The cryptocurrency XRP just went up over 69% in the past week. Let’s take a quick look at XRP, price analysis, and possible reasons for the recent breakout.

What is XRP?

Ripple (XRP) is one of the fastest and most scalable digital asset, enabling real-time global payments anywhere in the world.

XRP Price Analysis

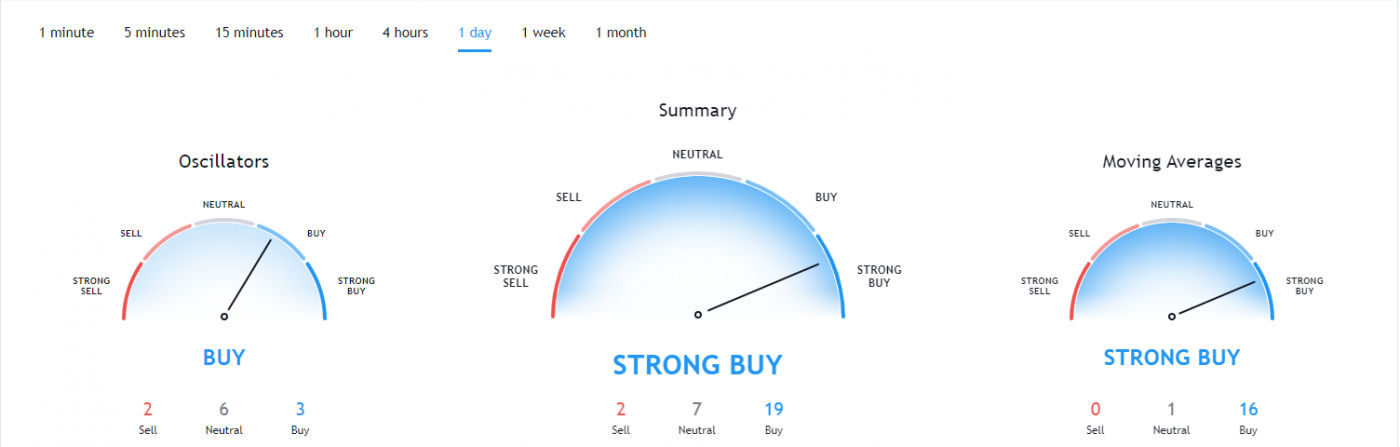

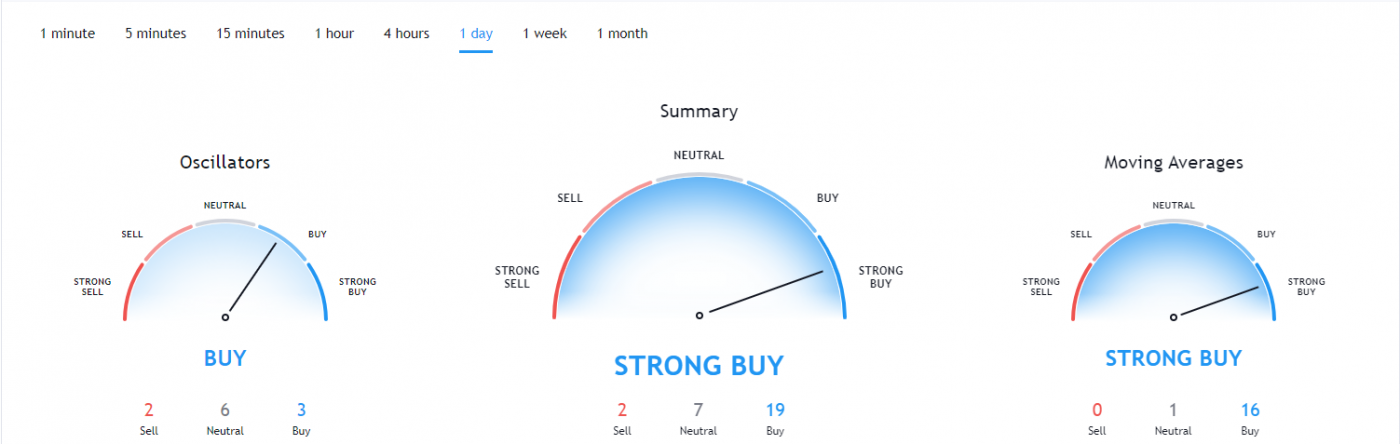

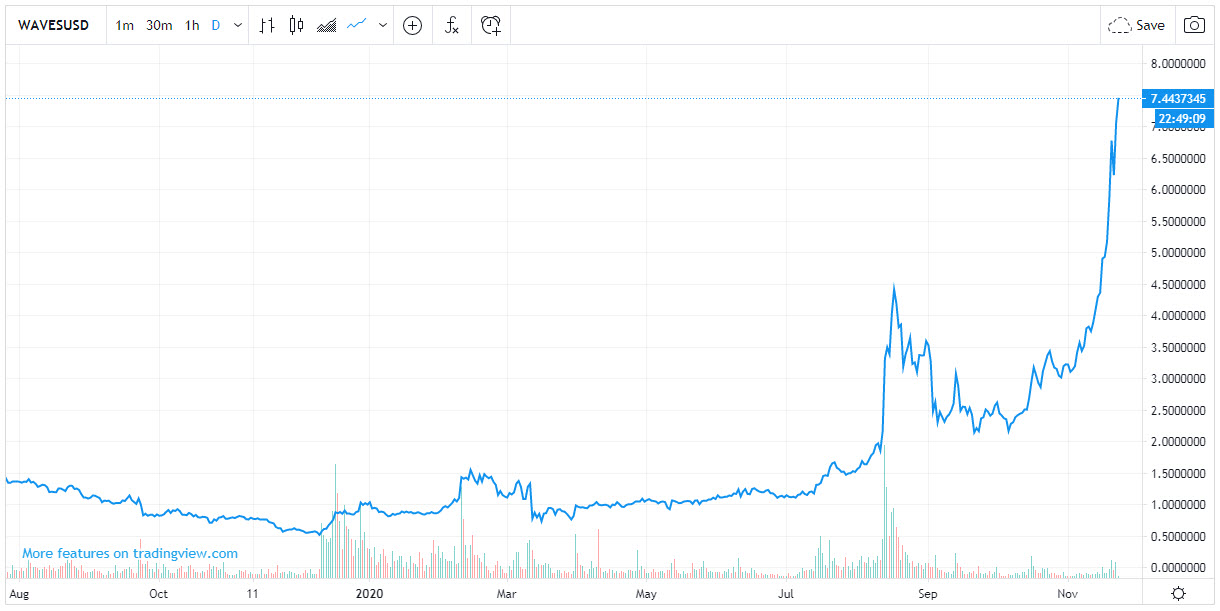

At the time of writing, XRP has ranked the 3rd cryptocurrency globally and the current price is $0.6266 AUD. This is a +69% increase since 11 November 2020 (12 days ago) as shown in the chart below.

