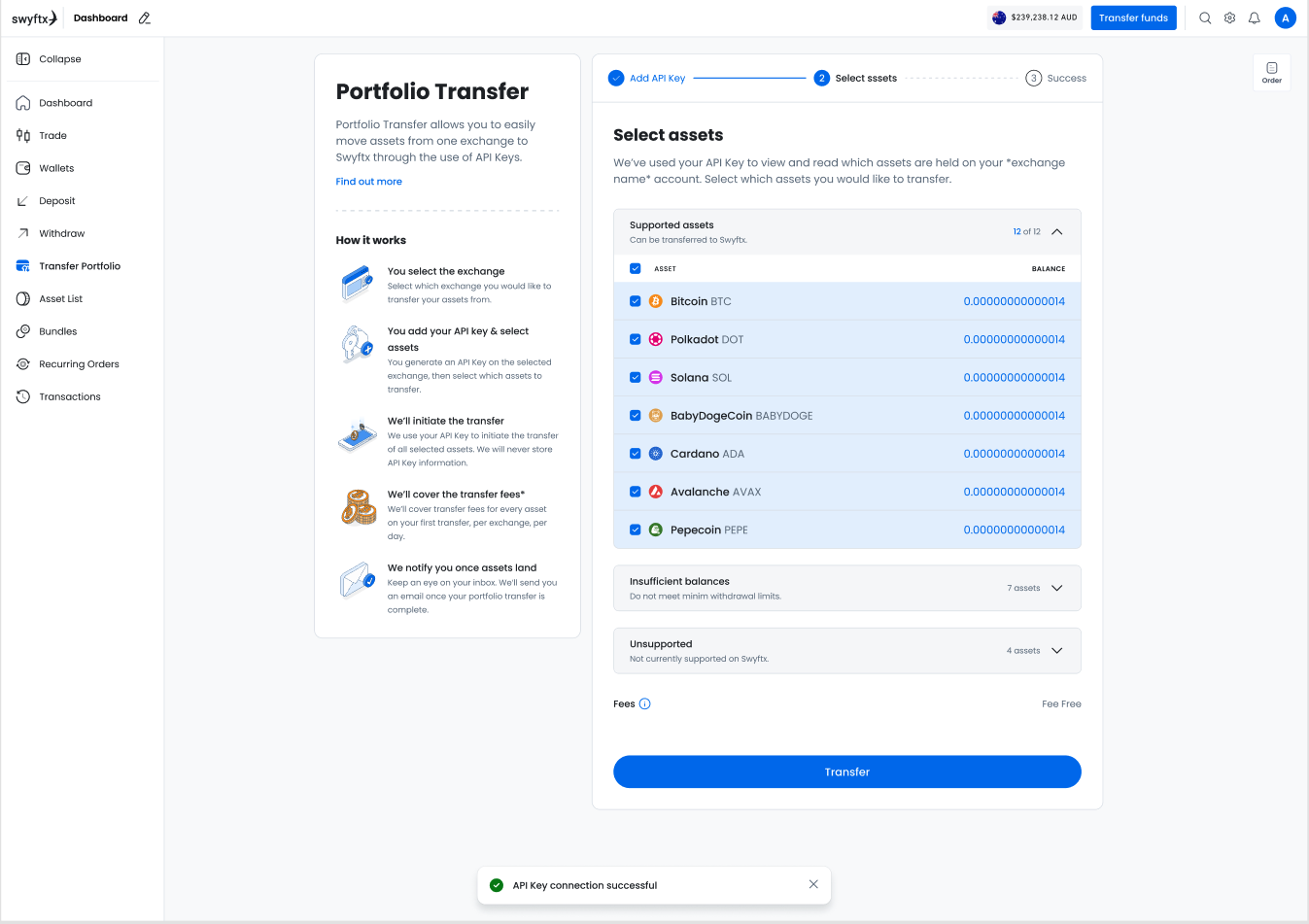

Australian crypto exchange Swyftx has launched a portfolio transfer service to make it easier and safer for crypto users at competitor exchanges to move their assets.

The Brisbane-based business said the new service would allow crypto holders to transfer multiple crypto tokens in a single transaction for the first time. Crypto users currently are required to transfer individual assets one by one if they wish to switch platforms.

Chief Operating Officer at Swyftx, Jason Titman, said:

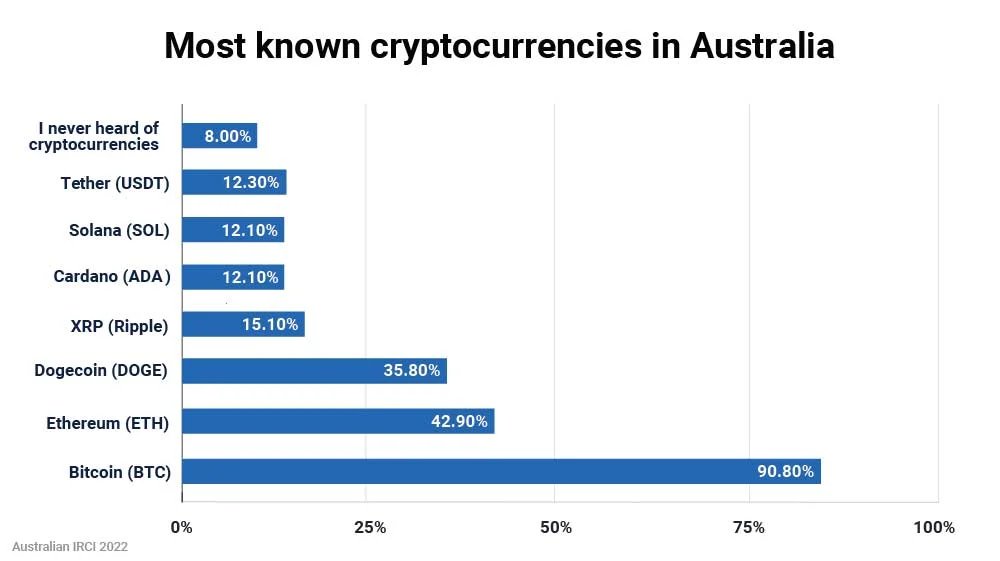

“We’ve seen an uptick in crypto users who want to move their assets to Aussie-owned and regulated platforms in response to FTX, as well as other recent regulatory enforcements.

“We expect crypto switching services to become an industry norm over the next five years as competition hots up. Even if exchanges don’t build them now, it’s likely that eventually they’ll be mandated by competition regulators. Just as we’ve seen in areas like bank account switching and mobile phone transferability between telcos.”

Swyftx Chief Operating Officer Jason Titman

The portfolio transfer feature will initially allow Australian customers at just two exchanges – Binance and Coinspot – to transfer their crypto portfolios across to Swyftx without any fees. Over the next few weeks, the service is expected to be expanded to include local customers at other global exchanges and smaller domestic competitors.

The portfolio transfer service works by using pre-existing APIs to transfer assets across the blockchain from one exchange to another. Swyftx said that the API data would not be stored or managed by the exchange.

Titman said the new service would reduce the risk of people losing crypto by inputting incorrect wallet addresses. It will also mean customers no longer have to transfer crypto one asset at a time.