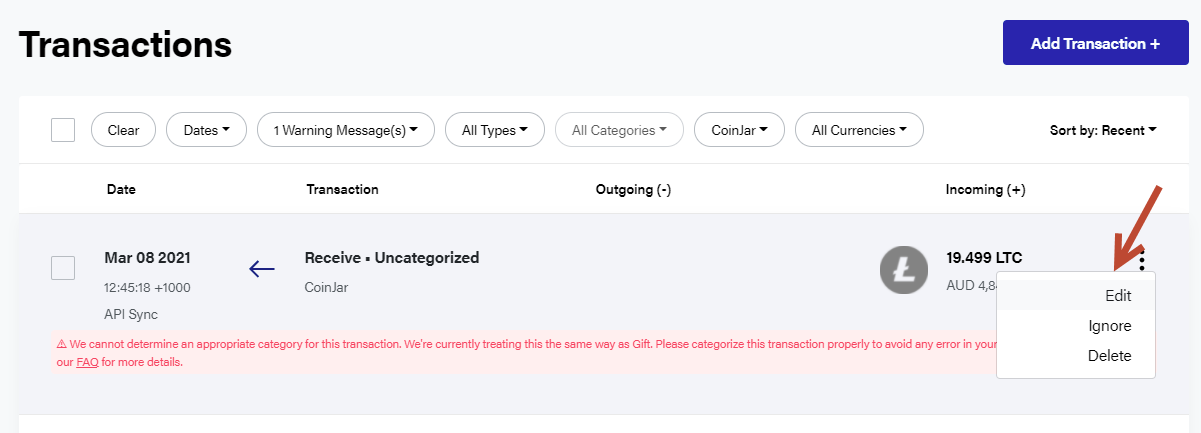

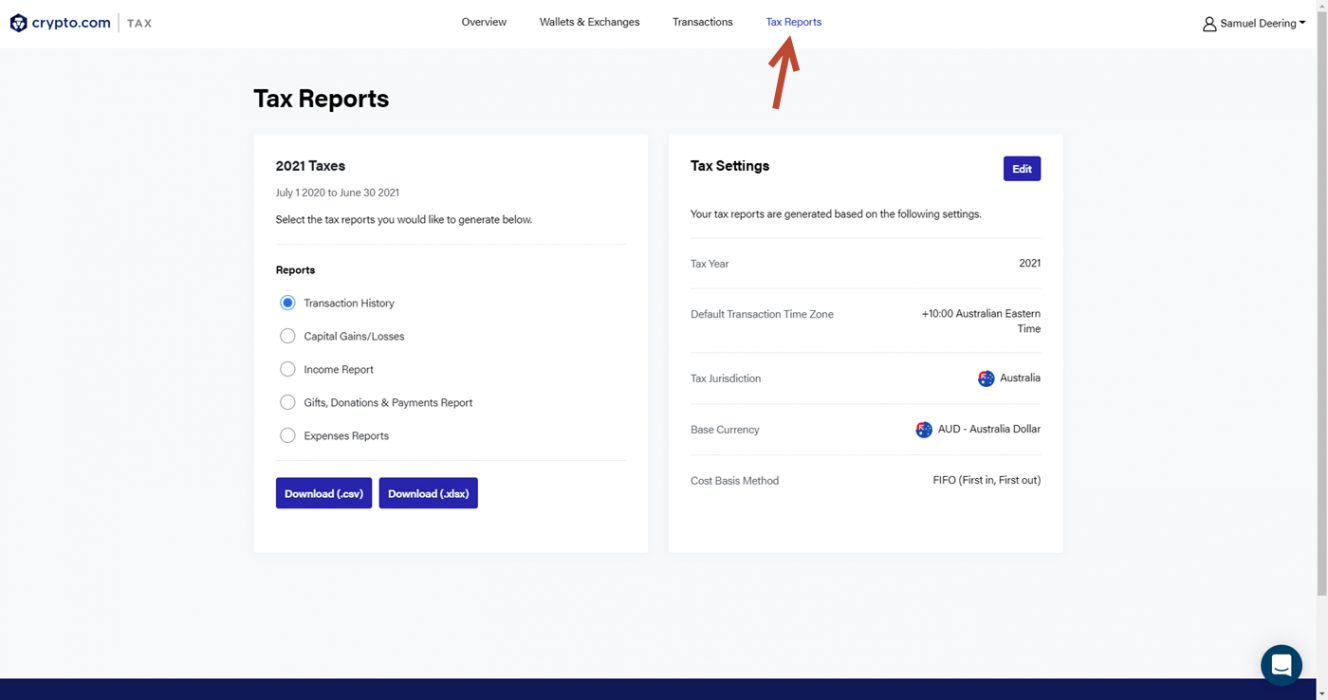

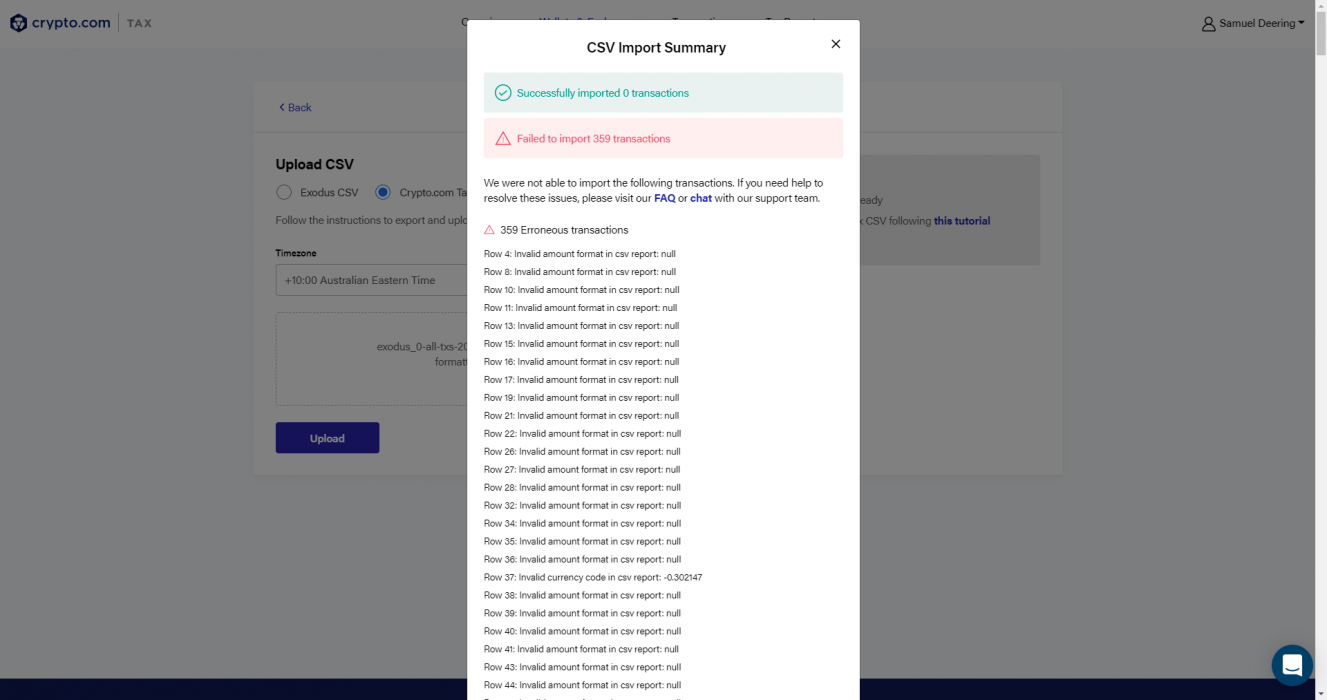

It’s important for investors to be able to assess all of their trades throughout the year so they can stay on the right side of the tax collector. Fortunately, there are some great free guides and calculators to help you manage your tax return.