In the wake of the collapse of FTX, cryptocurrency exchanges are rushing to convince customers that they’re safe and not likely to suddenly collapse — at least not in the next few weeks. Recently large exchanges like Crypto.com and Kraken have released proof of their reserves, and now Binance is following suit.

Last Friday, Binance announced its new proof of reserve system, which allows customers to verify that their funds have been included in the proof of reserves report by querying data in a Merkle tree. Binance claims this proves that customer funds are held on a full-reserve basis.

However, Binance’s new system has been met with criticism by the CEO of rival crypto exchange Kraken, Jesse Powell.

Powell referred to the system as “hand wavey bullshit” that provides nothing more than a cryptographic hash of an entry in a spreadsheet, which does nothing to show that Binance holds more assets than it owes.

Powell’s Criticism Explained

Powell said a meaningful proof of reserve audit must include all client liabilities with negative balances excluded, user-verifiable cryptographic proof that all accounts have been included in the audit, and cryptographic signatures verifying the exchange’s control over the wallets containing the assets.

2/2 #ProofOfReserves audit must have:

— Jesse Powell (@jespow) November 22, 2022

1. sum of client liabilities (auditor must exclude negative balances)

2. user-verifiable cryptographic proof that each account was included in the sum

3. signatures proving that the custodian has control of the walletshttps://t.co/QEZo0DzJfw

Without this information, Powell said proofs of reserve such as those released by Binance are “worthless” and tell users nothing of value about an exchange’s financial position.

This is simply “here’s a hash of your record in the BTC spreadsheet”. ok… but what’s the point? The whole point of this is to understand whether an exchange has more crypto in its custody than it owes to clients. Putting a hash on a row ID is worthless without everything else.

— Jesse Powell (@jespow) November 25, 2022

Powell’s Kraken exchange has implemented a similar Merkle tree-based proof of reserve system that he claims is more rigorous than that offered by Binance. However Kraken does acknowledge its system has some shortcomings of its own.

Crypto Journalists Cop It

Binance wasn’t the only target in Powell’s sights: he also took aim at crypto journalists for failing to understand the flaws in Binance’s system.

People who oughta know better, journalists, especially, should take the time to understand this before overselling it and misleading consumers.https://t.co/Qzb5UY3Bdj

— Jesse Powell (@jespow) November 25, 2022

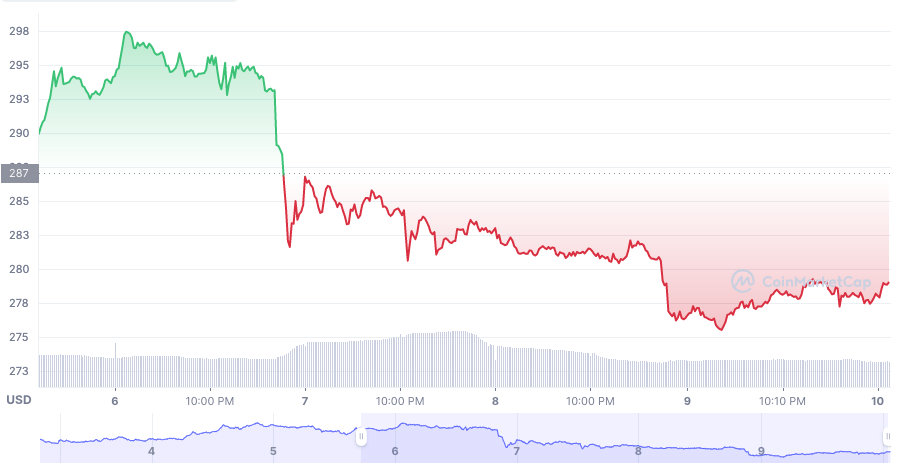

Previously, Powell had criticised the Binance-owned crypto tracking website, CoinMarketCap, for its implementation of its new proof of reserves feature, which he says simply includes a list of wallets and does nothing to clarify if an exchange has more assets than liabilities.