More dog-themed cryptocurrencies are flooding the market, following the surprising success of Dogecoin (DOGE), which was considered only a joke cryptocurrency at the early stage.

The growing interest in Dogecoin seems to have inspired the launch of similar cryptocurrencies on the Binance Smart Chain (BSC), including:

SHIB: from Dogecoin Killer to COVID Relief

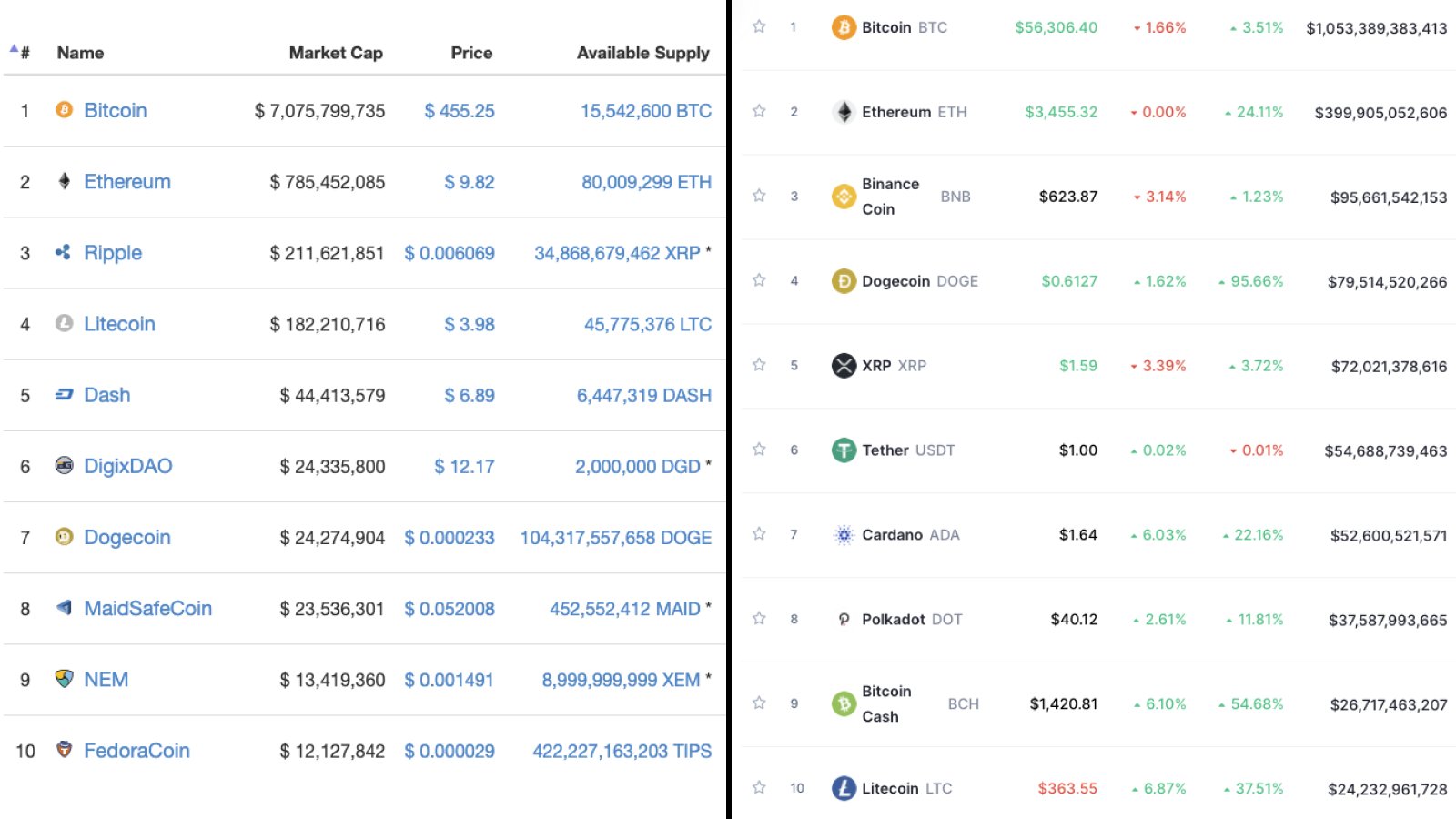

