Welcome to this weekly series from the TradeRoom. My name is Dave and I’m the founder of The Crypto Den, an Australian-based crypto trading and education community aiming to give you the knowledge to take your trading game to the next level.

Crypto Market Outlook

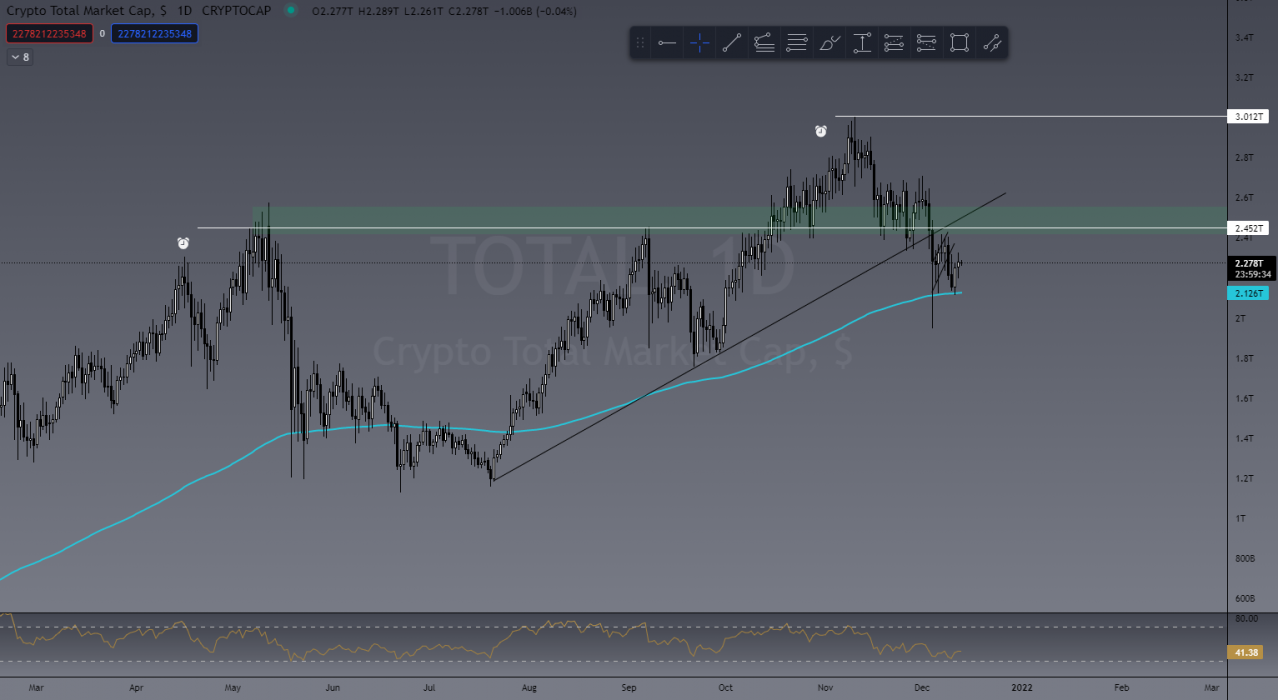

