After months of inquiries and input from stakeholders across the board, the Select Committee on Australia as a Technology and Financial Centre (Committee) has finalised its long-awaited report, containing 12 recommendations that, if implemented, will significantly alter the regulation of Australia’s growing digital asset ecosystem.

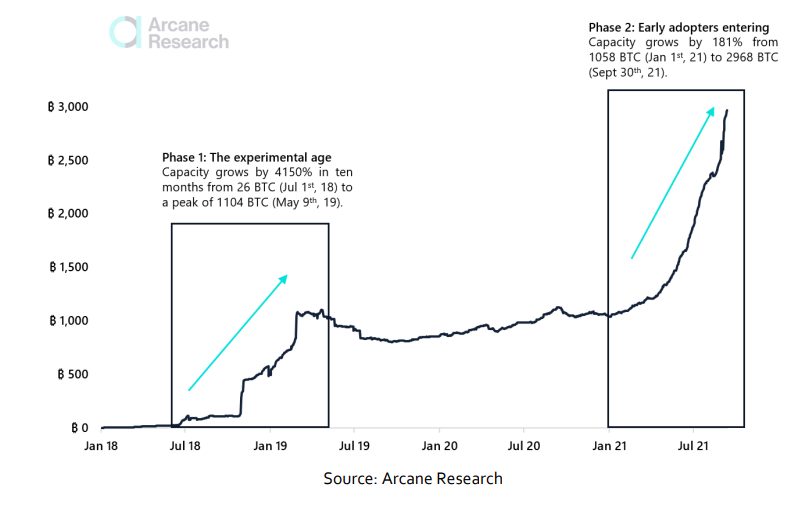

Swift Action Parallels Crypto Adoption Rate

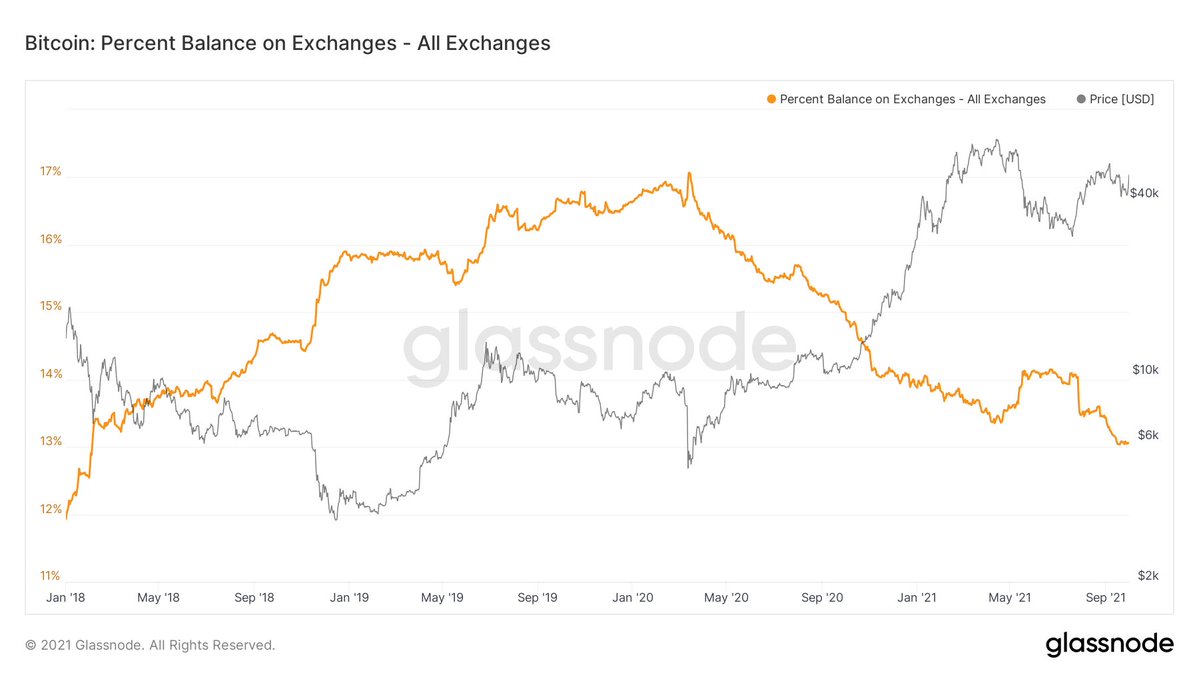

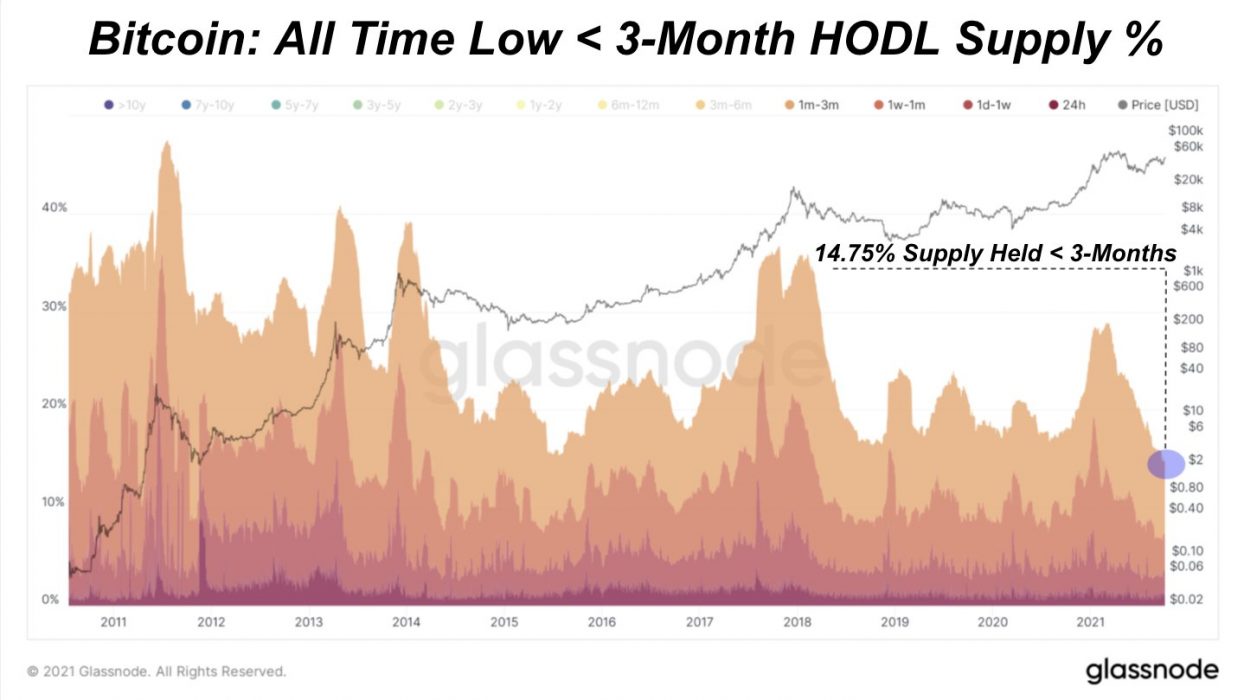

From the outset, one can’t help but be impressed by the comparable speed at which policymakers have grappled with an emergent, complex and relatively unfamiliar sector. It was only seven months ago that the deep dive really began. On top of that, over 100 submissions were received, illustrative of an engaging and proactive industry seeking regulatory certainty. No doubt, the committee’s swift action can at least partially be attributed to the rapid growth of crypto adoption within Australia, particularly over the past 12 months.

The committee grappled with a host of diverse issues within the cryptosphere, including blockchain, tokens, coins, DeFi, staking and DAOs (decentralised autonomous organisations), in addition to thorny matters such as licensing requirements, tax issues and debanking of crypto businesses.

Listening in on a few hearings, it became evident that the committee’s focus was aimed at striking a balance between consumer protection, regulatory clarity and otherwise providing space for the sector to thrive.