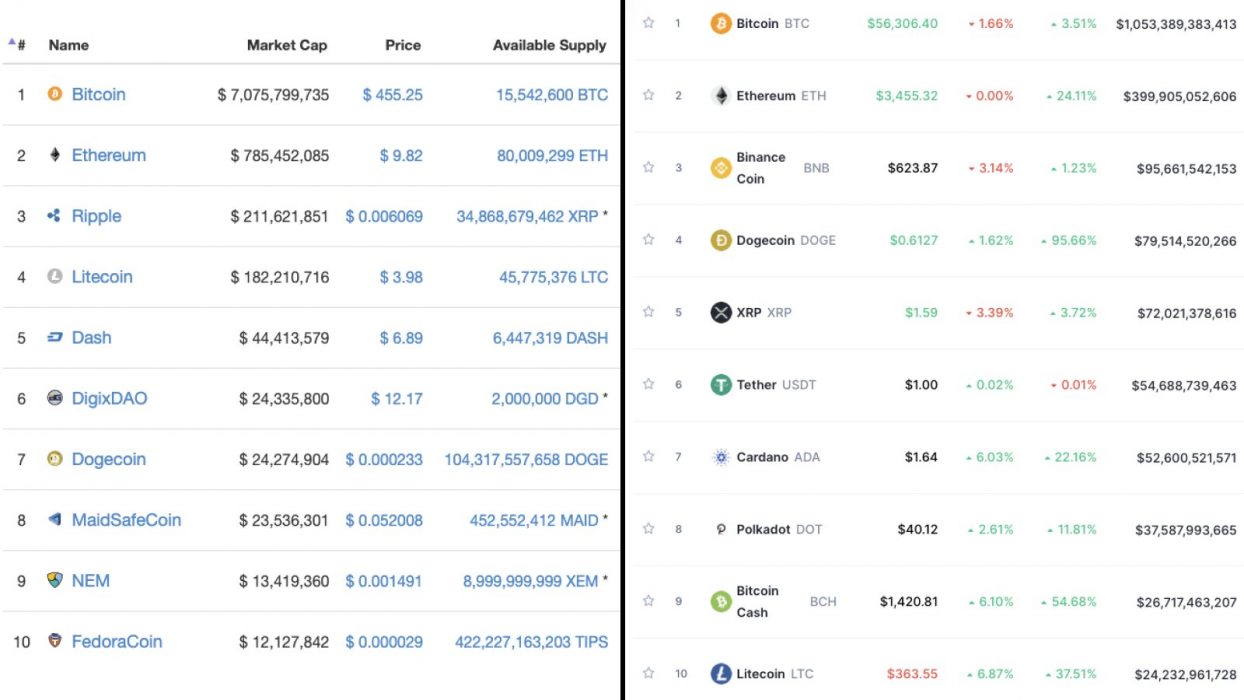

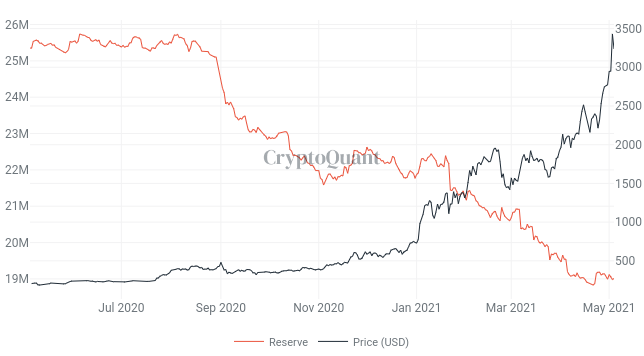

SHIB has the largest market capitalization amongst these coins. It’s known as “DOGECOIN KILLER” and recently took rank 23rd on CoinMarketCap, with a $9.5 billion USD market cap. Fifty percent of the maximum supply was burned to Vitalik Buterin, the co-founder of Ethereum, while the remaining percentage was locked on the decentralized exchange, Uniswap.

