Following the market crash on Wednesday, the founder of the TRON network, Justin Sun, announced he bought a sizable amount of Bitcoin (BTC) and Ethereum (ETH) in the dip. The total purchases he disclosed were worth over $285 million USD, and he plans to HODL them.

TRON CEO Stockpiles Bitcoin and Ethereum

Justin shared on Twitter that he purchased a total of 4145 BTC during the market dip on Wednesday. He bought the coins at an average price of $36,868 USD per BTC, spending a total of $152.8 million USD on Bitcoin. He also spent as much as $135.8 million USD for 54,153 ETH, at an average price of $2,509 USD.

In a separate tweet, Justin also confirmed that he’s maintaining a strong hand and won’t sell.

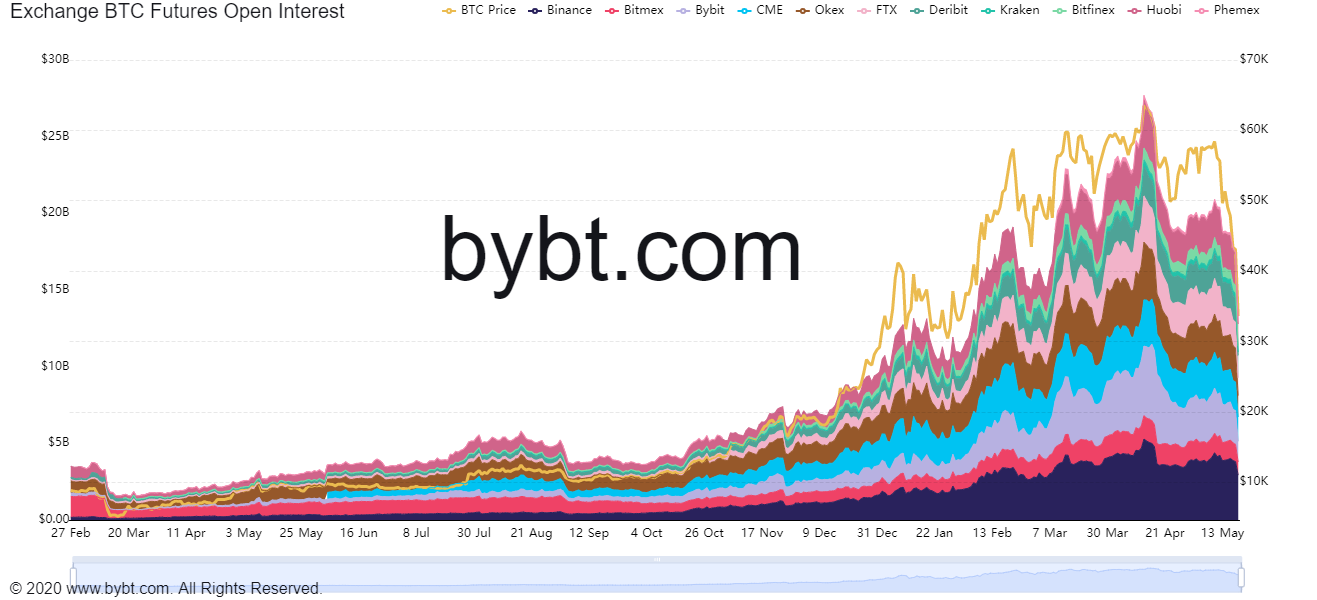

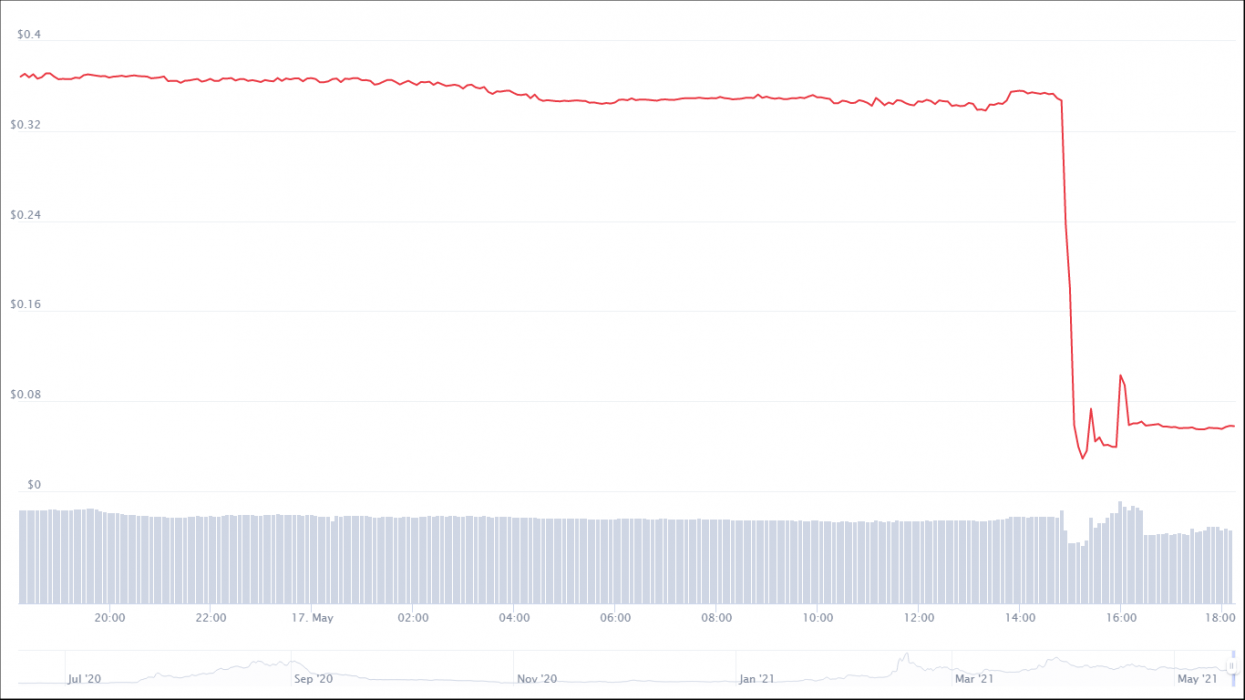