This [the recommendations] provides a very clear agenda for Australian leadership on digital assets, in terms of protecting consumers and boosting investment. The market is asking for regulation, and we are responding while trying to avoid trampling on innovation.

Senator Andrew Bragg, chair of the committee

12 Recommendations Made

The committee’s 167-page report offered 12 recommendations which, if adopted by government, will rank Australia among the more progressive and developed digital asset regulatory regimes, alongside countries such as Singapore.

The 12 recommendations are:

- Establish a market licensing regime for digital currency exchanges, including capital adequacy, auditing and responsible person tests under the Treasury portfolio.

2. Establish a custody or depository regime for digital assets with minimum standards under the Treasury portfolio.

3. Conduct a ‘token mapping’ exercise, through Treasury and with input from other regulators and experts, to determine the best way to characterise the various types of digital asset tokens in Australia.

4. Establish a new decentralised autonomous organisation company structure.

5. Clarify anti-money laundering and counter-terrorism financing regulations to ensure they are fit for purpose and do not undermine innovation.

6. Amend the capital gains tax regime so that digital asset transactions create a CGT event only when they genuinely result in a clearly definable capital gain or loss.

7. Amend relevant legislation so that businesses undertaking digital asset ‘mining’ and related activities in Australia receive a company tax discount of 10 percent if they source their own renewable energy for these activities.

