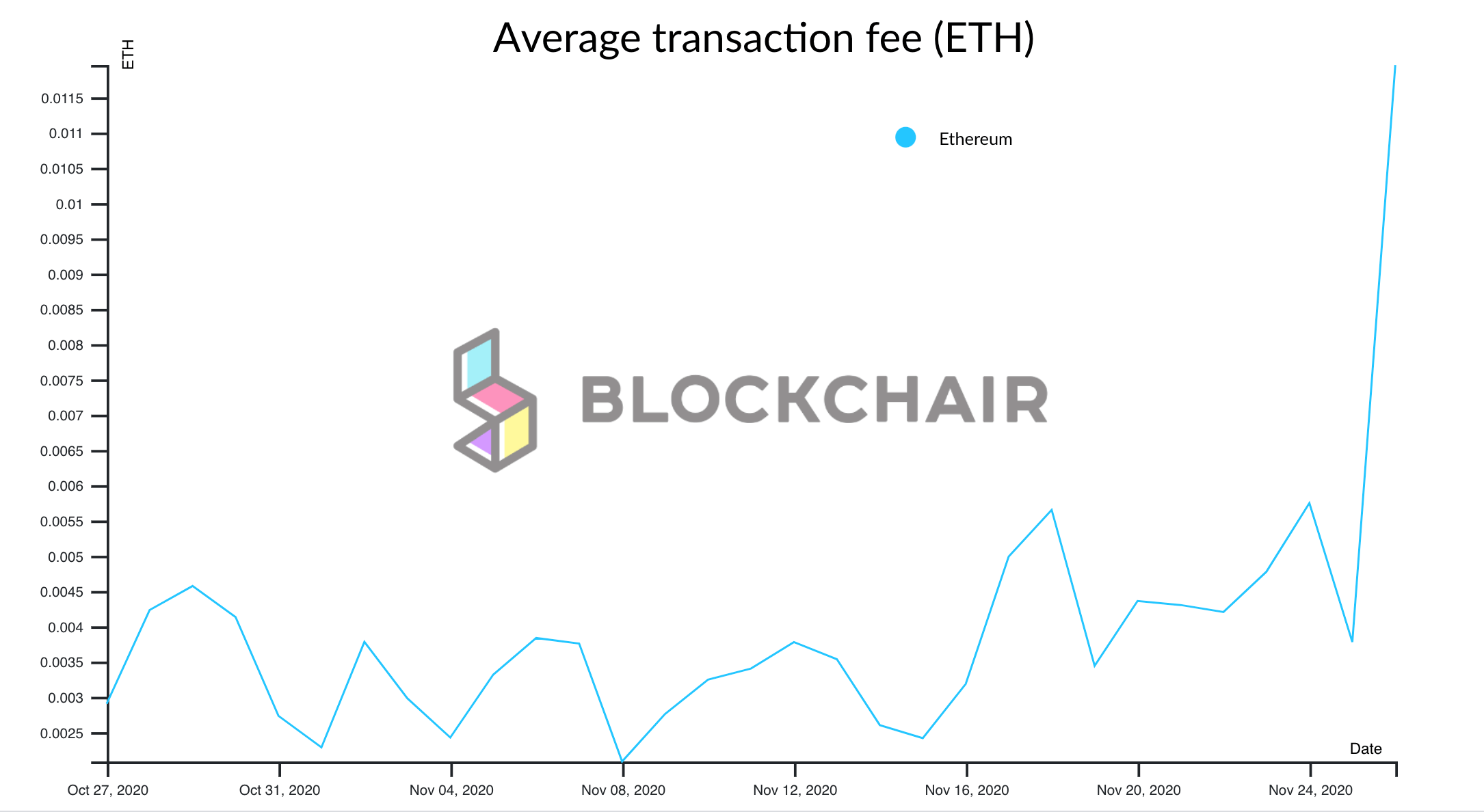

Many cryptocurrencies in the market, including Bitcoin (BTC) and Ether (ETH), have been retracing from the recent rally over the past 24 hours. Precisely, the second-largest digital currency dropped by more than 10 percent since the past day. The declining price of the cryptocurrency suggests a strong selling pressure amongst traders and investors. Meanwhile, ETH transaction fees have also spiked, just when the price is collapsing.

ETH Price Decline by Over 15%

During the time of writing, Ether was trading at the price of US$504, losing about 15.13 percent of its value in a 24hr chart, according to Coinmarketcap. The dropping price of the cryptocurrency shouldn’t be considered as an unusual development, as there is generally a massive sell-off in the crypto market, especially for the cryptos that surged exponentially during the bull market.

The price of ETH soared to a yearly high above US$620 on November 24, before dropping to the current price. However, it’s worth noting that Ether is still up by 5.84 percent on a week-to-week basis. This is unlike Bitcoin, which is already seeing a 12.03 percent drop on a 24hrs chart and a 6.63 percent decrease on a weekly chart.

Ethereum Fee is Surging Rapidly

As the crypto market entered into the correction phase, many traders were seen rushing to take out their profits from the crypto. In addition to decreasing the price, the rush also caused congestion on the network, which resulted in a spike in the fee required to make transactions on the Ethereum blockchain. The growing number of unconfirmed ETH transactions had also caused the leading exchange, Binance, to temporarily halt ETH withdrawals.

Is the bull market over?

Some crypto experts and industry analysts don’t think that the bull run is over, despite the current dips in the market. Michaël van de Poppe, a popular digital currency trader, showed in a chart on Twitter that the correction in the market will be short-lived and that Ether will return to making new growth when the bears are finally benched.