The cryptocurrency market got extremely volatile yesterday, with lots of buying and panic selling to the extent that major exchanges suffered system downtime and technical issues at some point. Although many cryptocurrencies significantly dropped in value leading to massive liquidations and more panic selling, some people like the founder of TRON seized the opportunity to buy major coins in the dip.

Tron Users Unhappy

Meanwhile, some people in the TRON community didn’t welcome the idea that Justin bought Bitcoin. They said he should have invested in the Tron (TRX) instead.

Bitcoin is Back to $40,000 USD

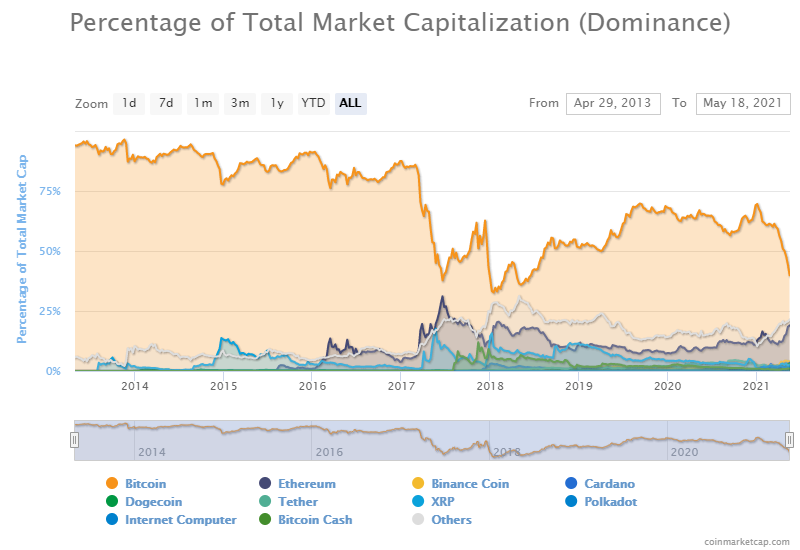

The cryptocurrency market is gradually regaining its shape, as some coins are recouping from the loss on Wednesday.

Bitcoin was trading at over $40,000 USD, with a market capitalization of over $730 billion USD, during the time of writing. The entire crypto market is worth over $1.7 trillion USD.