Some leading financial companies are collaborating to encourage a clear regulatory path for the burgeoning digital currency industry.

Known as the Crypto Council for Innovation (CCI), this group currently includes four prominent industry players: Coinbase, Square, Fidelity, and Paradigm. It aims at informing and helping global regulators understand cryptocurrencies while also encouraging responsible crypto-related public policies.

CCI to Unlock The Transformational Promise of Crypto

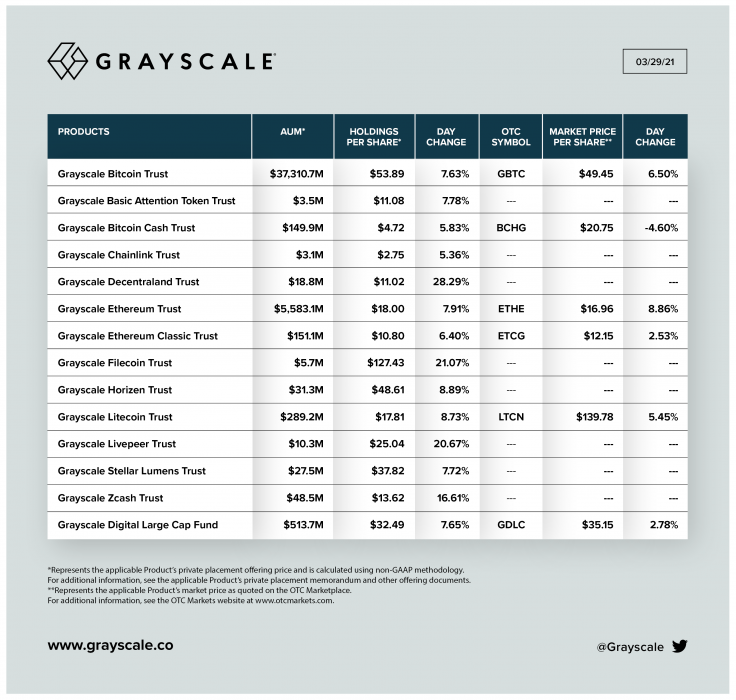

The companies behind CCI believe that digital currencies are at their critical stage. In recent years, more people have got to learn and invest in cryptocurrencies, including institutions and corporations. As a result, the crypto market has grown significantly, with the market capitalization recently touching $2 trillion. However, the regulatory uncertainties across different countries mean the industry doesn’t hold a clear or settled future.

Crypto is at a mainstream inflection point. It’s in its very early stages and, much like the internet (once was), it’s very fragile while it’s in that stage.

Fred Ehrsam, co-founder of Paradigm [Wall Street Journal]

Thus, the Crypto Council for Innovation wants to educate the institutions, regulators, and policymakers on the benefits of digital currencies. Part of the approach includes providing analysis and insight about cryptocurrency. The CCI will also focus on correcting some “misperceptions that inevitably accompany a transformative new technology.”

By educating leaders about crypto, we can help empower them to participate in the crypto ecosystem for the benefit of their citizens, communities, and families.

Gus Coldebella, Chief Policy Officer at Paradigm

More Mainstream Crypto Adoption?

The development today could greatly change the shape of the crypto industry from a regulatory aspect. Having clearer regulations for cryptocurrencies would possibly result in encouraging more mainstream crypto adoption.