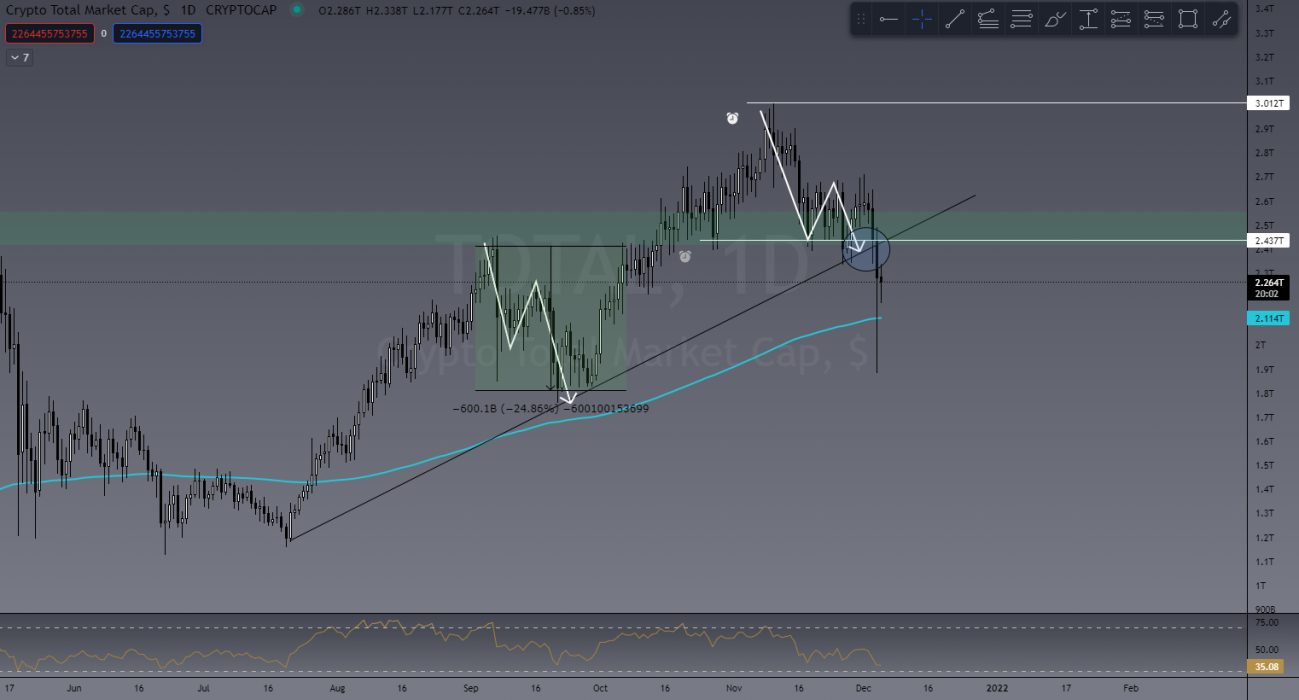

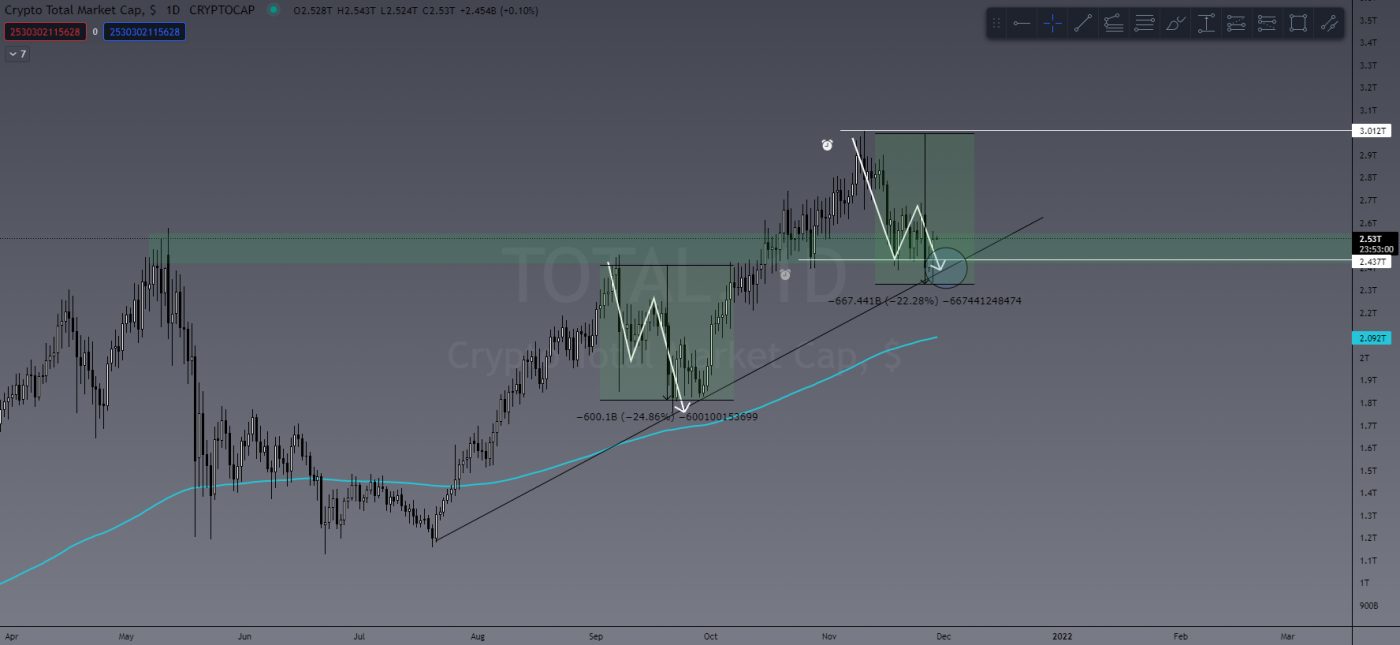

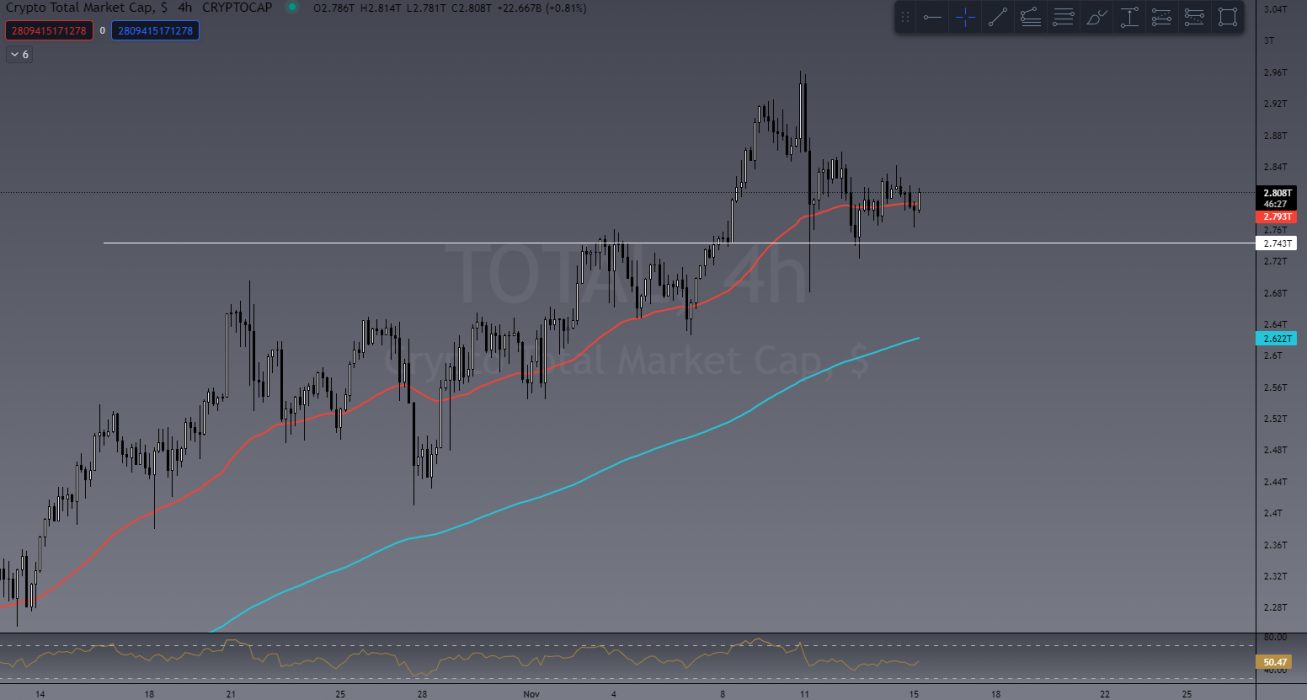

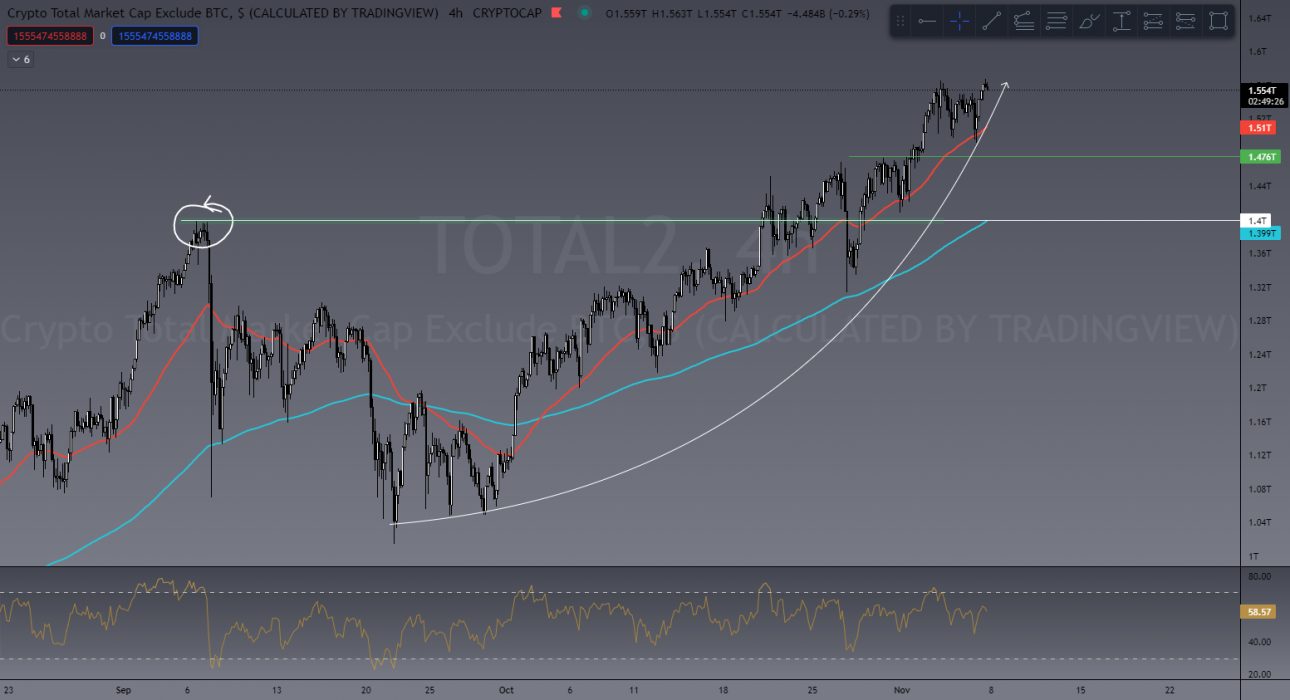

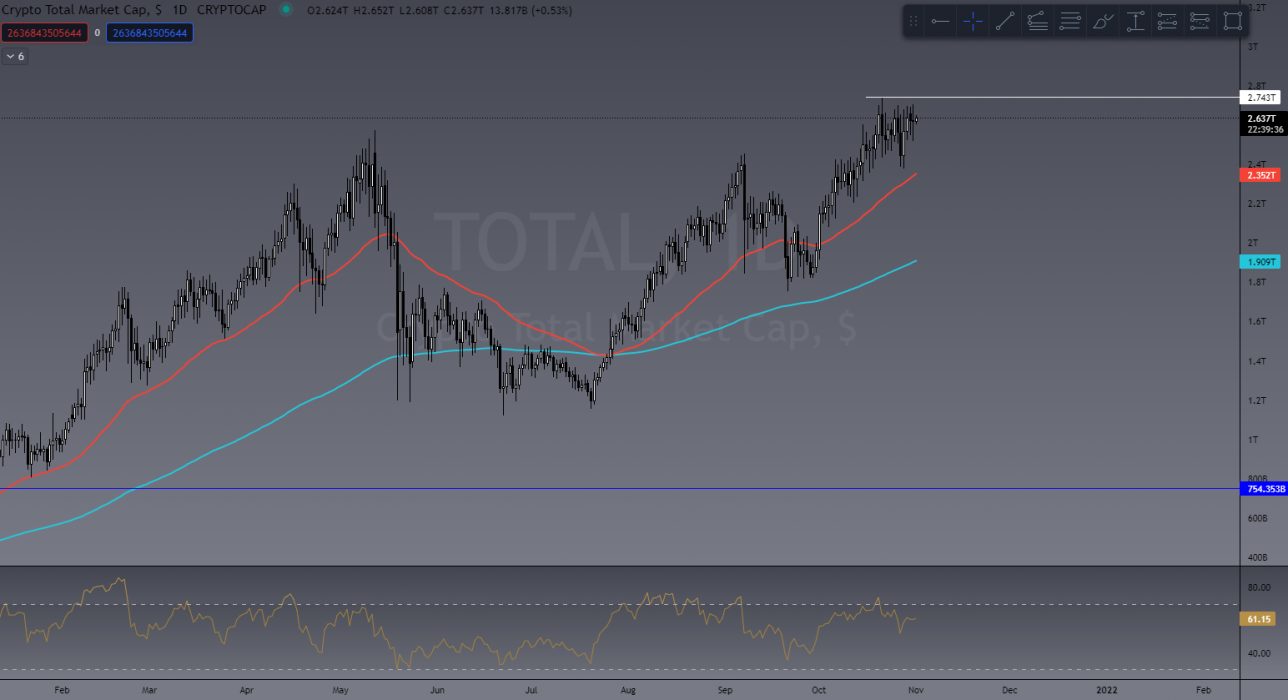

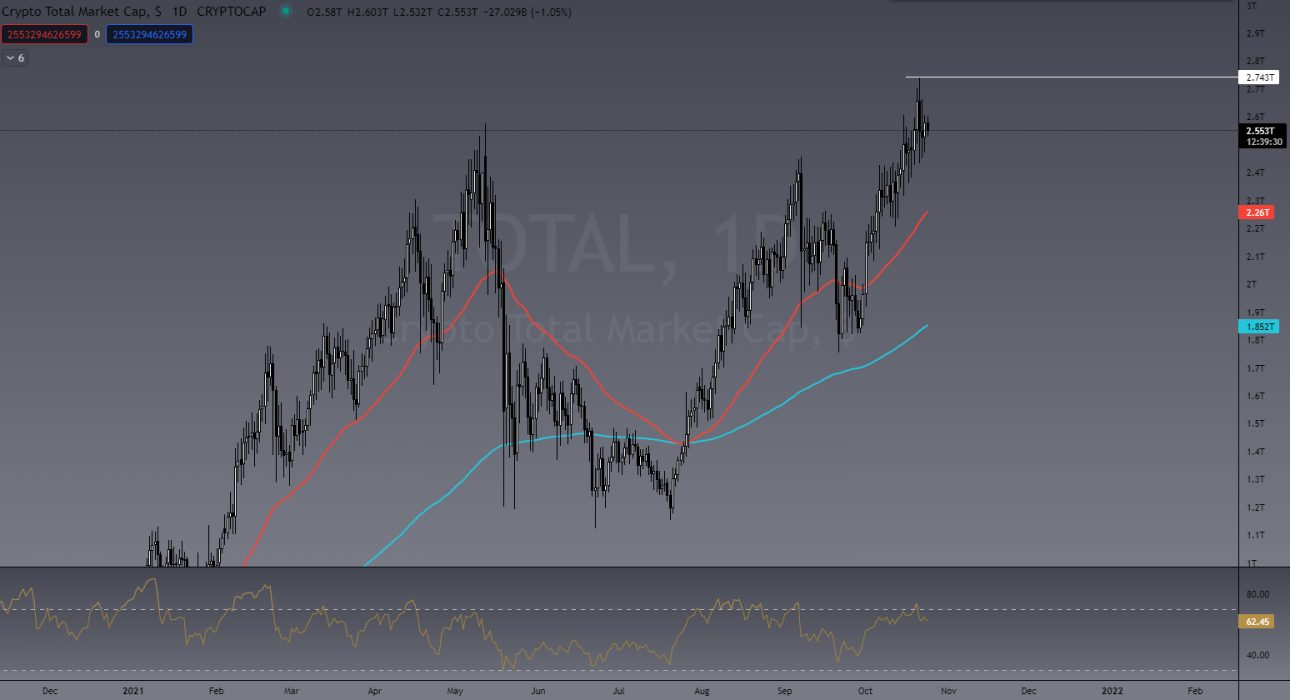

I expected to see some bullish signs showing for the TOTAL market cap by now and the fact we haven’t yet could be a bearish indicator. It’s currently sitting at US$2.19 trillion and really showing no sign of strength yet. We could see the market drop further to around US$1.8 trillion soon, especially if we don’t hold above that 200 EMA.