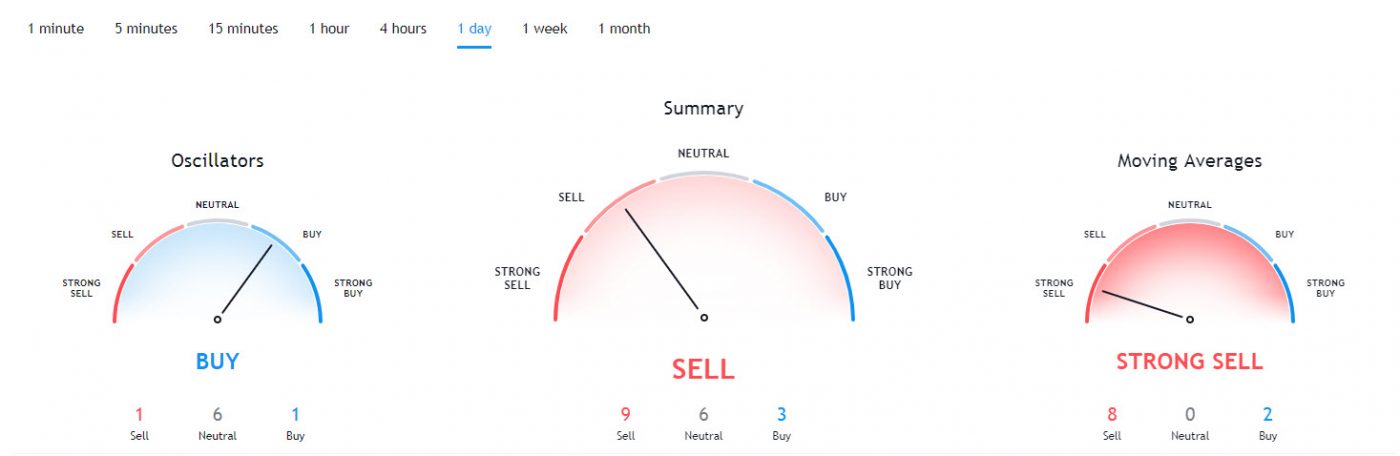

For now, XRPUSD has formed some solid bullish signs not only on the higher timeframes but also on the 30-minute chart which is likely to be the origin for the suggested targets to reach within the upcoming schedule, the next times it is necessary to elevate how XRPUSD bounces within the blue cluster and emerges from there, when the bounce is solid and strong this will give a great origin for the upside targets to be reached, currently, XRPUSD is one of the greater bullish cryptocurrencies out there which is necessary to differentiate as the divergence between the currencies is increasing more and more.

