Despite the Central Bank of Nigeria (CBN) recently banning local banking institutions from serving cryptocurrency users and companies in the country, the interest in crypto has been surging.

Amid the growing adoption rate of cryptocurrency in Nigeria, the CBN governor, Godwin Emefiele, recently assured publicaly that cryptocurrency would be brought back to life in the country.

Nigeria Will Allow Cryptocurrency

The Nigerian central bank withdrew its support for cryptocurrencies in February, citing speculative risks associated with them. They also said digital currencies were used in financing illegal activities.

We have carried out our investigation and we found out that a substantial percentage of our people are getting involved in cryptocurrency which is not the best. Don’t get me wrong, some may be legitimate but most are illegitimate.

CBN governor

However, the governor assured in their 279th MPR meeting that cryptocurrencies would come back to life in the country. The governor added “We are committed in the CBN, and I can assure everybody that digital currency will come to life even in Nigeria.”.

Nigeria Records Massive Increase in Crypto Adoption

One can easily predict that the central bank of Nigeria is open to forming a framework to regulate digital currencies. This is important due to the increasing rate of crypto adoption in the country.

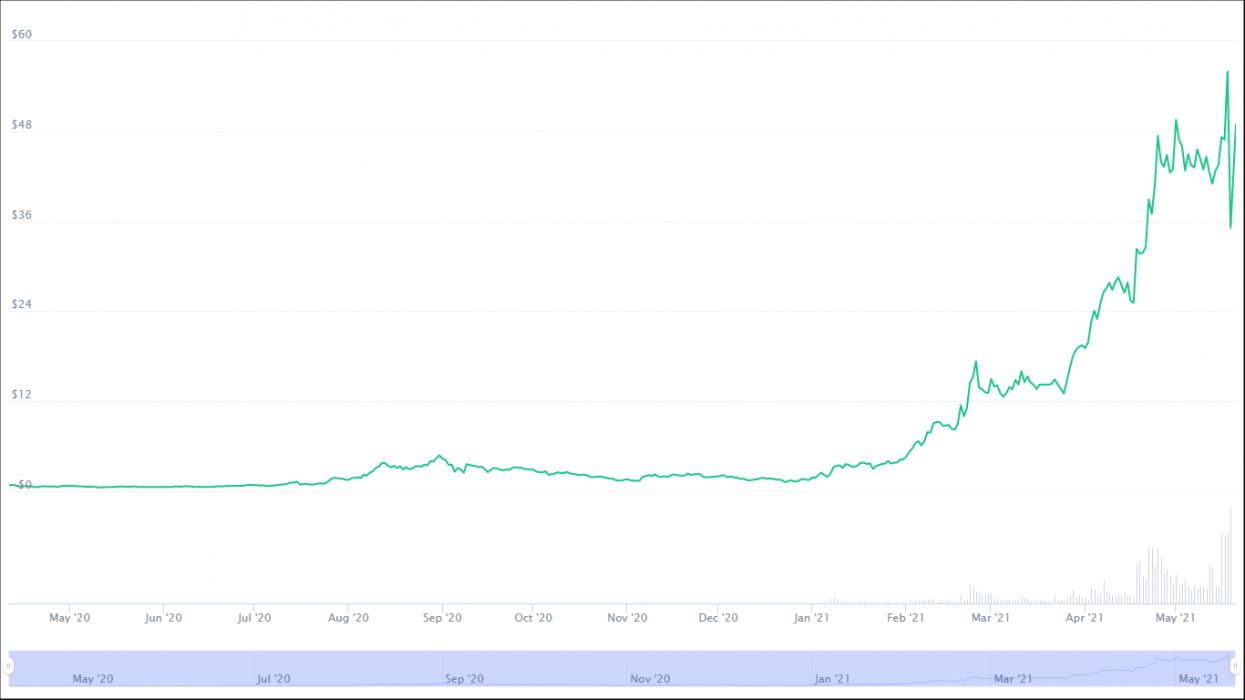

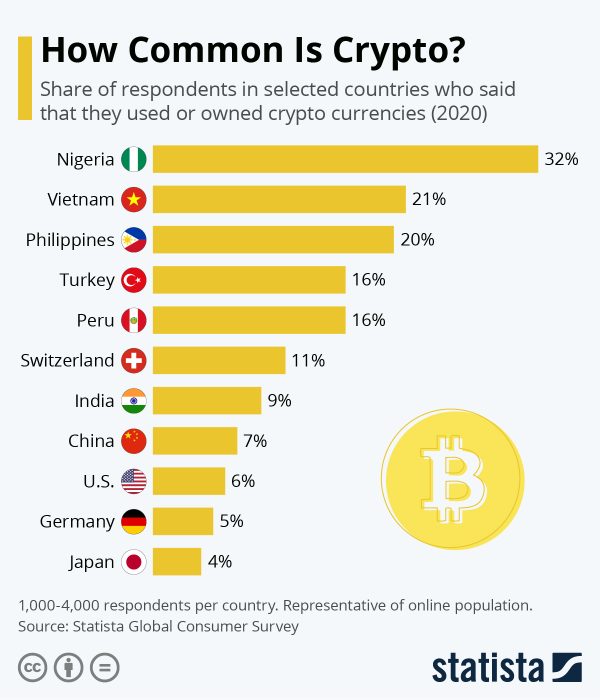

Nigeria is considered one of the top countries with the highest rate of cryptocurrency adoption. A recent survey conducted by Statista in different countries (1,000 to 4,000 respondents per country) showed that 32 percent used/owned cryptocurrency in 2020.

The numbers are increasing rapidly as many people are flocking to Bitcoin on P2P exchanges to hedge against the depreciating value of the national currency, Naira (NGN). This is evident as Paxful exchange recently announced Nigeria as its largest market, with over $1.5 billion in trading volume as of April.