There has been a notable level of shake-off for the ten largest whale addresses holding Ether (ETH) over the past 30 days. According to the information shared by Santiment, a crypto analytics platform, the number of Ethereum coins held in these addresses has dropped significantly, although this is not reflected in the cryptocurrency’s price. One plausible reason for the decline is the Ethereum 2.0 staking.

Per Santiment, the total number of Ether held in the ten largest addresses dropped from 16.4 percent to 4.5 percent within a period of one month. Despite this massive drop, the cryptocurrency is still up by over 61.4 percent, trading at US$590 at the time of writing. This is probably because new addresses were also being created at the time, thereby causing ETH redistribution from the top addresses to the new ones – not a sell-off.

Ethereum Whale Addresses are Staking ETH

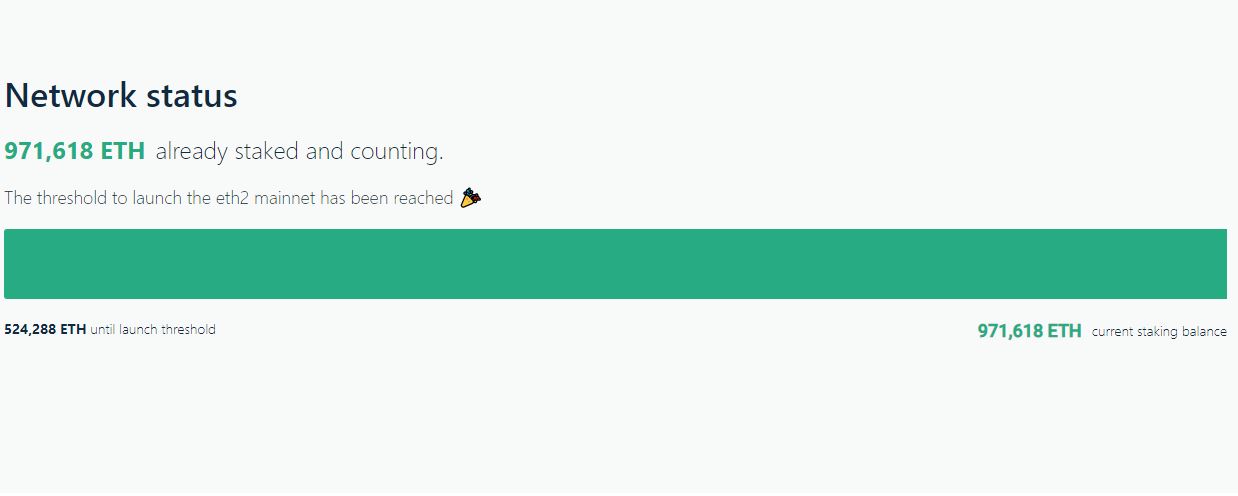

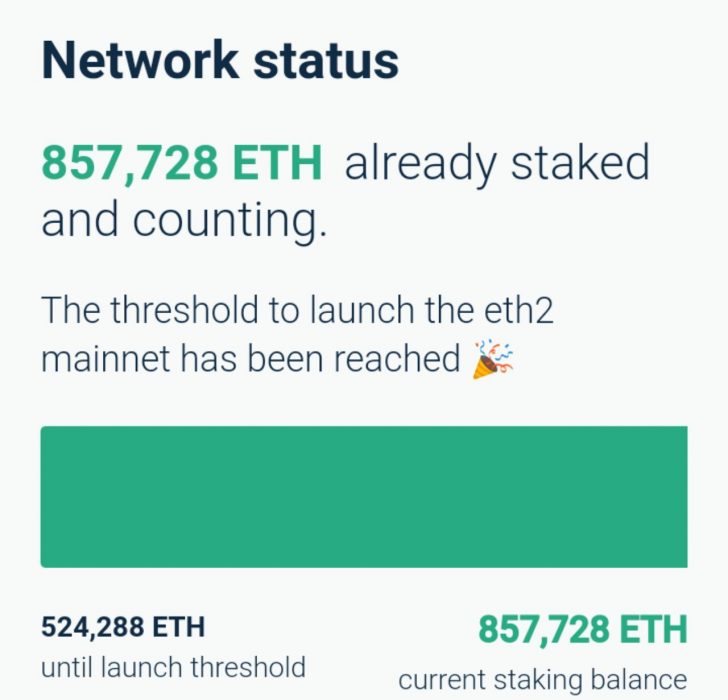

The creation of these new addresses also led up to the speculation that Ethereum 2.0 staking is a major factor causing ETH supply redistribution from the top addresses. Alex Saunders, the founder of Nugget’s News, explained this on Twitter, saying that the Ethereum 2.0 deposit contract required the network users to move the coins to a new address for the beacon chain & staking.

Backing this up is the fact that the deposit contract was actually launched last month, which is the same time the coins began leaving the whale addresses. So, more coins leaving the addresses to Eth2 staking is definitely not a thing to worry about as the crypto’s price is more likely to benefit more.

The Beacon Chain went live on December 1 with Phase 0, as Ethereum developers had estimated. This particular phase would act as the backbone for other functions to be released in the completion of the network.