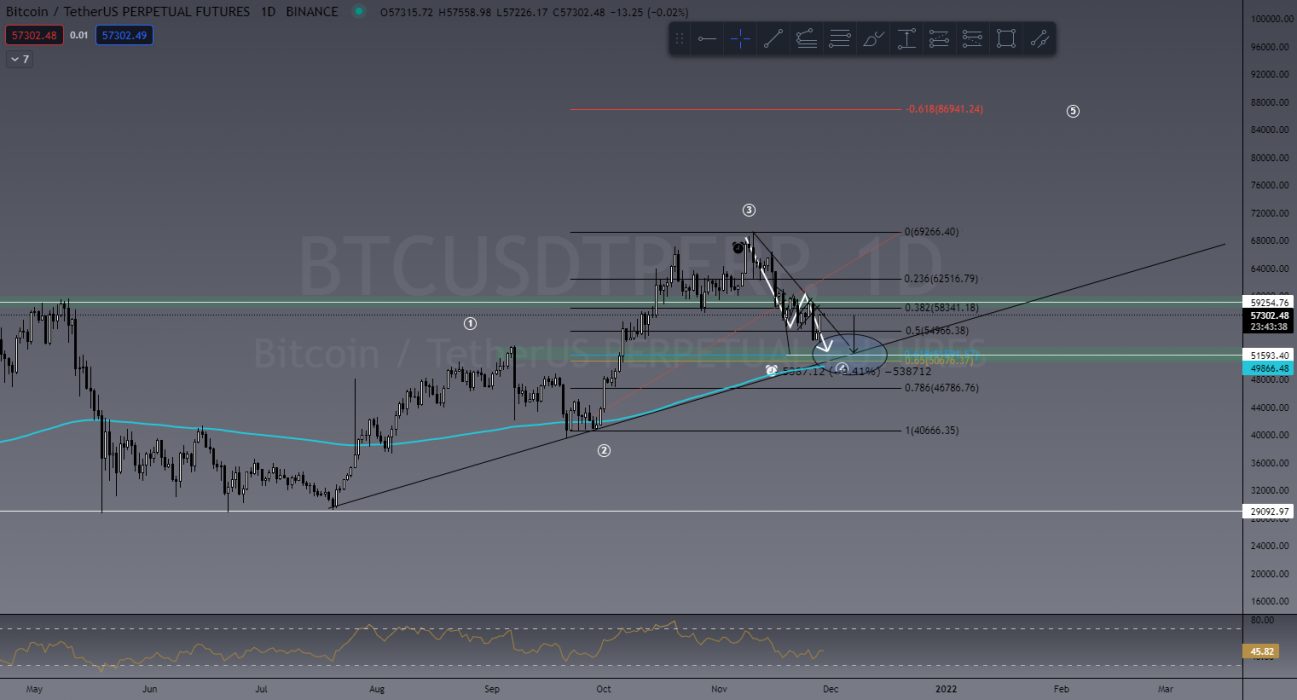

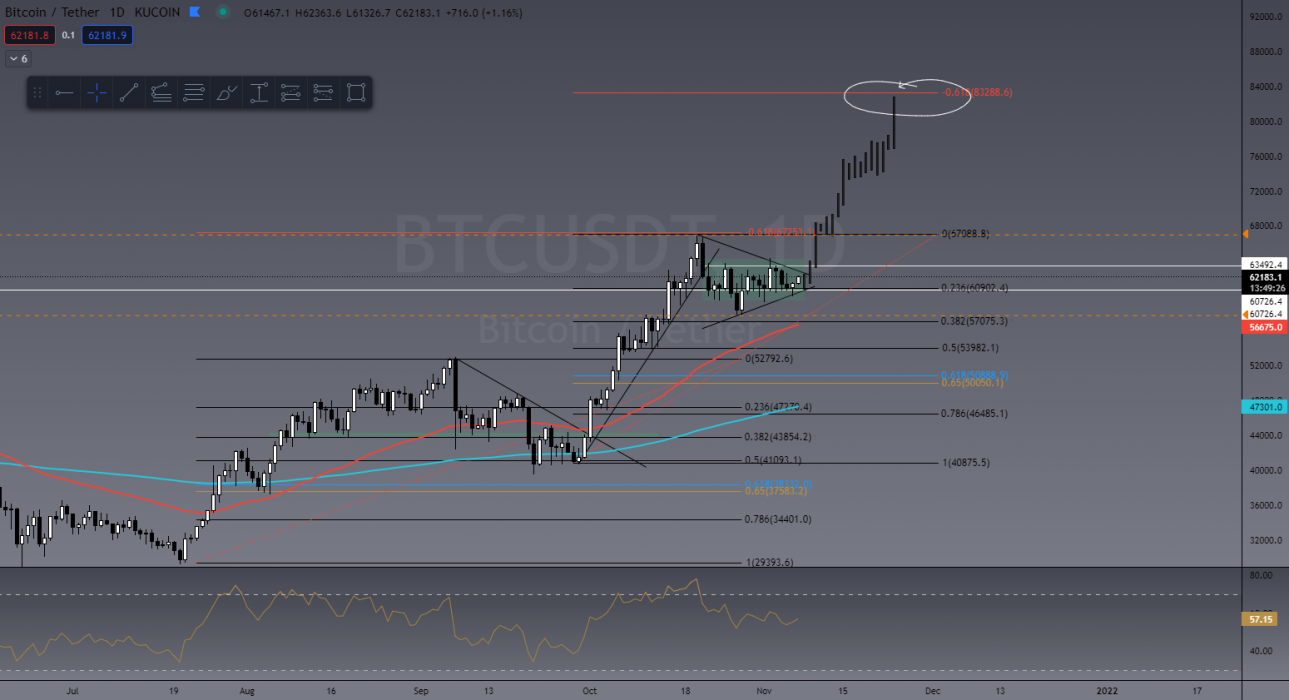

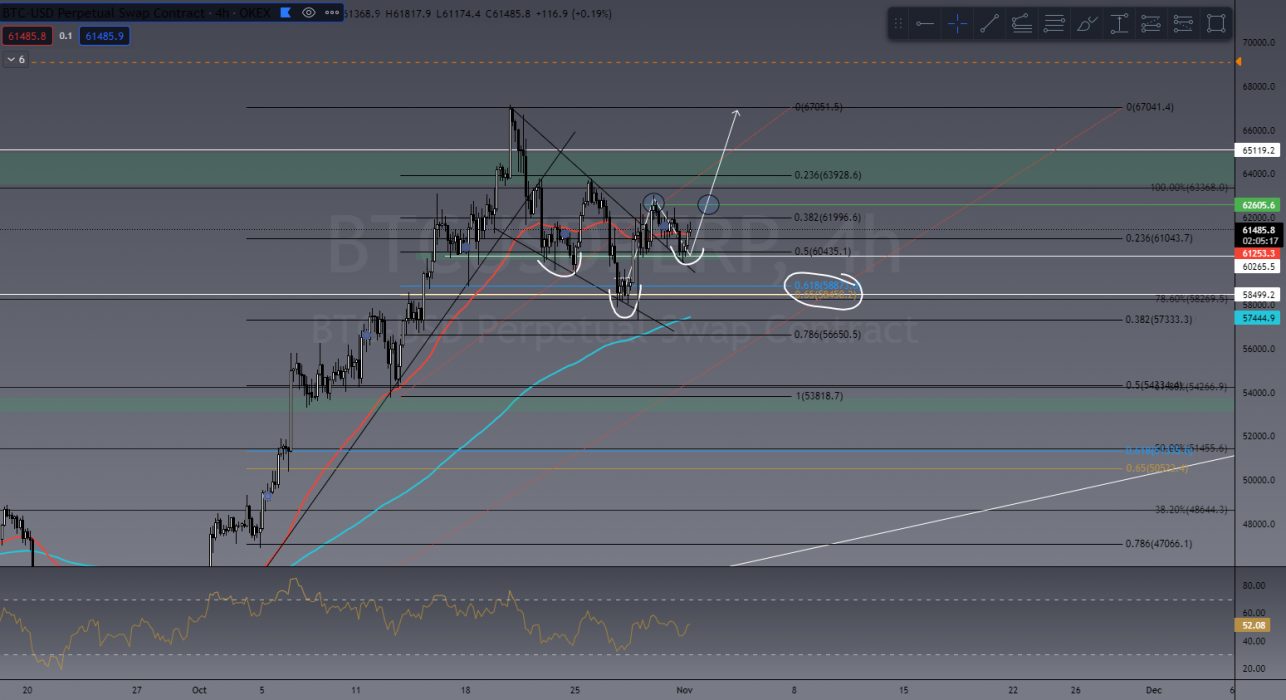

Let’s take a look at BTC, which has been trending down with a series of lower highs and lower lows since December 8 and just like the total cap, I’m really not seeing any sign of reversal just yet. Last week I outlined a possible target of US$40,000 and I think we could see that still in play. I still don’t think it’s full bear mode yet but something to keep in mind is that it’s Christmas time. Investors