Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Band Protocol (BAND)

Band Protocol BAND is a cross-chain data oracle platform that is able to take real-world data and supply it to on-chain applications, while also connecting APIs to smart contracts to facilitate the exchange of information between on-chain and off-chain data sources.

BAND is the native token of the Band Protocol ecosystem and is used as collateral by validators involved in fulfilling data requests, as well as being the main medium of exchange on BandChain, used for paying for private data.

BAND Price Analysis

At the time of writing, BAND is ranked the 394th cryptocurrency globally and the current price is US$1.40. Let’s take a look at the chart below for price analysis:

Like many other altcoins, BAND set a high around April before retracing 80% to the low at $1.20 in Q3.

Price broke through resistance near $1.45, which may mark an area of possible support on a retracement. If this support fails, bulls may also step in near $1.34. However, a drop this far increases the chances of a stop run to $1.25 and possibly into support near $1.19. For now, continuing bullish market conditions could help $1.40 become support.

The swing high around $1.73 gives bulls a reasonable first target, with $1.98 also likely to draw the price upward. Higher-timeframe resistance beginning near $2.10 or $2.19 could cap the move or trigger consolidations. If bullish market conditions continue, bulls might test probable resistance near $2.30.

2. Waves (WAVES)

WAVES is a multi-purpose blockchain platform that supports various use cases, including decentralised applications (DApps) and smart contracts. The platform has undergone various changes and added new spin-off features to build on its original design.

Waves’ native token is WAVES, an uncapped supply token used for standard payments such as block rewards. Waves initially set out to improve on the first blockchain platforms by increasing speed, utility, and user-friendliness.

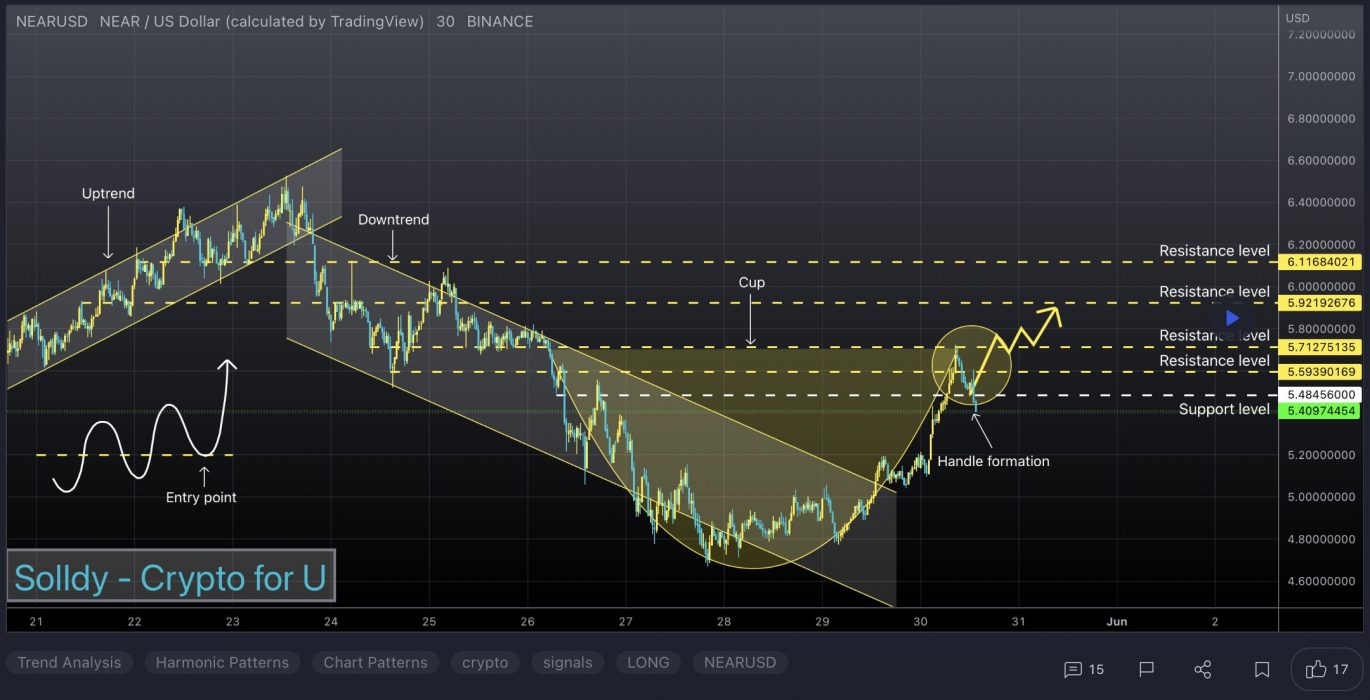

WAVES Price Analysis

At the time of writing, WAVES is ranked the 72nd cryptocurrency globally and the current price is US$5.02. Let’s take a look at the chart below for price analysis:

WAVES has dropped almost 95% from its late-March high and over 64% from its early June high. The price is now rallying toward the middle of its local range.

Bulls may find their first support between $5.00 and $4.80. This area shows inefficient trading on the daily chart inside June 21’s strong bullish impulse. It’s also just below the 9 and 18 EMAs.

The price may be seeking probable resistance near $6.40. This level shows consolidation on the daily chart over the current range’s midpoint. Weekly candle bodies also show that bears rejected bulls near January’s swing lows around this area.

This potential rally could continue over the June monthly open to $7.32. Candle bodies on the weekly and monthly charts show that bulls rejected bears at this level in late January. This area also shows inefficient trading on the weekly chart, which may need a revisit.

Yet relative equal lows near $4.56 offer a very tempting target for bears. The price could find some support under these lows, down to $4.13. This area shows inefficient trading on the weekly and monthly charts. It’s also near the high of September 2020’s consolidation.

A longer bearish move may continue through these possible supports to a zone from $3.87 to $3.45. If the price moves this low, it may be targeting bulls’ stops below weekly swing lows near $3.15. The bottom of this zone also shows inefficient trading on the monthly chart.

3. Ravencoin (RVN)

Ravencoin RVN is a digital peer-to-peer (P2P) network that aims to implement a use case-specific blockchain designed to efficiently handle one specific function – the transfer of assets from one party to another. Built on a fork of the Bitcoin code, Ravencoin aims to solve the problem of assets transfer and trading over the blockchain. Previously, if someone created an asset on the Bitcoin blockchain, it could be accidentally destroyed when someone traded the coins it was created with. RVN coins are designed as internal currency within the network and must be burnt in order to issue token assets on the Ravenchain.

RVN Price Analysis

At the time of writing, RVN is ranked the 104th cryptocurrency globally and the current price is US$0.03178. Let’s take a look at the chart below for price analysis:

Since the November high, RVN‘s 70% drop marks the current range as a reasonable area to expect accumulation.

The recent bearish flip of the 9, 18 and 40 EMAs may cause bulls to be less aggressive in bidding. However, possible support near $0.03045 and $0.02738 – between the 61.8% and 78.6% retracements – could see at least a short-term bounce.

Last year’s long-term consolidation suggests that the areas near $0.04846 and $0.05178 may be more likely to cause a longer-term trend reversal.

Bears are likely to add to their shorts at probable resistance beginning near $0.05412, which has confluence with the 18 EMA. A fast break of this resistance could trigger more selling near $0.05729, the start of the bearish move.

If an aggressive bullish move does appear, trapped buyers in the probable resistance beginning near $0.06045 may provide a ceiling for this impulse.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.