Australia’s financial markets watchdog is taking Aussie crypto platform Block Earner to court for allegedly providing unlicensed financial services and running an unregistered managed investment scheme.

The Australian Securities and Investments Commission (ASIC) announced Wednesday November 23 that it had commenced civil penalty proceedings against Block Earner — the trading name for Web3 Ventures — in the Federal Court.

“We are concerned that Block Earner offered financial products without appropriate registration or an Australian Financial Services licence, leaving consumers without important protections. Simply because a product hinges on a crypto-asset, does not mean it falls outside financial services law.”

ASIC Deputy Chair Sarah Court

ASIC has been active when it comes to enforcement in the crypto space of late, taking legal action against the company being the Qoin token in October this year.

Block Earner CEO Cites Lack of Regulatory Clarity

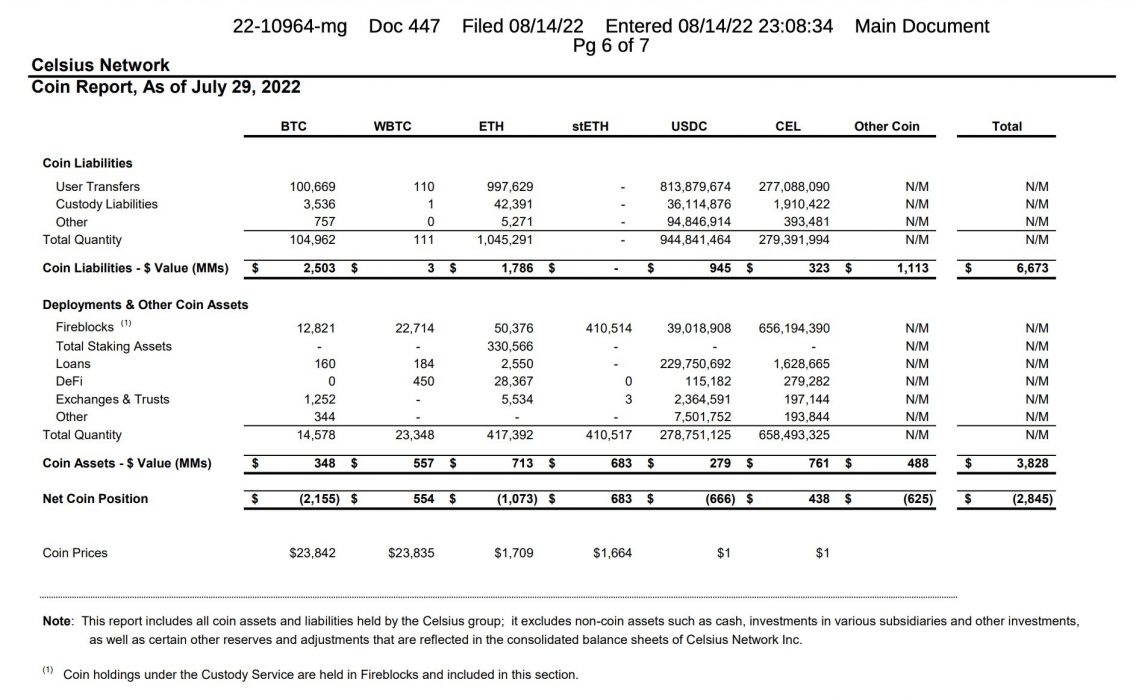

Bringing decentralised finance to the masses has been the catch-cry of Block Earner, which offers a range of fixed annual yield products backed by crypto, USD reserves and physical gold. ASIC said Block Earner’s crypto-asset-related offerings were financial products, which comes with a requirement to hold an AFS licence — which Block Earner does not have.

Speaking to Business News Australia, Block Earner co-founder and CEO Charlie Karaboga described the legal action as a “disappointing outcome”. He said the startup had invested in infrastructure to be able to operate compliantly and protect its customers against crypto market volatility.

“Needless to say, lack of clarity around regulation in Australia for cryptocurrency-related products creates friction between regulators and innovators like Block Earner in our industry. In an ideal world, we would build these products in a regulatory sandbox with more clarity around licensing regimes. In the future, we look forward to working with ASIC and other regulators in this space to make Australia an innovative space for the crypto industry.”

Block Earner co-founder and CEO Charlie Karaboga

ASIC Supports Regulation to Protect Consumers

ASIC said it supports the development of an effective regulatory framework covering crypto assets in order to protect Australian investors — who have demonstrated a strong interest in crypto.

Research released by ASIC in August 2022 found many new, young investors had become active in financial markets and 44 percent reported holding crypto. Just 20 percent of crypto owners considered their investment approach to be ‘risk-taking’, and many said they sourced information from social media, podcasts and financial influencers.

In its statement about legal proceedings against Block Earner, ASIC highlighted its concerns about consumers’ vulnerability in their rush to embrace crypto:

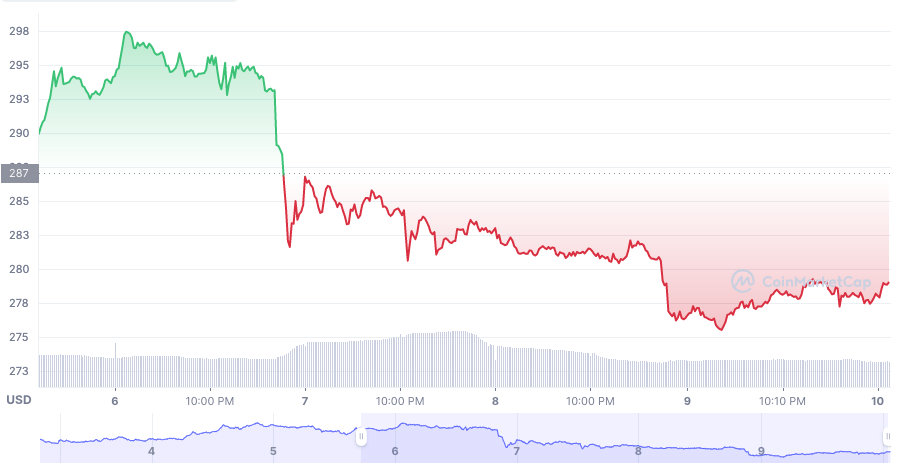

“Crypto-assets are risky, inherently volatile and complex and ASIC remains concerned that potential investors in crypto-assets may not fully appreciate the risks involved. ASIC supports the development of an effective regulatory framework covering crypto-assets to protect consumers and investors.”

ASIC Deputy Chair Sarah Court