and traders alike will take time off, meaning there will be less liquidity in the markets. This means it could pump OR dump a lot easier. We expect volatility.

Last Week’s Performance

BTC/USD

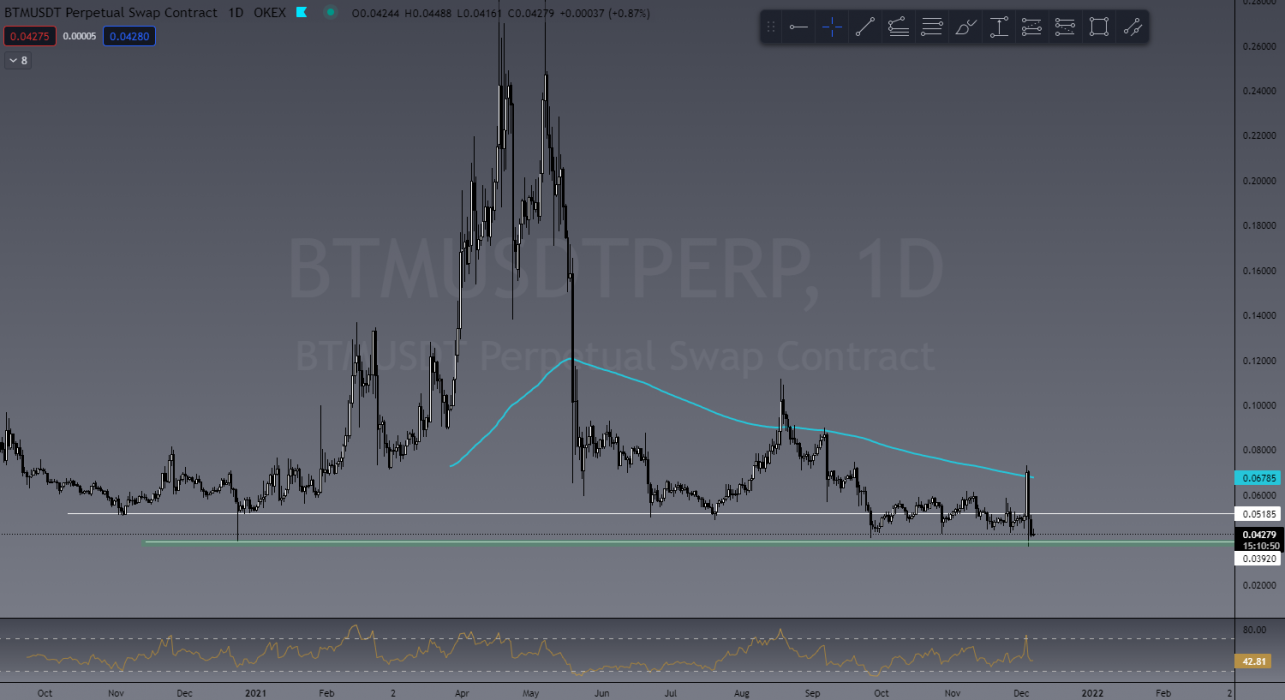

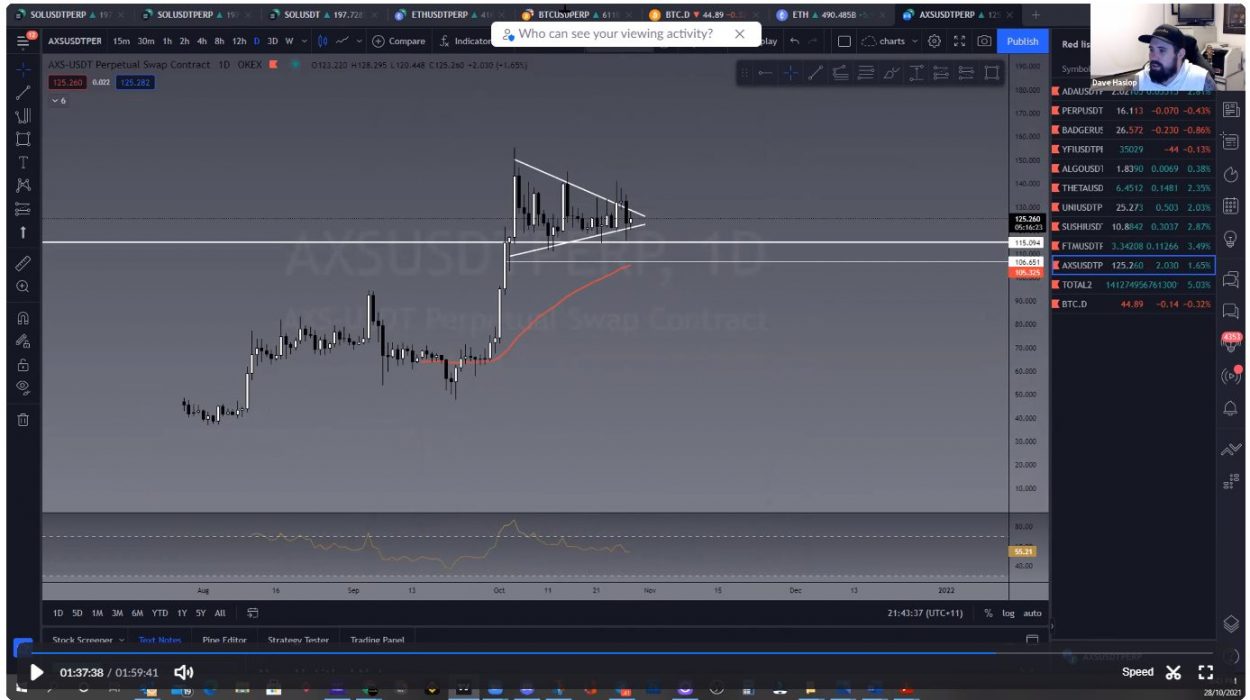

I shared this chart in our TradeRoom earlier this week and on our LIVE market scan while searching for a good short entry. This is why we feel it’s important to follow the charts instead of just getting excited on hopium and FOMOing into the market again.