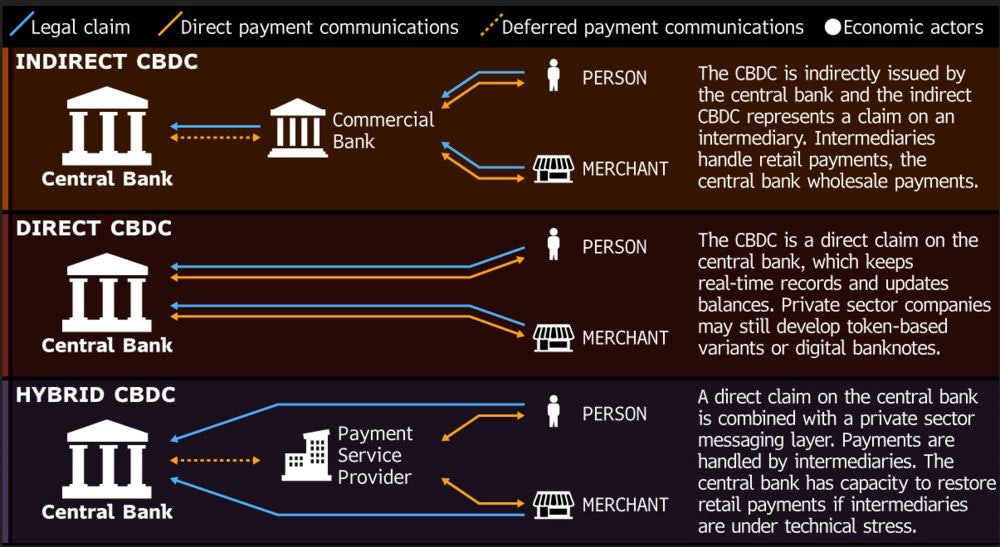

8. Have Treasury lead a policy review of the viability of a retail central bank digital currency in Australia.

9. Ensure the Council of Financial Regulators implements a scheme to address the due diligence requirements of banks by June next year, in line with recommendations from the 2019 ACCC inquiry into the supply of foreign currency conversion services.

10. Develop a clear process for businesses that have been debanked. This should be anchored around the Australian Financial Complaints Authority, which services licensed entities.

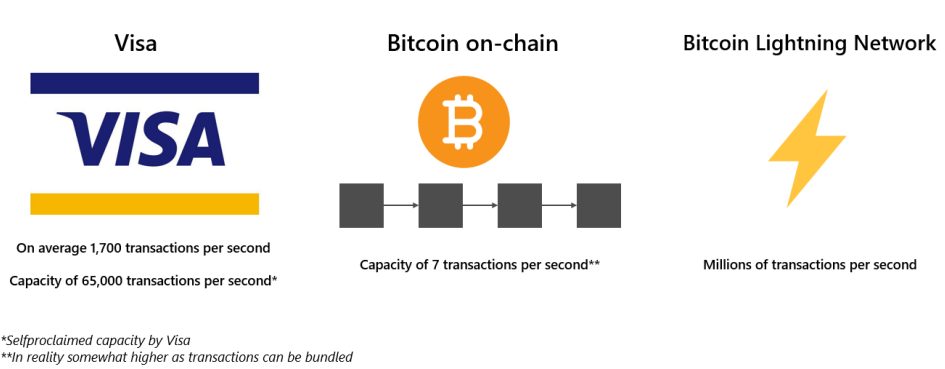

11. Ask the Reserve Bank of Australia to develop common access requirements for the new payments platform in accordance with the report by Scott Farrell, to reduce the reliance of payments businesses on the major banks for the provision of banking services.

12. Establish a global markets incentive to replace the offshore banking unit regime by the end of next year.

Naturally, the devil is in the detail as to precisely how these recommendations are reflected in the legislation. One’s only hope is that legislators spend sufficient time engaging with the issues to give Australia the best prospect of creating a dynamic and thriving local crypto industry.

Reactions Vary Within Crypto Community

Overall, the sentiment from the crypto community has been mixed, which is to be expected, given that so many diverse participants provided input into the process.

Many have echoed the sentiments of CoinJar, who praised the committee’s approach:

We applaud the ATFC for the forward-thinking approach they’ve taken with this proposed regulatory framework. CoinJar is committed to offering people a safe and positive experience when it comes to investing in cryptocurrency and we believe that effective regulation is the best way to achieve this.

Asher Tan, CEO, CoinJar

However, some said the report lacked sufficient detail, while others argued that it was doubtful whether government would actually implement the recommendations. Many are unquestionably also disappointed by the absence of “safe harbour protections“, which would otherwise have blocked damaging retroactive legislation.

Whatever your view, Australia seems to have taken a step towards greater regulatory clarity, something almost all market participants would welcome with open arms.