However, its price tanked shortly after Vitalik donated his SHIB to Indian charity CryptoRelief – a donation worth about $1 billion USD.

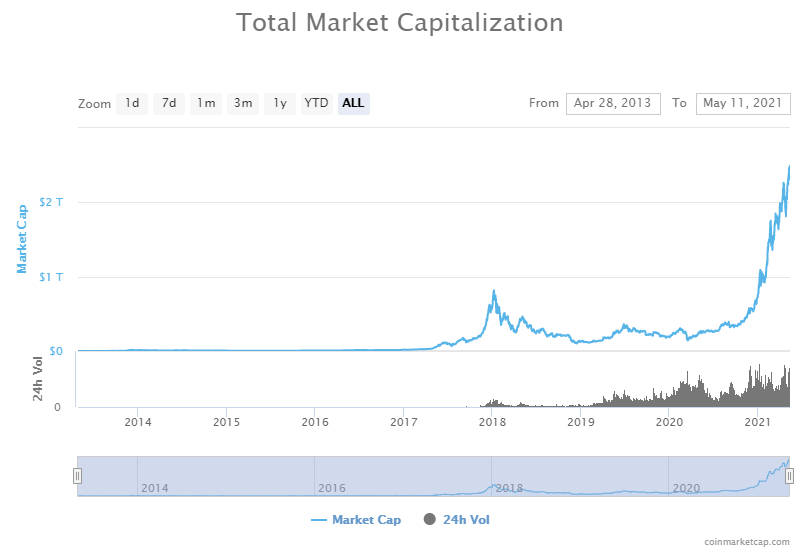

DOGE Surged Over 4,300% YTD

Many crypto users are increasingly stacking up these dog-themed coins with the hope of replicating the profits from Dogecoin. However, it remains unknown how well these new coins can play relative to DOGE.

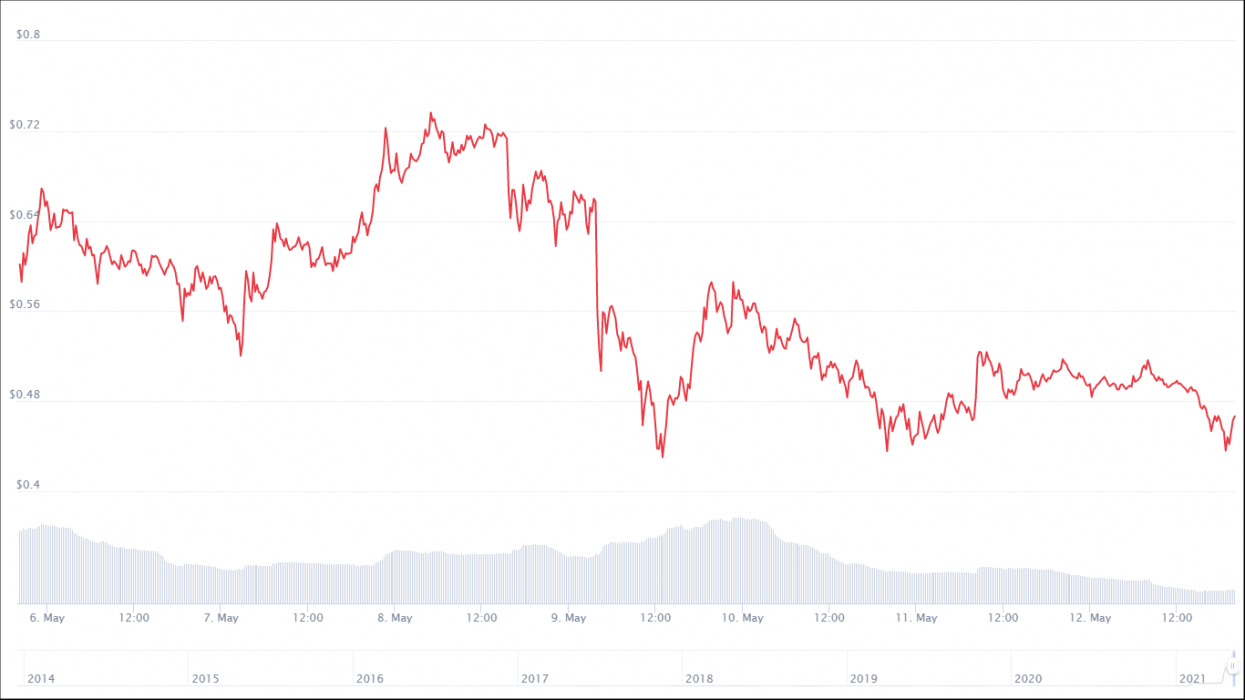

Dogecoin was trading at $0.4602 USD during the time of writing. It’s down by 8.78 percent on a 24-hour count.