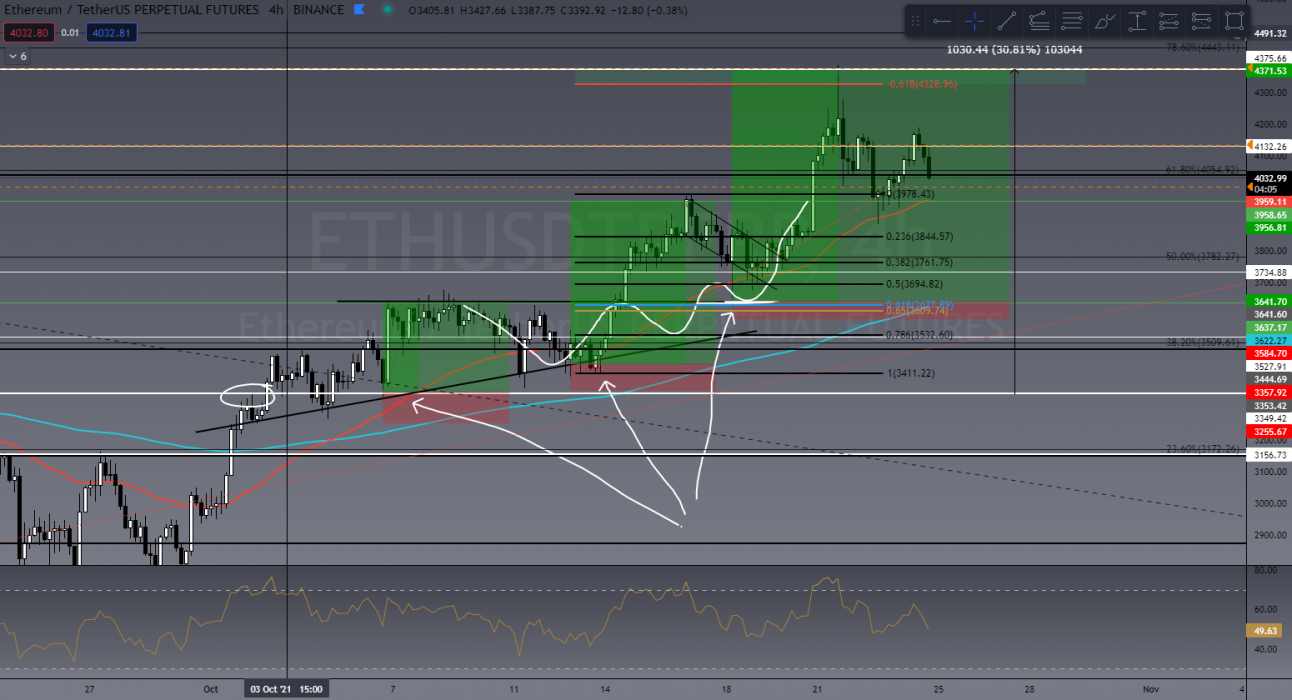

ETH/USD

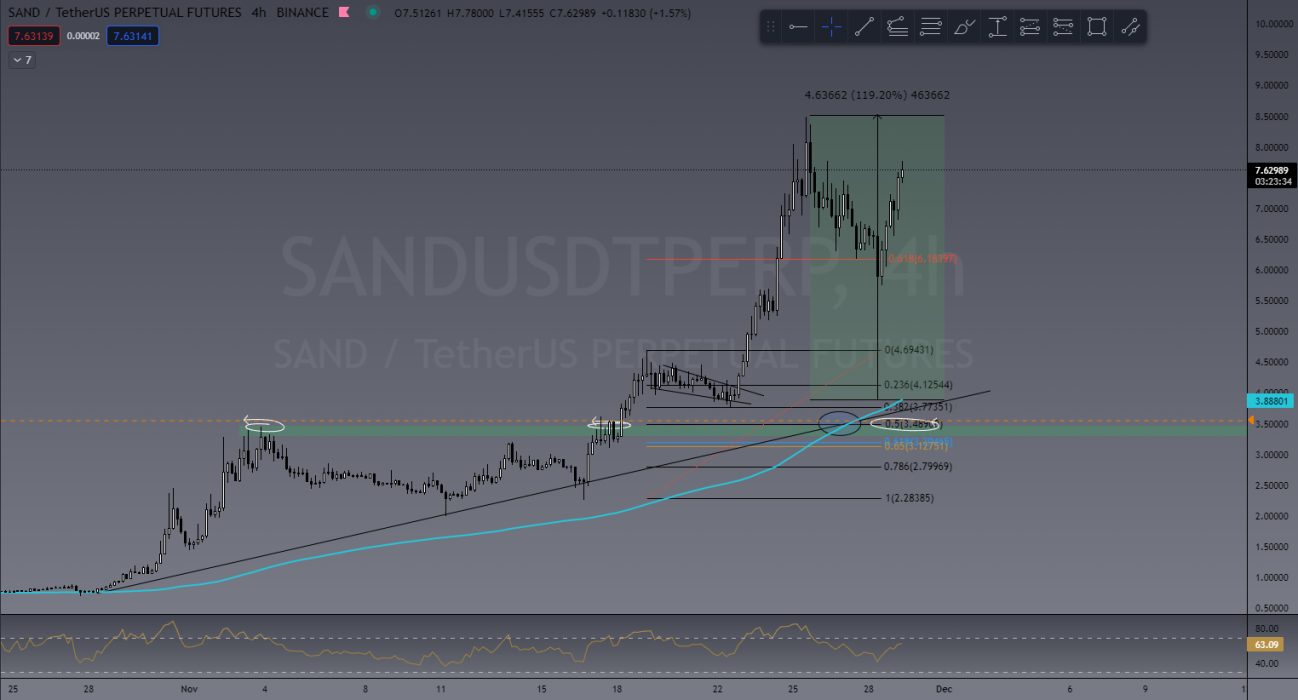

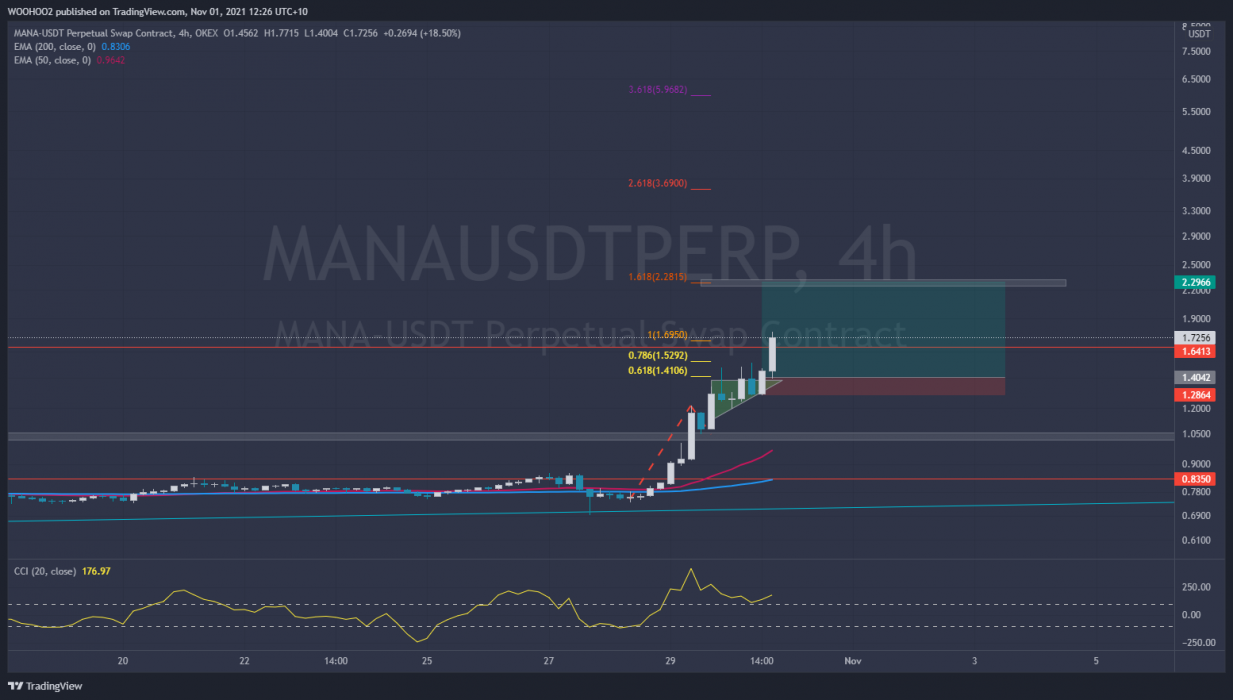

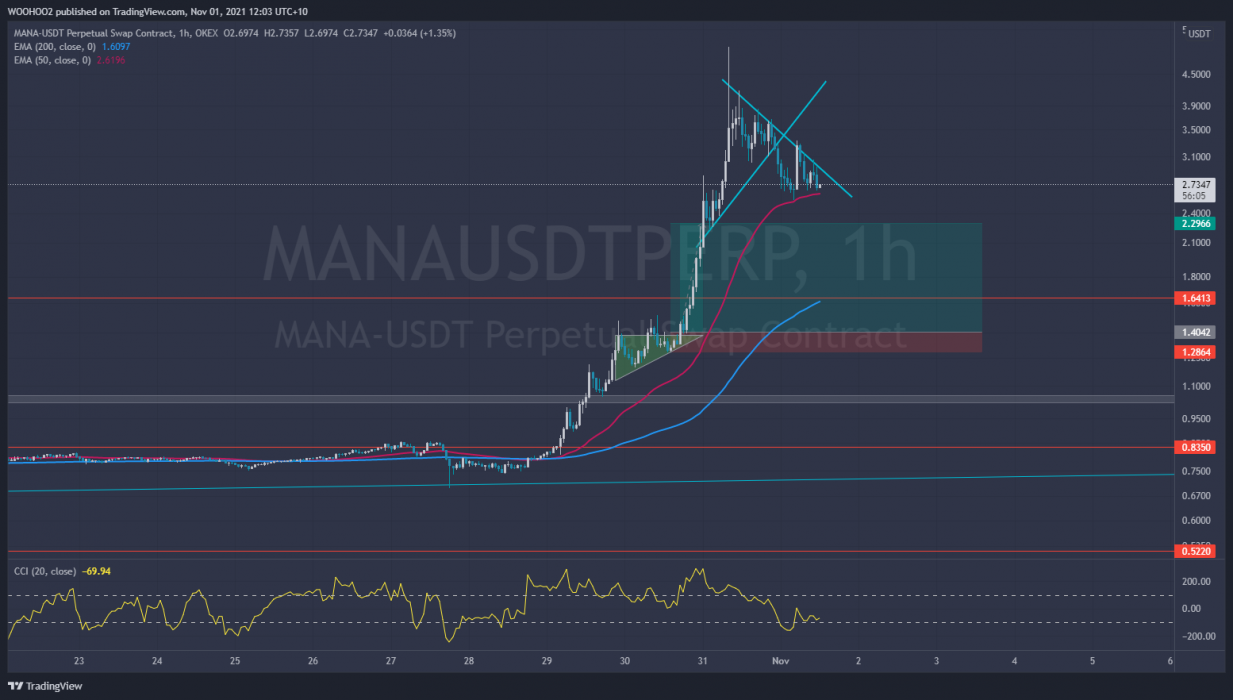

ETH had a nice little short that I wrote about in last week’s article. It played out almost perfectly with a 240% leveraged trade. Like BTC, ETH retraced to that 61.8% Fibonacci pocket, which also coincided with the local downtrend. We thought this was a great shorting opportunity and it didn’t disappoint us.

This Week’s Trades

ADA/USDT

ADA is still on the same path I wrote about in our November 29 article. I still believe there’s a high probability that ADA will hit US$1, and as I said in the previous article if that US$1 level doesn’t hold, then ADA may see dramatic losses happen. Great for shorters, not great for holders. There’s some small support at US$0.82, although after that ADA will see US$0.30 so it’s important for US$1 to hold strong. I’m expecting to see a lot of buyers there, so plan to scale into longs pending candlestick analysis.

