Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. STEPN (GMT)

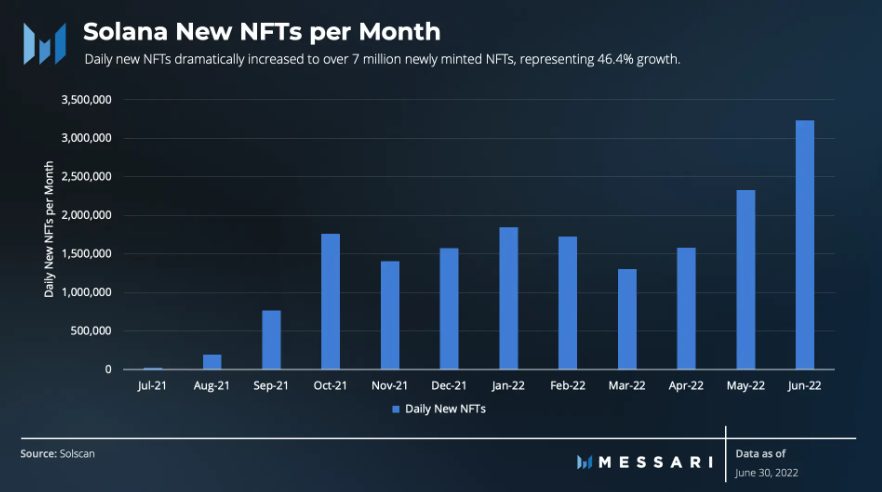

Stepn GMT is a self-styled “Web3 lifestyle app” with GameFi elements on the Solana blockchain. It combines aspects of a play-to-earn game with a fitness app to create a new category called “move-to-earn”. Users buy NFT sneakers, which they can use to earn in-game currency while walking, running, or jogging. STEPN aims to revolutionise the market of fitness applications by incentivising millions of users to follow a healthier lifestyle. The app solves several problems like “proof of movement” – proving that users really exercised – and a functioning GPS system. Moreover, STEPN incentivises users financially and plans to introduce social rewards elements and successfully contribute to carbon neutrality.

GMT Price Analysis

At the time of writing, GMT is ranked the 82nd cryptocurrency globally and the current price is US$0.6884. Let’s take a look at the chart below for price analysis:

GMT has retraced much of 2022’s parabolic run. It dropped 85% from its April high before rallying in mid-June.

Bulls are testing $0.6718 to see if it can hold as support. This area shows inefficient trading on the daily chart. It’s also near the top of early July’s accumulation before the most recent rally.

Even if the price eventually moves higher, it may first drop under the July monthly open to an area near $0.6029. Bulls rejected bears in early July at this level. It also overlaps with an area of accumulation in late June.

If the market sees it as bearish, a retest of $0.7614 could prove this level as resistance. Bears already rejected bulls once here. This level also contains the 40 EMA and is inefficiently traded on the daily chart.

A break through this resistance could retest an old area of inefficient trading, near $0.8432. The target would likely be bulls’ stops above highs at $0.8830 and $0.9517.

If the price reaches this level, it may go one step further and retest the June monthly open near $1.10. This level is at the low end of inefficient trading on the monthly chart. It’s also the origin of early June’s sudden breakdown.

Yet, while the market remains bearish, traders may want to focus on bearish scenarios. Rejection from any resistance might reach near $0.5813. This area shows inefficient trading on the daily chart. Bulls also rejected bears here on the weekly chart before starting June’s rally.

Below this level, $0.5146 may be the next target if the bearish trend continues. This area shows inefficient trading on the daily and weekly charts. It’s also just below relative equal lows, formed in mid-June. Bulls’ stops under these lows offer attractive targets to bears.

2. Solana (SOL)

Solana SOL is a highly functional open-source project that banks on blockchain technology’s permissionless nature to provide decentralised finance (DeFi) solutions. The Solana protocol is designed to facilitate decentralised app (DApp) creation. It aims to improve scalability by introducing a proof-of-history (PoH) consensus combined with the underlying proof-of-stake (PoS) consensus of the blockchain.

SOL Price Analysis

At the time of writing, SOL is ranked the 9th cryptocurrency globally and the current price is US$31.79. Let’s take a look at the chart below for price analysis:

SOL has retraced 87% from its Q2 highs and reached possible support near $28.34. Resistance might begin near $37.64, which has confluence with the 9 and 18 EMAs.

A more substantial rally might reach near the swing high at $44.23 and the 40 EMA. This high is less likely to break if bears plan to continue the downtrend without a lengthier consolidation.

While not highly probable in the current market conditions, a more animated move upward could reach a wide resistance area between $48.12 and $52.94. This zone is where the last movement down accumulated positions before breaking down.

Possible support rests near $30.54, which showed sensitivity on the last test. While it could provide support again, the higher-timeframe bearish trend is more likely to propel the price into an inefficient area between $26.10 and $23.54. If the price reaches this zone, the Q1 2021 swing high near $20.87 may mark a more sensitive level.

3. iExec Rlc (RLC)

iExec RLC claims to have developed the first decentralised marketplace for cloud computing resources. Blockchain technology is used to organise a market network where users can monetise their computing power, applications and datasets. By providing on-demand access to cloud computing resources, iExec is reportedly able to support compute-intensive applications in fields such as AI, big data, healthcare, rendering, or FinTech.

RLC Price Analysis

At the time of writing, RLC is ranked 183rd cryptocurrency globally and the current price is US$1.27. Let’s take a look at the chart below for price analysis:

RLC printed nearly 50% gains during Q1. After this move, the price has been consolidating for the past few weeks around a monthly level near $1.12.

Overlapping support zones should provide bullish strength, with the current region beginning at $1.25 providing a reasonable entry accompanied by a wide stop. Relatively equal daily lows near $1.15 could prompt a stop run that provides a better entry, maybe as low as the next overlapping support area near $1.03.

Last month’s high near $1.38 provides the highest probability target, with the next swing high inside resistance at $1.45 giving another target and potential short-term reversal area.

A strong move through this level into resistance beginning at $1.52 is likely to target the monthly high at $1.60, potentially reaching the next monthly high near $1.85.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.