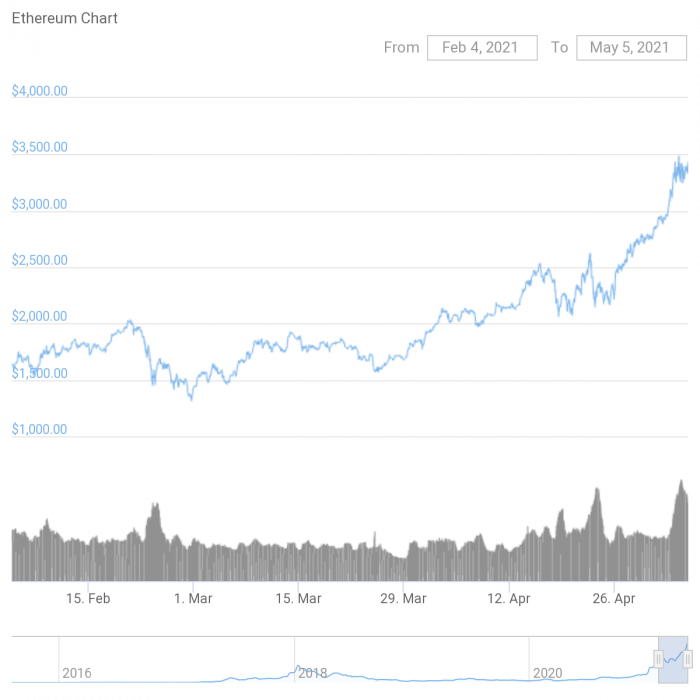

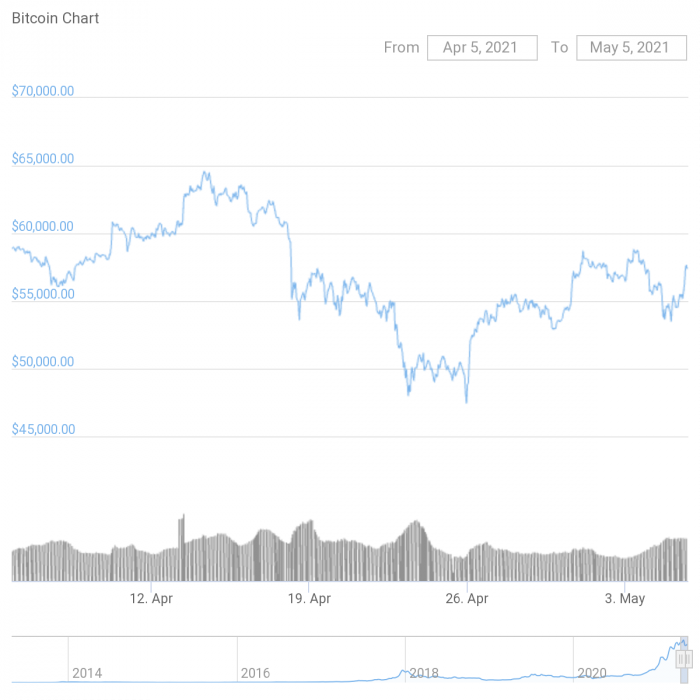

It is currently the fourth-largest digital currency, with a market capitalization of over $58 billion. The price of DOGE is up by over 4,300 percent on a year to date (YTD). Notably, the crypto gained mainstream popularity this year as many prominent personalities, including the billionaire founder of SpaceX Elon Musk, showed interest in it.

On several occasions, Elon Musk tweeted about DOGE and recently talked about it on a TV show, bringing attention to the coin.