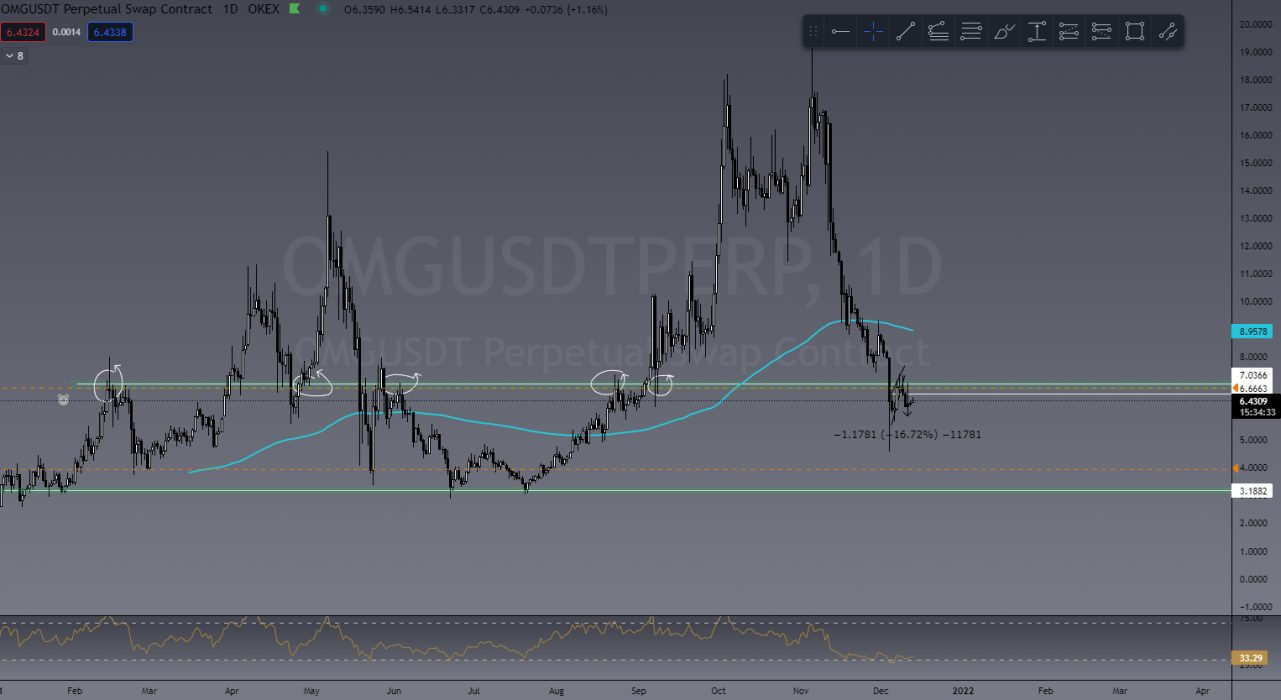

NEO/USDT

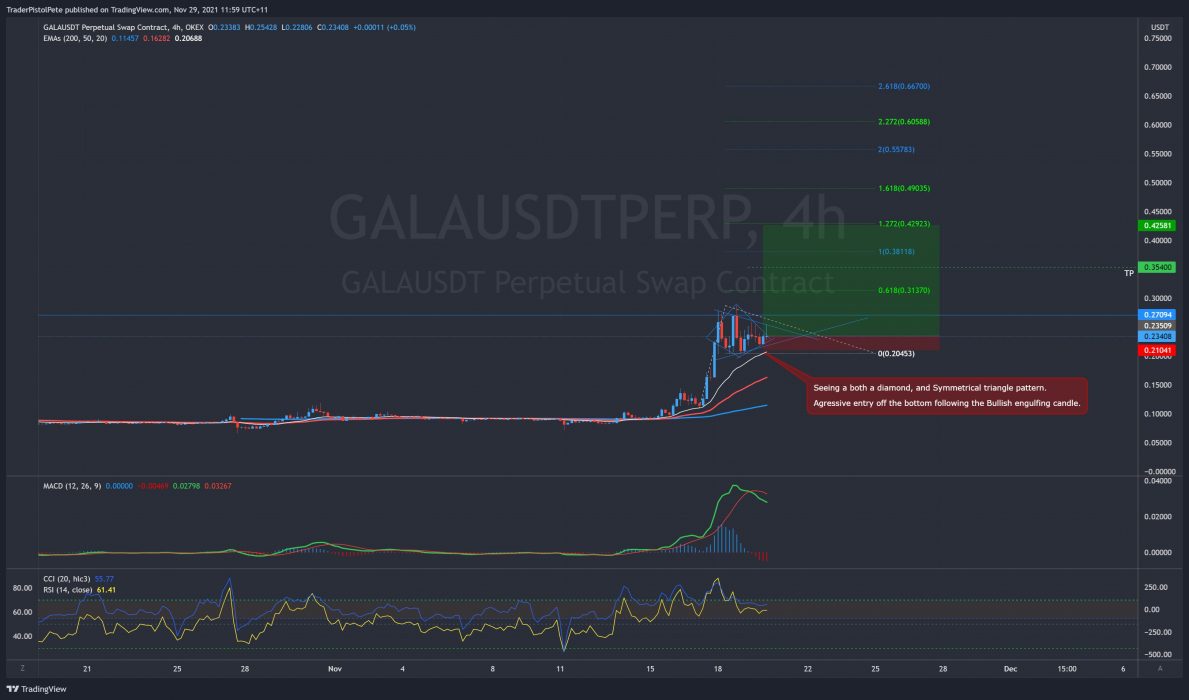

An old 2017 fan favourite, NEO is currently forming some daily bullish divergence at a key level of daily support. What I’m looking for here is a bullish engulfing candle to show me some strength. If we see that, NEO could do 40% on spot to take it back to US$35.00. If support fails to hold, then I’ll look to short to US$13.00, which is a 45% drop. Either direction it takes, we’re still looking to trade it.

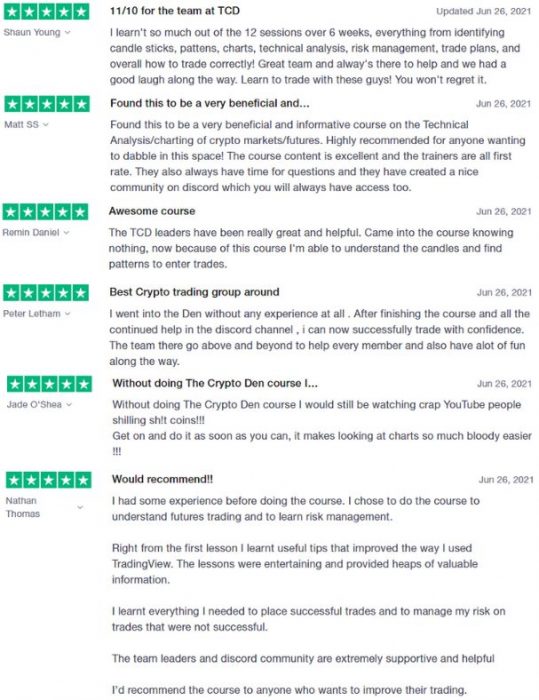

Invite to Join our TradeRoom

If you’d like to become a better trader, you’re invited to join our TradeRoom where we share daily charts and market analysis. In our community we strongly encourage and teach correct risk management strategies to keep our members safe in this new volatile crypto market.

Join our “Apprentice” plan now for your 7-day trial.

The Crypto Den was created in 2017 to help the rapidly growing crypto community learn and understand the fundamentals of digital currencies and how to trade them.

Since then we have taught thousands of members the basics of technical analysis and trading strategies to further progress and perfect their trading abilities.

In the TradeRoom you will be included in a supportive environment which encourages personal growth, education and community support.

It’s a place to share your trading ideas and follow other experienced traders’ feeds to help keep your finger on the pulse of such a volatile market!