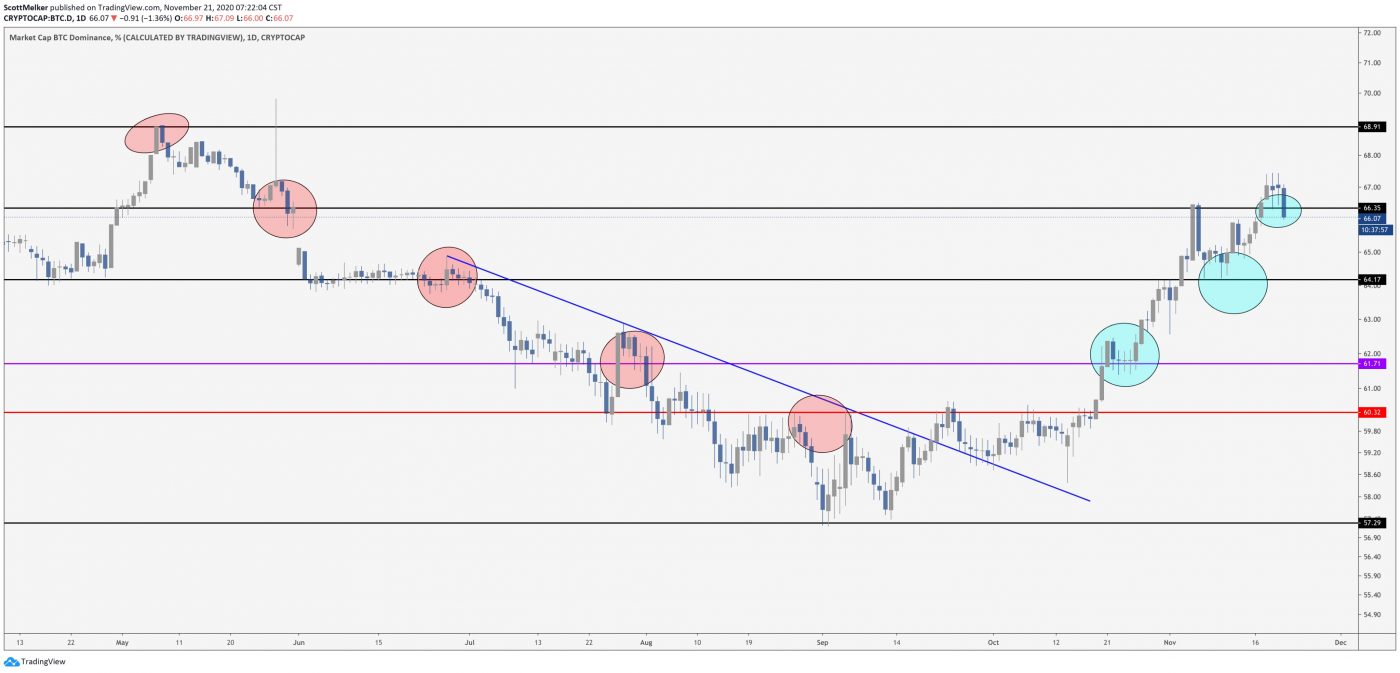

If we zoom out and take a look at the price over the past year or so with 1 day candle chart, we can see the recent breakout more clearly, the line is almost vertical which is insane.

So why did XRP breakout?

The recent rise in Bitcoin over 100% since the halving in May and then the suggested start of the Altcoin season could have contributed to the recent breakout. It could also be contributed to some of the recent events & news of XRP.

Ripple buybacks could be driving XRP price higher

During the third quarter of 2020, Ripple bought $45.5 million worth of XRP in a repurchasing program. The company described the initiative as a move to support healthy markets.

The sales summary listed on the Q3 2020 report detailed total purchases of $45.5 million. In previous quarters, Ripple did not repurchase XRP. The report reads:

“As indicated in the Q2 2020 XRP Markets Report, Ripple is purchasing – and may continue to purchase – XRP to support healthy markets.”

Recent XRP News & Events:

- 30 September 2020 – 0.7.0 Beta Version

- 28 September 2020 – Teamz Blockchain Summit

- 05 November 2020 – Q3 2020 XRP Markets Report

- 12 December 2020 – Spark Distribution

- 31 December 2020 – Xumm 1.0

Where to Buy or Trade XRP?

XRP has the highest liquidity on Binance Exchange so that would help for trading XRP/USDT or XRP/BTC pairs. However, if you’re just looking at buying some quick and hodling then Swyftx Exchange is a popular choice in Australia.